Throwing the gauntlet: dead in five years?

Three years ago, Maninder Gulati of OYO predicted at Phocuswright India that “plain aggregators” will be dead in five years. For Gulati and OYO, the future belongs to “controlled marketplaces”—those that offer predictable experiences to their customers. OYO was once a fledgling India-based hotel chain with an ambition to be “the world’s largest real estate network and brand”; today, it covers one million hotel rooms across more than a dozen countries and just added 125,000 vacation rentals and a few billion dollars in funding.

Booking.com’s sweeping ambition: Quality ratings for millions of homes.

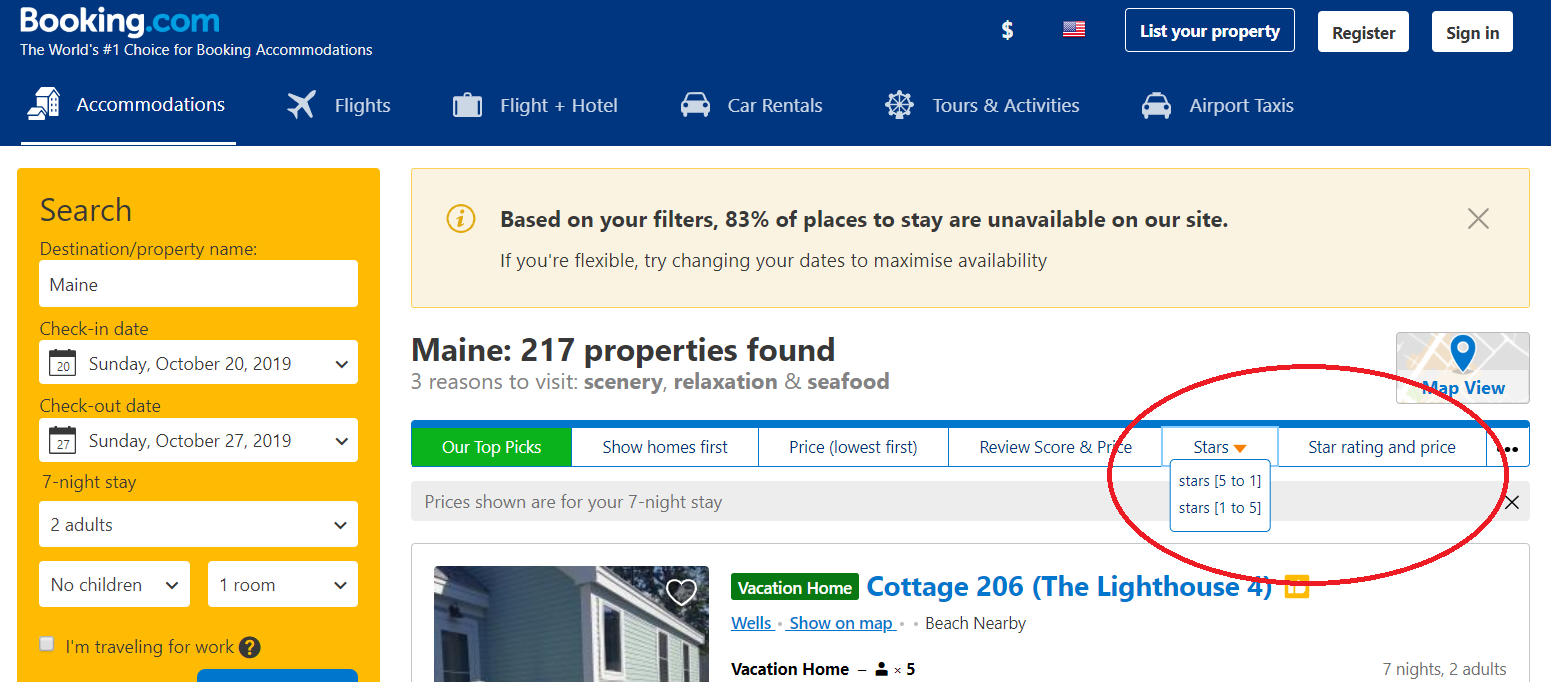

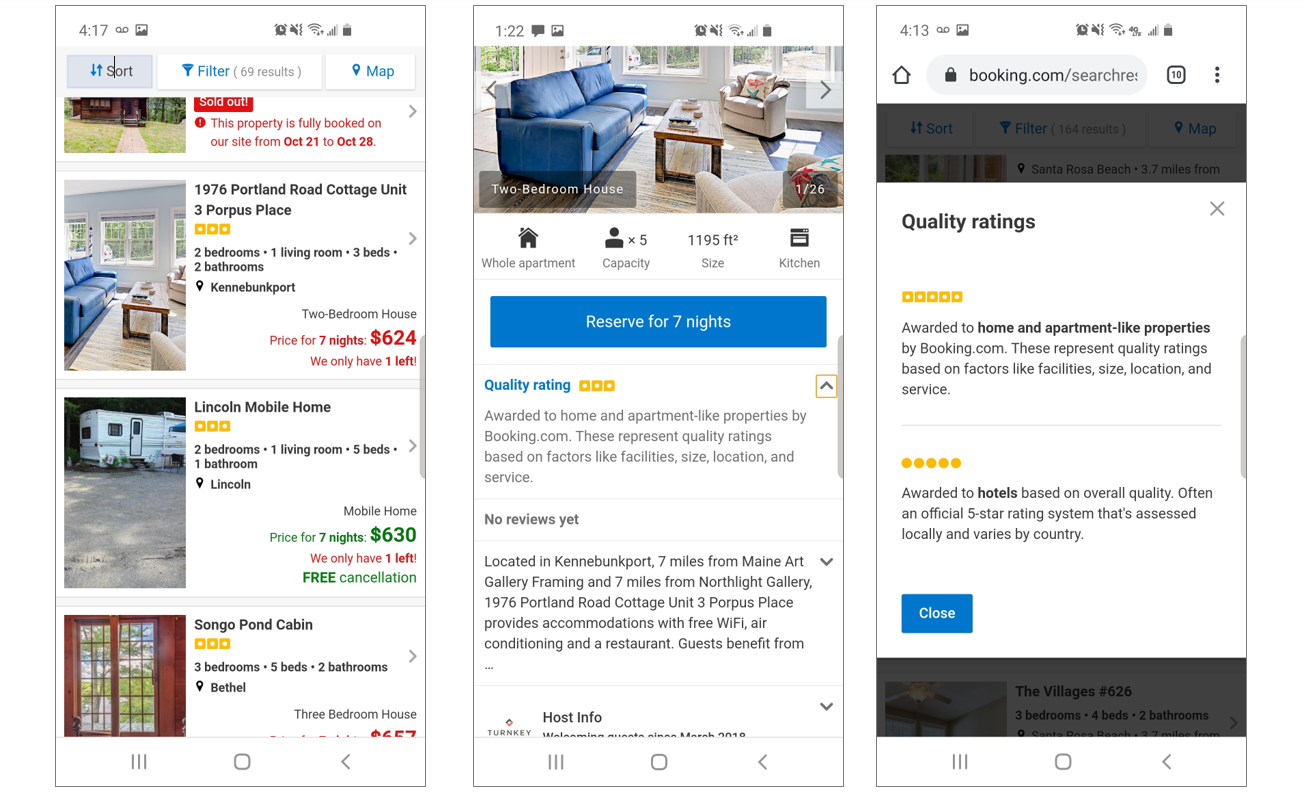

Arguably, Booking.com is (or was) one such “plain aggregator” in OYO’s crosshairs, but the company just responded with an equally ambitious initiative. At last weekend’s Vacation Rental World Summit (VRWS) in Como, Italy, Booking.com’s Alessandro Pacilio announced that it had introduced quality ratings for all of its vacation rental units globally, modeled on the 5-star quality classification. Quality ratings set a guest’s expectation (as opposed to reviews, which confirm whether the expectation was met).

