Most people in the vacation rental industry are comfortable with the idea that prices and availability settings for vacation rentals should change depending on the season, days of the week, length of stay, lead time, and whether there’s a big holiday coming up. This is because year-round demand for vacation rentals fluctuates widely. Furthermore, in some cases, even demand for serving different needs varies depending on seasons and days of the week.

There are two major principles involved in deciding how to change your prices.

1) Matching demand with supply

For example, if your area or portfolio is getting completely booked during high season and is 30 percent occupied in low season, that indicates seasonal prices can be adjusted more drastically than what’s being done currently. Of course, there is sometimes no way to fix this with prices alone. It’s quite possible that in low season your occupancy won’t exceed 30 percent unless you drop to an unacceptably low rate.

2. Segmentation

Depending on location, larger family groups are likely to book longer vacations in high season, while in low season, smaller families and couples book shorter weekend getaways. Once you smaller booking window than longer stays, you can cater to both audiences based on how far out they book.

Although the basic principles of revenue management for vacation rentals mirror similar industries (think hotels and airlines), practicing revenue management in vacation rentals is significantly more complex.

> Uniqueness

Each rental is unique and not identical to the one next door, unlike hotels with multiple rooms that are exactly the same.

> Portfolio optimization vs. equitable distribution

In most cases, each rental is owned by a different entity that wants its property to do as well as others being managed by you (or someone else). Unlike hotels, which only care about total revenue made by all the units in the property—and in some cases across all properties in an area—you have to worry about individual owners being happy.

> Highly fragmented supply

Vacation rentals managed by multiple companies and owners are all competing for limited demand in the area, especially during low seasons. If the occupancy is only going to be 30 percent, you want your rentals to be in that 30 percent. This starts a race to lower prices that might not always be fruitful.

> Owner restrictions

Owners of the rentals you’re managing might not give you complete freedom to do what you think is going to maximize revenue for them. This is not to say the owners are wrong, just that they may have their own concerns. But these concerns add additional constraints on your strategies.

Complexities aside, even in industries where the practice of revenue management has matured, pricing is still is one of the more rewarding problems to solve, both intellectually and monetarily.

