“In the middle of difficulty lies opportunity.”

—Albert Einstein

In these uncertain times, there is one thing the vacation rental management (VRM) industry can count on: We are on the brink of the greatest talent shift in modern history. This presents an incredible opportunity for vacation rental companies to identify and hire the best talent using the right strategy and plan of action.

For industry professionals who are now on the hunt for a new employer, this shift provides an opportunity to work with a strong company that has made it through what may just be the biggest challenge to date.

A short time ago, the single biggest challenge our firm identified for this industry was an unprecedented talent shortage. In an industry that is completely reliant on people to provide exceptional service, this talent shortage was a significant problem for most VRMs. We constantly heard that applicant flow was anemic, with those applying for the many open positions lacking the experience and capabilities to properly fill the roles. With unemployment recently at a record low, managers were forced in many cases to hire individuals to be placed in the wrong seats. In most cases, there were no measures taken to validate that these candidates were a good fit for the roles.

What a difference a couple of months can make.

At the time of this writing, it is clear that an unemployment rate of 20 percent or more is in the cards in the COVID-19 era. While many expect this to be short-lived relative to previous recessions, the sheer scope of this increase in unemployment is without comparison.

consensus that as this crisis passes, vacation rentals will be one of, if not the most, attractive travel option. Before we had significant competition from cruise lines and large hotels. However, as the new normal unfolds, the privacy, security, and safety a vacation rental offers will be more desired than ever before. After being cooped up for what feels like forever, families will look to get away with these assurances in place. Consequently, the combination of the return of rental demand and the talent shift will open up a significant opportunity for both businesses and individuals.

Where before it was exceptionally challenging to identify and hire top talent, there are more qualified people in play than ever before. For talented and passionate professionals, this is an opportunity to find a position with an organization that has weathered the greatest storm of our lifetime and is ready to take advantage of a period of growth like we have never seen before.

To take advantage of this opportunity, organizations need a talent acquisition plan.

Most vacation rental companies have a multifaceted rental marketing plan. They have allocated a budget and have a well thought-out document compiled of tried-and-true marketing practices, along with new concepts used to attract new customers and retain existing ones.

What we find with most companies in our space is that their talent acquisition plans consist of online ads and postings of open positions on their websites. The selection process focuses on the resume, and the interviews are typically unstructured. In many cases, the person or persons responsible for hiring juggle this role along with many other competing responsibilities. This creates a lack of focus and allows for other distractions to deter them from allocating the right time to the process. Therefore, the hiring manager will hire who they think will be the right fit based on subjectivity and their own biases. In some cases, the hiring manager himself may be in the wrong seat.

Companies must move swiftly to create comprehensive talent acquisition plans, leverage people analytics, and assign a point person to ensure consistency and effectiveness. These three steps coupled with a structured interview process will ensure a strong fit for your team.

Increasing the talent pool through people marketing

In rental marketing, we typically see a multifaceted strategy that includes a mix of search engine optimization, search engine marketing, social marketing, distribution, and more. People marketing should be done in a similar fashion.

One job posting is not enough. Put together a plan to distribute your job ads across multiple ad platforms such as LinkedIn, Indeed, ZipRecruiter, and CareerBuilder. Consider having a professional and polished looking career page on your website where all open positions are posted and include an email sign-up for job alerts.

Utilizing your team to get the word out is also an effective strategy. Incentivize this by paying a referral bonus to those who refer candidates that you successfully hire. Be sure to post any job openings on your social media outlets, paying special attention to LinkedIn, which according to Social Media Today, is the fastest growing social network. The ultimate goal of your people marketing plan should be to significantly boost applicant flow, so you have a strong candidate pool to select from.