This is a big deal. First, because no rating system for vacation rentals currently exists, Booking.com had to create one. By using artificial intelligence and Booking.com’s repository of data, the company proceeded to assign relative value to location, property size, reviews (if they existed), and amenities by market, based on what guests search and filter for. This would allow Booking.com to assign a quality category to both a historic villa in Tuscany and to a minimalist urban flat in Tokyo, no matter how distinct the property. Second, it marks a clear departure from “plain aggregation”: the quality rating is Booking.com’s, so the company “owns” the ratings and is putting its own brand behind it. This means Booking.com will have to defend the rating to both owners/managers and guests.

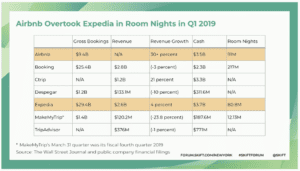

Third, Pacilio hinted strongly that more is to come soon: Booking.com will soon provide actionable suggestions to owners and property managers (PMs) on how to improve one’s rating, thus allowing them take a clear stake in the “offline” experience of their customers. This is sweepingly ambitious and perhaps recognizes that Booking.com takes OYO’s prediction seriously. Shortly after Booking.com’s announcement on this “first,” Tammi Sims and I moderated a panel on “The Rise of Quality and Brands” with Booking.com’s Thibault Masson, Marriott’s Chris Stephenson, Vacasa’s Michele Diamantini, and StayAlfred’s Richard Vaughton. Masson explained why Booking.com took such a big step: in our fast growing industry, many listings are so new that they don’t have reviews yet; for those, ratings can help solve the cold-start problem. Second, convergence is real, and with 27 million hotel room listings, many of which are searched for by star rating, Booking.com needed a way to serve up equivalent vacation rentals to guests filtering by a specific star rating. While neither Pacilio nor Masson provided details, both made it eminently clear that it just works: Booking.com has been backtesting ratings for months, and the improvements in conversion were compelling—witness the global launch.

High stakes

Marriott’s Chris Stephenson eloquently explained why the stakes are high: premium channels, such as Marriott, are working to deliver higher average daily room rates (ADRs), access new customer segments, give property managers an advantage with owners (versus those who don’t have access to such channels), and even help with loans and investors when quality is vetted. Of course, Booking.com might well play a similar game: if its ratings take hold and it underwrites ratings with its own brand, then ratings (powered by a strong brand) may become a substitute for brands. If anyone should know, it’s Booking.com: after all, it built a massive business in the European long tail of hotels, where global brands are largely absent, but where local brands and ratings help match properties with guest expectations.

But it’s far too early for Booking.com to declare victory. First and foremost, in typical Booking.com fashion, it appears the company has been testing ratings for months—so even with this big innovation under everyone’s nose, it has gone unnoticed—which means much consumer education and marketing remains to be done. Presumably, as confidence grows, Booking.com will start promoting its ratings, and explaining the critical difference between ratings and reviews.

Second, there are well-documented bumps on the road to quality and branding in alternative accommodation; for example, few would call Airbnb’s Plus a success, even after several reboots. While Airbnb Plus was arguably ill conceived from the start, with its operational complexity, one size fits all, and early focus on designing spaces rather than focusing on achieving operational consistency, it remains a warning as a very difficult subject to tackle.

Third, as owners and PMs review how Booking.com views their properties, we’ll soon see how closely aligned their views are with Booking.com’s and whether Booking.com’s AI magic got it (mostly) right.

Fourth, we’ll see how actionable the suggestions for improvements will be and what an “appeals process” might look like—this promises to become a high-stakes game for all involved.