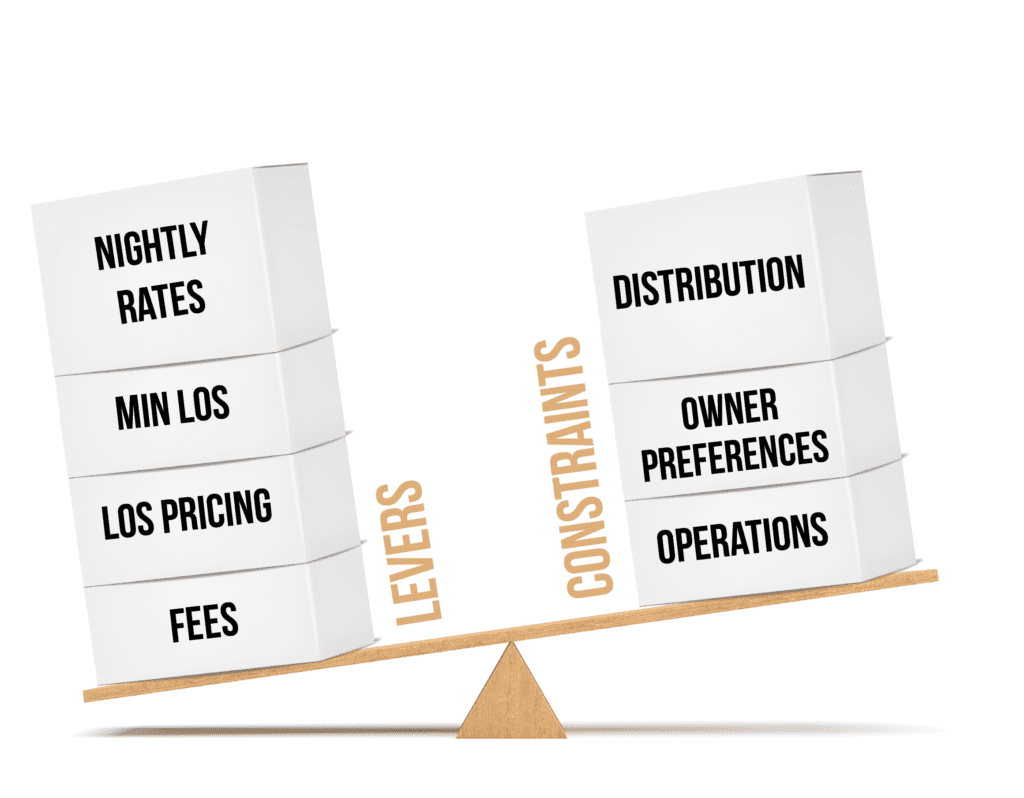

When thinking about revenue management strategies to implement for your vacation rentals, it is important to understand what levers you can pull and what constraints you have to operate within.

The most commonly used levers tend to be the nightly rates, minimum length of stay (LOS), LOS discounts, and fees. When working with any of these levers, it is important to be aware of any constraints and the effect the levers might have on them.

> Owner restrictions

Owners of the rentals you’re managing might not give you complete freedom to do what you think is going to maximize revenue for them. This is not to say the owners are wrong, just that they may have their own concerns. But these concerns add additional constraints on your strategies.

Complexities aside, even in industries where the practice of revenue management has matured, pricing is still is one of the more rewarding problems to solve, both intellectually and monetarily.

When thinking about revenue management strategies to implement for your vacation rentals, it is important to understand what levers you can pull and what constraints you have to operate within.

The most commonly used levers tend to be the nightly rates, minimum length of stay (LOS), LOS discounts, and fees. When working with any of these levers, it is important to be aware of any constraints and the effect the levers might have on them.

Nightly Rates

There are a few well-established frameworks that different managers use, varying in complexity with respect to both analytical capabilities and execution.

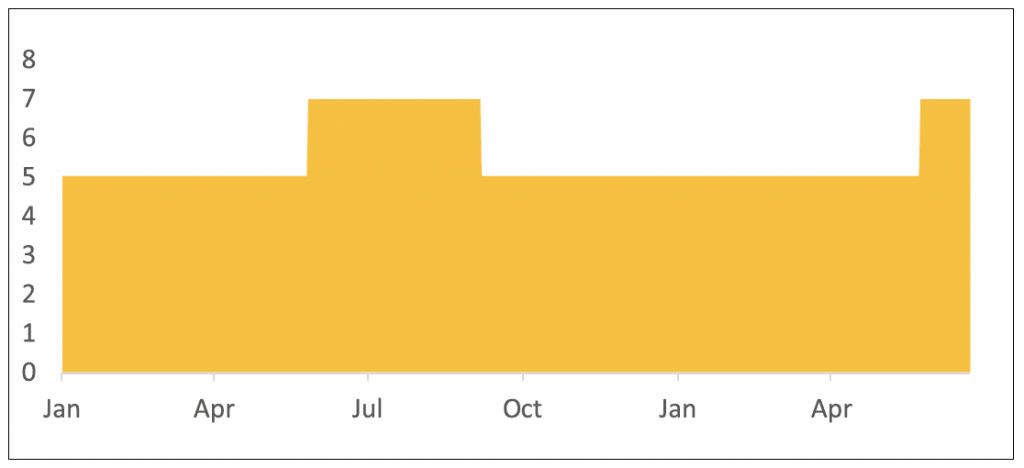

> Fixed rates

Many rental managers set or adjust rates for the next year or two at one point in the year, and then change them again for next year after the high season is over. This was fairly common when active revenue management wasn’t as popular as it is today, and distribution constraints didn’t allow for changing rates too often. While these are easy on distribution, you run the risk of not reacting to changes in demand trends as well.

> Dynamic rates

Many vacation rental companies have people on their teams who monitor portfolio performance, watching for abnormal booking patterns, and adjust rates accordingly.

