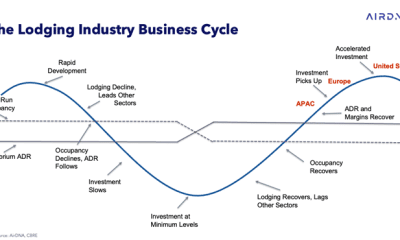

We are currently in an interesting time in the vacation rental industry for M&A transactions. From VC-backed companies to private equity (PE) firms, hotels, OTAs, and traditional short-term rental companies, there is no shortage of buyers for short-term rental management companies.

We get asked this question at least once a week: “How much can I get for my company?”

The short answer is, “It depends.”

Let’s start with the easy part—your financials.

Objective Part (It isn’t completely objective, but it’s close.)

- Figure out your trailing twelve-month (TTM) earnings before interest, taxes, depreciation, and amortization (EBITDA).

- Adjust by taking out all expenses associated with owners of the company (payroll, benefits, perks, one-time outlier fees, etc.). These can be subjective and are often negotiated.

- If you do not already have a general manager (GM) in place, add back in a “market rate” expense for replacing the owners/management team, upcoming minimum wage hikes, rent expense (if not charging market rent), etc. Once again, these expenses can be subjective and may be negotiated.

This should give you an adjusted EBITDA for your company.

Now that you have come this far, what’s next?

The Subjective Part (The “Fun” Part)

Put a multiple on this adjusted EBITDA (AE) number. The current range of multiples is somewhere between 3.5 and 5.5 times AE, with some acquisitions falling lower or higher. Currently, however, most deals are closing within this range.

Why are some companies valued at 3.5x and others at 5.5x? Consider these questions:

Q: Are you located in a “hot” market or not?

- Does your market have long peak seasons?

- Is the management fee in your market higher than that in other markets?

- Are local regulations lax?

Q: How is your company’s TTM EBITDA compared to its trailing 36-month EBITDA ?

- Are you growing or regressing? This can be defined as revenue, EBITDA, or inventory.

Q: What is the length of time the majority of your homeowners have been on your program?

- What is your inventory’s yearly churn (attrition) rate?

Q: What is your advance bookings report, as of today, compared to the “as of today” from one year ago?

- Are you getting more advance reservations? (Check out average booking window performance over the last 18 months in 11 leisure vacation rental markets. )

Q: Do any assets come with the deal?

- Office, real estate, facilities, vehicles, etc.

Q: Is there already a GM in place, and how much are the owners involved in the day-to-day operations?

- Is the owner of the company also involved in homeowner relations? Note: This can affect your valuation when trying to sell.

Q: How much of the EBITDA is from a real estate brokerage operation?

- Real estate brokerages traditionally trade at a lower multiple.

Q: What does the company culture/staff look like?

- Do the buyer and seller have similar company cultures and philosophies?

Q: What terms of the deal are you willing to accept? This can change your valuation wildly. Buyers are often willing to offer higher multiples for more agreeable purchase terms.

- Are you willing to accept a large amount of seller financing?

- Are you willing to stay with the company for x number of months/years?

- Is your entire staff staying on with the new company?

Each buyer has his or her own subjective reasoning that affects the multiple, and there are many more questions in addition to those above. Each buyer treats each factor differently as well.

Every deal is different.

If you use this cheat sheet to determine your AE and are realistic in your multiple for your company, then you can figure out a range of what your company is actually worth. As I have stated several times, every deal is different, depending on the buyer’s and seller’s priorities in the plethora of factors and issues.

About the Authors

C2G Advisors is an M&A consulting firm with more than 35 years in the short-term rental industry. The company predominantly advises buyers by helping them expand through acquisition. However, whether you are a buyer or a seller, Jim Olin and Jacobie Olin at C2G Advisors would love to work alongside you to help you get the best deal at the right time.

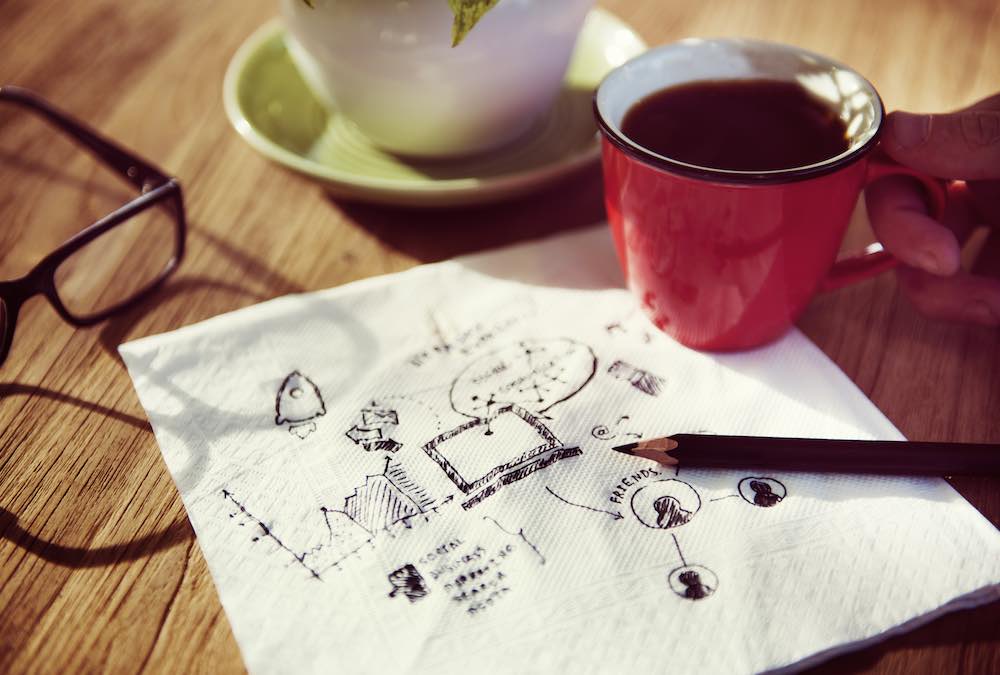

Debt is very important in an M&A deal in this industry. The article was just a quick overview of how a company can get a back-of-napkin number. The devil is in the details during diligence when seeing if the seller has fully-funded advanced deposits, debt on assets(office/laundry,etc), and figuring out the working capital.

On occasion I wonder if the traditional VRM valuation model of something like 3-6X EBITDA isn’t past its prime in the industry. I know it’s the standard model, but looking at other valuation examples that include debt levels are I think important as well. For example, the enterprise value model (and subsequent EBITDA ratio) I find a bit more helpful as debt levels are included.