The short-term rental (STR) industry has shown incredible resilience over the past couple of years. Even since the beginning of this year, we have been hit with record-breaking demand levels and new supply has been added en masse throughout the country. So despite a global pandemic and travel restrictions threatening the industry, the STR space has made the most of this situation.

Because the market is getting increasingly competitive, property managers must now up their games to study and outperform the competition, which is getting tougher and tougher. If you’re not leveraging data insights from your listings as a vacation rental manager, you’re falling behind.

Here are steps to learn how to identify the success drivers of the industry’s top performers and translate them into actionable tips that will leave you wondering, “Why didn’t I think of that?”

1. Don’t Panic: Understand Broad Economic Cycles

Just as we thought we were out of the woods after the pandemic, the economy decided to take center stage and become the next biggest threat to short-term rentals, leaving us with questions like, “Will we enter an economic recession in the next year?” and “How will this affect my bookings?” burning in our minds.

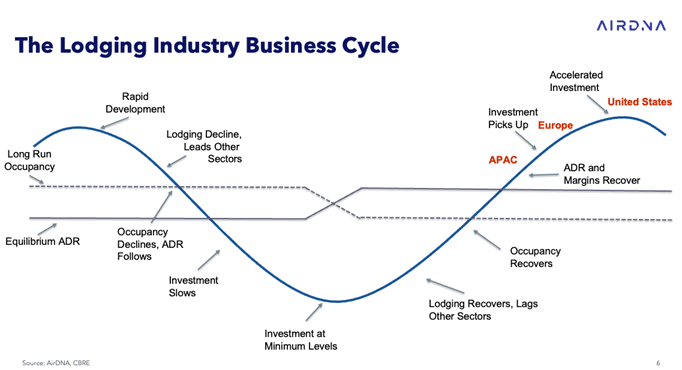

Whether you’re an optimist or a pessimist, there is some good news: The lodging cycle is predictable (with the exception of COVID).

The balance of supply and demand performance from summer 2022 and summer 2019 suggests that we have not yet entered a recession. So what is the current recession risk?

At the moment, the US is at a 50% risk of falling into a recession and Europe is nearer to 60% or 70%. However, the actual risk will become clear in the next couple of months after the impact of the European Central Bank (ECB) interest rate hikes is determined. (Make sure to watch closely because if Europe does enter a recession, the US could be pulled down too.)

The best way to keep a cool head during this time is to understand the hospitality lodging cycle and where you are in it. This may seem complicated at first, but it’s really quite simple once broken down.

Pre-COVID, the STR industry was last in the stability phase in 2010. It’s important to remember that lodging lags other economic cycles and travel is one of the last segments to recover, but this makes it even easier to predict since we can follow other industries’ timelines to mark the way. During this phase of recovery, growing occupancy rates push up average daily rates and profit margins. Then, there is usually a trigger of some sort that will announce the lodging decline and the cycle begins all over again—For all of you pessimists out there, it’s also important to note that being at the peak of the growth stage doesn’t necessarily mean an immediate decline. In fact, 2015 to early 2020 were all peak times.

Remember that regardless of where you are in the cycle, as long as you know what’s coming, you can prepare and act accordingly.

2. Choose Your Inventory Wisely

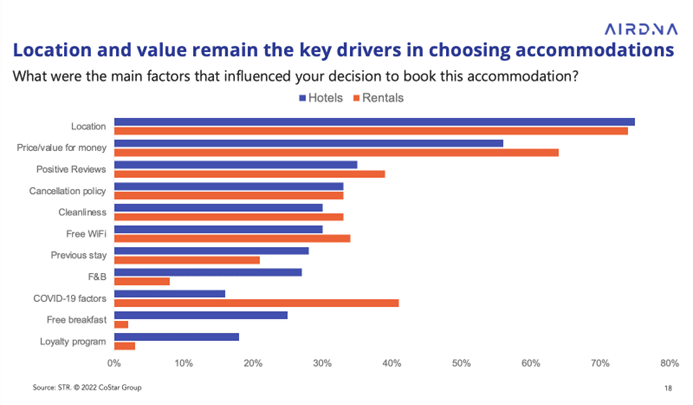

If the possibility to expand your business arises, the first factor to look at is the listing’s location—the number one determining factor in why travelers select one accommodation over another.

If your properties are lagging behind and you don’t have listings in the right area and right location, it’s time to take action. Be humble and responsible enough to switch your inventory and pivot business to where the demand is going. You’re the local expert, so if you know that a specific neighborhood is performing well, what are you waiting for?

Don’t put all your eggs in one basket. If your portfolio includes 20 units in the same market with the same specifications, you’re just giving away a stick to be beaten with. Have the foresight to predict (using data) where your future guests are going to be coming from and optimize for that prediction.