Narrowing the applicant pool using people analytics

With an effective marketing campaign and increased applicant flow, narrowing the candidate pool down to the best potential hires is key. As Predictive Index certified partners, our firm utilizes behavioral profiling in the hiring process, for example. Leveraging a highly accurate, but simple and quick-to-administer behavioral survey gives you the ability to understand the job applicant’s behavioral traits. Prior to collecting these surveys, a job target is set by internal stakeholders based on the role. For example, are you looking for a reservations agent? What traits lend themselves to success for the role, according to those who interact most with that position? From this quick analysis, a behavioral target is set. Then all candidates are filtered through the process with the intent of identifying the applicants who closest match the desired behavioral profile.

As a next step, we recommend a cognitive test. Cognitive tests have been shown to be a high predictor of job success and are simple to administer. A cognitive test tells you how quickly this person will get up to speed with new concepts and necessary training. In most cases, the new hire will need to learn software platforms and systems they are not familiar with. It is crucial that they have the ability to ramp up quickly. The more technical the role the higher the cognitive requirements become. In the vacation rental industry, we often find ourselves interviewing applicants with little or no industry experience. Applicants with a higher cognitive score have a shortened learning curve and become more productive faster.

The combination of having a candidate with the right behavioral drives and cognitive abilities has been shown to be a collective 51 percent predictor of job performance.

Reducing subjectivity through the use of structured interviews

Another helpful predictor of job performance (26 percent) is a structured interview. A structured interview is a standardized way of interviewing candidates based on the specific needs of the role they are applying for. Candidates are asked the same questions in the same order and responses are compared on the same scale. The key is to take the job description and build a group of interview questions that can properly access whether a candidate has what it takes to execute the job functions. This enables you to rate each candidate objectively and can greatly reduce hiring misfires.

The accountability chart

Hiring the right person and placing them in the right seat feels like quite an achievement at this point; however, do not overlook the foundation of defining roles for your entire team. Organizational charts should be deleted and replaced with accountability charts. This reporting structure is said to be an organizational chart on steroids because it takes problem-solving and production to a higher level of performance. When employees know exactly what is expected of them and there is transparency within an organization, the business plan is carried out in a much more effective way than simply showing employees a chart of titles and direct reports.

Onboarding is more than paperwork

Once you do the hard work of identifying the best players for your team, it is critical to set new hires on the right track. Research by Glassdoor found that organizations with a strong onboarding process improve new hire retention by 82 percent and productivity by over 70 percent. On top of that, Gallup found that only 12 percent of employees strongly agree their organizations do a great job of onboarding new employees.

Most organizations stop the onboarding process after one week. But the best onboarding processes are no less than 90 days with some extending a full year, depending on the nature of the role. It is critical that the talent acquisition plan encompasses a structured process that ensures the new hire feels welcome, receives a proper introduction to the culture, and has access to the tools and knowledge they will need for long-term success at the company.

In closing

In the vacation rental industry, the best teams win. It’s not the company with the best marketing person or housekeeping manager. It’s the company that has a cohesive group of professionals all rowing in the same direction to lead the team and the company to success.

The Great Talent Shift is an opportunity like no other to identify, hire, and retain the very best team. You may be simply missing a few pieces or need to build an entire leadership team as we come out of this challenging time. I would encourage you to focus on the talent acquisition strategy of your company and take advantage of the greatest pool of available talent in our lifetimes.

