The vacation rental industry is booming. In the United States alone, there are an estimated 4,500 professional operators managing more than 600,000 units with a compound annual supply growth rate as high as 7 percent. When smaller operators with less than five units are thrown into the mix, the total number of operators increases to more than 20,000. And the United States represents only 25 percent of the global market. This space is massive!

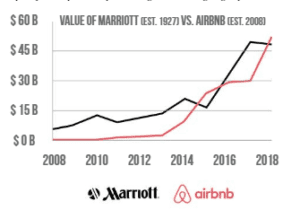

What about demand? Take one look at the growth of Airbnb’s valuation versus Marriott’s, and it is clear the vacation rental side of the hotel and lodging industry, which is expected to continue to grow by 10 percent year over year through 2022, isn’t going anywhere.

To that end, although both supply and demand are growing, the ever-changing vacation rental industry we all know and love remains highly fragmented and outdated on the business-to-business (B2B) side (for more than just technology). I’m not going to beat around the bush . . . it’s a mess!

Without naming names, it’s time we take an honest look at some of the core issues and inefficiencies on the software side of the space, which from a bird’s-eye view has remained largely unchanged for the past five-plus years (with the exception of revenue and yield management tools, which are frankly still maturing).

I’d also like to nod to some of the promising new technologies and services along different parts of the value chain that I believe are helping move the industry forward. There is tremendous opportunity out there for the brave, the bold, and the innovative.

Without further ado, I give you the good, the bad, and the ugly of the B2B side of our beloved vacation rental industry.

First, the Ugly: Lack of Transparency, Price Gouging, and Dishonesty

There exists, at this very moment, a thriving third-party distribution player that offers its paying customers zero visibility into reservations for the very units they manage. “You got a booking!” But from which channel? Not provided. Who is staying at our property? Sorry, but we mask the guest email address, and you can’t talk to them. How do I email my guests the check-in info or a survey after the stay? You can’t. Exactly how much are you making off of my inventory? Apologies, but we can’t tell you that.

Well, it turns out that this particular provider, which has substantial market share, is generating what are arguably exorbitant sums of money considering they don’t even have the keys to the properties. According to an anonymous but verified (and frustrated) customer, “After prodding one of their team members on a recent call he finally admitted to me that they always mark up the prices fed to channels like Airbnb, HomeAway, and Booking.com such that before paying the channel their company nets 23.5 percent in fees, at minimum, from each booking . . . for just channel management, which we already pay them 3–4 percent to handle.”

This frustrated customer continued, “If inflating prices for entire markets isn’t bad enough, we also found out they are double dipping our damage waiver fees by lumping our $75 waiver into the ‘cleaning fee’ they serve up to the guest, then charging each guest a separate waiver of $39 to $99, which their company keeps. We’ve calculated that over the past 90 days they have raked in over $25,000 from our company off of only 80 reservations, $7,500 of which is from damage waiver fees alone.”

Understandably, the aforementioned supplier has decided to pull its inventory from this service provider.

Although generating revenue is critical for any business, are significant price markups and non-transparency with suppliers and consumers helping move our industry forward? Is it logical that the party on the ground managing the unit has zero control of its reservation data or communication with the guest? I think my five-year-old could answer that one.

Next, the Bad: Lack of Innovation, Nickel and Diming, and Inertia

Although property management systems (PMS) and ancillary distribution tools are the backbone of the industry, there is a growing level of disdain among property managers for the software they depend on to run their businesses. Why?

The incumbents (several of whose tech platforms are between six to 10-plus years old) aren’t easy to use and simply aren’t innovating—not technologically, commercially, or in terms of customer success. Pricing models are old school, often involving thousands of dollars for setup with ongoing fee structures that are convoluted and really add up. Need to add a gateway? That’ll be $50 per month per bank account. Ready to add another property? First you have to buy the individual shell for $120, then pay $6.98 per month per unit (regardless as to whether it’s just an unused shell). Need to connect to our API? That’s $2.28 per month per unit. Oh, and we also charge you 1–5 percent per transaction.

Furthermore, the systems—even the leading “all-in-ones”—are disconnected, often leaving managers with no choice but to pay for, and sign into, five to 10-plus separate providers. Need an invoicing tool? We don’t do that, but we integrate with a company that does for $4.00 per month per unit. Housekeeping task management? Can’t do that, but we integrate with a company that does for $3.00 per month per unit. Contracts? That’ll be $50 per month. Need to distribute to this or that channel? We don’t have an integration with them, but we have a partner that does for 2 percent (or more) of every transaction.

Sound familiar?

In the current ecosystem, the incumbent platforms aren’t user friendly, it’s costly to ultimately market and monetize inventory, and it isn’t a cinch to switch providers (three to six months to onboard on average). The result? Inertia. It’s no wonder vacation rental software has remained largely unchanged for more than five years.

Finally, the Good: Standardization, Growth, and Breakthrough Solutions

Of course it’s not all bad out there. Consumer adoption of vacation rentals continues to rise, and professional suppliers are getting savvier. But the market is ready for technology adoption and consolidation. Guest experience and hotel-like services are a major focus, and innovation is greatly needed.