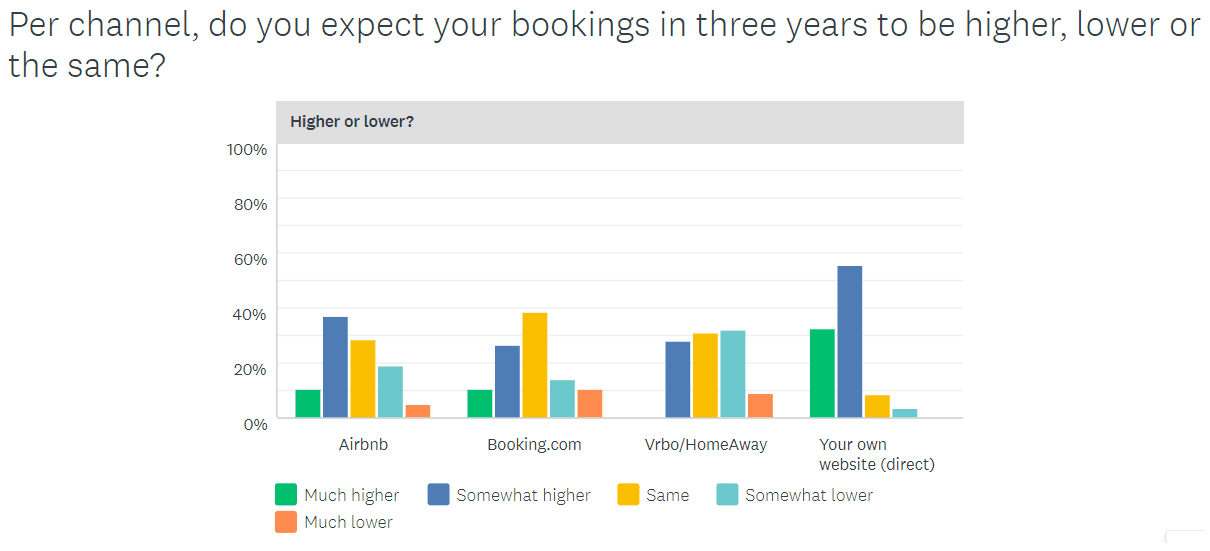

Fifth, in a way, this development heralds our collective failure as an industry to write our own destiny: Masson made it clear that this scheme would be proprietary to Booking.com. This means PMs and owners might soon find themselves catering to differing requirements for each platform or channel.

Sixth, this could further tilt the balance of power toward the OTAs if they now own ratings, and as they invest into building a ratings brand, we should expect commissions to increase. On our panel, we briefly broached the topic of franchising: after all, franchising is distribution with a brand and an agreement to follow brand standards. Developments like Booking.com’s may put them and others into a position to establish and enforce standards, guarantee them with their brand, and extract commensurate rents. Last, as Amy Hinote rightly notes, it’s still unclear whether VR ratings will favor hotels. I’d think that as far as Booking.com is concerned, there’s much more search volume on the hotel side, so convergence is more likely to drive traffic from hotels to VRs than the other way round.

A brave new world

Brands, and the predictable quality they should represent, have clearly arrived in vacation rentals: highlights at the VRWS were the keynotes by OYO and Marriott, unthinkable just a few years ago when hotels were the enemy and no one had heard of OYO. Sykes’ Graham Donoghue delivered a session on how PMs can preserve independence and build their own brand while driving 85 percent of direct bookings, and Google showcased its new VR search that showed in part where the pressure is coming from, to which Booking.com is responding.

Predictability and quality standards are great for our industry: they should be major drivers of growth. As an industry, we have to cater to the guest, and Booking.com made it crystal clear that quality ratings were created first and foremost for guests.

Properly’s Tammi Sims hit the nail on the head when she said that as an industry, we have a collective reputation and therefore a collective responsibility toward each other. Hopefully, each of the initiatives mentioned above increased the predictability of what our guests buy, while preserving the uniqueness of the properties we deliver. If we succeed, we should see continuing strong growth, as alternative accommodation succeeds in delivering unique experiences for ever larger segments of mainstream travelers with predictable quality and peace of mind.

At this week’s VRMA International Conference, we should hear answers to some of the questions raised above. Simon Lehmann will surely cover this topic in his fireside chat with Booking.com’s Olivier Gremillion, Vrbo’s Jeff Hurst, and Airbnb’s Clara Liang, and we should hear interesting perspectives from PMs on the receiving side of Booking.com’s new quality ratings in their Hospitality Masterclass panel.

