In after-hours trading, Expedia, Inc. shares fell 17 percent as the company missed analysts’ quarterly profit estimate on higher marketing expenses. While there is much to unpack in Expedia’s overall fourth quarter performance, CEO Mark Okerstrom and CFO Alan Pickerill shed light on many of the questions vacation rental managers have been asking about Expedia’s direction for HomeAway’s and its views on working with property managers and homeowners.

HomeAway: Key Points

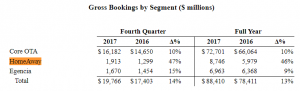

- Expedia’s HomeAway vacation rental business, reported a 16 percent jump in revenue (compared to a 45 percent increase in Q3 2017) to $193 million in the fourth quarter, compared with analysts’ average estimate of $225.4 million.

- HomeAway room nights stayed up 30 percent year-over-year for the same period.

- HomeAway adjusted EBITDA decreased 28 percent to $31 million in the fourth quarter, reflecting “the confluence of revenue deceleration and increased investments in the business.”

- In 2017, HomeAway advanced on its transition to an e-commerce business, with on-platform gross bookings hitting $8.7 billion for the year, up 46%. According to Pickerill, “Adjusted EBITDA of $202 million compares quite favorably to the $125 million of adjusted EBITDA back in 2015, the year of the acquisition.”

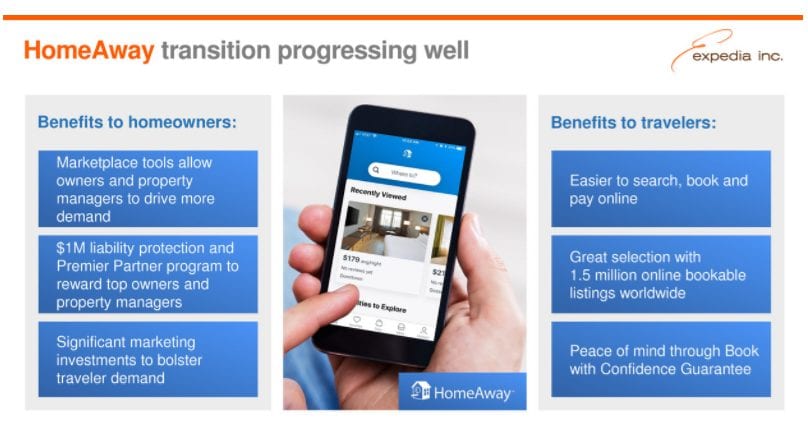

- Expedia now has 150,000 instantly bookable HomeAway listings integrated on Expedia (up from 95,000 in Q3 2017)

-

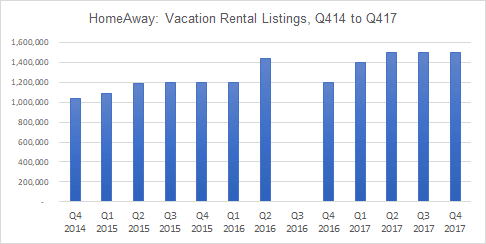

Based on SEC Filings: http://ir.expediainc.com (Note: In Q3 2016, the number of listings was not disclosed.) HomeAway launched its Premier Partner program, highlighting property owners and managers who meet marketplace requirements designed to provide great traveler experiences. Read the Premier Partner Pledge.

- The reported number of listings on HomeAway’s vacation rental sites has remained flat since the second quarter of 2017. Expedia executives discussed monetizing current inventory, but did not address the lack of growth in supply.

In yesterday’s earning call, Okerstrom and Pickerill discussed HomeAway’s booking acceleration, match back, the relationship between HomeAway and property managers, spending, Airbnb, and more.

HomeAway Bookings Acceleration

Alan Pickerill: HomeAway gross bookings grew 47 percent, while revenue grew 16 percent. The sequential deceleration in revenue growth primarily reflects HomeAway’s hyper-seasonal trends, difficult comps, and ongoing impacts of their transition to a transaction-based business.

