If you haven’t heard of Tripping.com before, you will very soon. Founded by Jen O’Neal in 2009, Tripping.com has become the world’s largest metasearch platform for vacation rentals.

Partnering with major vacation rental sites such as HomeAway, Wimdu, VRBO, FlipKey, Housetrip, Interhome, Roomorama, Booking.com, and more. Tripping.com aggregates over five million listings in more than 100,000 cities into a Kayak-like model and allows travelers to easily compare vacation rentals across providers.

Co-Founder, Jen O’Neal knows a little about building up online marketplaces. O’Neal was one of the first employees at StubHub, which was acquired by eBay for $310 million. After spending a year in Costa Rica launching the North American Marketing Division for ParadisePoker, O’Neal was invited by StubHub’s Co-Founder to head up marketing efforts for Viagogo. While living abroad, she developed a passion for the industry while hosting well over a hundred travelers through various hospitality exchanges.

Co-Founder, Jen O’Neal knows a little about building up online marketplaces. O’Neal was one of the first employees at StubHub, which was acquired by eBay for $310 million. After spending a year in Costa Rica launching the North American Marketing Division for ParadisePoker, O’Neal was invited by StubHub’s Co-Founder to head up marketing efforts for Viagogo. While living abroad, she developed a passion for the industry while hosting well over a hundred travelers through various hospitality exchanges.

We reached out to Jen O’Neal to find out more about her motivation to start Tripping.com, where the company is heading, what challenges are present for online distribution, and what opportunities she sees in the future for the vacation rental industry.

Q: What motivated you to start Tripping.com in 2009?

J.O.: The original concept for Tripping.com was a social network for travelers. I’d been a fan of sites like CouchSurfing, but I felt there was room for improvement on both the technology and safety fronts. Travelers seemed to agree. When we launched the company from TechCrunch Disrupt in 2010, we grew rapidly and had users in 175 countries within the first 30 days.

In addition to the viral nature of Tripping.com, our growth strategy centered around creating partnerships with organizations such as travel groups and study abroad programs. Soon after launching, we had over 40 partners including Ivy League schools, the Peace Corps, AmeriCorps, AARP, and more. Those partnerships enabled us to not only grow at breakneck speed, but they also gave us a highly vetted, high quality userbase.

Although we pivoted a year later, our new model resonated with our original users and they continued to engage with the site. Those early users formed the core of our current user base, which helped us transition into our new business model.

Q: How has the idea behind Tripping.com evolved over the last 6 years?

J.O.: We made a major pivot in 2011. At the time, the vacation rental industry was catching fire thanks to the growing buzz around Airbnb and HomeAway. My cofounder and I are data-driven people, so we did an analysis on the market. Three things jumped out to us immediately: the market was enormous, the existing VR technology was easily 10 years behind hotels, and the entire space was intensely fragmented.

The fragmentation caught our attention more than anything. We reasoned that building a metasearch site would solve fragmentation, both giving consumers an easy way to find vacation rentals and giving rental sites additional traffic. In late 2011, just 30 days after reviewing our initial data findings, we relaunched Tripping.com as a metasearch site for vacation rentals.

The only problem was that we were three years too early.

The market wasn’t ready for metasearch, but Jeff and I could clearly see where everything was heading. We pushed forward. Our cash was limited (most investors weren’t willing to fund an unproven model), which made us scrappy and creative. By the time the market was ripe for a metasearch player, we were perfectly positioned to capture the opportunity.

Q: Is the market still fragmented?

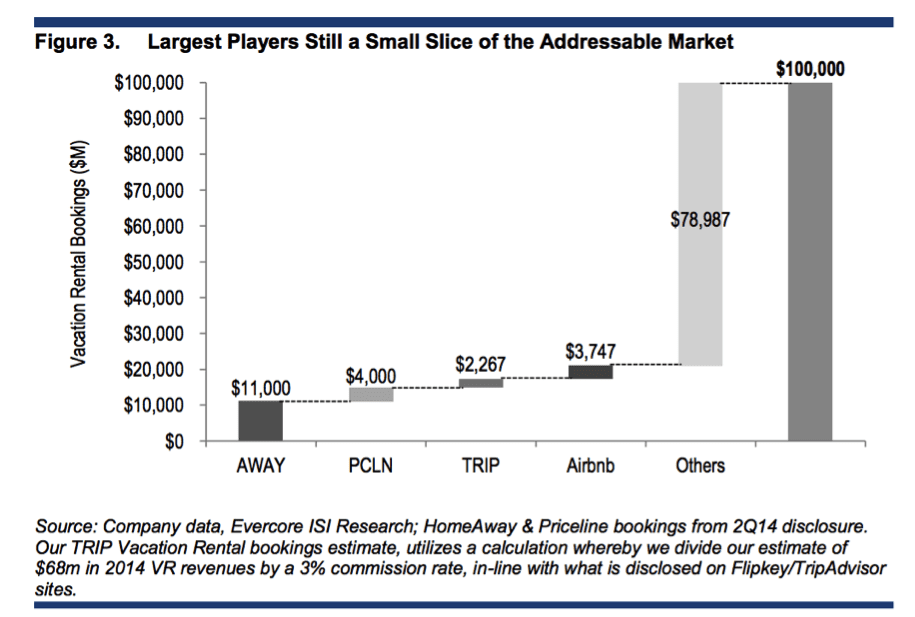

J.O.: Yes! A report published by Evercore (see chart) earlier this year shows that there is still intense fragmentation in the vacation rental industry. To point, the top four players – HomeAway, Priceline, TripAdvisor, and Airbnb still only have about 22% market share. This underscores the value of metasearch and what we’re building at Tripping.com:

Q: How did your experience with StubHub and Viagogo help in your vision for Tripping.com?

