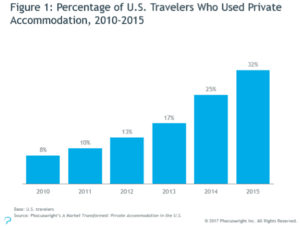

Travelers have been staying in vacation homes for centuries, but it wasn’t until the emergence and disruption of VRBO.com and Airbnb that the industry became a mainstream lodging alternative.  According to Phocuswright, 32 percent of U.S. travelers reported staying in a private home in 2015, up from 8 percent in 2010. This triple-digit growth has attracted attention from the entire travel sector, as evidenced at the Skift Global Forum last week in New York, during which every hotelier and OTA CEO addressed the subject of vacation rentals.

According to Phocuswright, 32 percent of U.S. travelers reported staying in a private home in 2015, up from 8 percent in 2010. This triple-digit growth has attracted attention from the entire travel sector, as evidenced at the Skift Global Forum last week in New York, during which every hotelier and OTA CEO addressed the subject of vacation rentals.

Vacation rental managers and homeowners have been battling—and, arguably, profiting from—disruption for the last eighteen years.

When VRBO.com was founded in 1999, homeowners in traditional vacation destinations (beach, mountain, lake, and theme park-oriented locations) found a marketing channel to reach a mass audience of travelers and no longer relied on professional property managers for bookings. In 2008, Airbnb was created, and by 2011, the company had become a global powerhouse initiating a cultural shift in travel and a marketplace for shared lodging options and privately-owned urban accommodations.

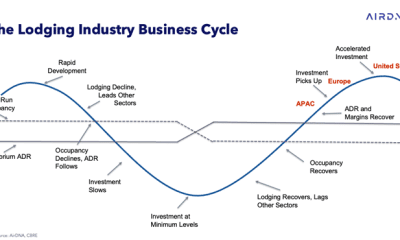

Since then, the vacation rental industry has experienced fast growth and consolidation with Expedia, Priceline, Airbnb, and TripAdvisor taking early leads by acquiring vacation rental channels and competing for market share in this rapidly-evolving travel sector. In addition, metasearch platforms and multi-destination vacation rental management companies are emerging and expanding, backed by millions of dollars in venture capital funding, with hopes of creating big-brand names for privately-owned accommodations.

Even with consolidation, the vacation rental industry is ripe for disruption.

Consumers still find it incredibly difficult to search for and book vacation rentals. Moreover, homeowners and managers experience friction using the latest marketing channels, property managers are challenged with scaling operations across destinations, and the industry has yet to adopt standards that rival the hotel and cruise industries.

Consequently, hoteliers, OTAs, and investors are chasing the next source of disruption in the fast-growing industry.

Where are the gaps and friction? In all phases of the transaction between the homeowner and the traveler, friction, gaps, imbalanced distribution of profits, and struggles with managing customer expectations still exist in the sector. Challenges and potential areas of disruption include:

- Marketing Dependence

- Booking Path Optimization

- Brand Recognition

- Scalability of Property Management Services

- Standardization to Meet Customer Expectations

Marketing Dependence

Vacation rentals are largely privately owned and managed by local companies which possess little brand recognition. As a result, these owners and managers have been increasingly forced to rely on online marketplaces as a primary source of bookings, and the expense of using these channels in rising.

However, while vacation rental managers and homeowners are dependent on OTAs, OTAs are dependent on Google.