> Automated dynamic rates

In the past few years, the use of automated dynamic pricing has become fairly common. Property managers set up a system, provide certain guidelines to make sure the prices don’t go outside a comfort zone, and the system changes prices daily based on supply and demand trends.

> “Supervised” dynamic rates

While automated dynamic pricing is beneficial, it is recommended that you don’t “set and forget” because human oversight is a key ingredient when using automated systems, which might not know some things you know based on experience. While every revenue manager has a standard set of reports, some common things to keep an eye on are discussed toward the end of this article.

Minimum-Stay Requirements

Minimum-stay restrictions greatly influence your revenue strategy but are also constrained by owner preferences and distribution strategy. Some common frameworks are listed below, and they’re all about allowing you to segment demand to meet supply.

> Saturday-to-Saturday weekly rentals

These are more common in traditional leisure vacation rentals than in urban short-term rentals and are based on behavior from repeat guests who book week-long stays from Saturday to Saturday. This system prevents short gaps in your calendar and provides a sense of operational certainty because you know there won’t be turnovers on days other than Saturday. But with vacation rentals going more mainstream, there is significant demand for shorter stays and stays that don’t start on a Saturday, which you would be completely ignoring with this strategy.

> Segmentation by season, or having different minimum stays for different times of the year

This strategy is probably the most common among vacation rentals that better understand the value of segmenting their customers. Longer stays are still required in high seasons but without the Saturday check-in restrictions, and shorter stays are granted for the shoulder and off seasons, realizing that there still are people visiting during these seasons for quick getaways.

