By Beverly Serral, cofounder and CEO of BESTNEST

Attendee 1: I hope I hear a lot about master leases.

Attendee 2: I hope I hear a lot about tech.

Me: I hope I hear a lot about the traditional resort market and what’s in store for second-home/vacation rental owners and managers.

Two out of three of us were not disappointed.

OK, well, I was not disappointed, exactly. The first-ever Skift-produced Short-Term Rental Summit, held earlier this month in New York City, was nothing if not enlightening. And educational. And heavily skewed toward the urban rental market.

Looking back, I suppose the fact that the conference title did not include the word vacation might have been my first clue. And I will cut to the chase and just tell you that the venture capital money seems to be focused on only this segment of the market—just in case you were wondering.

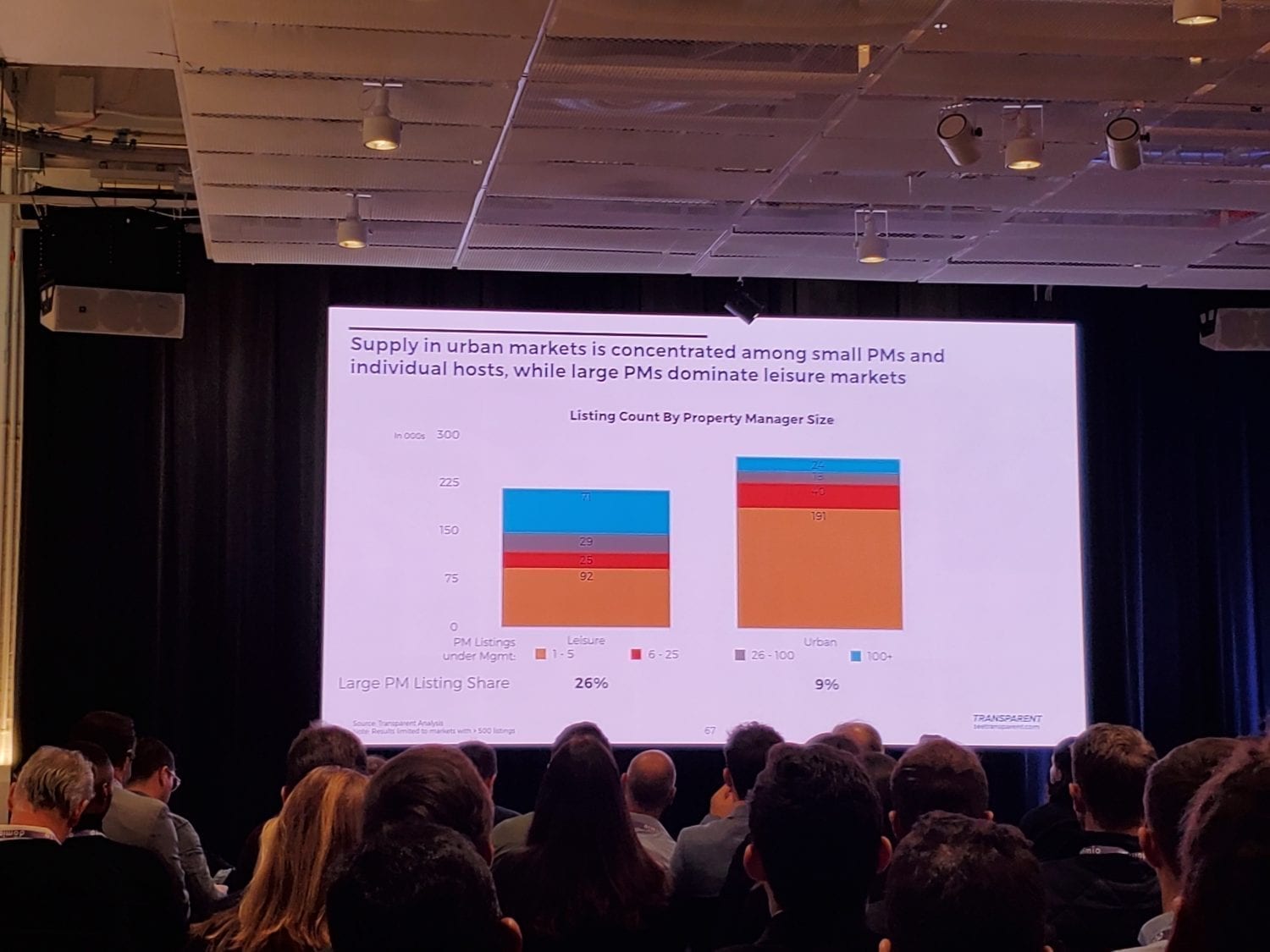

Unfortunately, the first presentation of the day, provided by the firm Transparent, set the tone and gave a markedly slanted analysis of the urban vs. resort market inventory by stating the number of short-term rental units in “top markets.”

According to Transparent’s Drew Patterson, the number of units in US urban markets—including Los Angeles, San Diego, Atlanta, Austin, Miami, and Seattle—totaled 273,000. In contrast, Transparent claimed there are only 217,000 total short-term rentals in leisure destinations with over 50 rentals.

Right off the bat, the mostly citified audience nodded in approval—as if they were the new (and perhaps only?) game in town.

The problem? There are not more TOTAL urban short-term rental units than leisure vacation rentals. There just aren’t. But you wouldn’t have known any different—especially after slide 2—unless you were a part of the resort vacation rental market, which a handful of us were/are.

But we listened on because, surely, there was more good stuff to come regarding the entire industry. However, because the groundwork had been erroneously laid, the error went forward, and the conference (not coincidentally cosponsored by the four leading brands in urban short-term rentals, Sonder, Lyric, Domio, and Stay Alfred) moved ahead.

Skift is known for gathering and presenting relevant speakers with timely messages, and its foray into the short-term rental conference sphere was no exception. Here are some snapshots of speakers and their missives.

