A Hotel Veteran’s Perspective

After working in the boutique hotel world for over 15 years with a specific focus on revenue management and distribution, I was excited to make the transition to the vacation rental space as CMO at RedAwning Group last year. This is an exciting space with enormous revenue management opportunity. Vacation rental property managers have been practicing revenue management for a long time (just having seasonal rates is a form of revenue management). With more technology and resources becoming available in the space, vacation rentals are ripe for next-level revenue management. If revenue management is done well, there is also a greater opportunity than ever before to steal market share from hotels.

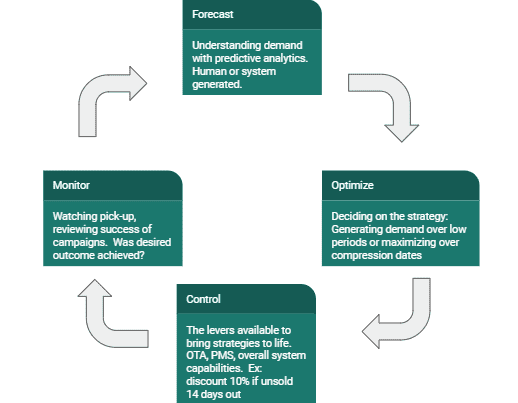

The Revenue Management Cycle and Top 3 Revenue Management Principles

The Revenue Management Cycle is something I learned about a long time ago. Simple and to the point, it comprises four elements: Forecast, Optimize, Control, Monitor (F.O.C.M.). Starting with an accurate, day-by-day forecast for your portfolio and then following the steps continuously, you can make a solid revenue management strategy come to life. The next step is to understand the revenue management levers available to you: PMS capability; channel promotion capability; packaging, policy, price, or stay restriction capabilities; external market data input; or automated rate tools.

Once you’ve got the basic revenue management cycle up and running, you can start testing strategies around some core principles. These principles are applied to revenue management in many industries: restaurants, parking garages, retirement homes, and even toll roads. Here are the Top 3 Revenue Management Principles to take your revenue management to the next level:

Understand Your Price Elasticity

The most important aspect of an accurate marketing strategy is ensuring an accurate forecast. A high-yield unit will be elastic, meaning that a small change in price has a large impact on conversion and volume of bookings. A low-yield unit will be inelastic, meaning that rate changes will have minimal impact on conversion. For example, in markets like Orlando, there are clear high-demand time periods over special events or holidays. Because this is a highly competitive market with significant supply and both business and leisure travel demand, this is a high-yield market, and the opportunities are endless. Let’s take a medical convention demand period as an example. It’s important to understand the demand length of stay, booking window, traveler type, distance of your units from the venue, and where travelers may be shopping for their accommodations. In this example, where the market has an influx of individual traveler demand, it’s the perfect opportunity for a studio or one-bedroom unit to compete with hotels. For this event, these unit types may be even more price elastic, meaning a price of $200 per night may not sell, but a price of $185 will. A small change in price can have a large impact on volume. Obviously, the goal is to sell every unit for the most nights at the highest price, and understanding all these factors will ensure you maximize your revenue per rental unit. In contrast, a few luxury units in a limited demand market may be inelastic. This means even a large price change won’t impact how many nights the units are occupied. There may be enough demand to achieve only 35 percent occupancy, whether that’s at $500 per night or $600 per night.

The beauty of global distribution is that with additional merchandising and target marketing, there is an opportunity to generate more demand in either example. The distribution capabilities, tech functionality, and third-party data are all areas where you can add revenue management levers to your toolbox.

Apply Rate Strategies

You can apply several different strategies to price, and knowing what is appropriate for you and each of your unit types is key. Shadow, rational, and anchored and decoy pricing are several options you can consider. Additionally, you may find you need to select an approach based on day-of-week or seasonality patterns.

Shadow Pricing: When you can forecast your demand with more certainty, this strategy can work well. You are confident in in the market’s behavior, and you set your strategy to follow competitors.

Rational Pricing: When there is uncertainty in a market and you have shorter booking windows, sticking to a price vs. fluctuating too frequently can be the best approach.

Anchored and Decoy Pricing: The human brain tends to make judgments based on contrast. I find this a fascinating strategy. Comparing the same unit with two different prices, but attaching different policies or inclusions (for example, prepaid nonrefundable vs. flex cancel) could work well here. If the customer perceives value, this can drive conversion. In restaurant revenue management, there is a concept of putting three burger options on a menu. If there is a low-, mid-, and high-priced burger, you are more likely to sell the middle option than if you offered just a low- and mid-priced burger. The third, higher-priced option is intentionally on the menu, but the chef doesn’t expect it to be a top seller. This is decoy pricing. It creates contrast and drives customers to select the mid-priced option.

Understand Unit Type Dynamics

Understanding larger trends across unit type is related to policy, price, merchandising strategy, and booking trend data. If you are a property manager with many different unit types, it’s critical to understand the demand curve by type. Your pricing strategy may need to differ by unit type. Obviously, your goal is to sell every unit every night. If a studio has a booking curve of 7 to 21 days, this is the sweet spot for maximizing price and length of stay. These types of units may do well with more flexible cancel policies, as you have opportunities to resell units closer to arrival. Homes with eight or more bedrooms may have a booking curve of 90 to 120 days, and if the property is unsold in that window, it will be harder to fill.

What I love about vacation rental revenue management is that for every unit, you are either 0 percent or 100 percent occupied on any given night, but you can also optimize your portfolio as a collection. With rep-level inventory, even overbooking strategies can come into play! So many different strategies can apply, but no matter what the unit type mix of your portfolio, there is a next-level revenue management opportunity.