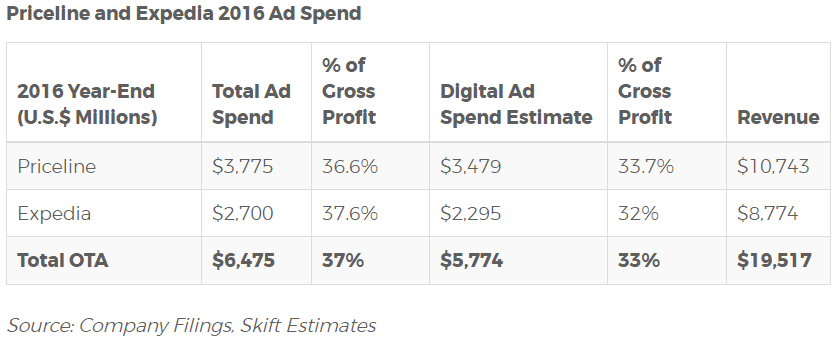

According to Skift, “Combined, Priceline and Expedia likely spent $5.8 billion on digital advertising in 2016… Assuming that a few percentage points of spend is on Facebook and a few is on other channels, we can estimate that around 70 percent of Expedia and Priceline digital ad spend went to Google. This would amount to just over $4 billion in 2016; this includes both AdWords and the much smaller metasearch part of Google.”

This spending on digital advertising translated to 33 percent of gross profit for the two travel giants.

Google travel executive Oliver Heckmann told Bloomberg that he has the tricky job of keeping online travel agents happy while building increasingly competitive services for consumers. These advertisers need Google as much as the Alphabet Inc. unit needs them, but he’s always mending fences.

“If I look at the industry, everybody is sort of collaborating and competing with each other,” he said, while dismissing concern about a larger threat from Google. “I want to get a margarita every time I have to clarify that misunderstanding.”

The current level of marketing dependence in the industry points to potential disruption. Vacation rental suppliers are spending 20-25 percent of their profits on digital marketing channels (including OTAs), and OTAs are spending a third of their profits on digital marketing.

If a new player can find a way to insert itself between search engines and bookings for vacation rentals, there is a significant margin up for grabs.

Booking Path Optimization

The vacation rental industry has not yet identified the best booking path for individually-owned vacation homes.

OTAs are forcing a booking path that mirrors the hotel booking process. However, in contrast to hotels, vacation rentals are a “considered purchase” (Defined as a more complex buying decision with a high degree of financial and emotional risk which requires more investigation and comparison prior to a transaction than booking a hotel).

OTAs have implemented processes over the last year to eliminate contact between the traveler and the homeowner or manager. These actions have caused an uproar among vacation rental owners and managers as the new process fundamentally changes how vacation rentals are sold.

On one hand, as a “considered purchase,” the rental traveler has more questions when booking a multi-bedroom home for a multi-night vacation than they do when booking a standardized hotel room; and owners and managers have a need to talk to customers to set expectations and convey critical information about the property.

On the other hand, many homeowners and managers are slow to respond to requests for information causing anxiety and difficulty for travelers. Each owner or manager who does not respond immediately to an email, chat, or phone call pushes the entire vacation rental industry further into the hands of OTAs.

The difference in the booking path between vacation rentals and hotels presents a challenge that, to date, has not found a solution.

Brand Recognition

OTAs have created a booking path that mirrors hotels—with one notable exception. OTAs still prominently display the hotel brand, while they have removed the brand name for vacation rentals.

Airbnb, Expedia-owned HomeAway, Priceline, and TripAdvisor have proactively taken bold steps to insert themselves between travelers and the homeowner or manager by masking customer information, becoming the merchant of record, and eliminating any mention of the brand name or homeowner.

The idea of creating a big-brand global name for vacation rentals was first attempted by ResortQuest. Through many iterations, the idea proved to be unsuccessful at the time.

Alex Nigg noted in his article, Fighting 800 lb Gorillas, in the fall issue of VRM Intel Magazine, “Simon Lehmann, formerly of Phocuswright, at VRMA (Europe) in Amsterdam, said building a brand is an exercise in futility for a VRM. If he is correct, day-to-day operational management of properties will become the key competitive advantage of property managers.”

The fact that no company has been able to build a sustainable, recognizable brand in vacation rentals does not mean it is impossible.

Scalability In Property Management

Several multi-destination property management companies are raising funds and attempting to consolidate supply into managed brands. These companies have the objective of decreasing the cost of management by implementing technology solutions and scaling processes. However, the vacation rental industry is difficult to scale. As evidenced by reviews, these companies are challenged with maintaining a high level of quality and cleanliness while scaling operations for several identifiable reasons.

