Insurance products are among the variety of solutions available to vacation rental management companies (VRMCs) for the remediation of accidental guest damages and bed bug infestations. Security deposit waiver and bed bug remediation insurance programs reimburse VRMC users the expenses incurred to repair accidental guest damage and personal property damage and treat for bed bug infestations.

A careful assessment of the frequency of these events and the expense of repairing such damage suggests that the use of these forms of insurance is not the best solution for VRMCs.

Rather, the best strategy for the repair of accidental guest damages and the remediation of bed bug infestations is a VRMC-provided homeowner and guest service. VRMCs offer several valuable homeowner and guest services, including deep cleaning and end-of-stay housekeeping, linens and bed-making, keyless entry and security, winterizations, pre-arrival inspections, and concierge. Accidental guest damage repair and bed bug damage remediation are best provided as another valuable homeowner and guest service.

The benefits of providing accidental guest and bed bug damage repair as a service rather than an insurance product are fourfold. It is extremely profitable, far less administratively burdensome, and exponentially more efficient; and it increases the market value of the VRM business by an average of 4.7 times every dollar added to a VRMC’s bottom line.

Insurance companies are businesses. They offer products and services that generate net profits after operating and administrative expenses and users’ claims for reimbursement are paid. If an insurance company offers a product to a VRMC, it is always because that product yields an attractive profit for the insurance company.

An analysis of the frequency and the expense of accidental guest damage repairs and bed bug damage and treatment remediation provides insight into an insurance company’s profitability from security deposit waiver and bed bug remediation insurance.

A survey of nine large VRMCs generating 82,830 reservations in 2016 identified 39 bed bug infestation incidents—an infrequent .05% of total reservations. The cost of repairing corresponding personal property damage and providing treatment was $84,820, an average of $2,175 per incident. One of the bed bug remediation insurance programs currently available to VRMCs includes a fee of $30.00 for every reservation. VRMCs retain $10.00 and forward the remaining $20.00 per reservation to the insurance provider. If the previous survey respondents had used this particular type of insurance program as their solution for the expenses of their 2016 bed bug damage repair and treatment, they would have remitted $1,656,600 in premiums and incurred only $84,820 in remediation expenses. With the frequency of personal property damage and treatment from bed bug infestations occurring at a negligible average of .05% of total reservations and the average expense of remediation being $2,175 per event, the insurance product solution is expensive and unnecessary. It is not the best practice for VRMCs.

A careful analysis of the frequency and expense of accidental guest damage and repair yields the same conclusion.

Insurance providers enable VRMCs to offer a variety of security deposit waiver insurance benefit levels ($500, $1,500, and $3,000) for a “sell-for rate” of $49.00, $59.00, and $69.00, respectively.

From the sell-for rate, VRMCs forward a net premium amount to their insurance providers. VRMCs retain the difference between their sell-for-rate and the net premium. An average offering may be a $3,000 security deposit waiver benefit with a sell-for rate of $69.00 and a net premium amount of $19.00 paid to the insurance provider. The VRMC retains the $50.00 difference between the sell-for rate and the net premium paid to the insurance provider. This is an attractive source of revenue for the VRMC, but there is more.

