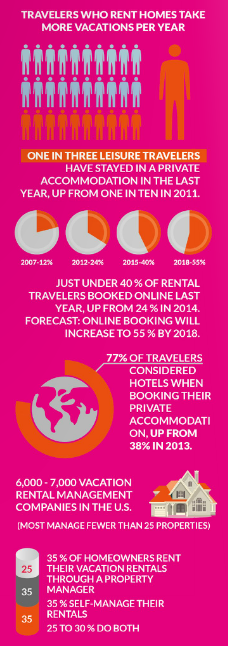

By Amy Hinote –One in three leisure travelers has stayed in a private accommodation in the last year, up from one in ten in 2011, and almost 40 percent of those travelers booked online, up from 12 percent in 2008. We know this—and much more—about the vacation rental industry because of the research being conducted by Douglas Quinby and his team at Phocuswright, the travel industry’s research authority on how travelers, suppliers, and intermediaries connect.

Prior to joining Phocuswright, Quinby, senior vice president of research, led his own firm, which provided strategic research, communications, and marketing services to travel technology companies. Shortly after he joined Phocuswright in 2004, he began examining the vacation rental industry.

“We did a short analysis in 2004–2005 when HomeAway began rolling up URLs,” Quinby said. “At the time, there were a bunch of startups besides HomeAway, including LeisureLink and Zonder, who were working towards facilitating online booking on aggregated marketplaces.”

Phocuswright’s research in the vacation rental industry began to take shape in 2008 with its landmark study, Phocuswright’s Vacation Rental Marketplace: Poised for Change, which revealed the size and scope of the sector. Consequently, investment capital poured in, building up HomeAway, Airbnb, OneFineStay, HouseTrip, Zonder, Tripping, and more. Phocuswright’s follow-up study, U.S. Vacation Rentals 2009–2014, shed even more light on the industry as a $23 billion market with an online booking rate that had doubled in just a few years.

Quinby and his Phocuswright team have continued qualitative and quantitative research on the vacation rental industry, which has helped the broader travel market to segment and size the market and forecast consumer behavior in this high-growth and rapidly evolving segment of the travel industry.

Quinby and his Phocuswright team have continued qualitative and quantitative research on the vacation rental industry, which has helped the broader travel market to segment and size the market and forecast consumer behavior in this high-growth and rapidly evolving segment of the travel industry.

Over the summer, VRM Intel partnered with Phocuswright to conduct a survey of businesses that manage vacation homes, condos, and other short-term rentals for travelers. This fall, Phocuswright published Phocuswright’s A Market Transformed: Private Accommodations in the U.S., which takes a 360-degree look at the current state of private accommodation rentals in the U.S.

I had the opportunity to interview Quinby to find out more about the growth in the vacation rental industry, his findings from Phocuswright’s most recent study, and what he expects to see in the category in the coming years.

AH: Phocuswright is now using the term “private accommodations” in its recent research instead of “vacation rentals” or “short-term rentals.” What does that term include?

DQ: For us, a private accommodation is any type of rental where the renter is staying for travel purposes, and it includes vacation rentals, new-generation rentals, and shared spaces.

AH: Since you’ve been researching the industry, there has been a huge shift in investment and interest from Wall Street and the broader travel industry. What is driving the escalation?

DQ: The industry has gone from one in ten travelers staying in private accommodations in 2011, to one in three in 2016. This kind of growth in a vertical category is unprecedented. To have a category explode like this into the marketplace and into the traveler consciousness is significant. Also, the big OTAs are under threat from hotels increasing their direct bookings and from enormous shareholder pressure to continue to grow, and they are looking for the next big, new category to drive that growth. The category has arrived. For years, it had been framed as “alternative accommodations,” but we are now at the end of that era. These “alternative accommodations” are no longer a nontraditional category. We are seeing the mainstreaming of private accommodations.

AH: From your perspective, what have been the major milestones or turning points that have shaped the industry?

DQ: There is no doubt that HomeAway played a huge role in the development of the space. HomeAway brought profound disruption to the industry. By nailing down “shopping and discovery,” HomeAway took us to a place where they successfully aggregated supply and demand. As a result, property managers found themselves having to compete with homeowners, putting downward pressure on management commissions. This also forced property managers to up their game—by making properties more attractive to online consumers and to become more engaged with owners and guests.

While HomeAway had a soft approach to supply with a subscription model, Airbnb had online booking baked in from the beginning because that is what consumers want, just like they want reviews. When it came to online booking and traveler reviews, HomeAway fell behind. Airbnb showed us that online booking does work.

AH: Comparing HomeAway’s performance with Airbnb’s performance in the professionally managed space, which company seems to have the advantage?