On May 28 and 29, Masson is hosting a free

On May 28 and 29, Masson is hosting a free

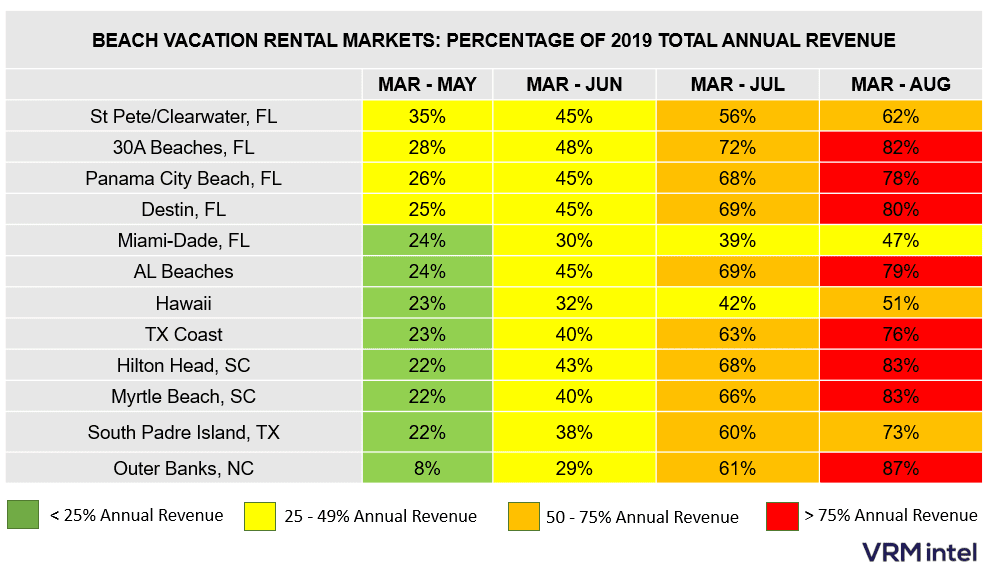

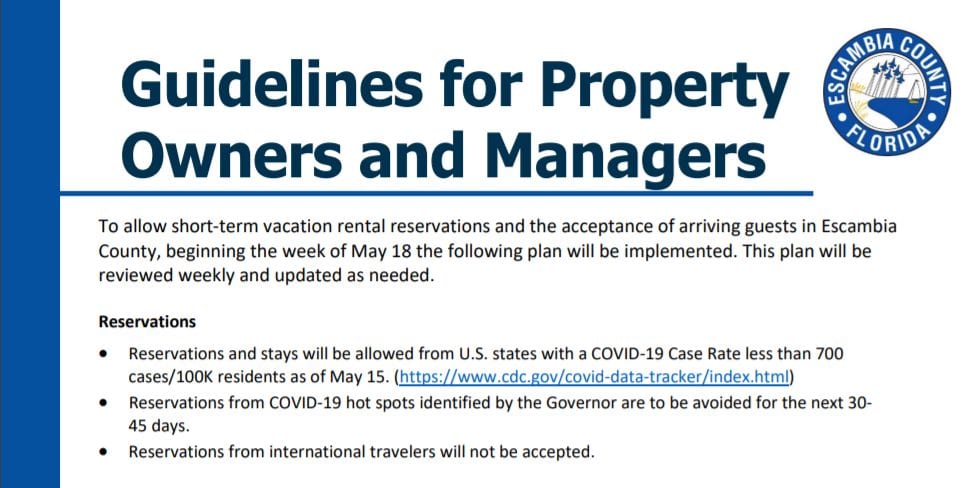

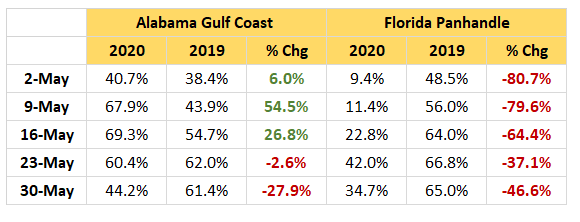

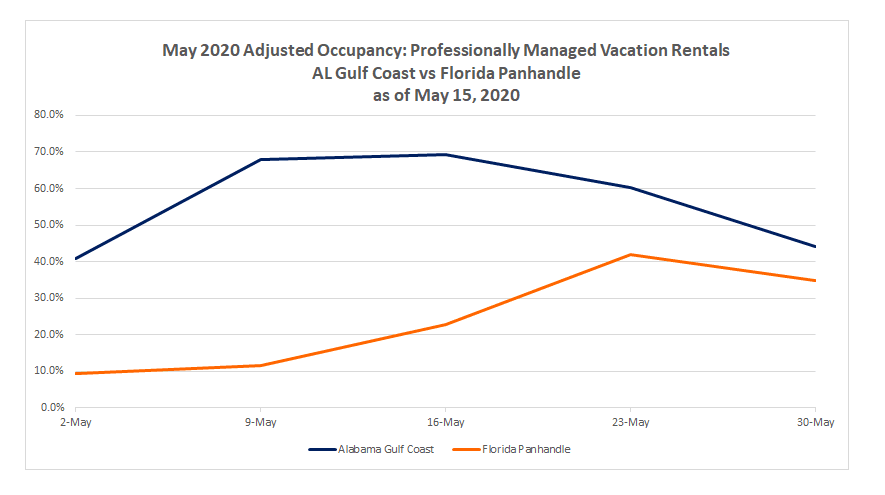

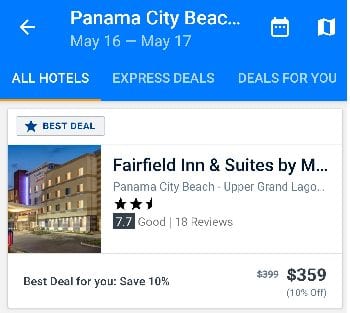

Alabama’s vacation rentals are not the only beneficiary of DeSantis’ short-term rental shutdown. Florida’s hotels in the panhandle are also benefiting. As of May 16, only one Panama City Beach 2.5-star hotel showed availability for the weekend, and this non-beachfront budget hotel was priced at $359 per night.

