If there was a bright spot for travel in 2020, it was found in the vacation rental industry.

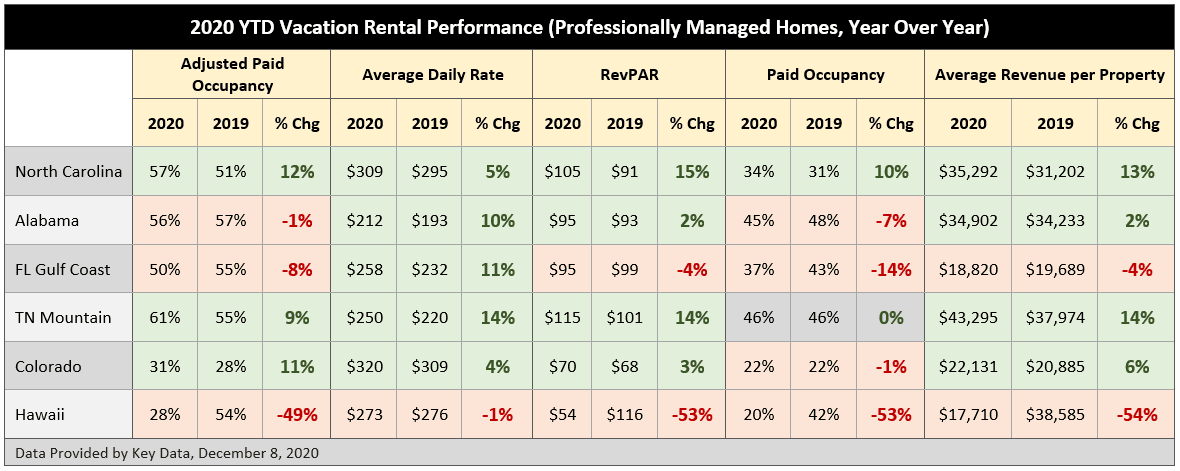

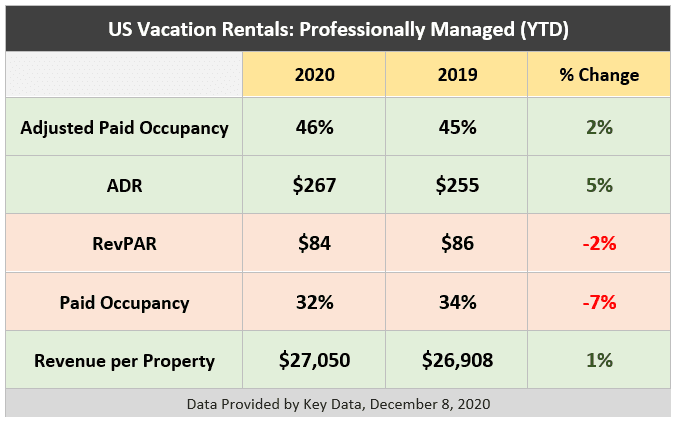

US performance data provided today by Key Data shows that professionally managed vacation rentals are having a better year than was expected when COVID-19 transformed our way of life, but the narrative has been a story of haves and have nots.

In the United States, overall average daily rates (ADRs), revenue per property, and adjusted paid occupancy improved in 2020, year to date (YTD), over 2019.

Consumers continued to travel in 2020, but they opted for drive-to locations, leisure destinations, and whole-home vacation rentals. However, these were not the only factors that contributed to success; government mandates and travel restrictions also drove their decisions.

Destinations that prohibited or restricted travel in home rentals for long periods of time (Hawaii), or even for shorter periods (Florida through Memorial Day), were not able to fully recover from COVID-19’s initial hit. Further, hurricanes and wildfires in 2020 negatively impacted performance in key leisure markets.

Note: Paid Occupancy is calculated by dividing the number of paid guest nights by total nights (365 per property). In contrast, Adjusted Paid Occupancy is calculated by dividing the number of paid guest nights by the total nights available to rent. In the vacation rental industry, Adjusted Paid Occupancy is more often used than Paid Occupancy since homeowners often “block” nights from being available for rent for personal use or home improvement projects. With the pandemic, for example, many homeowners used their second homes as retreats to get away from the cities in which they have primary residences, taking their second homes out of the rental pool.

The resilience of vacation home rentals as accommodation alternatives during difficult times has been proven over multiple crisis events, including recession periods and after 9/11.

In addition, the percentage of direct bookings with local rental management companies increased as guests in drive-to feeder markets are more familiar with local brands and do not need aggregators, like Airbnb and Vrbo, to find rentals. However, Airbnb and Vrbo benefitted from new vacation rental travelers who are were more likely to stay in hotels under normal circumstances.

As Clark Twiddy, president at North Carolina’s Twiddy & Co., wrote in a recent article about forecasting, “2021 will most likely be another strong year for many vacation domestic home rental operators as traveling confidence will be slow to return. It’s 2022 that is the big question mark.”

To hear discussion about vacation rental performance, join Skift’s Short-Term Rental Summit on December 9th. Use promo code VRMINTEL for VRM Intel’s discount to save $36. Click here.