Is Airbnb the top booking source for vacation rental managers? Not by a long shot.

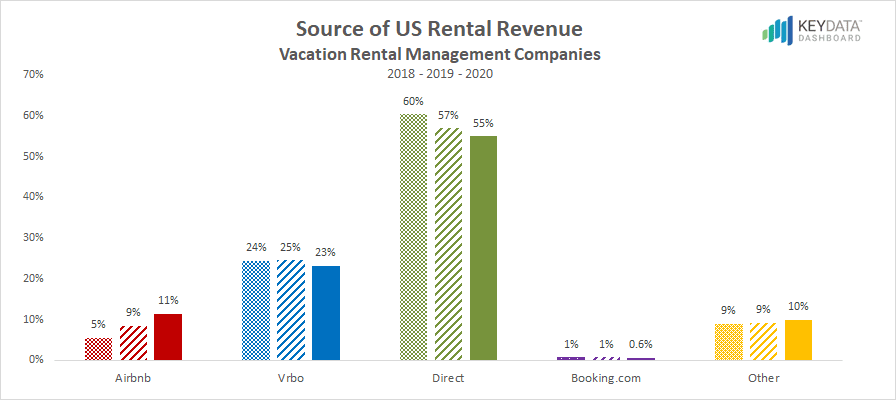

Looking at $2.4 billion in 2020 rental revenue received by US vacation rental management companies, Vrbo outperformed Airbnb as a booking source by more than double (Key Data, 2021).

What might surprise Airbnb’s pundits is that 55 percent of rental revenue is coming directly though managers’ own websites and call centers.

Rental Revenue per Booking

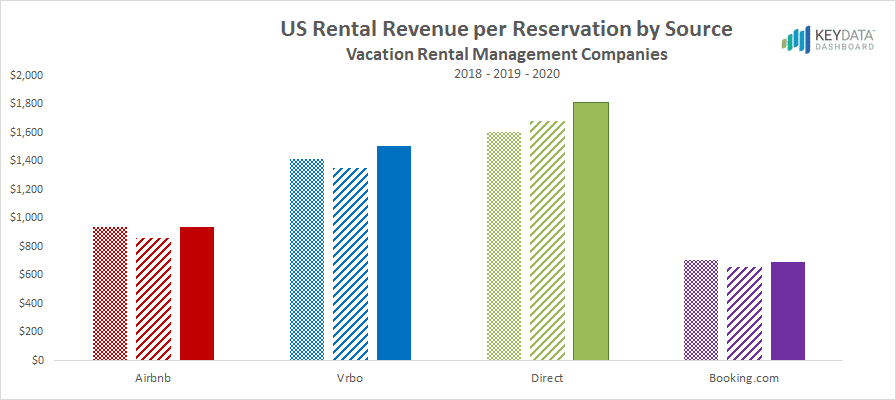

The research also shows that the rental revenue per booking differed significantly across channels for vacation rental managers. In 2020, the average booking coming from Vrbo was $1,505, while the average booking coming from Airbnb was $941. Booking.com was even lower at $695.

Direct bookings were more valuable than those coming from channels with $1,813 in average rental revenue per direct reservation.

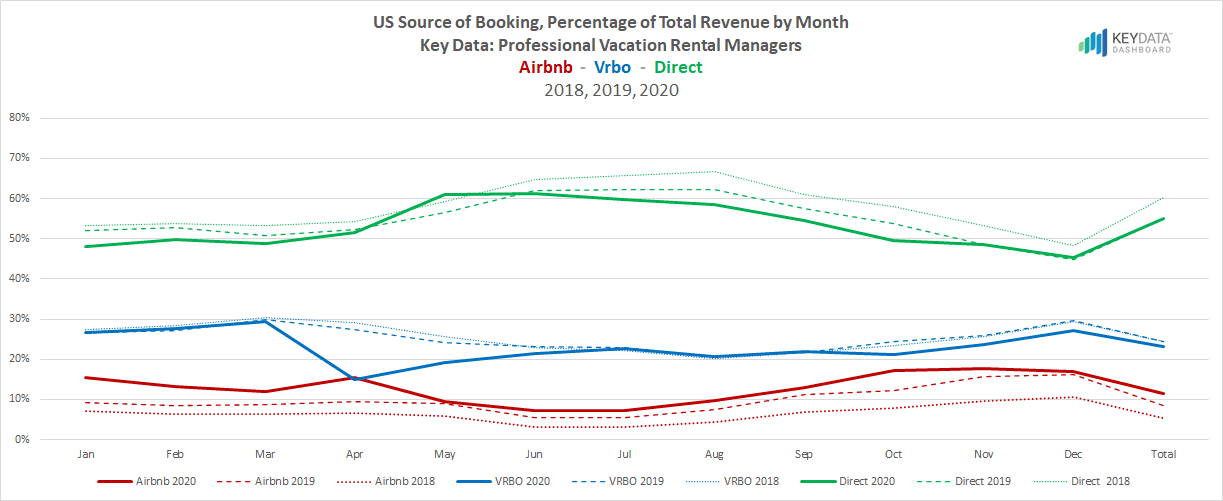

In an upcoming article in VRM Intel Magazine’s winter issue, Key Data CEO Jason Sprenkle writes, “VRBO is steady throughout the year. Airbnb performs poorly in the summer months and stronger in the winter months, and direct bookings capture the largest share in peak summer months.”

