This week, Knoxville-based Greater Sum Ventures (GSV) announced to its Vacation Brands and Property Brands teams that it has combined its short-term and long-term property management companies into a new brand—Inhabit IQ.

According to an internal announcement, “Inhabit IQ is a unique collective of tech-forward software companies, formerly Vacation Brands and Property Brands, serving the residential, commercial and vacation rental industries.”

According to an internal announcement, “Inhabit IQ is a unique collective of tech-forward software companies, formerly Vacation Brands and Property Brands, serving the residential, commercial and vacation rental industries.”

Over the last year, GSV led a private-equity-funded rollup, acquiring majority stakes in large technology companies and service providers in the professionally managed vacation rental industry (including Streamline Vacation Rental Software, Bizcor, Bluetent (which purchased Visual Data Systems), Rental Guardian, Virtual Resort Manager (VRM), iTrip Vacations, and LiveRez).

Initially, GSV aggregated these companies under a short-term rental umbrella known as Vacation Brands. GSV led a similar initiative in the long-term rental management industry under the Property Brands label.

According to the email, “Vacation Brands and Property Brands have come together to form a new entity doing business as Inhabit IQ,”

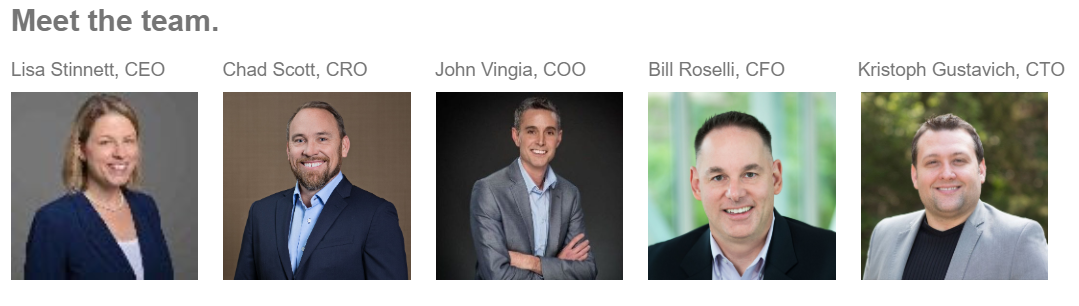

The announcement named a new leadership team:

- Lisa Stinnett, CEO

- John Vingia, COO

- Chad Scott, CRO

- Bill Roselli, CFO

- Kristoph Gustovich, CTO

According to its email, this team “will lead Inhabit IQ, providing insight and tenured management expertise to companies across the platform through extensive operational, financial, and strategic go-to-market experience.”

The announcement added, “In many ways, you won’t experience any noticeable changes. Your company’s platforms are still sold to the market individually, as Inhabit IQ does not offer any solutions itself to the market. Rather, the companies under the Inhabit IQ umbrella manage unique and independent go-to-market strategies with the operational oversight of Inhabit IQ leadership. Now, you have a wider network of partnerships supporting the momentum of the market.

“Some of the near-term benefits you can expect from the combination support operational efficiencies, such as Vacation Brands companies benefiting from an established Property Brands infrastructure and experienced corporate executive team. We also anticipate additional opportunities for employees in this structure as we continue to move forward.”

The email added, “The positive effects that were expected from the Vacation Brands formation will continue on with Inhabit IQ as we work to identify valuable integrations, cross-sell opportunities and innovation strategies that offer more to our customers than ever before.”

So far no one is including property managers in the conversation, and we are being treated like widgets.

A strange oversight in our opinion, as we are the ones with the bulk of the inventory. It will be interesting to see the response over the next year.

First congratulations to GSV for buying LSI. I would not count on VRMA to keep their Insight project with LSI since GSV owns Itrips – a property management franchise model that competes with local companies. Talk about allowing the fox into the hen house! Second, GSV is using an old Private Equity trick. They are “merging” Property Brands with Vacation Brands to try to hit their numbers and cloak the upcoming shortfall in the Vacation Brand numbers. The big question for those companies who sold into Vacation Brand is what valuation are they getting as they get diluted into Inhabit IQ. Another concern for those companies who sold early like Streamline is how much money GSV paid to acquire LiveRez which is rumored to be $90 million due to a bidding war. Companies who are talking to GSV would be wise to learn from LiveRez that their best strategy would be to hire an I-Bank and solicit multiple bids. This is what LiveRez did and it reportedly generated twice the valuation as Streamline. Of course, the goal has always been for GSV to flip the merge company to another PE company. Hope whoever they are shopping this roll-up does their homework and actually talks to property managers in the industry.