Cowen & Co. analysts Kevin Kopelman and James Sullivan offered up a massive note summarizing findings from a survey of 1,400 travelers, which suggest to him that while the threat of home-sharing startup Airbnb to Priceline (PCLN) and Expedia (EXPE), two stocks he rates Outperform, is real but also overestimated by most.

Kopelman has price targets of $1,360 on Priceline and $135 on Priceline and Expedia, respectively.

We surveyed 1,400 US travelers to gauge Airbnb’s trajectory as it triggers shift from hotels to homes. Results were favorable for Airbnb, driving our long term estimate of ~500M nights in FY20 & ~1B in FY25. We remain cautious on Hotel REITs as Airbnb places add’l pressure on top line, esp. in gateway markets. However, our cannibalization & market share scenarios indicate risk to Priceline/Expedia is overstated.

Kopelman estimates that Airbnb had bookings in 2015 of $7.2 billion, perhaps rising to $12.3 billion this year. That’s based on what he thinks were 68 million guests in 2015 and what may be 129 million this year, at an average of $4,837 per guest last year, rising to $4,907 this year.

On all that, Airbnb, may have made $900 million in total revenue last year, and may make $1.6 billion this year.

That would be a revenue growth rate this year of 76% this year, down from 87% last year.

He describes some of the survey results:

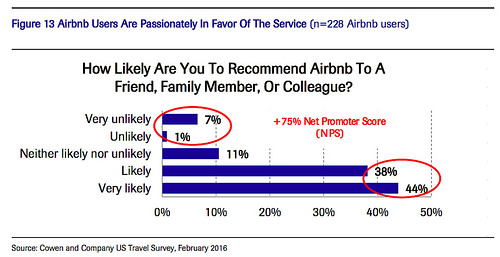

Airbnb had an extremely high net promoter score (NPS) of +75% and compared favorably vs. the average hotel. Airbnb customers in our survey were passionately in favor of the service, with an NPS of +75% (82% would recommend, vs. 7% who would not), including 44% saying they were “very likely” to recommend Airbnb. Airbnb users were also 9X as likely to be more satisfied by their average Airbnb stay vs. their average hotel stay for leisure travel (63% vs. 7%, with 30% neutral). Lastly, customers who used Airbnb for business were 5X as likely to be more satisfied with Airbnb for business than their average hotel stay (51% vs. 10%, with 39% neutral).

Regarding Expedia and Priceline, Kopelman writes

There is some investor concern that Airbnb hotel cannibalization could disproportionately affect OTAs, given a high customer overlap, effectively stalling or slowing down OTA market share gains within the hotel industry.

Given relatively high levels of reported hotel cannibalization, and survey responses showing that most Airbnb customers prefer Airbnb to their average hotel stay, we expected to see evidence of some Airbnb customers abandoning hotels entirely for Airbnb. On the contrary, we found that 99% of Airbnb customers in our survey used hotels in the past year, and were heavier users of hotels (at 10 leisure hotel nights per customer) than the average hotel customer in our survey (at 7 leisure hotel nights per customer). In fact, looking at share of all paid travel nights (hotel + all short-term rental), hotels continued to account for 69% of Airbnb customers’ total nights.

Kopelman also observes that Priceline and Expedia are investing in their own “short-term house/apartment rental” offerings:

Priceline began investing heavily in alternative accommodations in Q4:13. Since that time, vacation rentals have increased as a percentage of properties listed on Booking.com from an estimated 29% to 46% today. Most of Booking.com’s vacation rental properties are located in Europe. The company has focused on maintaining 100% instantly bookable properties, in order to seamlessly integrate its vacation rental properties into the overall Booking.com experience and maintain high customer conversion rates. Booking.com has also specialized adding new types of professionally managed ‘self-catered product’ in urban areas, such as apartment- hotels. We estimate that vacation rentals now account for ~15% of Priceline room nights booked.

Things are a lot darker for LaSalle and hotel REITs like them:

We believe that Airbnb creates an incremental negative variable for our Hotel REIT coverage at the same time that other fundamentals, unrelated to Airbnb, have become more challenging. The primary impact over the next 2–3 years, assuming the Airbnb penetration rates outlined above, should be that room night demand should trail the typical levels that we would expect per unit of GDP growth. Given that the industry has entered a multi-year period in which supply growth should be above long-term average annual levels, this is likely to make it more difficult for the industry to achieve pricing gains. As a result, we expect near- term ADR growth rates to trail the current forecasts provided by the primary third-party sources that the industry uses, which typically range from 4%-6% for 2016. We reiterate our Market Perform ratings on Host, LaSalle, and Pebblebrook.