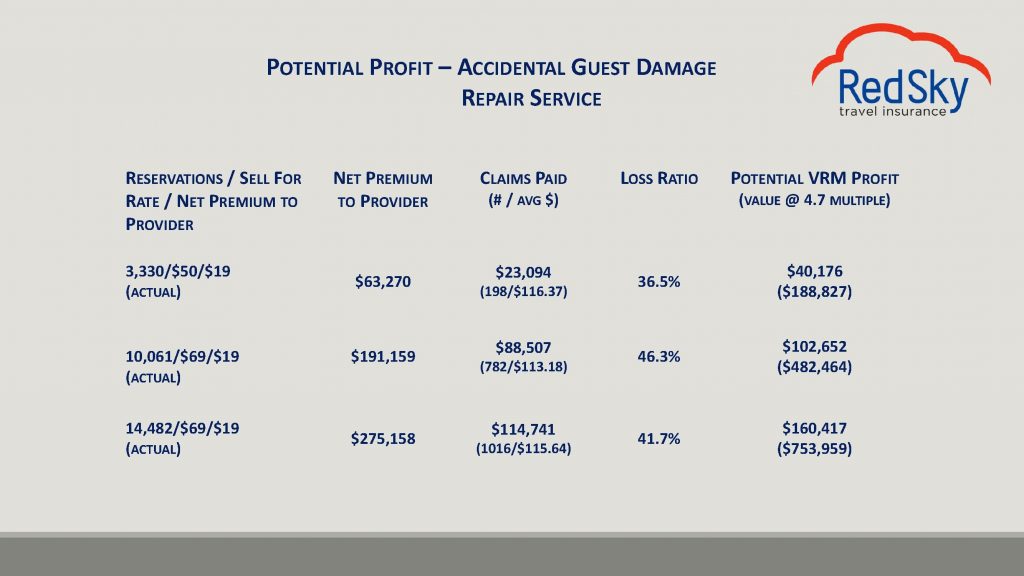

Insurance companies that provide security deposit waiver insurance products make a handsome profit from the $19.00 net premium amount remitted for each policy sold. This is essential because they are in business to make a profit, too! The following table summarizes actual security deposit waiver insurance product programs used by several VRMCs.

The first column describes the actual number of reservations made, the sell-for rate per reservation for the security deposit waiver insurance policy, and the net premium forwarded to the security deposit waiver insurance provider. The second column identifies the total net premium forwarded to the security deposit waiver insurance provider. The third column identifies the actual claims paid by the insurance provider, the actual number of claims, and the average cost per claim. The last column identifies the actual profit made by the insurance provider—that is, the net premium paid minus the claims paid.

Security deposit waiver insurance products are profitable for insurance providers; however, an accidental guest damage repair service provided by VRMCs for their homeowners’ and guests’ benefit is profitable as well. The highest loss ratio for any Red Sky Travel Insurance security deposit waiver user is 46.3%. Almost $0.54 of every premium dollar remitted to Red Sky Travel Insurance for security deposit waiver insurance is gross profit.

Hundreds of VRMCs have created accidental guest damage repair services for homeowners and guests, and each of these VRMCs has captured the profits previously earned by their insurance provider. It is easy to determine the potential profit of creating an accidental guest damage repair service: Simply calculate the amount of premium remitted to the security deposit waiver insurance provider in 2017 and the amount of money the insurance provider reimbursed to the VRMC for accidental guest damage repair claims in 2017. The difference between the premium paid and the amount reimbursed is the profit a VRMC can earn by creating an accidental guest damage repair service.

These same VRMCs also enjoy the ease and efficiency of managing an accidental guest damage repair service, which is like any other maintenance service, rather than struggling with the burdensome, time-consuming administrative exercise of using an insurance product. Filling out and filing claim forms and supporting documentation; taking and submitting photographs, answering follow-up questions; addressing guest complaints when insurance providers directly contact guests about damage that supposedly occurred during their stay; following up on claims payments; and receiving, accounting for, and depositing claims payments are exhausting, expensive, and unnecessary burdens. The best practice for repairing reported accidental guest damage is to simply generate a work order for repairs, have the repair work done, pay the work invoice, and move on to the next task.

The most important advantage of creating accidental guest damage repair services and bed bug damage and treatment remediation services for homeowners and guests is the market value this best practice adds to the VRMC. The average value of a professionally managed VRMC is about 4.7 times EBITDA. Every dollar that a VRMC captures and delivers to its bottom line enhances its value by 4.7 times that dollar. There is no easier, quicker way to increase the profitability of a VRMC or enhance the VRMC’s market value than to adopt these best practices. VRMCs that create and provide these valuable homeowner and guest services capture the profits formerly forwarded to the insurance provider and increase their value by 4.7 times the added profit.

Interesting article, the Nat’l Assoc of Insurance Commissioners are looking heavily at these “damage waiver” plans. They mirror an insurance transaction. Since vacation rental companies are not licensed insurance agents there’s a liability you’re accepting should a damage incident go sideways. I am a Host and the founder of Property Protect, a Host insurance product. One of the reasons I created the company was to offer an ‘actual’ insurance policy for other Hosts, not a pseudo policy or a ‘guarantee’ that’s not really a guarantee. As hosts, we are in the business of reviews. If you take on the roll of recovering damage funds directly from guests it puts you in a very vulnerable position to secure your good review.

This sounds intriguing but I’m confused — is a “service” simply collecting a fee from the guest, and creating a fund for future repairs?