Property managers get all kinds of questions from homeowner clients, and sometimes these are tax and financial questions. Homeowners may share tax-relevant information with you. Listening for a few key topics or phrases may help guide them to a much better financial result—and that is what great property management is all about.

This guide introduces a few critical and advanced tax topics that often affect vacation rental owners. Vacation rentals are particularly complex from a tax perspective, so be sure you or your clients engage a CPA or other qualified professional for advice specific to their situation. This introduction is intended to help recognize potential opportunities and initiate a discussion rather than reach any conclusions or recommendations.

The article is written from the perspective of individuals who own property directly or through a single-member LLC (including LLCs owned by married couples). Partnership tax often has similar implications, but partnership taxation is even more complex, beyond the scope of this article. S corporations are not covered because, as you will read, real estate should (almost) never be held in an S corporation.

1. Should they be taxed as a business or as an investment?

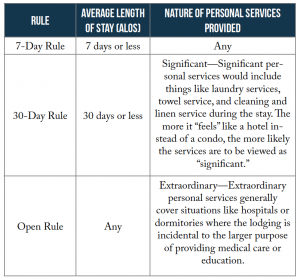

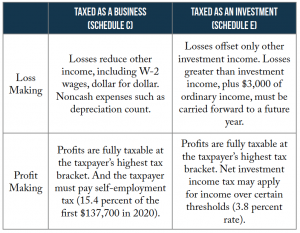

Believe it or not, property managers often make decisions and set policies that cause a vacation rental to be classified as a business instead of an investment. The tax implications for the owner can be substantial. A rental will be considered a business, and it will be filed on Schedule C in the following situations. Otherwise, they will be taxed as an investment using Schedule E. (See IRS Publication 925 for more).

Generally, vacation rental owners will fall under the 7-day rule or 30-day rule. The open rule typically will not apply to vacation rentals. Property managers can affect the tax treatment their homeowners face by setting the average rental duration to be over or under seven days. They may also adjust the service bundle to be significant or not. Generally speaking, owners of a property operating at a loss will prefer to be taxed as a business, whereas those reporting a profit will prefer to be taxed as a rental or investment. The difference can be substantial.

2. Help Them Qualify For a 20% QBI deduction

The 2017 Tax Cuts and Jobs Act created a significant 20 percent deduction for most income generated by entities other than C corporations. Rental real estate considered a “trade or business” qualifies for QBI, assuming the other general requirements are met. However, as discussed above, determining if a vacation rental is a trade or business is not always easy.

In 2018, the IRS published regulations clarifying a QBI Safe Harbor that, if met, allows most vacation rentals to receive the QBI deduction. The safe harbor requires the following:

The taxpayer (your client or you on their behalf) must keep separate books and records of income and expenses.

250 or more hours of rental services are performed annually, by the owner or someone working on the owners’ behalf—such as housekeeping, property management, supervision, maintenance work, billing, booking, or collection of payment.

The 250 hours must be documented with contemporaneous records showing hours of service, description of service(s), the dates of service, and the person(s) who performed the service.

Hours may be aggregated across multiple properties that have been designated in advance as a group by the taxpayer.

The QBI reduces taxable income by 20 percent. That’s a big deal for most people.

Consider helping your homeowners cut their tax bill using the QBI Real Estate Safe Harbor rules by documenting the hours spent on their property. This “extra mile” service might attract and retain clients, making it worth an extra fee in some cases.

3. Avoid S Corporations

The best form of business for rental or investment real estate is frequently debated. Many owners of single properties or smaller portfolios hold them directly. Although direct ownership does not afford the same liability protection as an LLC or other legal entity, insurance products can mitigate that concern.

LLCs are the most popular legal entity for holding vacation rental property. Any LLCs with one owner (or one owner plus a spouse) is called a “disregarded entity” by the IRS and taxed the same as sole proprietorships on Schedule C (or E). Any LLCs with additional owners will be taxed as partnerships by default. Any of these might be a good option for holding real estate.

The owner(s) of an LLC may elect to be taxed as a C or S corporation. Disregarded entities are also entitled to take a C or S corporation election. Usually the C corporation is a bad move because income will be taxed twice. And S corporations are never a good idea for rental real estate. There are four reasons why:

With extremely limited exceptions, appreciated property cannot be distributed from an S corporation without triggering capital gains taxes.

Tax-free exchanges under Section 1031 are complicated and may not be able to achieve the desired result.

Losses in basis step up upon the death of an owner.

There will be a loss of tax shield for the owner’s loans against the property.

If your clients are considering what form of business to use for their vacation rentals, and especially if they are considering an S corporation, send them to a tax professional for guidance.

4. Eliminate Capital Gains Tax

Many investors have a simple rule: “Never sell real estate!” That is probably good advice, but sometimes people have good reasons to sell. In some cases, listing and selling might be a good way to exit. For appreciated property, a 1031 tax-free exchange can be a smart move because it defers tax on the appreciation of the property (capital gains tax). This is particularly relevant in 2021 and beyond, given that real estate and other asset classes have appreciated quite rapidly.

But what if I told you there was a way not only to delay capital gains tax but to completely avoid it forever? For estates worth less than $11.4 million, appreciated assets, including appreciated vacation rental property, pass tax-free to heirs. And even better, the tax basis of bequeathed property is adjusted upward to the current market value. This means the heirs can sell it the next day at the current market value without owing a penny in capital gains tax. Yes, even if the bequeathed property was fully depreciated and carried at zero basis by the parent, spouse, or other benefactor, the sale of the inherited property is untaxed. Selling can cause the property owner to miss out on what may be the single greatest tax loophole in the entire US tax code: don’t sell!

Property managers can share this nugget of information to help homeowner clients (or their heirs) who are considering selling appreciated and/or depreciated real estate save a bundle on taxes and keep a property under management in the process.

5. Help Them Book “Paper Losses”

Ahhh, paper losses are those wonderful tax deductions that you get but without spending any cash out of pocket (well, at least not that year). The biggest driver of paper losses in vacation rental real estate is depreciation. Generally, the cost of the improvements, but not the land, is divided by 27.5 years, with the resulting amount taken as depreciation each year. In some situations, it may be advantageous to separately depreciation equipment like ovens, range hoods, fans, and refrigerators. (If classified as a business, these costs and related depreciation will reduce taxability in the current year, including W-2 income.)

Note: The IRS requires that property used as a rental be depreciated: if it is not depreciated, the error can cause higher tax liabilities when the property is subsequently sold.

In some cases, repairs, restorations, and refurbishments, such as new carpet or replacement appliances, can be expensed in the year they are purchased. In other cases, these costs must be added to the original cost of the property and depreciated.

Mistakes in depreciation (such as not taking it), can be fixed by filing Form 3115 to notify the IRS of a change in accounting methods.

Property managers who help clients with maintenance and repairs can provide good records not only of the amounts spent but also of whether the expenditures were upgrades, or maintenance; they can then ask homeowner clients if they are taking appropriate depreciation.

6. Avoid Using the Rental as a Residence

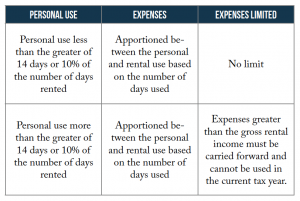

One of the best things about owning vacation rental property is the prospect of using it yourself. Of course, that not only can displace billable rental revenue but it can also change the tax treatment of the rental. Here are the thresholds and the implications of each option:

This is primarily relevant to homeowners who are booking paper losses and wish to use them to offset current income (e.g., average rental days less than seven). Property managers can alert clients who are booking more personal time than these limits allow that they may forgo some short-term tax benefits by doing so.