Well, the cavalry is on the way.

Thanks to smart home technology and the Internet of things, guests are now enjoying more automated and flexible check-in/check-out procedures and better service overall as property managers are able to shift their focus to guest experiences by automating control of locks, garage doors, thermostats, noise monitoring, and more. Property owners benefit from lower energy expenses, increased security and peace of mind, and ultimately more revenue generated. This is just the tip of the iceberg of what this technology will do for the industry.

On the growth side of things, more and more we’re seeing national (and multinational) operators steadily increasing the size of their portfolios through acquisition of smaller suppliers in an effort to become a household name among the masses. The challenge in building a brand that to the consumer is as reliable as the best hotel brands is providing a consistent experience. Smart home integration is a core component, but the ones who will ultimately provide the best service and generate the most revenue aim to standardize all operations while still maintaining the charm inherent in vacation rentals: standardization of guest communication and in-destination experience, on-the-ground staff workflows, and onboarding of acquired property owner clients, to name a few. We are witnessing this progression at this very moment.

There are also a growing number of urban, multi-family players who have moved from owning or leasing out individual spaces to working directly with developers to build new complexes or renovate vacant old spaces into apartment-style units they lease to the operator. Business travelers who appreciate the comforts of home and the reliability of hotels get the best of both worlds. This phenomenon is largely thanks to Airbnb’s model and technological advancements over the last decade.

As we approach the new year, players will have greater access than ever before to near real-time market information for making better data-driven decisions. Operators large and small will have access to new educational tools, more growth capital, and new M&A opportunities.

But what about the PMSs professional operators run on? Technologically speaking, we’ve already witnessed a few generations of players progress through the product life cycle. The incumbents are recognizing that change is afoot and, in response, are increasing the features and services they offer through acquisitions and integrations but often offering little innovation of their own.

To that end, I think we are about to witness the new generation of the all-in-one PMS. These providers are harnessing the latest web technology, ignoring the patterns that have led to the current fragmented space and instead innovating with game-changing features, best-in-class parity tools, and true end-to-end solutions.

2019 is going to be an interesting year.

Great show and great article overall. I disagree with one item. Simon suggests that “new” is better than mature and successful solutions and that old is old fashioned. Over the course of our twenty years in the industry, we have rebuilt our solution four times to stay cutting edge, each time we have used the opportunity to learn from our mistakes. So of course, I am going to disagree with this premise.

Barefoot is the most mature browser-based system in the industry. Our average client size is 250 units (no one has a larger average in this industry) and we have an almost 90% retention rate since inception. Our perspective is that we are an Enterprise Resource Program (ERP) and our clients build their technology ecosystem around our software. We also are often first to market with functionality, in part because we are designed to be tailored and because we listen to our clients and focus our development around their needs. We also have an expansive partner program, where we always seek to implement a two-way integration, so that our platform seamlessly runs all aspects of a vacation rental or property management business.

What Simon also misses in his evaluation is what I believe is the most important piece of this industry and any Property Management System, which is trust or escrow accounting. You will notice that the “older” software players all have moved to trust accounting. Those software providers that offer trust accounting take about five years on average to work through issues if they consider all the variables and do it correctly the first time (few do). It took us two versions to get it close to being correct.

Property Management and Vacation Rental companies don’t own anything, they are middle men and women between guests and owners, the taxing authority, and the many other third parties they may work with for concierge or property management. It is a requirement in about half the US states to work in an escrow environment under real estate law and the local real estate authority. Failing an audit can result in the loss of your business license. If you don’t use trust accounting, you will have little opportunity to become a multimillion-dollar company or position yourself for a buyout without this efficiency.

So, I would advocate that a property management software, who has mature accounting, listens and can react quickly, are consultative and surrounds themselves with the most innovate clients is not outdated, but is the future.

Like the PM referenced above re: the mentioned 3rd party distribution player, we also pulled our inventory from “them” (or at least one that looks a lot like them)… And we’ve never looked back.

To the point about PMS systems: For all the things that I may dislike about working with an in-house-built, proprietary software, the problems (read: costs) you outlined are exactly why I’m willing to take those pains all day long. Because in the end, they’re minor, and frankly, are fixable whenever we determine it’s necessary (because we have the dev resource in-house).

Finally, as much as I dislike the invasion of technology into our lives as a society in general, I am able to separate that personal hesitation with the reality of life in the 21st century and beyond. As someone who has been creating and using her own RM tools for the past 3 years in the VR sphere (recreating hotel RM tools as closely as possible), I’m thrilled with the things that are emerging now… They’re certainly not any sort of silver bullet, but I’m happy to see them appearing and evolving.

It will be interesting to see who makes the plays that will take us forward.

Sarah – Would love to talk shop sometime about your custom setup, specifically on the RM side. I have almost a decade of experience in our space, and recently launched a next-gen PMS called Direct (www.getdirect.io) that addresses a lot of my own pain points over the years. Our product / value prop resonated well with managers at VRMA last week, and open to feedback!