We will be watching this closely—I’ll probe for PM reactions on Wednesday’s VRMA Urban Manager panel and for a strategic perspective from investors at VRMA’s Investor Panel. And we won’t stay on the sidelines; Properly was conceived as a quality management platform for the backbone of our industry, the small and medium-sized property managers. They are the ones who strive to deliver consistent quality on a daily basis and will soon have to navigate the quality standards of increasingly branded distribution.

In closing, first movers have arguably been a poor predictor of success in our industry: this was certainly true for Airbnb’s Plus and the hotel industry’s first foray into vacation rentals. It appears that Marriott and Booking.com’s second act promises to be much more promising. My bet would be that quality, and the rise of brands, will continue to play center stage, and I’m very much looking forward to the third act.

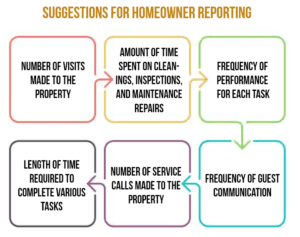

There are many ways to foster owner relationships, from personalized preventative maintenance plans to consistent and reliable communication.

There are many ways to foster owner relationships, from personalized preventative maintenance plans to consistent and reliable communication.

“I like our side, the Booking.com way, every single alternative accommodation that is on our site—every home, condo, treehouse, everything—[is] instantly bookable,”Fogel said. “When you press ‘I want it,’ you’re done, all done. Go get your thing. That is the difference.”

“I like our side, the Booking.com way, every single alternative accommodation that is on our site—every home, condo, treehouse, everything—[is] instantly bookable,”Fogel said. “When you press ‘I want it,’ you’re done, all done. Go get your thing. That is the difference.”

According to an internal announcement, “

According to an internal announcement, “

But what about ROE?

But what about ROE?