Francis Davidson, Cofounder and CEO of Sonder

Buzz: $360M raised so far; 3,500 units with 10,000 in the pipeline; hospitality brand led by tech; takes only days to make a property guest-ready; let tech lead the guest experience and keep things efficient and affordable; master leases of entire properties are attractive to developers; long-term vision; make provisions for economic changes; in-house dynamic pricing; not looking at acquisition of traditional PMs; building a true hotel in Miami; spending 0 marketing dollars—all channels.

Takeaway: Sonder seeks to become a globally recognized brand that operates hotels/vacation rentals/apartments, using all things tech, a master lease or ownership model, and risk management approach to business.

Jennifer Hsieh, VP of Homes and Villas, Marriott

Buzz (mostly an answer to why Marriott would enter the VR market at all): 27 percent of Marriott guests are leaving hotels to rent a VR; pain points for travelers include too much choice in VR properties, uncertainty of product, and anxiety from booking to arrival; Marriott will work with PMs (not acquire PMs); three-layer process to partner with PM: (1) look at the PM operations and financials, (2) look at every property, and (3) robust quality audits; backbone of the model is housekeeping and cleanliness; guests can use Bonvoy points; 5,000 properties in the portfolio; property profile is three+ BR, five+ nights; 90 percent loyalty members; poised for growth mainly in beach and ski locales.

Takeaway: Marriott looks to keep its guests loyal to the brand while maximizing the Bonvoy program.

TJ Clark, Cofounder and President of TurnKey, and Jordan Allen, CEO and Cofounder of Stay Alfred

Buzz: TurnKey saw a fragmented resort market and uses tech to help ensure a consistent guest experience; uses HomeAway software but built its own digital lock; monitors noise and uses Ring doorbell and iPads with guest info; looks to add inventory in resort markets. Stay Alfred built its own tech; hot on the master lease model; targeting properties specifically designed for VR; seeking more urban inventory; has 31 percent repeat guest rate. Both agree the word luxury is tired (moving to adjectives such as upscale) and see lines blurring between hotel and VR.

