Airbnb filed for its long-awaited public offering on Monday, shedding light on its past performance and trajectory.

According to its S-1, Airbnb has 4 million hosts in 220 countries listing 5.6 million “active listings” on its platform, with 29% of its “Nights and Experiences” and 41% of its revenue coming from North America.

As of September 30, 2020, Airbnb has 5,465 employees in 24 cities around the world after reducing its workforce by approximately 1,800 in May 2020.

Airbnb is the third US company in the short-term rental industry to go public, preceded only by ResortQuest (1998) and HomeAway (2011). Both companies were purchased within 6 years of their IPOs.

The filing provides a highly anticipated show-and-tell of Airbnb’s performance, including its financials, listing counts and calculations, risk assessment, and strategic position.

The Numbers

Airbnb’s revenue dropped 32% between January and September 2020, losing $697 million through the first nine months of the year, more than twice as much as it lost in the year-earlier period. However, Airbnb reported that it was profitable in Q3 2020 largely due to the seasonal nature of the industry and after COVID-19 forced it to slash expenses and cut a quarter of its staff. Q3 revenue fell 18% to $1.34 billion from the same period a year earlier, with a profit of $219 million.

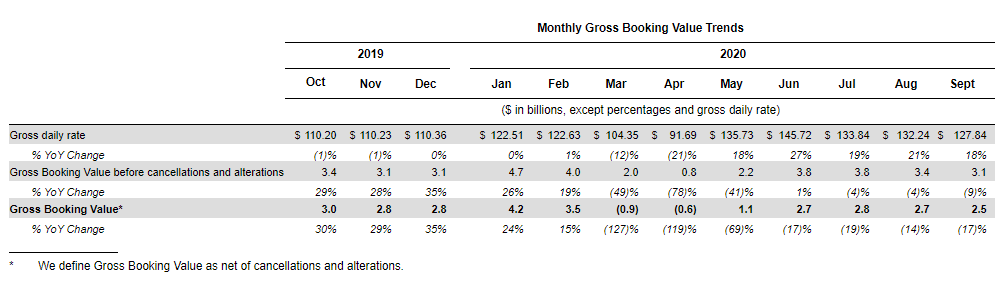

Without breaking out fees, Airbnb’s Gross Average Daily Rate by Month shows an 18 – 21% YOY increase in Q3.

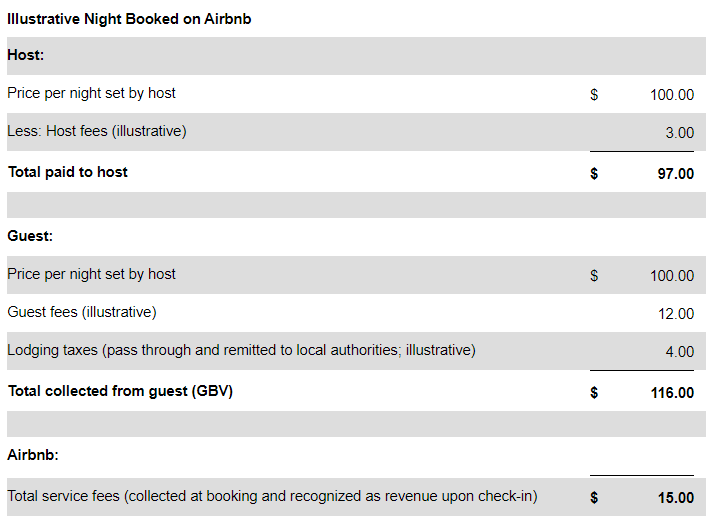

In 2019, Airbnb generated Gross Booking Value (GBV) of $38.0 billion. Its GBV of $38.0 billion in 2019 consisted of $31.3 billion in host earnings, $5.3 billion in service fees for Airbnb, and $1.4 billion in taxes, consisting primarily of lodging taxes.

5.6M Active Listings; 76% booked at least once in last year

While Airbnb has boasted over 7 million listings for the last year, its filing shed light into its listing calculation.

“Our hosts had 7.4 million available listings of homes and experiences as of September 30, 2020, of which 5.6 million were active listings.”

Airbnb defines an active listing as a space or experience that “is viewable on Airbnb and has been previously booked at least once on Airbnb (excluding Hotel Tonight).”