J.O.: As an early employee at StubHub and Viagogo, I developed a love of marketplace businesses. I also got to see exactly what it takes to build billion-dollar companies both in the US and internationally, which has proven to be a solid blueprint for what we’re building at Tripping.com.

Q: With your experience in aggregating the eccentricities of the vacation rental industry, what strikes you as being the biggest challenge facing the industry?

J.O.: The shift towards instant bookings is a major challenge for the industry right now. This isn’t just from a technological standpoint. While users seem ready to whip out their credit cards and book rentals, we still see a significant amount of resistance on the part of property owners and managers. Major brands are trying to push hard for online bookings, which will ultimately advance the industry. With that said, it will still be a few years before the vast majority of properties can be booked with a click of a button.

Another challenge centers around calendar availability. In aggregating data from top rental suppliers, we often see inconsistencies in rates and availability. We work closely with our partners to solve these issues and we reward properties with updated availability data by moving them up in Tripping.com’s search results. That’s the beauty of a search engine; we can ensure that the best properties always go to the top of our results.

Q: To add to the question of aggregating vacation rental data, what – if anything – was easier than you expected?

J.O.: We only had a handful of partners for the first three years. This is because rental sites either didn’t have the capability to build feeds or they weren’t interested in working with us. Now we have a growing queue of over 200 rental sites that are waiting to get on Tripping.com. This has been a really nice surprise and it makes building partnerships easier than ever before.

Q: What does having a successful metasearch platform mean for vacation rental managers?

J.O.: Vacation rental managers who list on sites like VRBO and Booking.com (among our other great partners) are getting more bookings thanks to Tripping.com. We’ve really nailed the marketing side of the equation, which means that we’re sending highly qualified traffic to our partners. This traffic converts into bookings, which means that managers are filling up their calendars and making more money.

One important distinction is that metasearch increases the quality of users. This is because users can do an initial comparison on Tripping.com, find the property they want, and then click over to our partner’s site to book it. Since they’ve already done their research up front, they’re more likely to convert once they hit our partners’ sites. And of course this translates into more bookings for vacation rental managers.

Q: (In the preceding “funding” article, I am reporting on your Series B raise of $16M) Tripping recently raised $16M bringing your total to over $21M. What are your plans for the company over the next 12-24 months?

J.O.: We were excited to announce our Series B earlier this summer. The round was led by Steadfast Venture Capital out of New York and other investors including: 7 Seas Venture Partners (founded by Jeff Xiong, former Tencent CTO), Enspire Capital out of Asia, Fritz Demopoulos (Qunar founder), Erik Blachford (former Expedia CEO), Monte Koch (board member at Choice Hotels), and Drew Goldman (Head of Real Estate Investing for Deutsche Bank), among others. We’re also happy to have the continued support of Recruit Holdings in Tokyo and Quest Venture Partners, a Silicon Valley firm that led our Seed round.

We’re using this funding to fuel our growth, enhance our product, and aggressively expand into international markets. Since closing the round, we’ve substantially grown our teams in both San Francisco and Europe.

Q: How does Tripping.com fit in the overall vacation rental marketplace in relation to HomeAway, Airbnb and other distribution channels?

J.O.: An investor recently compared us to a spoke in a wheel. As the top metasearch site for vacation rentals, we sit in the middle of the industry by sending bookings to rental sites such as HomeAway and Villas.com. Though there is always a natural tension between metasearch sites and their partners (as we’ve all seen with Kayak, Trivago, and Expedia), our team is ruthlessly focused on helping our partners grow. We work closely with them to optimize conversion funnels and ensure that travelers have a great experience booking vacation rentals.

Q: Looking at the industry from your unique perspective, what do vacation rental managers need to do in order to be successful in marketing their properties online in 2016/2017?

J.O.: Great question. Based on what we can see, this is what I’d recommend for vacation rental managers who want to increase their bookings:

- Update your calendars to show when your property is available. Properties with fresh availability get higher placement in search results on com and other sites, so you’ll be rewarded with more bookings.

- Use data to price your listings competitively. Before setting your nightly rate, do some research to see how other owners are pricing their listings. You can also look at nearby hotel rates to get a wider view of the accommodations market. Additionally, be aware of big events and conferences that could positively affect the price of your listing: if the area is sold out, you should be able to charge a premium for those dates. Strategic pricing will help increase your bookings and revenues.

- Show high-resolution photos to increase conversation. Our data consistently shows that property listings with many high-res photos are far more likely to convert into bookings.

- Be open to taking online bookings. It could save you a lot of time and hassle. Given that most rental sites now offer insurance, the risk is pretty low.

- List your property on multiple rental sites. Ensure you have the bandwidth to update multiple calendars. This will immediately increase your exposure to potential guests and enable you to test things like pricing.

Managers often approach us directly, asking if we can help them price their listings to make sure they’re getting the most money for their properties. Our team is always happy to help with this, since our data enables us to actively and simultaneously increase revenues for both managers and our partners.

Q&A

by Amy Hinote