This is a very interesting article and I agree that now is the time to bring forward the best in class PMS / Reservations systems, however for the independent software solutions to be successful the independent agents must have an appetite for the cost of technology as we see the big players making huge returns from the same bookings that they would achieve as pointed out above.

However if the independents could charge the same prices then they would have a much higher profit margin to invest in their technology, this would enable software providers like ourselves to invest more in innovation and to bring more functionality in house.

Though actually I believe there is a lot of value in using integrated specialist software. With API’s and platforms like Zapier, a business can automate so much more and still use specialist software which is far better than poor imitations when using an “All in one” solution.

I have a lot of respect for Simon in most things that he is involved in, but in this one I think he has ignored two significant aspects of the process. Carl references them below and they are Cost of Change and Capacity. Having been involved in the creation and evolution of the “Bad” of the industry for a while, next year will see the retirement of two Enterprise level systems currently owned by HomeAway. PropertyPlus will be 23 years old and FRS over 28. Why do they still exist ? Why are the Managers moving off now and many reluctantly? because HomeAway is making them and not necessarily because they want to.

The pain of change for a large manager with Complex Operations is somewhat akin to a Root Canal without Anesthetic, the costs are immense and the risks are real, they will likely suffer material damage to their business just by changing. Add to that, the Software Companies that are scooping up these new clients are struggling to deploy the Human Resources that it takes to convert these new clients.

If you have 10 properties, depend on AirBnb and other channels for reservations, don’t have a Repeat Business model that accounts for more than 50% of your reservations, use Quickbooks for accounting with no Real Estate oversight and have unlimited access to Housekeepers and Maintenance people they can change every week to the next shiny thing on the shelf. If you have 250-2000 then it is a project that needs to be planned, managed and will likely take a year or more to complete. This is not a fault of the provider, it is a mature and responsible approach to managing the change.

5 years without innovation is also a bit unreasonable, but the reason you think it is 5 years is that is how long most of the new up and coming PMS systems take to become a comprehensive reservation system. Once they reach that ceiling, there are only a handful of systems that make the leap to Enterprise systems and the requirements increase disproportionally. You cannot recover the development costs to provide the features needed to service the larger Managers so you rely on best in class innovators to provide the additional functionality and this has a cost.

I believe what you describe as the “All in one” systems that are coming along are not All in one Solutions for a Property Manager, they are “All in one Reservation Systems” and for what real Managers need, that is only half of the puzzle.

Great commentary Doug.

Really interesting article and one of the commonest phrases we hear is: “I need to change my PMS”. Part of the problem on PMS for small and mid-sized businesses is one standard software package does not suit all and may not have all the needed refinements (e.g different channels for different prices or specific pricing structures or multiple tax codes or tailored automation, or multi-currency or owner-manager financial reconciliations etc. Then there is the price for all the moving parts as mentioned. The total take can be as high as 10% with card fees, channels, PMS, automation etc, that’s on top of the OTA commission. The net effect is that the owners get less or the guest pays more.

Where will it go? On the last count, there were 250+ systems that had some relevance and probably 20 that could be considered major players. But with acquisitions of middle managers and superbrands, brand building property companies and the OTAs providing all the tools for owners, the eco-system is changing shape rapidly.

It looks like the small managers need a cost-effective complete system, with a simple revenue model. I notice Glenn charges $15 per booking, that’s 1%ish based on UK averages I believe and this is the number that is probably acceptable for a full standard PMS system long term. Even if 15% can head off to the marketing company! Without bookings, there is nothing to manage everyone says!

Alternative and cost-effective marketing channels are maybe a better bet for serious tech investment these days to counter where the real income drain is…..

Thanks Simon, we built Genkan in 2010 with the aim of a “all-in-one PMS” I have believed in the CRM principle all along and we havent swayed from that direction.

Since 2010 we have directly integrated 7 banks credit card through api ( no intermediary so as they get the best rate ) plus Paypal.

We have directly integrated through ( no middle man ) Booking.com, Airbnb, Tripadvisor, HomeAway, Expedia and near completion of CTrip.

We in 2011 integrated the Kaba API for door control

We auto send ( and have done this since 2011 ) all codes via sms and it appears in their app at checkin time also

Guests complete check-in online and have done so since 2015 just like they would as if it was plane travel.

Compendiums all online accessed via the smart phone or tablet.

Our users require no “bolt on” or added services, we have a survey module, inspection module, loyalty module, email and sms marketing engine, all communication is automated and scheduled. Our survey results are fed into HomeAway through the api so as they appear on our website and HomeAway the same time. We have a fully integrated SHOP that really we could almost load Walmart or tours and events.

Accounting, trust accounting is fully integrated , no bolt on, fully integrated to the booking and to the owners portal

I think I have covered it all or most of it, so where have we gone wrong.

Well its difficult down here in Australia. When we demonstrated VRMA in Las Vegas not one waled away not saying it was the best they have seen.

We charge $15 a booking, nothing else.

So where have we gone wrong if your article is correct.