First, these new companies are more willing to add inventory to their portfolios that other local companies have declined to service. Business development employees are incentivized by adding homes, not adding quality homes. As a result, the base level of quality is difficult to manage. Second, the multi-destination management companies are focused on technology and—at least in the short-term—are struggling to accomplish automation without sacrificing quality and service. In time, automated solutions will improve and adapt; but the process has been slow, and learning curve is steep. For example, a number of multi-destination companies sought to replace housekeeping inspectors with mobile photos taken by contracted housekeepers. Most soon discovered that mobile photos cannot replace an inspector in gauging cleanliness.

Scaling services for successful vacation rental management has not been perfected, and opportunities for disruption continue to exist in developing multi-destination processes that decrease expenses, maintain quality, and encourage guest loyalty.

Standardization to Meet Customer Expectations

The vacation rental industry has struggled to adopt meaningful standards for accommodations. In some vacation rental destinations in the US, homeowners still require guests to bring their own sheets. In many others—including some of the largest property management companies—linens are being washed in the home between stays by housekeepers without any attention to laundry safety standards. In kitchens, many homeowners leave food in cabinets and refrigerators and cleaning supplies in easy reach of children. The industry also does not having any exit postings or safety instructions, which make it vulnerable to regulations and attacks by hotel advocates and lobbyists. This lack of standardization offers an opportunity for industry disruption that has the potential to make or break the sector.

Who Will Disrupt the Industry?

In spite of the many challenges facing the industry, vacation rentals as a mainstream lodging alternative are here to stay. Where there is friction in the booking process, challenges with scaling operations, a lack of a strong brand, needless marketing spending, and a need for standardization, many opportunities exist to disrupt the sector. The one thing we can say with certainty, the evolving story of vacation rentals continues, and there is ample room for new players and solutions we have yet to discover.

I have a small beach-front condo on the Alabama Gulf Coast. I bought it 10 years ago. I’m a Hands-On kind of owner and I immediately discovered that going with a local property management company was not going to work for me. I was not willing to sacrifice 30% of my profits to some company who would do the things that I could easily do myself from afar. I joined VRBO right from the start and I was very pleased with how everything worked with that site. I paid my annual fee for advertising on their site and I was then able to manage all of my rentals on my own and have a very personal touch with my renters. I kept my VRBO calendar updated and scheduled my maid accordingly. It was easy for me to keep up with any maintenance issues, simply by using various local repair people. The kind of people who rent a small condo on the southern Gulf coast very much appreciate being able to communicate with the owner. They have all kinds of querky little questions that I was more than happy to answer, because I knew they would more than likely become repeat renters. And they did! All of this worked out beautifully for me until about a year-and-a-half ago, VRBO decided to go rogue and impose all of their new regulations and fees. When they refused to renew my annual listing unless I signed on for the ruthless, greedy corporate takeover, I quickly deleted my account. Screw them! Many of the vacationers I spoke to were extremely upset about VRBO doing this and they were more than happy to keep my contact information and contact me personally to make their future bookings. This level of vacationer cannot afford all of the extra stupid fees. It’s all they can do to afford the rental fee, the tax, the maid fee, the parking pass, etc. Then to have to add a stupid booking fee to VRBO on top of that?! No way! VRBO wanted to charge anywhere from 10-12% on top of the entire fee to these poor people who just want to book a small vacation at the beach. VRBO- you guys shot yourselves in the foot. I’m happy to report that my condo has stayed booked up with my repeat renters … who like to think they have a family friend here, which they do. I would be happy to renew with VRBO if they would just allow me to reinstate my listing the way it was before. In most of these cases, it is VERY important for the renter to have a personal connection with the owner. And as an owner, I’ll be damned if I’m going to let corporate mega-monsters make my business decisions for me. And, it’s hugely frustrating to both owners and renters … God forbid they should need to ask a question or get assistance from a live person … the best they can get is a foreigner halfway across the world who barely speaks understandable English – and who really doesn’t give a rat’s a#@ about the caller. The way I see it – VRBO and your ilk … you’re the biggest loser.