Mark Okerstrom: The gross bookings acceleration is really a combination of a lot of great stuff that HomeAway is doing. As you recall, there are a bunch of pieces to the transition. One of them was around monetization, and we introduced the traveler fee. Now, we’ve lapped over that. We introduced that in 2016. It was really creating that conversion engine, improving travel experiences, and owner and property manager experiences. And they’ve been executing really well against that. And then, of course, solving this problem of people taking bookings off platform. And so, what you’re seeing is a combination of all of these things working. And when they work, it allows HomeAway to start stepping on the gas in sales and marketing. And that’s what they’ve been doing.

They’re now in a position where–having worked with a lot of our core OTA businesses and actually having a leader in their online marketing function who used to be the leader for hotels.com–they’ve really got the technology stack in place, and they’re executing on the online marketing playbook. And that is driving some very nice growth. The flipside of that, of course, is that it can put pressure on near-term profitability. And Alan spoke about that in terms of Q1. And what we’re finding interestingly is that unlike our core OTA business, a lot of times for these big whole homes, we’re seeing bookings not only booked into the busy summer months like Q3, which is a high, high peak quarter for them, we’re actually seeing things start to slip into future years as well. So we’re starting to get a better handle on how to forecast these things. But it is really a combination of a lot of great work.

Match Back, a.k.a. off-platform booking attribution

Okerstrom and Pickerill were asked: “On Match Back, the recent interview, Jeff Hurst from HomeAway, I quoted him as saying that HomeAway had originally expected some of the offline leakage would close on its own, but it hasn’t. So, I guess, just wondering if you can give us your latest thinking on whether you can migrate that $15 billion of total bookings at HomeAway online. And why do you use something like Match Back that’s so upsetting the suppliers, given the market still seems fairly nascent?”

Okerstrom and Pickerill were asked: “On Match Back, the recent interview, Jeff Hurst from HomeAway, I quoted him as saying that HomeAway had originally expected some of the offline leakage would close on its own, but it hasn’t. So, I guess, just wondering if you can give us your latest thinking on whether you can migrate that $15 billion of total bookings at HomeAway online. And why do you use something like Match Back that’s so upsetting the suppliers, given the market still seems fairly nascent?”

Mark Okerstrom: On Match Back, I think–as it is often the case when you make some of these platform changes–people find ways around them. And we had a situation with a very small group who was able to essentially get credit for bookings as if they were on platform but actually go around the platform. And so, what this program is meant to do is actually, through the honor system, self-report and actually get credit.

There will be a vocal minority of people, who are against it. But unfortunately, we’ve got to do these things to drive the health of the overall marketplace. And this particular program doesn’t at all change our view on migrating the bookings online. They’re making exceptional progress there. It’s not just one thing. It’s one thing after another thing. And then of course, you find situations like this where people try to find a loophole and exploit it. You close them down.

Mark Okerstrom: In terms of off-platform bookings how to get attribution. I mean, the biggest thing with the HomeAway team is focused on, right now. Is just creating reasons for people to book on platform, they’ve developed some incredible technology around their marketplace feeds, the revenue management platform that they’ve rolled out–lots of great reasons for property owners and managers to actually use the platform, engage with the platform–when they do get bookings on the platform, they get credit in short order. And then, on the traveler side again just the book with confidence guarantee, the insurance, the making sure that ultimately you’re protected from fraud. I mean, they’re all great reasons to be on the platform and that’s the primary focus for them, right now. And in addition, they’re looking for areas where there is abuse going on and trying to close those loopholes, where they can.

Relationship with Property Managers

Okerstrom was asked: “There’s been a couple recent vacation rental property manager conferences that sort of spoke to some of the displeasure around some of the recent HomeAway changes, especially around the attribution. How would you assess your relationship with some of the large property managers right now?”

Mark Okerstrom: With respect to the property managers’ displeasure and how those are going, listen, I would say that broadly speaking, the property manager and owner community are adjusting to the changes. They’re finding ways to use the platform to benefit them. And generally, things are moving in a very, very constructive direction. But, of course, because HomeAway is making so much change and implementing change to this platform, they’re always trying to find ways to incent the right behaviors or correct problems that are resulting in leakage or poor behaviors.

And you can see some of the things they’ve done in terms of charging fees for off-platform bookings, some of the movements they made in terms of taking subscription pricing up just a little bit, all really intended to create the right marketplace activity, so that HomeAway can continue on the path it’s on, which is thriving and growing, and ultimately, continue to drive great bookings and great revenue for all of their property managers and owners. So we think the relationship continues to be good and constructive. And we’re very happy with the progress there.