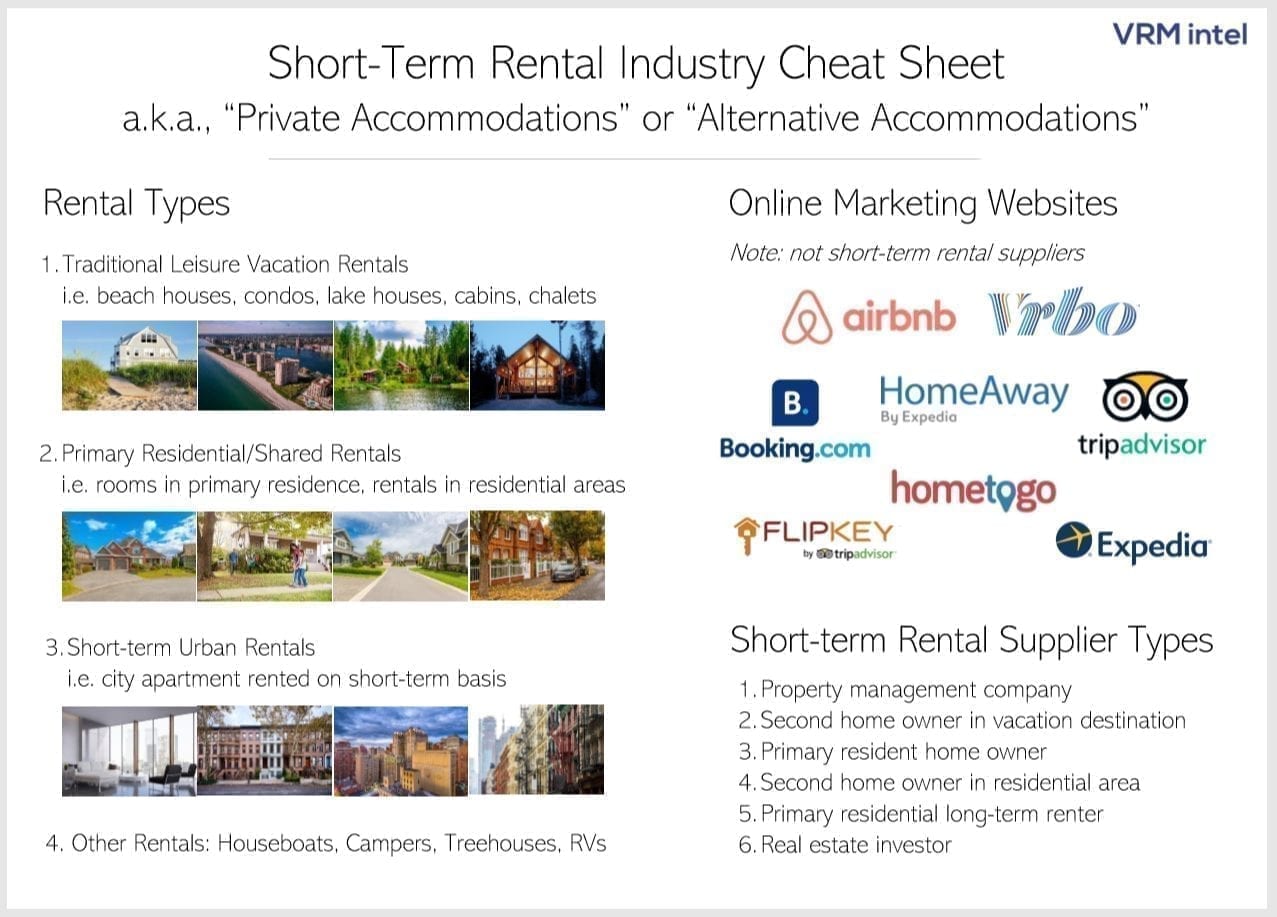

There are many options in the marketplace to solve for the lack of direct channel integrations, and there are many different flavors in that space as well.

There are many options in the marketplace to solve for the lack of direct channel integrations, and there are many different flavors in that space as well.

