For a vacation rental manager, adding inventory is the best way to grow the value of your business.

The demand for vacation rentals is at an all-time high. Getting bookings is a problem for yesterday’s managers. The real revenue driver today is inventory growth – and the mega managers know it.

Now is the time to grow your inventory and defend it too. The vacation rental market has never been more full of opportunity and competition. If you ask me, there is no better ROI on the planet than investing in inventory acquisition.

One of the first things I realized when I started out in the vacation rental industry is that if you don’t grow your inventory – you won’t go very far. I also realized quickly that for most property management companies, keeping up with day-to-day operations is a full-time job.

This often means that owner acquisition strategies fall to the side.

The most successful business owners know their opportunity costs and they focus on making decisions that generate the greatest long-term value.

I strongly believe that as an owner, you need to focus on making investments in your company to grow, and this belief took me from 0 to 500 properties in just 5 years.

I’ve always followed the metrics mantra “If you cannot measure it, you cannot improve it.”

Grow Your Vacation Rental Management Company Beyond the Rental Income

In this article we are going to look at three of the most important metrics in acquiring new inventory:

- Calculate your customer acquisition costs (CAC)

- Calculate the lifetime value of new inventory (LTV)

- The LTV:CAC ratio – the holy grail of all metrics!

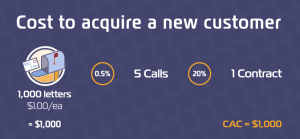

How much does it typically cost to generate a new customer?

The answer is…it depends. The amount you invest in marketing to new homeowners should be dependent upon your growth goals, but here is an important and simple calculation that every professional property manager needs to know – the cost to acquire a new customer (CAC).

Calculate your cost to acquire a new customer (CAC)

For the sake of this example, let’s assume that to generate one new contract, you invested $1,000.00 in direct mail postcards. Your cost to acquire one new homeowner in this example would be $1,000.00 in proactive marketing.

How valuable is adding a new property to your VRM?

Before you crunch the numbers, first it’s important to know what goes into calculating the value of adding a property to your portfolio.

- Look at how much gross booking revenue it will make per year

- Know your profit margins (we’ve found this is usually 10% of the gross booking revenue)

- Consider how long you will keep the property in your portfolio (we’ve found the avg is 10 years)

- Realize the value of the property to your portfolio if you were to sell your company

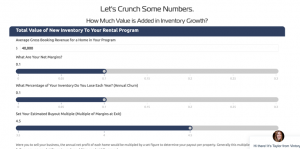

Or you can do all this using our handy online calculator.

When you focus on the lifetime value of a property and not just its annual revenue, the financial impact is pretty impressive.

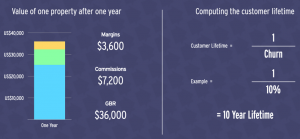

Example: Let’s crunch some numbers together

Let’s say you have a property that is grossing $36,000 in gross booking revenue, which means your margins are going to be about $3,600 (10%).

If you were to add this one property to your program, it’s going to net you about $3,600 in year one.

Now, let’s say you keep that property and you retain it for about ten years.

Let’s do that math:

$3,600 x 10 (years) = $36,000

Now, you’re at $36,000, and this example is just one property.

Let’s amplify that up to $50,000 or $100,000 – think about the value in those numbers.

The example above is just for one property – consider if you were to bring on 10 to 20 properties a year.

Watch this video here to see the value of new inventory.

And remember, there’s not only the value you are gaining through the lifetime of this property in your program, but if you decide you want to exit your business, you’re going to get a check for each one of those properties.

We’ve found that the average “per door” value is roughly between $9-$20k!

If you’re interested in understanding more about the value of your company – check out our interactive company valuation calculators here.

Now let’s say you added an extra 30 properties to your portfolio – you’re looking at your dream retirement home.

Can you make more profit from your customers than it costs to acquire them?

The short answer is YES! A bit of a longer answer is, this is all about unit economics.

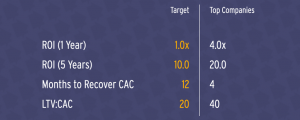

The holy grail of all metrics in inventory acquisition is the LTV: CAC Ratio, which is the lifetime of profits of a property vs. the cost to acquire them. This calculation takes into account all of the key factors in inventory acquisition. It takes into account churn, the lifetime of a property, and acquisition cost.

If you’re going to track one metric for inventory acquisition – this is it. So typically what we are looking for is a target of 20x but the best companies out there are doing it at 40x.

Take a look at the results of your competitors

Here is a summary of the target numbers and the results from the best in class companies:

The bottom line: Now is the time to grow your inventory

When 2021 vacation bookings began, it was widely reported that vacation rental sites like Airbnb and VRBO were seeing a boom in bookings. Now the surge in demand for vacation rentals is so high that the short-term, vacation rental industry has never seen occupancy rates at this level, leaving vacation rental managers scrambling to find more properties to rent out for available occupancy in a desperate attempt to help more families book their long-awaited vacations.

The lack of vacation rental inventory will mean that bookings will become nearly impossible for many as travelers are opting to choose the safety, security, and accommodations that rentals offer.

There has also never been more investment and acquisition activity in the industry. Simply put, there is more money, more interest, more demand, and more competition than ever before.

Now is the time to grow your inventory to take advantage of these trends while they last.

About Brooke Pfautz: From 0-500 properties in just 5 years, Vintory and Comparent.com CEO, Brooke Pfautz, has lived and breathed inventory acquisition. Brooke’s vision is to accelerate the growth of the entire vacation rental market to become the preferred way to travel, work, play, dream, rest and invest. Vintory is the 1st and only CRM & Sales and Marketing automation platform designed exclusively for Vacation Rental Managers to grow their inventory. At Vintory, a team of over 50 growth experts is laser-focused on one thing: helping VRMs hit or exceed their growth goals.

Great article Brooke. However, where will the physical inventory come from? i.e. the correct location, age, design….is there an ample supply of homes and/or condos that are attractive units to be added as inventory? So it seems there is a qualification that a management company only wants to attract new ‘good’ inventory. New homes if designed and located properly likely have a good shot at rising to the upper echelons of popularity and revenue…while older units fall in performance and as desirable units to be in the inventory at all.