DQ: In terms of sites used, HomeAway.com and the HomeAway family of sites are far and away the most important for property managers. The vast majority list on HomeAway, but Airbnb has grown quite significantly. If you speak to the Airbnb guys, they did not consider traditional vacation rental accommodations to be part of their core business. They were supplemental to their core business, which was urban supply. They came later to vacation rentals as an obvious area of growth and revenue. In our most recent research, we found that the percentage of property managers listing on Airbnb increased from 7 percent in 2012 to 47 percent in 2016. The overall impact of Airbnb has been incredibly positive.

AH: We’ve heard reports from property managers that Airbnb’s approach is hurting the industry, especially with its impact on regulations. Are you seeing any resistance from property managers in listing their vacation homes on Airbnb?

DQ: In the course of the study we are doing, we are not seeing that as a big issue, and I think that reflects the maturation of the industry over the last decade. There is a realization by property managers that there are other models that are here to stay, and they need to adapt. And there is a recognition by the industry that these changes are going to come. Any animosity towards Airbnb is being driven by the hotel associations and by residents in certain communities.

AH: As you know, HomeAway and TripAdvisor recently adopted Airbnb’s revenue model by adding a traveler/service fee for bookings. In a recent interview with VRM Intel, Booking.com’s David Mau said that this model is not sustainable. In your view, is the shift to this revenue model of having a consumer fee sustainable?

DQ: I think it is still early days for the debate over the business model because there is still enough disparity of supply among the channels, so there is not as much of an issue. It may become more of an issue as there is increasingly more overlap across the major channels.

We did see in the latest study that, among property managers, one in three are seeing and forecasting a drop in rentals from listing sites like HomeAway and VRBO, and we attribute that to the change in the business model. That being said, half of property managers are reporting that their business from third-party online channels is growing.

AH: Is there room for another player in the OTA/intermediary space?

DQ: There is always room for great product and innovation, and there is always room for creating something customers want. There has been significant consolidation, and two online giants—Expedia and Priceline—have what many consider to be a duopoly. But then three guys without a lick of travel industry experience got together to create Airbnb, a company that is now the third-largest online seller of accommodations worldwide and is probably the fourth-largest online travel intermediary by gross bookings. So who says you can’t build an online travel company today? It doesn’t mean it is going to be easy, and it is going to require rolling up the sleeves, but it can certainly be done.

AH: With the increase in the number of new travelers choosing private accommodations, are you seeing customers having higher hotel-like expectations for their accommodations?

DQ: It really hasn’t been an issue. When travelers want a hotel experience, they stay in a hotel. Even with the influx of new rental travelers, guest satisfaction has remained consistent. However, it does favor the RBO side slightly over property managers. While travelers who stay in professionally managed rentals say they have access to more services, those who stay in owner-managed rentals report higher levels of guest satisfaction, driven by increased interaction with the host or owner.

Airbnb is the most standout example of this, as they have made the host the linchpin in selling of the property. The traveler is not just buying the place; they are buying the host. Property managers that are moving to a virtually managed experience with no interaction with the guest may want to reconsider by finding opportunities for personalization. If you are not interacting personally with guests, you might want to consider finding ways to make guests feel welcome. Personalized interaction does have a positive impact on guest satisfaction.

AH: What trends are you seeing in the homeowners’ decision to self-manage their vacation rentals or work with a professional property manager?

DQ: Owners who self-manage, we see, start out managing their rental by themselves, and after one or two years, they realize the time and expense, and they start to work with professionals.

We estimate that there are between 6,000 and 7,000 vacation rental management companies in the US, and most manage fewer than 25 properties. 35 percent of homeowners rent their vacation rentals through a property manager, 35 percent self-manage their rentals, and 25 to 30 percent do both.

There is a full spectrum of services needed to manage a vacation rental, and homeowners choose a service level that falls somewhere along that spectrum. The RBO versus PM debate is so five years ago. There is no more “us and them.” Technology has broken all of that down, so that now property managers are competing on service. Looking forward, property managers should ask themselves if they are offering all of the services that their competitors are offering, including both homeowners and other property managers.

AH: Looking ahead over the next two years, what do you predict will cause the biggest shift in the marketplace?

DQ: There has been substantial growth in online booking, which we expect to increase from just under 40 percent this year to 55 percent by 2018, being propelled by growth at Airbnb, changes at HomeAway, and adoption by property managers. But the big shift we are forecasting in the market is the increase in the number of bookings going through intermediaries. Rental sites and travel agencies will account for 70 percent of online bookings by 2018.

Phocuswright’s A Market Transformed: Private Accommodations in the U.S. can be purchased on the company’s website. Douglas Quinby will be speaking at the VRMA National Conference in Chandler, Arizona, on October 19, at the ARDA Fall Conference on November 11 in Washington D.C., at the Phocuswright Conference, held November 14–17 in Los Angeles, and at the Airbnb Open in Los Angeles on November 18-21.

Curious, when 40% booked online? Up from 12%. Is there any research to determine if they booked online “after” speaking to a representative? Or……….. Booked online without speaking to anyone at all?? We have found that many travelers prefer to speak to an agent to assure the company representing the home is indeed real? Comments?