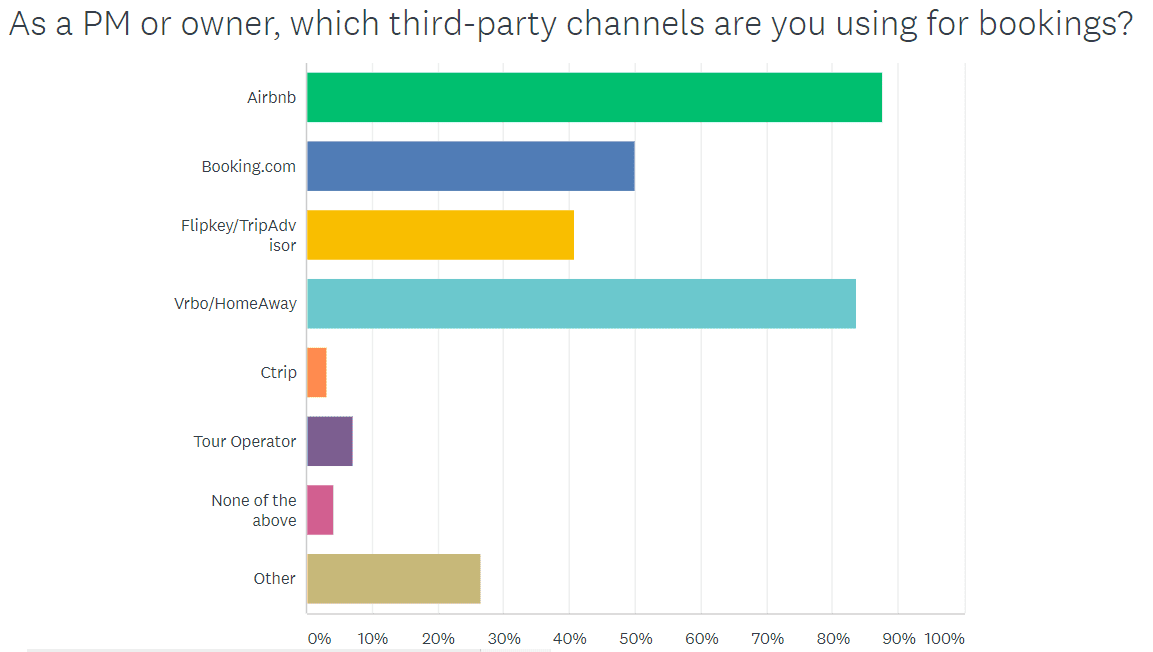

This conference was a who’s who in data and pricing technology. It is safe to say that every company committed to providing solid data and pricing tools for US vacation rentals was represented here. These companies demonstrated to attendees how they are approaching solutions, and they were candid in discussing their business models, their strengths, and their limitations.

This conference was a who’s who in data and pricing technology. It is safe to say that every company committed to providing solid data and pricing tools for US vacation rentals was represented here. These companies demonstrated to attendees how they are approaching solutions, and they were candid in discussing their business models, their strengths, and their limitations.

This event was an amazing learning experience, and being a part of the groundbreaking discussions that happened here was exciting. We wanted to get the smartest minds in VR data and revenue management together, and I think we came really close to having all of the best of the best.

This event was an amazing learning experience, and being a part of the groundbreaking discussions that happened here was exciting. We wanted to get the smartest minds in VR data and revenue management together, and I think we came really close to having all of the best of the best.

Naturally, someone is going to get up in the night for a comfort break. They fumble around in the dark, trying to find a light switch, and then they stumble, half-asleep, down a dark hallway. It’s an accident waiting to happen that could be easily prevented with the use of mobile motion-sensing night-lights. Whether using a battery powered stick plugged in or holding it in your hand, this simple and effective remedy will show you are thoughtful and have your guests’ safety in mind.

Naturally, someone is going to get up in the night for a comfort break. They fumble around in the dark, trying to find a light switch, and then they stumble, half-asleep, down a dark hallway. It’s an accident waiting to happen that could be easily prevented with the use of mobile motion-sensing night-lights. Whether using a battery powered stick plugged in or holding it in your hand, this simple and effective remedy will show you are thoughtful and have your guests’ safety in mind.

A ranking as one of the most popular small appliances across the US means that the majority of homes will probably have one. Because we strive to deliver a property that is as good as or better than a guest’s home, this is a great addition to the kitchen set-up. Give your property a gift, and your guests will love you.

A ranking as one of the most popular small appliances across the US means that the majority of homes will probably have one. Because we strive to deliver a property that is as good as or better than a guest’s home, this is a great addition to the kitchen set-up. Give your property a gift, and your guests will love you. The days of the boom box are over. Guests are bringing music on their devices and a

The days of the boom box are over. Guests are bringing music on their devices and a  Most guests traveling internationally will think ahead and bring their own adapters to convert the power from UK/European voltage to US voltage. Providing a couple of these will endear you to those who haven’t.

Most guests traveling internationally will think ahead and bring their own adapters to convert the power from UK/European voltage to US voltage. Providing a couple of these will endear you to those who haven’t.

Setting your properties apart from hotels means doing what they don’t do. Easy, right? Doing this means investing a little more in the amenities understood to be standard in a hotel, like towels. You have to be quite close to the luxury brand of hotel to get a bath towel that will wrap an ample rump and come together at the front. That should not hold true in any self-respecting vacation rental.

Setting your properties apart from hotels means doing what they don’t do. Easy, right? Doing this means investing a little more in the amenities understood to be standard in a hotel, like towels. You have to be quite close to the luxury brand of hotel to get a bath towel that will wrap an ample rump and come together at the front. That should not hold true in any self-respecting vacation rental.  cold drink. Now imagine arriving at a rental home to find there’s either no ice at all or two tiny ice trays that came with the fridge that will serve up enough ice for a couple of drinks but will also melt in minutes.

cold drink. Now imagine arriving at a rental home to find there’s either no ice at all or two tiny ice trays that came with the fridge that will serve up enough ice for a couple of drinks but will also melt in minutes.