Note: Airbnb combines stays and experiences in all of its reporting. In January 2020, Airbnb shared that it has 40,000 experiences on the platform.

Note: Airbnb combines stays and experiences in all of its reporting. In January 2020, Airbnb shared that it has 40,000 experiences on the platform.

Its $31.3B in host earnings translates to an average of $5,589 in annual host earnings per active listing on Airbnb. In comparison, a 2019 survey by HomeAway found the average owner who rents out a second home collects more than $33,000 a year in rental revenue on Vrbo.

Additional listing insight from Airbnb

- Approximately 76% of active listings had been booked in the twelve months ended September 30, 2020.

- To flip this KPI, 24% of active listings (1.27 million) did not have a single booking in the previous year.

- As of December 31, 2019, 90% of Airbnb’s hosts were individual hosts, and 79% of those hosts had just a single listing.

- As of December 31, 2019, 72% of nights booked were with individual hosts.

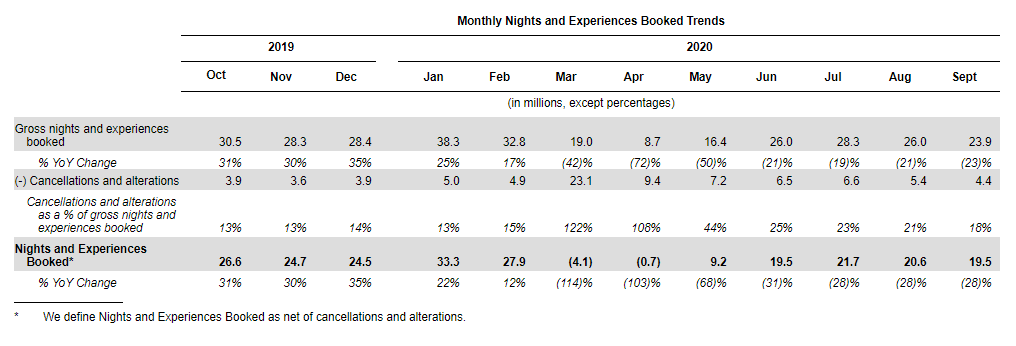

- While the category of one to 27 nights (short-term stays) was down 81% year over year in April, long-term stays were down only 13% year over year and saw year-over-year growth from May through September 2020.

- In 2019, 63% of revenue was generated from listings outside of the United States.

- Active listings are available listings that have been previously booked at least once at any time since Airbnb’s inception.

Potential Risks

Airbnb’s filing detailed a long list of potential risks facing the company, including competition, Google, safety, regulatory issues, legal challenges, racial discrimination, and many others.

Regarding safety, Airbnb stated, “In addition, we have not in the past and may not in the future undertake to independently verify the safety, suitability, location, quality, compliance with Airbnb policies or standards, and legal compliance, such as fire code compliance or the presence of carbon monoxide detectors, of all our hosts’ listings or experiences.”

If reference to Google, “How Google presents travel search results, and its promotion of its own travel meta-search services, such as Google Travel and Google Vacation Rental Ads, or similar actions from other search engines, and their practices concerning search rankings, could decrease our search traffic, increase traffic acquisition costs, and/or disintermediate our platform. These parties can also offer their own comprehensive travel planning and booking tools, or refer leads directly to suppliers, other favored partners, or themselves, which could also disintermediate our platform.”

Market Opportunity

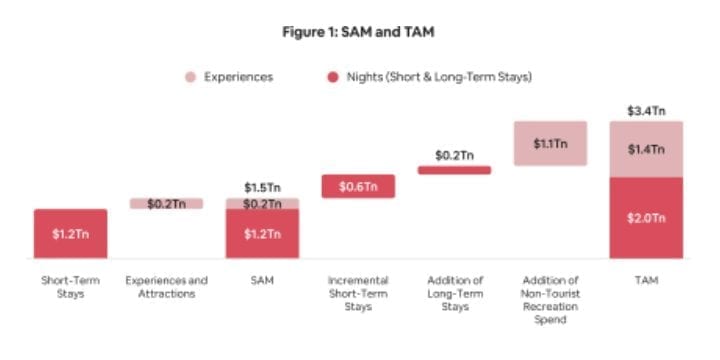

One of the more shocking sections in Airbnb’s filing was its calculation of the sector’s opportunity in the addressable market, as the company showed numbers our industry has not previously identified:

We estimate our serviceable addressable market (“SAM”) today to be $1.5 trillion, including $1.2 trillion for short-term stays and $239 billion for experiences. We estimate our total addressable market (“TAM”) to be $3.4 trillion, including $1.8 trillion for short-term stays, $210 billion for long-term stays, and $1.4 trillion for experiences.