Alabama’s vacation rentals are not the only beneficiary of DeSantis’ short-term rental shutdown. Florida’s hotels in the panhandle are also benefiting. As of May 16, only one Panama City Beach 2.5-star hotel showed availability for the weekend, and this non-beachfront budget hotel was priced at $359 per night.

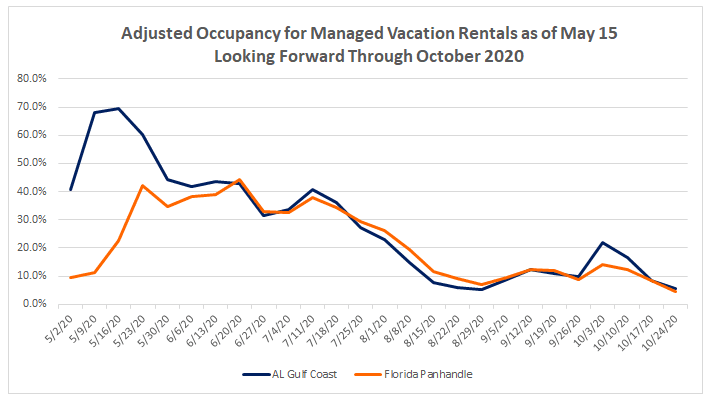

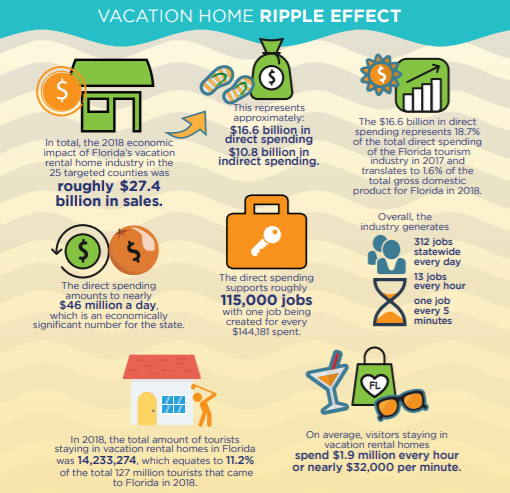

In Florida, vacation rentals have been an established and popular lodging type in the state for a century.

In Florida, vacation rentals have been an established and popular lodging type in the state for a century.

