At Triptease’s Direct Booking Summit for the hotel industry in early October, Isaac Collazo, vice president of competitive intelligence at IHG, shared several largely positive trends in the hotel industry. Digging into these statistics reveals key takeaways and reminders for the vacation rental sector.

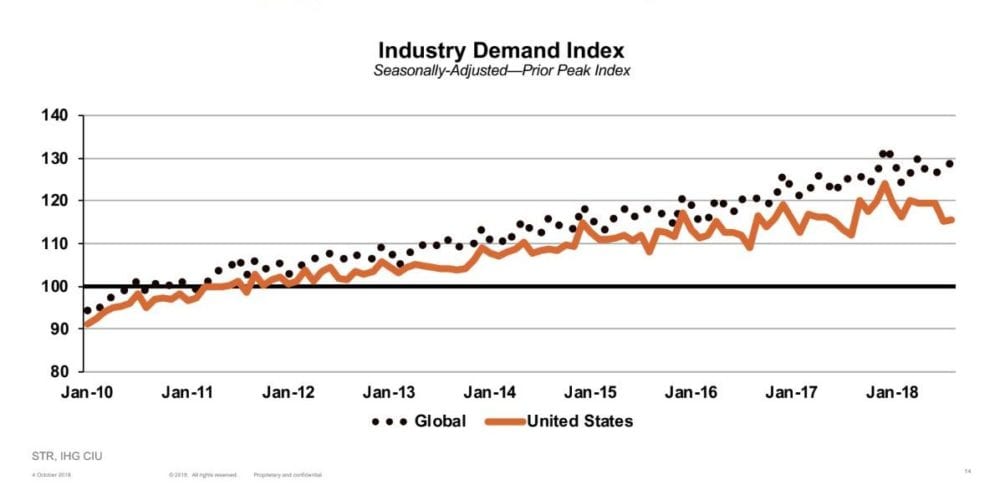

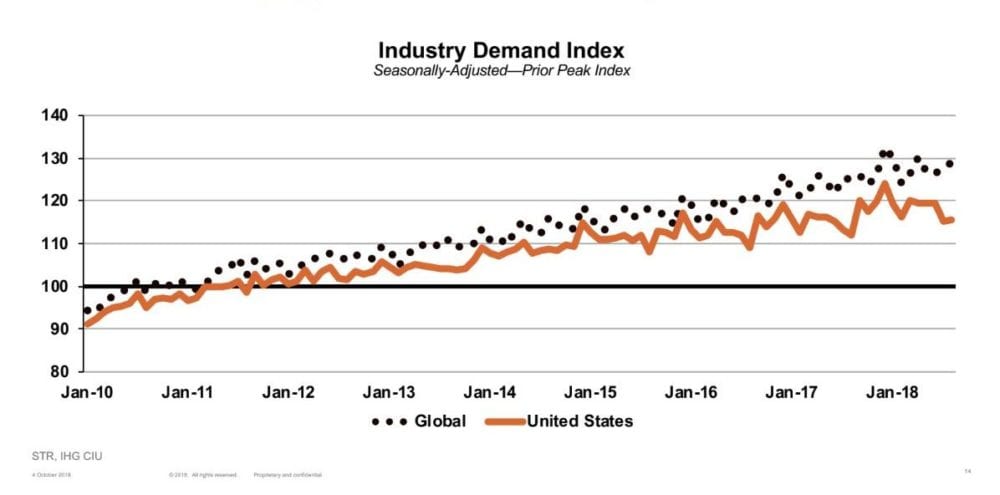

US year-to-date demand is at its highest growth rate of the past four years. US hotels have set occupancy records the past three years, reaching nearly 66 percent on average in 2017. US year-to-date occupancy has reached as high as 67.6 percent.

Furthermore, hotels reached these records even with a 40 percent growth in inventory over the last 10 years.

But while these numbers were being shared at the Direct Booking Summit, VRM Intel editor Amy Hinote was hearing equally positive statistics for the vacation rental industry at the LiveRez Partner Conference. In former Airbnb executive Shaun Stewart’s presentation on the state of the vacation rental industry, he reported that demand for short-term rentals as a lodging alternative increased 81 percent between 2012 and 2017 and is predicted to increase 59 percent between 2017 and 2022. (See Hinote’s full recap here.)

The fact that both accommodations sectors are doing well points, in part, to the steady and improving economy supporting a healthy travel and lodging industry as a whole. “Beware of napping at the wheel,” said Charlie Osmond, chief tease at Triptease, “and be prepared for tougher times ahead.” His advice was for hoteliers, but it applies to all travel sectors.

Despite occupancy and supply growth, average daily rate (ADR) growth remains below prerecession levels.

Hotel ADR growth is rising at the same pace as inflation. In other words, real ADR growth hovers at 0 percent. Collazo said that one reason for this could be new construction leading existing hoteliers to cut prices in order to retain their market share.

It is possible that real ADR growth hovering at 0 percent is helping to fuel occupancy growth. The more the economy strengthens, and the longer real ADR growth stays at 0, the more accessible hotels become.

The opposite may be true in vacation rental destinations that have seen seasons soften lately. In the fight against margin compression, pushing rates up too quickly can outpace what the market can handle, and it can inadvertently make hotels more appealing.

Whether or not this is the case, margin compression is a real issue. In a separate discussion about how budget hotels and hostels can compete with luxury brands, John M. Scott, chairman of A&O Hotels and Hostels, illuminated a strategy to combat this. He pointed out that luxury hotels are always piling on new amenities and not getting rid of old ones. Budget properties can cut out the clutter and focus on only those things that are really important to their guests. The vacation rental industry may find that this concept works here too, as may many other strategies.

Corporate profits remain conducive for labor and travel growth, and IHG expects profits to continue increasing in 2019.

The topic of how to appeal to business travelers as a secondary or tertiary market has floated around the vacation rental industry for some time. With the rise of “bleisure” travel (tacking leisure days onto business trips) and the recent massive investments into hybrid business-leisure rental companies like Stay Alfred and Sonder, perhaps it’s time to deepen this conversation and think beyond Wi-Fi and desks.

Appealing to business travelers with more purpose-built offerings can serve as a hedge against less stable leisure travel seasons, like bonds to the vacationer stock market, particularly in vacation rental destinations near urban centers and major airports. Think shared spaces for meetings, small in-office cafés with work stations, or dry cleaning pickup and delivery.

Low unemployment is also a positive indicator for leisure travel.

Low unemployment is a double-edged sword. It helps get guests in the door, but if VRMs weren’t already feeling the labor pinch, they will soon. There’s no time like the present to reevaluate hiring strategies and compensation packages to recruit and retain good employees.

These hotel industry indicators are only one piece of the puzzle. Keep an eye out for Hinote’s discussion of hotel data in “Are Predictive Indicators Holding and Are Generational Changes in Consumer Behavior Affecting the Vacation Rental Industry?” in the VRM Intel fall 2018 issue. “Thankfully, the era of self-reported comparative data is coming to an end and is being replaced with real-time data that is integrated with property management software systems for apples-to-apples comparison,” she writes. “As the vacation rental industry matures, and comparative market data is available on a market basis, the correlation between economic conditions and actual performance will become rapidly clearer.”

Hinote’s pro tip on considering hotel performance indicators: Experienced vacation rental revenue managers take a deeper dive into leisure travel versus business travel and into related individual markets.