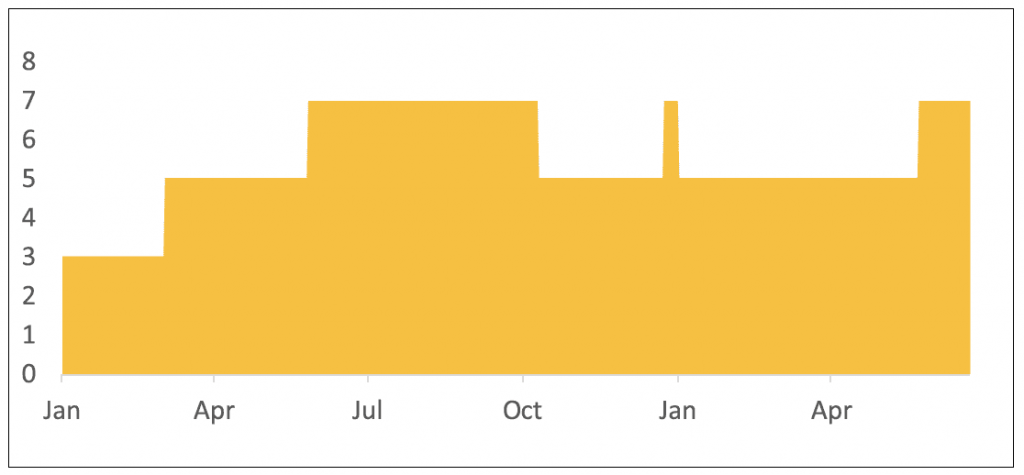

> Dynamic minimum stay, or segmentation by booking window

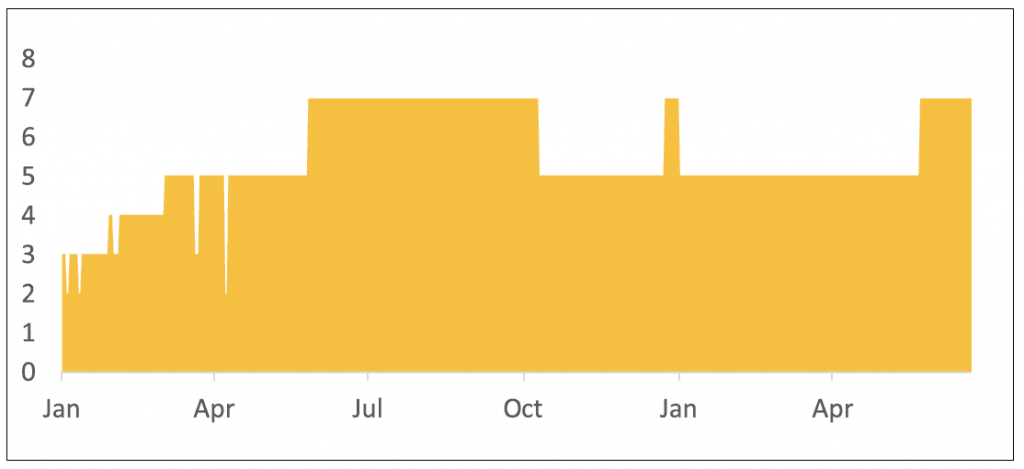

This strategy takes segmentation up a notch by recognizing that people who book last minute generally tend to book shorter stays. With this in mind, you could start with your usual LOS requirements for each season but lower them as the dates get closer and there are vacancies remaining.

> Dynamic minimum-stay plus, or unlocking vacant but unbookable supply

There are times when your minimum stay is five nights, but you have a four-night gap sitting between two bookings that no one can book. Adjusting minimum-stay requirements to match what’s available (either manually or automatically) is a great way to make sure these availabilities end up filled. If your constraints allow, this is a great way to increase revenue.

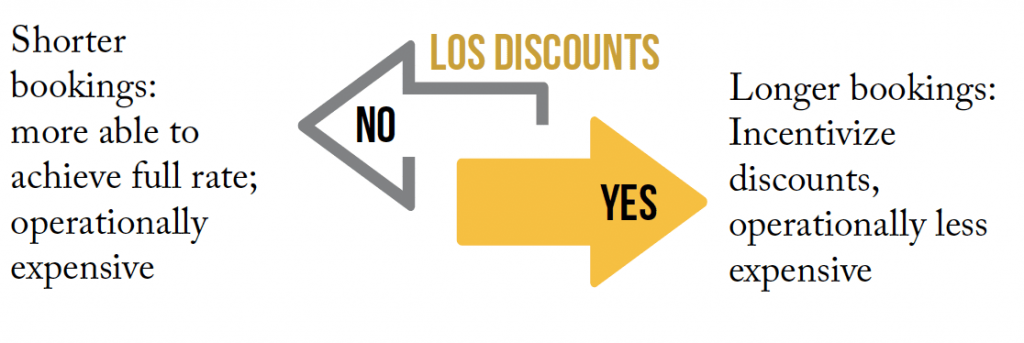

LOS Pricing

Having incentives to book longer stays reduces your average daily rate but might increase midweek occupancy and is easier on your operations. On the flip side, not having those incentives will result in a greater number of shorter stays (as long as your minimum-stay strategies allow for it) and be operationally expensive.

The most common frameworks that let you slide along this scale to help find the right place include the following:

> Weekly or monthly discounts to encourage longer stays

> “Short-break” pricing where guests can book one or two nights as long as they pay the price for three nights

> Complete LOS pricing/discounts plus premiums for shorter stays and discounts for longer stays

Monitoring Your Revenue Management Strategy

Whether you go with manual or automated revenue management frameworks, it is important to monitor the way your rentals are performing and take corrective action if needed. Some basic reports used by revenue managers include the following:

