The national unemployment rate of 3.8 percent (as of May 31, 2018) is the lowest it has been since April 2000. With unemployment under four percent and the greatest number of jobs available since 2000, today’s strong labor market is putting many job seekers in the driver’s seat, which is starting to translate into increased turnover and pay increases.

With declining unemployment, it is even more important to communicate the value of your employees’ total compensation package so that they fully understand the value of the benefits the company offers to them and their families. Providing employees with total compensation statements helps businesses clearly communicate the value of their wages, paid time off, health insurance, retirement benefits, training and development, and other fringe benefits such as company cell phones, tablets, and laptops.

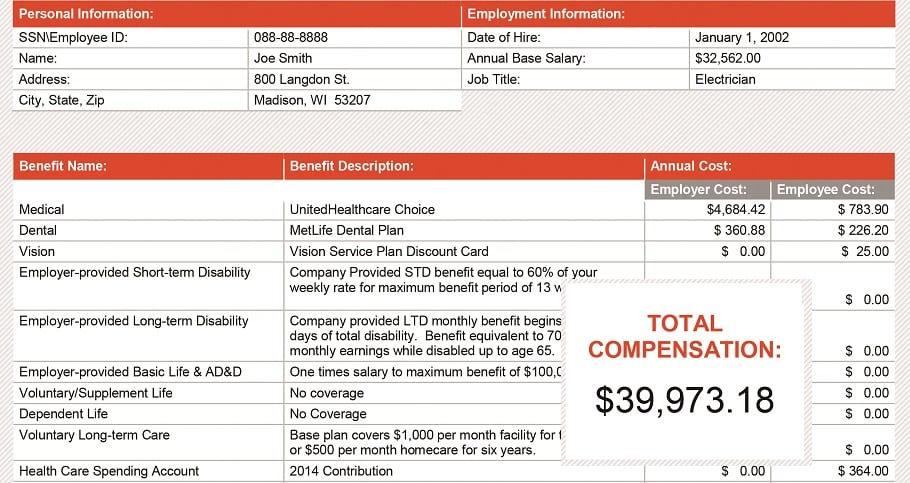

Most employees understand how much they make in wages. What they don’t understand and frequently miss out on is the value of the various benefits that you provide to them as part of their employment package with your company. The value of these benefits is often overlooked and is commonly referred to as your employee’s “hidden paycheck.” Total compensation statements are a great way to illustrate for your employees their full compensation package, including the amount you pay on their behalf. Your employees’ total compensation statement is one of the best employment marketing tools you can use to differentiate yourself as an employer of choice. You can use total compensation statements to do the following:

- Provide your employees with a realistic picture of their total compensation, which leads to increased motivation, engagement, and retention.

- Assist potential candidates to understand how strong your compensation and benefits are in comparison to other employment offers.

- Communicate your company culture and how you value your employees through your compensation and benefits.

Creating these statements is an investment, but it is one that can really pay off. Don’t trust your paycheck stubs to communicate the value of your employees’ total compensation.

Several years ago, while teaching at Oregon State University, I asked students to create a presentation on their companies’ benefits. During one of the presentations, a student didn’t mention health insurance benefits, which I knew the company offered. When I asked him why, he explained that he didn’t think about it because it was 100% paid for by his employer and not reflected on his paystub. Imagine if this employee saw an employee deduction for health insurance of $0.00 and a company contribution for health insurance of $175.00 every two weeks on his paystub. That’s a powerful marketing message. Don’t miss the opportunity to communicate this value, both through total compensation statements and your employees’ paystubs.

What types of things should you include in a total compensation statement? Include anything and everything you can think of that your business provides as a benefit to employees, such as the following:

- Base wages

- On-call wages

- Manager on duty wages

- Overtime wages

- Bonuses and incentives (annual and low-cost rewards and recognition)

- Paid time off benefits (sick, vacation, personal days)

- Paid holidays

- Paid leaves (jury, bereavement, short-term/long-term disability)

- Government-mandated benefits (Social Security, Medicare, federal unemployment tax, and workers’ compensation)

- Insurance premiums (health, dental, vision, life, short-term/long-term disability)

- 401(k) retirement savings plan/profit-sharing contributions

- Training and development (conferences, seminars, workshops, tuition assistance)

- Monthly subscription costs per person (apps, payroll, benefits administration)

- Professional licenses and industry memberships

- Cell phone/company computer/tablet

- Internet/data plans

- Mileage reimbursements

- Company-provided lunches

- Company-provided logo wear/uniforms

- Company-provided vehicle/transportation

- Company discount programs

- Comped stays in your managed rentals

- Gym memberships

- What else?