Airbnb Doubles Down on “Home sharing” in future strategy

We expected to see Airbnb expand its focus to include professionally managed short-term rentals, hotels, and flights, especially after emailing guests in April encouraging them to book a hotel instead of a home stay. Instead, Airbnb affirmed its singular focus on home sharing and defined itself as the creator of a “new category in travel” :

Airbnb has enabled home sharing at a global scale and created a new category of travel. Instead of traveling like tourists and feeling like outsiders, guests on Airbnb can stay in neighborhoods where people live, have authentic experiences, live like locals, and spend time with locals in approximately 100,000 cities around the world.

According to an included letter from the founders, “When the pandemic hit, we knew we couldn’t pursue everything that we used to. We chose to focus on what is most unique about Airbnb — our core business of hosting. We got back to our roots and back to what is truly special about Airbnb — the everyday people who host their homes and offer experiences. We scaled back investments that did not directly support the core of our host community. This focus came at the right time. People are feeling increasingly disconnected in the world, and loneliness is pervading our society. The opposite of loneliness is belonging — the feeling of deep and genuine connection to a person, a place, or community. It’s the feeling of being ‘at home.’ The feeling of being known and loved.”

What can Property Managers expect from a Public Airbnb?

While we will have many opportunities to discuss Airbnb’s actions from this point forward, based on our experience when HomeAway went down this path, we can expect to see:

- Increased monetization of the site and an effort to increase transactional take rates

- Increased efforts to limit/block communications between guests and hosts

The difference between HomeAway and Airbnb is that HomeAway’s executives were actively engaged with the VRM community. In contrast, many of the largest vacation rental property managers have never had the opportunity to have a conversation with Airbnb’s C-suite. Airbnb hasn’t demonstrated any concern for the needs of its professional suppliers, and its filing shows no intention to cater to this supply sector of its business.

Listing professionally managed vacation homes on Airbnb will mean playing by their rules.

Additional Questions Raised from Airbnb’s Filing

Will the post-COVID traveler relate to home sharing? While much of the industry has moved to keyless locks and contactless check in, Airbnb is doubling down on the idea of connection and shared spaces, but will the 2021 traveler want to have up close and personal interactions with a host?

Will Airbnb engage its professional suppliers in a more meaningful way? Is the “peace, love, and an extra bedroom” message conveyed yesterday a sustainable service line, or will we see Airbnb pivot its branding direction to a more professionalized accommodation experience?

Will guests coming from the Airbnb platform be the kind of guests that top-tier homes want to attract? We regularly hear from PMs that the guests coming from Airbnb do not behave as well as guests booking directly or through other platforms. In contrast with hotels, professional PMs have a need to ensure guests can function as good neighbors.

Will Airbnb be able to follow through with launched initiatives and standards for guests? For example, what happened to Airbnb Plus? And with its Enhanced Cleaning Protocol, according to Properly’s Alex Nigg at the Vacation Rental World Summit, only 15% of hosts say they are complying with the standards. We’ve seen lofty standards introduced by Airbnb with no enforcement or follow through.

What PMs know they can expect is that changes are coming to Airbnb.

Airbnb plans to trade under the symbol “ABNB” on the Nasdaq. Read the entire S-1 filing here.

Nice report Amy. Up late?

Apparently, the market is 3x the size of the hotel sector ($590bn I believe). A number never witnessed before in the $trillions. I remember the $100bn numbers from HomeAway not so long ago, we are now x15 of that.

Ignoring all the other unspoken numbers and narrative that avoids talking about the vast numbers of managers inventory, just hosts, it’s this sentence that is simply not true and carries alienation: “Airbnb has enabled home-sharing at a global scale and created a new category of travel.”

Actual “Home sharing” is now a small fraction. Whole properties are the ones making $’s and volume. Its been going on for 2,000 years plus, nothing new. The Internet is new, however, relatively speaking and vacation rentals, well we’ve all been doing it well before anybody shared a lilo!