As I listened to Simon Lehmann at the European VRMA Conference explain why he always brings a set of sharp knives when staying at a vacation rental, I turned to Jessica Gillingham of Abode PR and asked:

“Are we really still talking about poorly equipped kitchens?”

She nodded.

I was reminded of an earlier session at the same conference when a panelist said, “The number one requirement for everyone should be great content, which means photos and descriptions,” to which Simon Lehmann responded:

“Are we really still talking about photos and descriptions?”

Sadly, it seems that in-property amenities and poor content are still very real issues. (I’d also add that writing property descriptions is still the most frequently requested service we see at Guest Hook.)

Consider this finding from Google:

“Only 9 percent of travelers have a brand in mind before they start researching.” (Source: Google’s Javier Delgado Muerza at the European VRMA)

Here’s my point: sharpen your knives, communicate your value proposition clearly and quickly, and deliver on excellent service throughout the guest stay cycle. Grab the 91 percent of guests who are clearly open-minded and looking for a brand that resonates with them. And then retain them.

It’s time to double-down on the guest experience.

Pre-booking Experience

“Never has there been a time in our industry when your content needs to count more.” – Wes Melton, smokymountains.com

“Never has there been a time in our industry when your content needs to count more.” – Wes Melton, smokymountains.com

Consider the 91 percent of guests looking to be inspired by a vacation rental brand. If they find you on HomeAway, will they be served a headline that screams or seduces? Will they see photos that depress or energize? Have you clearly explained your value proposition?

And what about your website? PhocusWright predicts that 72 percent of online bookings will be from the OTAs by 2020. Does that mean you should abandon your website? Absolutely not.

Instead, be ultra-picky about where you invest your time and money. Focus on content that counts. Ask yourself the same question before updating anything on your website: will this photo/video/text/graphic reflect my brand as well as be helpful and/or inspiring for my guests?

We know many businesses, just like our friends at Beside the Sea Holidays, who consistently achieve more than 50 percent of bookings directly on their websites. It’s no coincidence that they have identified what they stand for, have embedded that into everything they do, and have committed to brand-relevant content that helps or inspires.

Define Your Brand and Stay Consistent

“Vacation rentals are just places to sleep.”

I’ve heard that said more than once recently. Take that stance at your peril. Booking a vacation isn’t the same as buying paper towels or ordering a quick lunch—it’s intensely personal.

In an industry that’s expected to grow to $170 billion by 2019 with millennials unleashing part of their estimated $1.4 trillion travel spend, you can no longer afford to blend into the crowd if you want to thrive.

Capture that 91 percent by standing for something. Define your true identity. What are your genuinely unique selling points? How do you communicate those through your content? What brand voice do you use in your property descriptions and website content? When there are dozens, hundreds, or even thousands of rentals in your destination, it’s not enough to be a comfortable, cared-for accommodation. Decide what sets you apart, and then embed it in all your marketing.

That includes both the OTAs and your website. A guest who finds you on VRBO should discover the same brand on your website. VRBO is simply an entry point to your brand. So when you write your property description for the listing sites, use the same brand voice—and explain the same selling points—as you do on your website.

And don’t forget the valuable opportunity that still exists to promote your business in the “Property Manager” section of your HomeAway listings. Who knows how long that brand potential will remain?

Steve Milo of VTrips makes the undeniable business case of using OTAs to your advantage:

“In 2014, only $500,000 of our revenue was generated by instant booking on OTAs. In 2018, over $36 million of our revenue will be generated by OTA Instant Booking. We spend a lot of money working directly with OTAs to bring in new guests.”

And my pet-peeve: enticing people and then failing to deliver. Take the website newsletter process. There is nothing more value-destroying than gaining an opt-in—someone who has signaled strong interest in your offer—who you then serve dreadful information to or ignore.

The same holds true for social channels that are often seen as box-ticking activities. If you offer potential guests the opportunity to interact with you and consume your content, then make the entire process a joy—inspire your guests with content that is true to your brand.

Post-booking Communications

“Leading the guest through a mapped-out process from booking to arrival ensures a win-win for both the guest and owner. The guest feels cared for, and the owner/manager frees up mental energy knowing that there is a process in play.” – Elaine Watt, holidayletsuccess.com

Booking secured. Now comes another complex task: figuring out what, how, and when to communicate with your guest.

As a guest, here’s where I consistently see things unravel. Not because the owner/manager lacks professionalism or doesn’t care, but because it’s a bloody complex process.

What’s the first communication you have with your guest post-booking? Is it an automated email from your PMS? Is it an Airbnb message? An SMS? Perhaps it’s even a phone call. Regardless of the mode of communication you use, it’s what you communicate that counts. That first impression the guest has needs to be consistent with their pre-booking experience.

Video can be a perfect complement to your written communication. It’s not simply about engaging guests who don’t read; it’s also a moment to share your brand in a typically faceless, email-driven, pre-stay experience. Try a 90-second video overview that welcomes your guests and explains what you’ll be sending them and when. No need to personalize each one—a canned video that pairs with your first written communication will do.

And in your first email, don’t merely stick to the formula of pushing information. Try a little pull as well. For example, pose a question in the first sentence: “What brings you to X?” or “What are you most looking forward to during your stay at Y?” Of course, not all guests will reply, but for those who do, you will have built a foundation to provide a great guest experience.

Finally, write that process down and make it available for any new person who joins your organization. Documenting is tedious, but it’s the basis of every excellent and consistently repeatable process. Think of the opportunity cost of your own time or a member of your team’s time that would be required to train someone new.