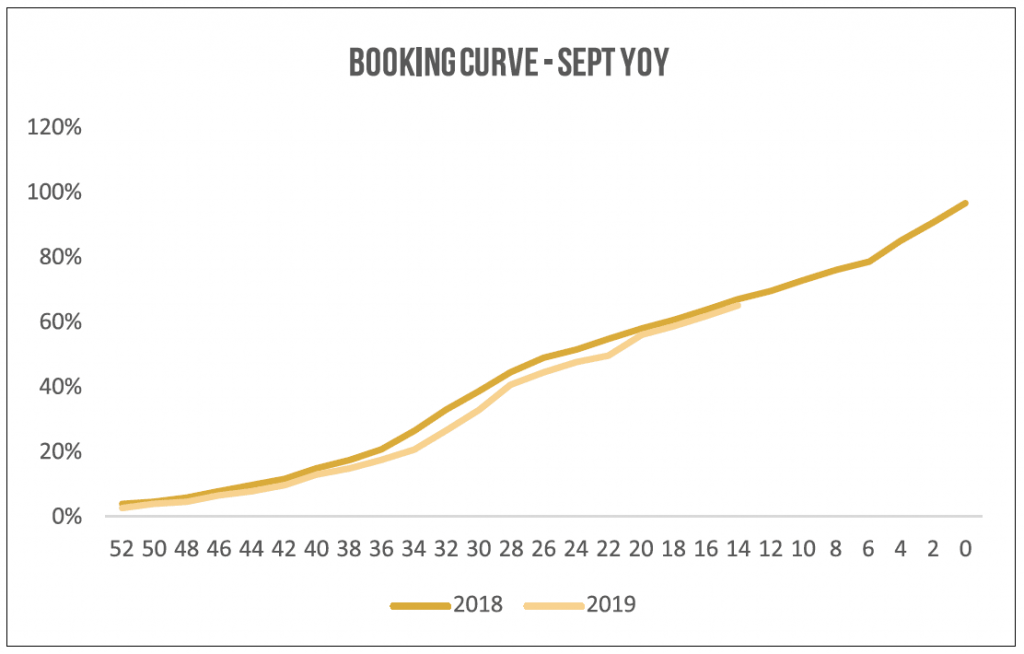

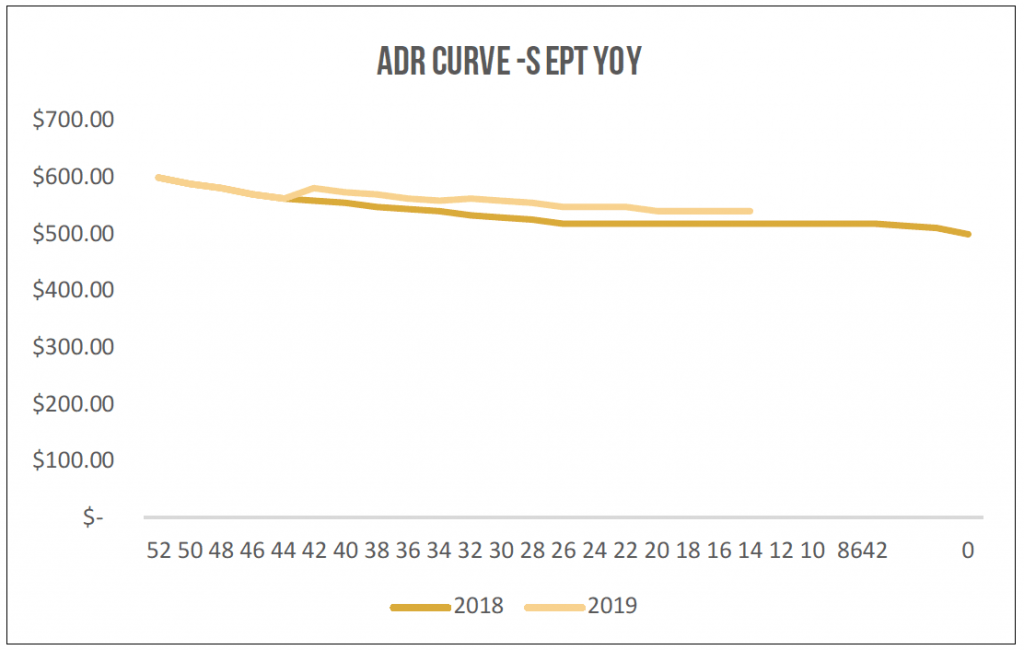

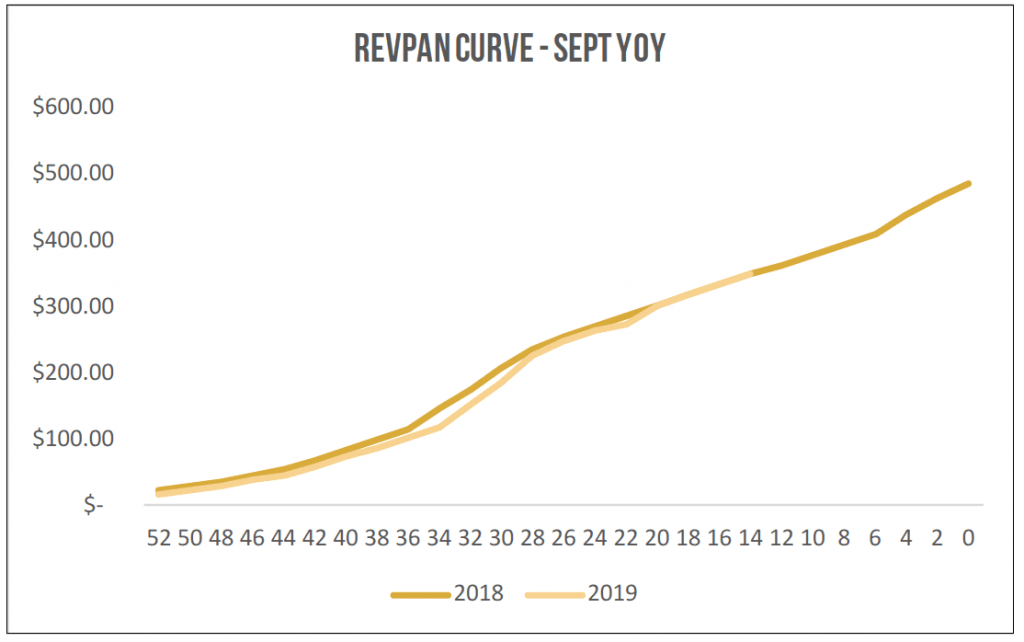

> Year-over-year booking curve, ADR, and Revenue per Available Night (RevPAN) reports.

It is good to be aware of how key metrics for your business are shaping up for the upcoming month compared to last year. Year-over-year booking curve, ADR, and RevPAN reports help you understand if a corrective action should be taken, regardless of whether it’s because of your pricing strategy or changes in underlying demand.

These reports are usually run at an aggregated level, both for a timeframe and a segment of your portfolio that