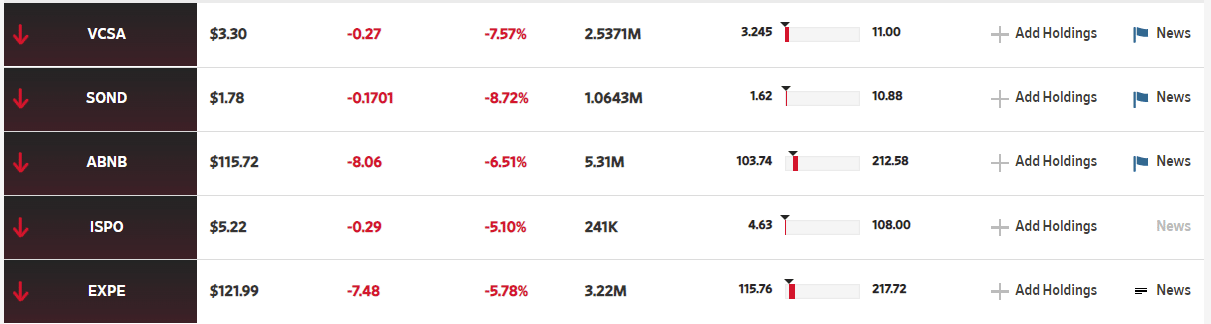

Since Monday, Vacasa (NASDAQ: VCSA) stock has fallen over 30 percent as trading volume increased and lock-up restrictions expired. The stock had a trading volume of 2,536,505 shares, compared to its average volume of 915,445.

1:38 ET: Updated Jun 10 to reflect accurate number of shares held by Eric Breon (65,242,864), and Goldman Sachs target at $5.50 instead of $6.50.

Since its IPO, Vacasa stock is down over 67 percent, closing on Thursday at $3.30.

According to a recent SEC filing, the 180-day lock-up restriction lifted on Monday, and director and cofounder Eric Breon sold over 500,000 shares in multiple transactions ranging from $3.76 to $4.04. At market close, the stock was trading at $3.30. Breon still owns 65,242,864 shares of the company.

On Thursday, Vacasa had its price target reduced by equities research analysts at JMP Securities from $12.00 to $6.50, and Goldman Sachs dropped it from $9.00 to $5.50. Zacks Investment Research cut Vacasa from a “hold” rating to a “sell” rating in a report on Tuesday.

The chart below compares performance at Vacasa, Sonder, and Airbnb over the last 90 days.

Low Float

Some analysts are attributing the volatility to the low float. Corporate insiders own 37 percent, and hedge funds and other institutional investors own 36.21 percent of the company’s stock.

On the day of Vacasa’s IPO, CEO Matt Roberts warned of volatility in an interview with VRM Intel. “There’s going to be—over X period of time—there’s a lot of volatility,” Roberts said. “There’s not a lot of float in the market. So any move in the stock, that’s going to be exaggerated. And when it’s super high, guess what, we’re not brilliant and awesome. And when it goes down a lot, it doesn’t mean we did something wrong either. It’s just volatility. So hopefully they can take that message and take it to heart. There’s this human nature to want to look at it—and I understand that and I appreciate that—but I really want them to focus on delivering great service, and then everything will take care of itself.”

SPACS Are Underperforming across the Board

The two highest-profile SPACS in the short-term rental industry, Sonder and Vacasa, have fallen sharply since their IPOs with Sonder down 82 percent and Vacasa down 67.5 percent since their NASDAQ debuts.

Today, Sonder announced in an internal memo that it has laid off 21 percent of its employees and will carry out this layoff over the next two weeks.

The chart below compares performance at market close on Thursday, June 9.

According to Dot.LA—as a refresher—a SPAC is a financial mechanism that allows a company to circumvent many of the regulatory hurdles involved in a traditional IPO as it goes public. The speed of the process made it popular in the tech sector. The SPAC model begins when a shell company (with no assets or business of its own, really) goes public through an IPO. Because the company is only a shell, the IPO process is extremely simplified with far fewer SEC hoops to jump through. Investors in the shell company typically receive stock at $10 per share as well as warrants, which are additional securities that allow them to purchase discounted stock in the future. The shell company then goes hunting for a promising startup that wants to go public.

SPACs aren’t performing well.

“While the stock market at large has certainly been bearish recently, the Defiance Next Gen SPAC Derived ETF (SPAK)—a fund that tracks a huge swath of SPAC performance—has declined around 30% since the start of the year, far outstripping the decline of the S&P 500 (which is down around 13% in that time). Add in a smattering of high-profile catastrophes like WeWork, and the space has started to look like a losing proposition to many investors.”

SPACS are also facing heightened scrutiny from regulators. At the end of May, the SEC proposed tighter restrictions on the SPAC market that are designed to protect investors. The SPAC strategy has been accused by critics of offering outrageous value to the sponsors who initially form the shell companies, while offloading much of the risk onto retail investors. The SEC’s proposed regulations aim to rebalance the scales and provide increased transparency—which, for sponsors, makes starting a new SPAC less attractive.

However, although low float and underwhelming SPAC performance are factors, they don’t tell the whole story of what is going on at Sonder and Vacasa. Industry experts point to inflated valuations as the leading contributor as these companies misidentified themselves as SaaS-based technology companies.

It is possible we will see Vacasa follow Sonder’s lead with financial restructuring and layoffs if its market performance approaches the losses the industry is currently seeing at Sonder.

Would be interesting to update the analysis in this article after Vacasa’s latest earnings call.

Interesting piece, wonder if somebody thinks to take them private again?