Welcome to the future! Customer service/approach needs to excellent to win the travelling or vacation rental game.

Excellent points in this article. I would add that finding the correct insurance for your short term rental is imperative. Traditional homeowners insurance does not cover vacation rental business activities. Fortunately there are some great companies out there custom penning insurance for this situation. I know Proper Insurance completely replaces your current coverage and is backed by Lloyd’s of London. Read some reviews at https://www.proper.insure/

Try WalkonVacations.com , I am using it…Found it really good for owners.

Regional approach. Long-tail keywords. Book direct. Here’s to the future!

Great article Amy.

Last week I presented a session on The Future Of Vacation Rental Marketing at the VRWS. In short, I see the future of VR marketing being less and less about the property.

The future will be story based and the OTA’s can’t allow stories because stories lead to leakage.

This will be the disrupting factor.

Many talk of marketing dependence and independence but we have a new concept – Marketing Interdependence – Where we connect individual owner websites together to form a branded network that will harness the power of the storytelling crowd.

Pull up a coffee and watch a video version of the presentation here https://vimeo.com/234482163

In the video, I look at the past, present and future of VR marketing and if you watch it all, I guarantee it will change the way you think about the future of VR marketing.

Nice article! You speak about vacation rentals which are 2nd homes but dont mention 1st homes. Chip Conley at his keynotes last year in LA at PhocusWright and the AirBnB Open mentioned Digital Nomads as a significant growth sector of AirBnB users but although seemed to allude to renters on AirBnB but they are also renting their homes when they are traveling to offset their travel expenses and in some cases its cheaper to travel than stay at home depending where they live. We see empty nesters turning their homes into bed and breakfasts, people that need cash and trying to help pay the rent/mortgage and staying with family or friends when they get a booking, etc. For the new entrants those type properties may not be profitable, we at http://www.sharingXchange.com are looking to fill a niche and make a profit from those types of properties and they dont share the same issue with providing checkin, cleaning, and maintenance as vacation rentals.

Great article Amy.

Last week I presented a session on The Future Of Vacation Rental Marketing at the VRWS. In short, I see the future of VR marketing being less and less about the property.

The future will be story based and the OTA’s can’t allow stories because stories lead to leakage.

This will be the disrupting factor.

Many talk of marketing dependence and independence but we have a new concept – Marketing Interdependence – Where we connect individual owner websites together to form a branded network that will harness the power of the storytelling crowd.

Pull up a coffee and watch a video version of the presentation here https://vimeo.com/234482163

In the video I look at the past, present and future of VR marketing and if you watch it all, I guarantee it will change the way you think about the future of VR marketing.

Amy, this article demonstrates your in-depth knowledge of the industry all the way down to the cleaning inspection! Well written and you didn’t even mention Vacasa or VacationRentalsPros. We here at TeemingVR.com see these industry challenges as well. I believe it is possible to create a brand name in a definitive geographic location but to do so on a nationwide scale would take millions of dollars and resources the likes of Google. Hmmm.

TeemingVR.com #7 Inc5000 in Travel & Hospitality

Great article Amy.

Last week I presented a session on The Future Of Vacation Rental Marketing at the VRWS. In short, I see the future of VR marketing being less and less about the property.

The future will be story based and the OTA’s can’t allow stories because stories lead to leakage.

This will be the disrupting factor.

Many talk of marketing dependence and independence but we have a new concept – Marketing Interdependence – Where we connect individual owner websites together to form a branded network that will harness the power of the storytelling crowd.

Pull up a coffee and watch a video version of the presentation here https://vimeo.com/234482163

In the video I look at the past, present and future of VR marketing and if you watch it all, I guarantee it will change the way you think about the future of VR marketing.

The other extremely important client is the homeowner. NPS scores typically refer to the guest experience, but something similar to measure owner satisfaction is very important to us internally, although rarely does the industry have any standards for this externally.