behaves similarly (e.g., four-bedroom beach-facing homes in September) and shows how the chosen metrics are trending compared to a similar time last year.

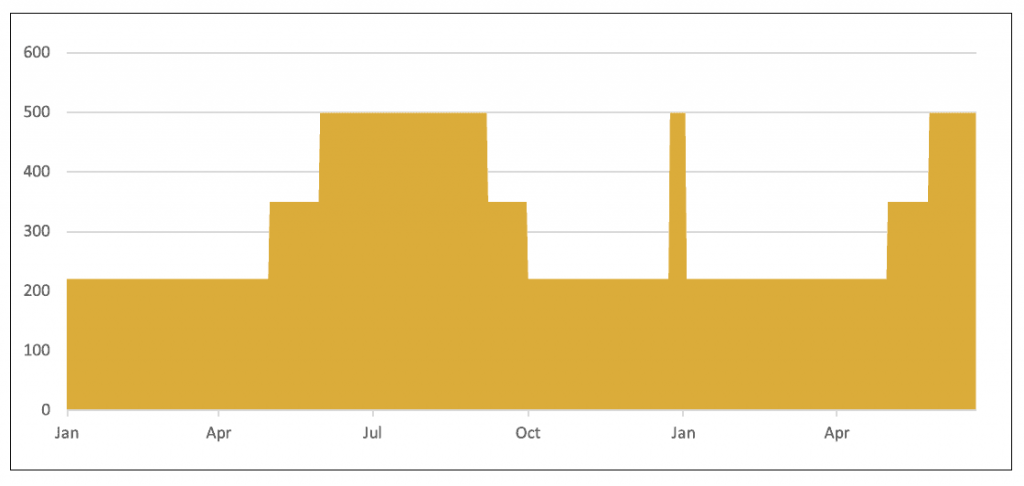

Suppose we’re 15 weeks away from September, and you want to know how things look compared to last year. Knowing the final occupancy rate for September last year is useful, but only after September has ended this year as well; before that point, you’re not able to make any corrective changes. The following chart demonstrates that knowing how occupied your rentals were for the month of September around the same time last year allows you to be proactive.