Takeaway: Guest-facing tech and consistent experience are the future in all markets.

Vered Schwarz, COO of Guesty

Buzz: Millennials are not buying homes and don’t even want long-term leases; business travelers’ needs/wants also changing; guests prefer experience/space/brand; Guesty chatbots soon will do 70 percent of guest communications.

Takeaway: Um, more tech looming as we boomers fade into the sunset?

Olivier Gremillon, VP of Global Segments, Booking.com

Buzz: 39 percent of travelers prefer VR over hotel; 70 percent of travelers would be keen to book an eco-friendly accommodation; Booking.com not buying PMs.

Takeaway: No one much wants to buy a traditional PM.

Andrew Kitchell, CEO and Cofounder of Lyric

Buzz: STR market shifting from “alternatives” to “new norm”; Lyric investing in quality (space, custom furnishings) and community (partnering with local vendors); don’t hit the guest with tech; 500 current units; keep it consistent.

Big Buzz: Steve Hafner, CEO of Kayak, joined onstage to announce that Lyric will be Kayak’s first partner in Premium Experiences. Guest can use the Kayak app to check in with Lyric. Steve noted that the travel market is big enough to absorb all niches.

Takeaway: A little less on tech and more on guest experience but still high on master lease and urban market.

Jay Roberts, CEO and Cofounder of Domio

Buzz: Domio founded to be a branded home manager (72 percent of hotels are branded, while 1 percent of VRs are branded); travel has exploded as it has become more affordable; VR = wild card, inconsistent, larger spaces, and hotel = small spaces, expensive, branded; Domio opened its own apartment hotel in New Orleans, which is ranked #1 in NOLA on TripAdvisor; has moved from 20 to 60 percent direct bookings; adding 1,000 units per MONTH in 2020; started with homes, moved into master leases, and, now, signing only apartment hotels.

Takeaway: Brand, urban, explosive growth.

Laurence (LT) Tosi, Founder and Managing Partner of WestCap and former CFO of Airbnb

Buzz (here goes because LT is a fast talker): We are in the late cycle of real estate market; large-scale, multifamily developers weighing STR as a way to fill units; urban market hotter than resort market; urban to be more consistent; resort market will always be fragmented; master leases attractive to investors; STR can be efficient and margins higher than hotels; of the urban STR brands, only a few will remain; lines crossing as Airbnb buys Hotel Tonight; brands must control the guest experience because the marketplace is unstructured; brand that offers consistent product wins; WestCap invested in Sonder; need to integrate guest services such as Shipt, DoorDash, etc.; no one wants to call the “front desk”; most owner hosts are still unprofessional; tech moves the needle; necessary for success are (1) scale, (2) tech, and (3) operations.

Takeaway: Heavy on tech and scale and no mention of actual accommodations or hospitality, but then, again, this was a VC presentation.

All in all, the Skift STR Summit was a hugely informative, if somewhat perplexing, day. The first such type symposium I attended was the 2018 Phocuswright Conference, and, while short-term or vacation rental was only a small part of the overall focus there, the industry was represented by and inclusive of urban and resort rentals as well as the subscription-style vacation model; phrases such as “guest experience,” “consistency of product,” “branding,” and “professionalization of the industry” were part of almost every presentation.

And, while all these topics were mentioned at Skift, I must say that, when they were directed at the resort markets, it was almost in a lost-cause sort of way. It got me thinking—how can we in the resort markets, with collectively hundreds of thousands of properties, better tell our own story? And if recession is looming and travel patterns change, which will travelers give up: a long weekend in Austin or a week at the beach?

My personal takeaway? Don’t write off the resort markets. I lived and worked through the worst years in real estate, and what looked to the buyer to be a little “tired” in the glitz and glam of 2005 was suddenly “comfortable, stable, and secure” in 2010.

Go forth with tech and branding, but keep a little historical perspective.

“It got me thinking—how can we in the resort markets, with collectively hundreds of thousands of properties, better tell our own story?”

You just did. Nicely done.