Increased Expenses at HomeAway

Alan Pickerill: Technology and content grew slightly faster than revenue during the quarter, primarily due to headcount added at HomeAway to drive innovation on supplier and traveler-facing products and technology.

Alan Pickerill: We expect cost of revenue to grow slightly faster than revenue due to expanding owner and property manager support and new payment options at HomeAway, customer operations for our partner solutions business, and the increase in the investment in cloud.

Alan Pickerill: Additionally, for HomeAway, we continue to ramp investment in performance-based and brand marketing on the back of better overall capabilities and improved transaction-based monetization.

HomeAway Inventory Conversion on Expedia Platform

Mark Okerstrom: In terms of HomeAway inventory on the Expedia platform, yeah, we generally, what we see is, when we are able to expand inventory, the overall conversion rates for the destinations generally go up. And that’s what we see with alternative accommodations generally. It can have a higher impact in some markets that have a higher mix of that type of inventory. But we have not yet cracked the code on getting to the degree of proficiency that we want to get to in terms of just matching the perfect property with the perfect shopper yet, but that’s exactly the work that we’re doing. So it is conversion accretive. We think it can be a lot more, and we are actively working on product features and sort algorithms to actually optimize the opportunity ahead of us.

Performance-Based Marketing vs Brand Marketing

Mark Okerstrom: So in terms of branded performance, I don’t want to get into specific mix, I would say that HomeAway has been brand advertising for a while. Performance marketing, though, is one of those things that’s relatively new. So in terms of growth rates, I would expect performance marketing to be a bigger part of the story.

Year-over-Year Comparisons

Mark Okerstrom: [Last year] the HomeAway subscription revenue peeling off was one of the largest factors for domestic. So it hit that disproportionately hard, if you remember last Q4, we were in the spot…that we were essentially double earning. We were in the spot that we were still recognizing the revenue from the subscription business, including tiers–and we had added the traveler fee and we were comping over that for HomeAway so that was a bit of a drag.

Mark Okerstrom: [Last year] the HomeAway subscription revenue peeling off was one of the largest factors for domestic. So it hit that disproportionately hard, if you remember last Q4, we were in the spot…that we were essentially double earning. We were in the spot that we were still recognizing the revenue from the subscription business, including tiers–and we had added the traveler fee and we were comping over that for HomeAway so that was a bit of a drag.

On Airbnb

Question: “With the recent management shakeup of Airbnb and the delay of its IPO until at least 2019, do you see opportunity to lean in even more aggressively to the alternative accommodation sphere, to drive faster supply and demand growth?”

Mark Okerstrom: It doesn’t really change our overall philosophy. I think, as we’ve said a number of times, this is just a massive market, and we think ourselves and other competitors in the marketplace can grow very well for a long period of time. I think these management changes happen, and you never know exactly why they happen. We’ve got a ton of respect for the Airbnb team. I think I’ve met Lawrence a number of times. I think he is a very sharp guy. I think people went their own ways, and who knows the reasons, but I’m not reading a lot into it.

Expedia to Put the “A” back in OTA

Mark Okerstrom: On becoming more customer-centric–or putting the “A” back into OTA–one of our key goals in 2018 is to put ourselves in our customer shoes. We want to go beyond just making it easier for customers to shop and book on our sites. Our objective is to provide customers with increased confidence that–if things go wrong on the trip, which does happen in this messy travel industry of ours–or plans change, we will do what we can to help.

It appears tech is getting too unmanageable for techies…..consumers as well as property owners are hopelessly confused….just raising costs and having regional meet ups will not cut it.

Dear Mr. Okerstrom:

Your customer service team did not put themselves in my shoes! So you folks are already falling short in meeting your 2018 goals.

I booked an apt. on 1/31/18 in Niagra on the Lake Canada and got a $773.61 charge on my credit card. On March 6th the owner cancelled our reservation for August 6-10. I got a refund for only $729.02 on my credit card. Why am I the loser??? It is not a good or ethical business model to expect the customer to lose money due to an exchange rate difference. (I live in the USA) This was the only explanation given to me.

I expect Expedia/Home Away to make the customer whole. In my case, it means I am still waiting for a refund of $44.59.

Can you put yourself in my shoes?

Sandra Simpson