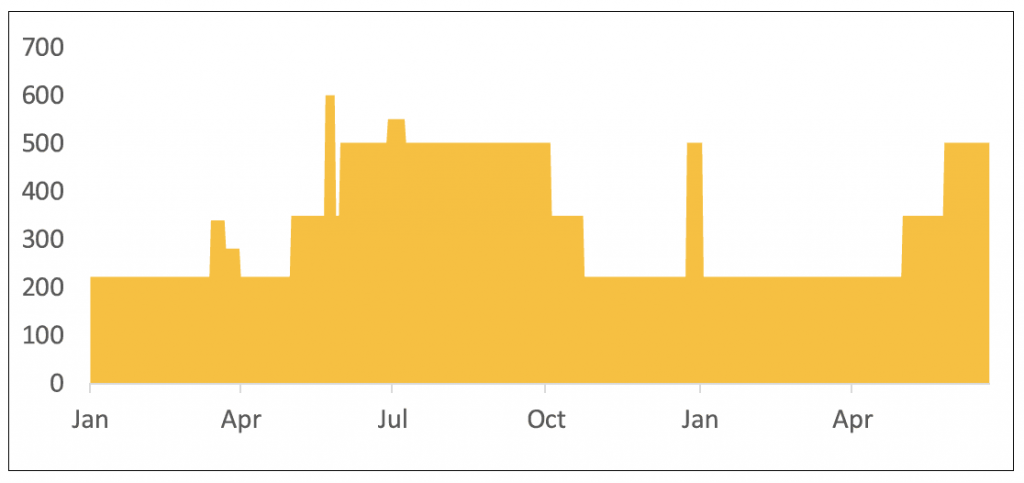

The booking curve suggests that we’re trailing compared to last year. This might seem bad, but without similar reports/charts for ADR and RevPAN, we don’t see a complete picture. Let’s also look at similar charts for ADR and RevPAN.

These suggest something more nuanced. Though we’re trailing on occupancy, the ADR has been higher, and in terms of RevPAN, we’re almost even with last year. And we have more left to sell in the last few weeks; this is a much better position to be in! Comparing metrics year-over-year doesn’t mean that last year was the best you could do and is what you should be repeating; the data should be used as a guideline to see if your revenue is on track to be similar or better than last year.

The reports also illustrate market behaviors that might have nothing to do with your pricing strategy. Suppose you’re trailing on both occupancy and ADR (and as a result, RevPAN) compared to last year. This suggests that there may be less demand than last year because even though you’re selling for a lower price, you’re not selling more. You can try finding out if it’s softness in demand everyone is experiencing or if it’s something only you’re seeing. Either way, the solution now seems to lean toward demand stimulation rather than pricing.