Make strategic decisions long before it’s crunch time. Growing your business efficiently without data is like trying to read a map without a compass. We always talk about how data can help you grow, but even more importantly, it helps you avoid only growing in quantity while forgetting quality. Don’t waste your time and effort onboarding properties that will cause you headaches and not generate enough revenue.

3. The Bigger Your Portfolio, the Harder You Need to Work for Reviews

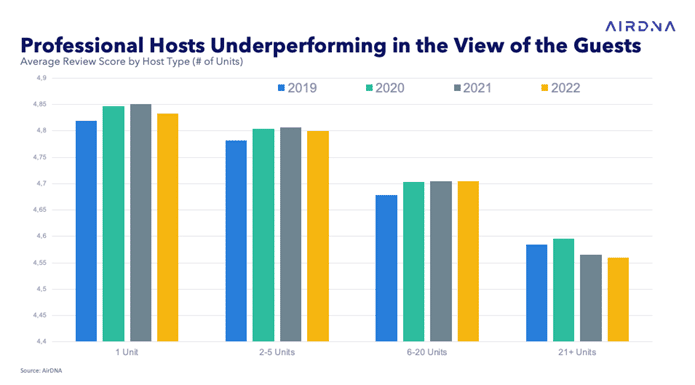

Here’s the bad news: Professional hosts are consistently underperforming in the eyes of guests. The larger the portfolio, the lower the ratings. Could this be because guests prefer the personalized experience of an individual operator even though there is no guarantee of quality?

Booking with a larger vacation rental manager (especially one operating in multiple cities or countries) gives a more standardized service, but it’s likely that more communications and services are automated which can be disappointing for those who prefer a more human touch.

Booking with a larger vacation rental manager (especially one operating in multiple cities or countries) gives a more standardized service, but it’s likely that more communications and services are automated which can be disappointing for those who prefer a more human touch.

Communication and accuracy is an easy area of improvement for hosts. There is absolutely no excuse for professional managers to rank poorly in this area with all the technology available to help hosts improve communication, . Aim for not only meeting your guests’ expectations but exceeding them by thinking of unexpected ways to show your guests the full value of your service, enhancing their experience from before check-in to after they leave.

Action Items for Communication: Is your property located 10 minutes walk from the city’s top attraction? Highlight this fact not only in your description but also in your photos and any other communication you have with your guests.

Action Items for Accuracy: Are you doing spot-checks of all listings on a regular basis? Are you ensuring that all amenities listed are working & property descriptions are up to date?

4. Go the extra mile for first-time reviewers without leaving money on the table

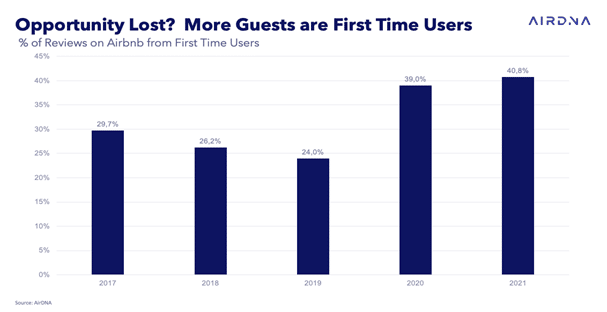

Never stop asking for reviews (particularly from new users/guests): in 2021, 40.8% of Airbnb reviews were left by first-time users of the platform, up from 24% in 2019. More guests have discovered short-term rentals for the first time thanks to the pandemic-driven search for more space, and new users may have expectations that don’t line up with the service offered, so be clear from the start about what guests can expect.

Put yourself in your guests’ shoes, and think of the small details that make for an exceptional hospitality experience. Is it a chilled bottle of wine and local delicacies ready for their check-in? An insider guide to the best places in the neighborhood? Is the heating switched on using smart home appliances so it’s cozy when they arrive?

When is a 5/5 a bad rating? Value. At first glance, a 5/5 rating seems great, right? Wrong! Think of it this way: this excellent rating means that guests thought your property was extremely good value for the money they’ve spent. Translation = you are underpriced. If you want to boost your profitability, look closely at how your properties are performing for this rating, and adjust your pricing accordingly by paying close attention to what your competitors are charging.

Conclusion

There will always be some external circumstances that are out of your control, like an economic recession, a global pandemic, or a natural disaster. For all the rest, you hold the keys to future-proofing your vacation rental business by leveraging data to eliminate the guesswork of pricing and benchmarking, establish trust and credibility with your clients on one side, and have more time to focus on quality service for your owners on the other.

About the Author

Sarah DuPre is the Senior Sales Director at leading short-term rental data and analytics provider AirDNA. Sarah’s passion for international travel led her to the sales team at the Barcelona office, where she helps property managers, hoteliers, and local governments comprehend the impact of Airbnb and the sharing economy on their local area, and works with real estate investors to help them find the best opportunities for short-term rental investment.

Link: airdna.co/vacation-rental-managers

Comments are closed.