Why are Direct Bookings So Strong for Vacation Rental Management Companies?

In spite of billions in marketing spend from OTAs, there are several reasons that direct bookings still account for over 55 percent of rental revenue for management companies:

- Repeat guests

- Higher conversion rates with better, more personalized customer service

- Travelers who are familiar with the destination and coming from drive-to feeder markets

Building a brand that is known nationwide is near impossible for local vacation rental management companies. However, developing a recognizable brand within their main drive-to feeder markets and with their core demographic is doable. Guests who are familiar with the destination know the area in which they want to stay; often they know the exact community, street, or condo building they want. Local companies not only have developed strong in-market and feeder-market branding, they also better optimize for specific areas and communities in search engines.

Warning: The Percentage of Direct Bookings is Slowly Decreasing

Although direct revenue activity is strong, Key Data’s research shows the percentage is decreasing.

For vacation rental marketers, this is not good news. Rental revenue per direct booking almost doubles that of bookings from Airbnb.

For vacation rental marketers, this is not good news. Rental revenue per direct booking almost doubles that of bookings from Airbnb.

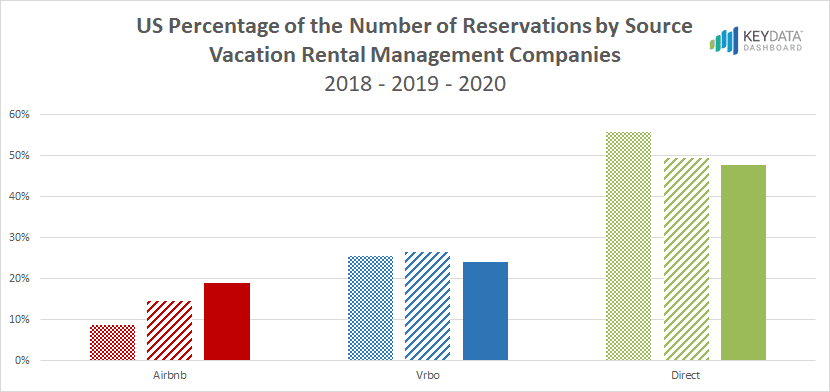

However, when we look at the number of reservations, Airbnb gained ground in 2020, while the percentage of direct reservations decreased.

To be fair to Airbnb, the company was clear in its pre-IPO S-1 filing that it is not looking to grow its business from professional vacation rental managers. Instead, the company says it is focused on the individual host. Moreover, Airbnb’s S-1 did not use the term vacation rental at all, labeling the decades-old sector as rural rentals.

When considering expanding presence on Airbnb, vacation rental companies have additional considerations. Dozens of managers are reporting more problems with Airbnb guests than those coming through Vrbo or direct channels. Further, Airbnb holds the power to override providers’ cancellation policies, causing headaches for managers. As you will read in Sprenkle’s article in VRM Intel Magazine Winter 2021, the average booking window for professional vacation rentals in the US is 212 days for stays between March and July. In 2020, Airbnb made several unilateral decisions to cancel reservations with short notice, and most properties were unable to rebook in that time frame without significant rate reductions.

Over the past several years, we’ve seen vacation rental management companies evolve into two general camps in their marketing paradigms:

- Those who mainly rely on OTAs for bookings (Large national companies that master distribution optimization and small local companies that don’t wish to compete with larger local brands for awareness)

- Those building a recognizable consumer brand (Primarily local management companies with strong destination awareness, drive-to feeder markets, repeat guests, and high levels of participation in the community.)

It is worth noting that the first group is dependent on—and rides the coattails of—the second group which works within the community to build and maintain a viable, sustainable tourism destination for everyone else . . . but that’s a story for another day.

It would be interesting to see what percentage the 10% “Other” category for revenue is from Google VR.

This is a great article, thank you Amy! However, for the last 2-3 years my business has changed. Before that time, I would book, on average, 120 nights/year on VRBO and 20-35 on Airbnb. Then about 2-3 years ago it flipped and I was booking about over 120 nights/year on Airbnb and just 20-30 on VRBO. When I attended the last, in-person, VRBO Owner’s summit in Nov of 2019 not one of the execs could even attempt to offer any explanation. Swings in bookings are naturally going to occur but that big of a swing is a sign of something deeper. I still haven’t figured it out. In 2020 my bookings set a record for me – 191 nights – VRBO=72 and Airbnb-119. And, I think I took only about 15 more nights direct. In 2021 I’m working on even more direct bookings. Finally, I had NO damage claims made and don’t see any difference in the Airbnb guest quality vs VRBO.