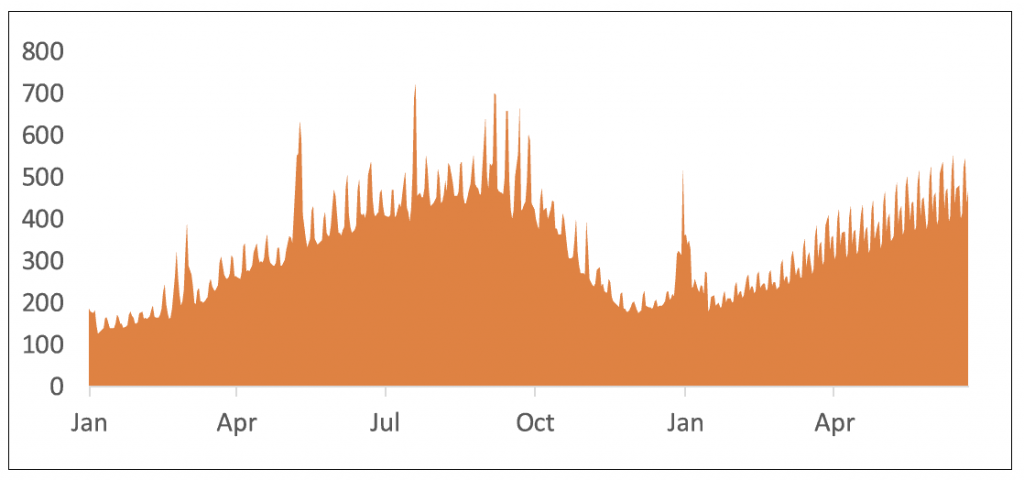

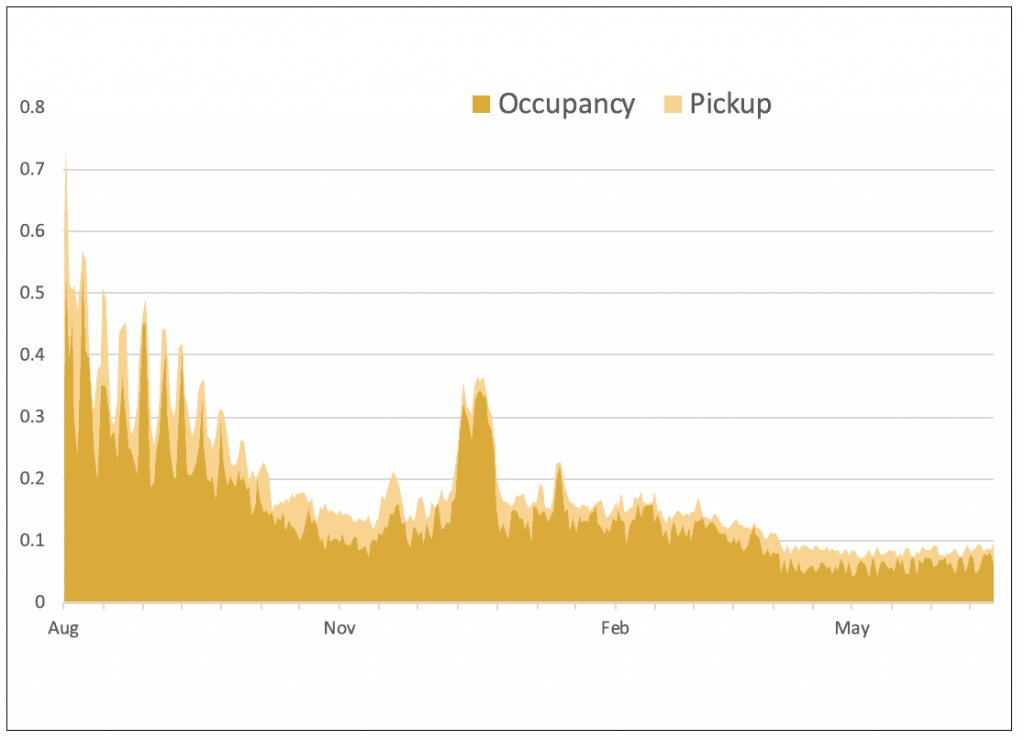

> Future-looking occupancy and pickup rates

These reports can show how the demand for future dates is shaping up and if there’s a date-level pricing adjustment that can help. The chart below shows the current occupancy outlook and which of those bookings were made in the past week. This will identify peak demand periods, which will be high overall, or periods that are not yet highly occupied but may become so (where the bookings in the last week are particularly strong).

There isn’t enough space here to cover everything seasoned revenue managers look at, but if you aren’t using these reports yet, these, along with some unit-level reports, might be considered. Though we’ve included the reports in this segment about pricing, it is important to note that other levers (minimum stay, LOS pricing, etc.) influence these in an equally meaningful way.

Practicing Revenue Management

Now that you know the frameworks that can be used to pull the various levers you have available and understand the metrics you should be monitoring, it is important to identify where you are currently placed and see what constraints are stopping you from experimenting and finding out if there’s something better you can do. Revenue management is a continuous improvement process. Even airlines, which are considered pioneers of the field and started five decades ago, are still innovating on this front. With that in mind, even if just for a few of your properties, experiment!