On April 20, 2010, high-pressure methane gas ignited and exploded on the Deep Water Horizon drilling rig, engulfing the platform. Eleven missing workers were never found and are believed to have died in the explosion. 94 crew members were rescued by lifeboat or helicopter, and the Deepwater Horizon sank on April 22.

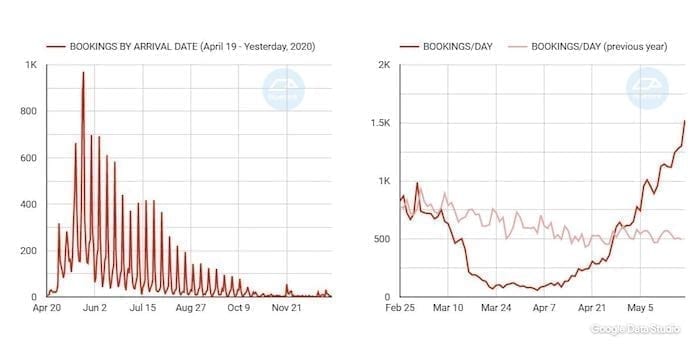

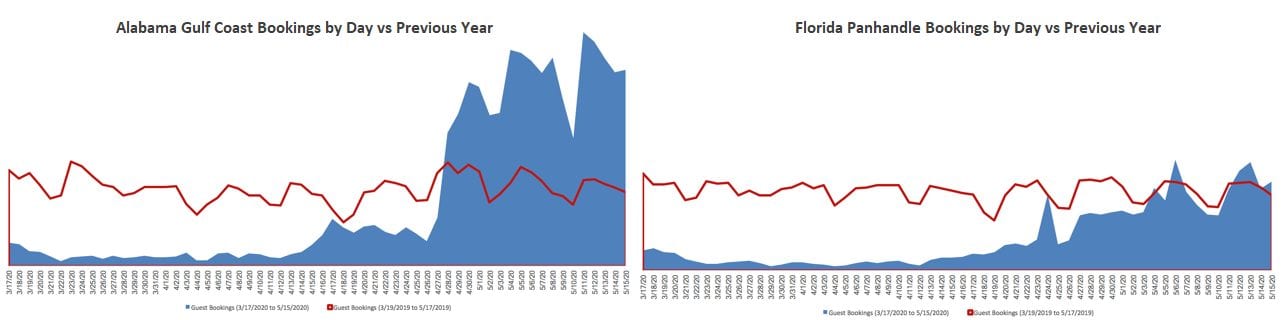

On April 20, 2010, high-pressure methane gas ignited and exploded on the Deep Water Horizon drilling rig, engulfing the platform. Eleven missing workers were never found and are believed to have died in the explosion. 94 crew members were rescued by lifeboat or helicopter, and the Deepwater Horizon sank on April 22. In 2010, travel was rebounding from the 2008 recession, and vacation rental managers located in Gulf states were anticipating their strongest summer on record. In the same way, in 2020, booking activity was up approximately 15 percent, and the vacation rental industry was looking forward to an exceptional year before shutdowns related to the spread of COVID-19 began. And, like the 2010 BP Oil Spill, no vacation rental business had listed “global pandemic” on their 2020 SWOT analysis.

In 2010, travel was rebounding from the 2008 recession, and vacation rental managers located in Gulf states were anticipating their strongest summer on record. In the same way, in 2020, booking activity was up approximately 15 percent, and the vacation rental industry was looking forward to an exceptional year before shutdowns related to the spread of COVID-19 began. And, like the 2010 BP Oil Spill, no vacation rental business had listed “global pandemic” on their 2020 SWOT analysis.

While vacation rental companies and destination marketers were trying to keep guests coming, the locals protested that conditions were not safe and states were not doing enough to protect the beaches, seafood, ecology, and the environment.

While vacation rental companies and destination marketers were trying to keep guests coming, the locals protested that conditions were not safe and states were not doing enough to protect the beaches, seafood, ecology, and the environment.