If you are not one of the big distribution gorillas, then homeowner NPS becomes even more important. Interesting to read JB’s numbers below which are very similar to ours here in Europe. In my experience HO NPS used to be half of guest NPS on large marketplaces but could also quickly deteriorate to 0 when the inquiry/ booking to price relation went out of balance. In the Full Service segment there’s a great opportunity to own a much bigger portion of the homeowner experience and hence I’m convinced that great HO NPS in that part of the industry need to come much closer to the guest NPS numbers discussed here.

Interesting. But don’t under estimate history!

The decline of the BnB lodging phenom was due to inconsistent local and autocratic management, overpriced product, fluffy amenity wars alienating men. No OTA or reservation system could overcome these impediments. The last real estate cycle finished them off and thankfully many of these creaky old houses reverted back to residential rentals or homes for nostalgic buyers.

Now this new real estate cycle darling is vacation rentals attracting a new generation of investors with wads of cash looking for others to pay for their overpriced beach shanties and rumpled 70’s/80’s deferred mountain hidden-aways…….

The investors’ mistakes start at the mortgage leverage buy of such properties and there are hordes of these investors creating a glut of vacation rentals and making investors anxious and vulnerable to internet marketing tinkers and useless brick and mortar Visitor Bureaus….and….. developing their own rarely to be seen web sites, adding those marginal amenities, burying renters with rules or being unresponsive to real life renter needs…..maintenance, hygiene, human interactions.

P.S. This investor group rarely trusts nor likes costs of professional management…..though a local presence is essential…..

Will end well?

Great article as usual Amy! I’d be curious to see how folks think a PM’s service level should actually be judged. At TurnKey, one of the technology-focused multi-destination companies, we feel that we have been able to deliver even higher levels of service. We’ve done that by using technology combined with TurnKey folks on the ground in every destination, and we believe technology exists to help our people do their job better, but not to replace them. But ultimately the measure of success depends on how you define a level of service measurement.

We have five main ways we gauge our service delivery. The most well-known and common is our consumer post-stay NPS score. Even in July and August, our busiest times, that score was 48, matching Westin, which is listed as the highest NPS-rated hotel chain. Our goal is to get this over 60, hoping to match the level companies like Southwest Airlines has, clearly we are not there yet. The other four metrics are all some type of guest survey based on various facets of the business, and in all cases, over 90% of those surveyed are in what we would call a “successful” category of either 4-5 stars, or similar.

We are certainly not patting ourselves on the back too much and always trying to come up with better processes and higher levels of service, but we like how things have gone so far. Our sense is those are the types of metrics we should use to judge the service level, although I’m always curious to hear what others think about how we gauge ourselves as a business and industry.

I also think it is important to separate the multi-destination companies as there are very distinct differences. For starters, TurnKey is trying to deliver management to owners at as low a cost as possible. Our rates are roughly half of what companies like Vacasa charge. That is a big difference – we firmly believe owners must see value from their manager. With take rates reported over 50% at the Skift conference, it is hard to understand how Vacasa is doing anything to decreases costs – certainly they are not for owners.

In addition – I think there is a real question over fact vs. fiction on technology. It is difficult to understand how PMs are actually utilizing technology to benefit owners and guests. We have deployed a tangible suite of products we can show every owner or guest. They are designed to make stays safe and consistent, while giving owners a much better idea of how their home is being taken care of. We are using technology every step of the way, from 3D home tours and floorplans, to advanced guest screening systems, to truly secure digital locks (not keys and lock boxes), in-home tablets that enable all sorts of services, the industry’s first noise monitoring, SMS relays, and now even advanced video monitoring.

The end result is what we feel to be disruptive – guest NPS scores rivaling Westin, CSAT success over 90%, costs to owners among the lowest in the business about half of our national competitor, all aided by fully deployed technology that keeps it tied together.

Troll.

Amy, one small nit. Ground Zero for the vacation rental industry was not VRBO. Instead, it was CyberRentals in Ludlow, Vermont. When we were putting HomeAway together, I met with all the “founders” of the industry, each of them were advertisers on the other. But it was his ad on CyberRentals that inspired the founder of VRBO (Dave Clouse) to start his own for rent by owner website. Keep doing what you’re doing!

Not much to ad from my side! Great article.