It’s officially nine days until tax day in the U.S.; and while many might be ahead of the curve, there are millions of Americans who will wait until the last week to file or request an extension.

One of the main reasons people procrastinate is due to complexities with their taxes, and owning a vacation rental only adds to an already complicated ball of wax.

While nothing replaces the need for a knowledgeable CPA, Vacasa created a vacation rental tax guide that can be useful when advising homeowners on taxes.

The Right Form Matters

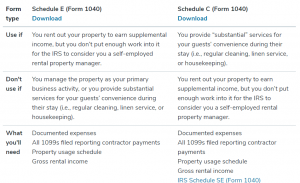

First and foremost, there are two forms that are applicable to vacation rentals: an IRS Schedule E and an IRS Schedule C. When considering which is the correct form, it’s easiest to think about the income being generated by the property. If the property is generating supplemental income to the homeowner, Schedule E is likely the way to go. If it’s a primary business and high-grossing unit (i.e., considered more as a business), Schedule C should be used to file vacation rental taxes.

First and foremost, there are two forms that are applicable to vacation rentals: an IRS Schedule E and an IRS Schedule C. When considering which is the correct form, it’s easiest to think about the income being generated by the property. If the property is generating supplemental income to the homeowner, Schedule E is likely the way to go. If it’s a primary business and high-grossing unit (i.e., considered more as a business), Schedule C should be used to file vacation rental taxes.

For either document, homeowners need to have a list of documented expenses, all 1099s filed reporting contractor payments, property usage schedule, and gross rental income.

The 14-Day Rule Applies

Second, the amount the homeowner uses the property will have an impact on what they can write off. In simplest terms, the 14-day rental rule means you don’t pay taxes on the income you receive from your short-term rental if BOTH of the following are true: A) you rent out the property for less than 14 days and B) you use the property for 14 days or more. However, if you rent the property out for more than 14 days and use it yourself for less than 14 days, taxes can become more complex.

Homeowners should keep a log of each day the property was in use, and include a breakdown of vacation rental days, personal use days and days used for repairs and property maintenance. This will help the IRS determine whether the property is rented for more than 14 days per year, and thus, how much the homeowner is able to write off. Another important note: tax deductions vary by state, but in all cases require a receipt for each expense deducted, so homeowners should make sure they have a file – preferably digital – to keep track.

Repairs vs. Improvements

A lot goes into maintaining a property and while it may seem that all upkeep is assigned to one category, there are actually two when it comes to your taxes: improvements and repairs. Repairs, like fixing loose banister or a broken window, can be written off, however, improvements to the home, like updating an old bathroom, are handled differently. Instead of being written off in the year of the expense, they are deducted over the use of their lifetime. While this may sound complicated, homeowners should still include when filing as it is indeed tax-free income.

Sharing these tips with homeowners can alleviate potential headaches and help familiarize vacation rental tax laws, especially if they are down to the wire.

Five Essential Tools for Vacation Rental Taxes

- Usage log: detail personal, rental and maintenance/repair days. Note: donated stays count toward personal use days.

- Digital folder: retain, organize and back up photos of receipts and cross-reference with accounts used for supplies (Amazon, Costco, etc.)

- Financial log: Track payments for property taxes and mortgage.

- Updates log: Document expenses and generally describe all repairs, maintenance and improvements.

- Depreciable assets schedule: show reduced value of assets as it may be an expense you are able to write off.

Disclaimer: This is designed to provide general information regarding the subject matter covered. It is not intended to serve as legal, tax, or other financial advice related to individual situations. Because each individual’s legal, tax, and financial situation is different, specific advice should be tailored to the particular circumstances. For this reason, you are advised to consult with your own attorney, CPA, and/or other advisor regarding your specific situation. The information provided here is for your use and convenience only. We have taken reasonable precautions in the preparation of this material and believe that the information presented in this material is accurate as of the date it was written. However, we will assume no responsibility for any errors or omissions. We specifically disclaim any liability resulting from the use or application of the information contained in this publication.