How you communicate the value of the total compensation statements is key to ensuring your employees read and understand them. Listed below are five things to consider to be sure that your total compensation statements are compelling and attention grabbing.

1.Involve your marketing department.

A total compensation statement is a marketing communication to employees. Just like your communications to homeowners and guests, you are marketing your company to your current (and prospective) employees. Your total compensation statements should promote your company as an employer of choice. It’s your brand, after all.

2.Keep it simple, easy to read, and visually appealing.

Use a lot of color and blank space. Keep your language simple and clear. Try not to use acronyms such as PTO, FICA, FUTA, or other abbreviations that employees might not understand. If your statement is cluttered, boring, or difficult to understand, your employees will not easily comprehend the value of the benefits you provide. Remember, keep it simple for the greatest impact.

3.Use graphs and charts to tell a story.

If an employee’s annual wages are $35,000 and the value of the total compensation including benefits is $50,000, the hidden paycheck you are providing this employee is an additional $15,000, which is equivalent to 42.8% of the wages. Imagine what that might look like in a simple pie chart.

Another chart might illustrate the employee’s missed opportunity in not participating in a company-sponsored retirement plan that provides an employer match. An employee who is earning $35,000 and is not contributing to the company-sponsored 401(k) retirement plan could be missing out on an additional $1,050 of compensation annually. This example is based on a 401(k) retirement plan that provides a 3 percent match on the first 3 percent of the employee’s contribution. Nobody likes to leave money on the table. Show them the money they are losing out on by not contributing to the company’s 401(k) retirement plan.

1.Choose the right time to distribute your statements.

Each business is different, so carefully consider the best timing to distribute your total compensation statements to your employees. I recommend that employers consider creating and distributing total compensation statements to employees in February each year. There are a couple of reasons for this:

-

- Employees receive their W-2s by January 31 and can easily be misled about their annual wages when they see their taxable earnings. Because taxable earnings are usually lower than annual wages due to the employee’s pre-tax, federal, and state tax deductions, employees can be disappointed with their current wages.

- Creating total compensation statements takes work to gather data residing mostly in your payroll and accounting systems. Using your payroll information at year end to create statements in February is much easier than in other months during the year because you have already collected a lot of the data to create and distribute your employee W-2s.

Consider the following example: An employee earning $35,000 receives his W2 statement January 31 indicating that his taxable income is $30,000 after taxes, insurance and 401(k) deductions. Now imagine that this same employee receives his total compensation statement three weeks later, indicating that the total value of his compensation while working for your company is $50,000.

This paints a significantly different picture than the W-2 statement he received.

2.Choose the right method to distribute your statements.

The method you choose to distribute your statements to your employees is equally important. Whether you choose to deliver the statement in person, during a conversation, or by mailing it to your employees’ residences, up-front thought is required. Which delivery option provides the most value to your employees depends on how knowledgeable your employees are about their compensation and benefits.

I recommend using your total compensation statements as an opportunity for managers to have open dialogue and discussions with their employees about their pay so that they truly understand the value of what the company offers. Investing your time to help your employees understand their total compensation makes the process even more valuable.

Communicating through total compensation statements is a good business decision when it comes to showing employees the full extent of the value of working for your company. However, don’t just think about using total compensation statements as a one-time event. They can be a very effective marketing tool to communicate the value of working at your company when you are seeing a rise in turnover or lack of qualified applicants.

Total compensation statements are highly effective when recruiting talent to your company. Let’s say you’re interviewing an employee for a position that pays $42,000 a year. Think how powerful it could be to show applicants a projected total compensation statement that lays out, in simple terms, what their total compensation might look like if they joined your company vs. others they may be interviewing with. Using total compensation statements as a part of your recruitment process is a strategic business decision that differentiates your company from others competing for the same employees in your local areas.

Market your investment in your employees, increasing their motivation, engagement, and retention in your workplace, by implementing a regular system for creating and distributing total compensation statements. There is no better time than the present to begin sharing this information with your employees.