Pre-arrival Communications

“The ongoing provision of information/advice/insider knowledge to bring the guest as close to us and, importantly, to raise their level of anticipated gratification, is key (i.e., ‘This is going to be a brilliant holiday!’)” – Bob Garner, casaldeifichi.com

Don’t burden yourself or your guest with six attachments, twelve paragraphs of email text, and complex pre-arrival forms. Your only goal in this regard should be to ensure your guest has received—and knows how to access—the important pre-arrival information: address, access instructions, check-in time, contact details, and similar items.

Don’t forget your brand at this stage—the way you send the information, the format of that information, the tone of voice you use. Those are all absolutely necessary factors in maintaining brand consistency and keeping that guest experience on brand.

If tech is a part of your brand, then a guest welcome app is probably the right choice. We have thousands of properties using Touch Stay to manage that process, but there are many alternatives including Hostfully and YourWelcome. Alternatively, you may have a high-open-rate email series in your PMS that delivers the important information in a pre-branded way.

During Stay

Not every guest wants communication with you during their stay. And not every business has the resources, or even the desire, to open a dialogue with its guests. Nonetheless, there needs to be a way for communication to take place. What’s worse than a negative review that could have been avoided by a simple conversation during that guest’s stay?

There’s a lovely anecdote that a client recently relayed to me that illustrates that point perfectly. A guest had sent a text message to Richard of Beside the Sea Holidays at 11 p.m. on the day of check-in:

“I can’t make the sofa bed work; can you please come and help?”

Richard’s wife went around, was invited in, and went upstairs to set up the sofa bed. All was well—until Richard received another text at midnight:

“When are you coming round to fix the sofa bed?”

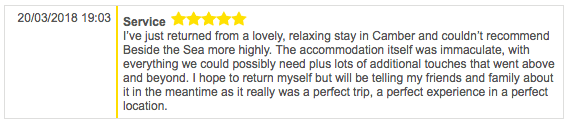

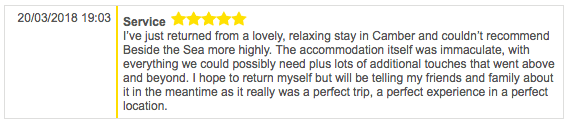

Two sets of guests had a nearly identical phone number, and the wrong house had been attended. What makes that anecdote so wonderful is what happened the next day. Not only was the guest with the real sofa bed issue delighted at having had things fixed within an hour so late at night, but the wrong sofa bed guest left a five-star review as follows:

How did that happen? Richard and Sophie visited them the next morning, apologized, explained the situation, and left a bottle of prosecco. But that wasn’t the reason for the five stars. Beside the Sea’s brand, aside from offering properties “beside the sea,” is rooted in personal service at every stage of the guest journey. The guest subliminally understood that the prosecco and apology were genuine rather than hastily concocted ideas. Just look at the review title: “Service.”

Richard explained to me that they don’t directly engage guests during stays. Instead, they give guests their own space but make it clear how they can be contacted—text message, email, phone, or even a knock at the door. And because the guest understands this is a personal business, they treat the offer of communicating as genuine (welcomed, in fact) rather than throwaway.

Beside the Sea manages forty-four properties. Like most PMs of such size, balancing personal connection with efficiency is a challenging task, yet they prove that being personal doesn’t have to mean physically talking to each guest at each stage of their journey. It’s about fostering the relationship through their website, their auto-emails, their sense of family, and their passion.

Post-stay

How do you maintain a relationship with the guest after they’ve left so that they book with you again or recommend you?

The first step is to ensure you have collected your guest’s email address and have the required approval to add them to your newsletter list. Don’t destroy the brand equity you’ve accumulated by letting them disappear or run afoul of anti-spam regulations. A list of emails is great, but if you’re able to tag each email with some simple additional information about the guest, it’s worth multiplies.

Jeanette Lawson of Kiawah Island Getaways illustrates that perfectly. Prior to confirming a reservation, Jeanette’s guests are required to fill out a simple online form. Names of guests staying, reason for visit, options to purchase add-ons like bike rentals, and so on. That simple form has an obvious advantage in the guests’ minds, and it ensures that Jeanette gathers some powerful data to help her create valuable content for her email list.

Perhaps a guest is celebrating a birthday or enjoying a honeymoon. Perhaps they are taking part in a local marathon or annual convention. This information allows you to communicate with guests prior to the anniversary date, tailoring emails to specific groups of guests. With the right email platform and templated messages, none of this has to be time consuming.

As Bob Garner explains, “Through social media, blogs, and email/newsletters, we ensure guests are kept aware of our ongoing interest in their lives and how we would like to once again have a chance to help them have another brilliant stay.”

It is worth noting that Bob has a repeat rate of 55 percent and a referral rate of 20 percent. In his words, “We certainly have our ‘skin in the game’ in doubling-down on the guest experience, which makes the work of finding those remaining 25 percent of new guests each year less arduous.”

Don’t Cherry-Pick

Doubling-down on the guest experience isn’t about mastering the one week they are physically with you. It’s about their entire journey. Steve Milo puts it like this:

“Our goal is to pay only one time for the acquisition of the guest. After that, our goal is to communicate to them the value of booking directly with VTrips for the best information, the best selection, the best reservation staff, and the best pricing.”

That clear business goal—pay only one time for the acquisition of the guest—depends entirely on excelling at every stage of the guest journey. Reflect your brand with every guest interaction in a genuine and natural way. The prize is repeat and referral guests.

Help shift your guests away from the 9 percent crowd who don’t have a brand in mind the next time they are considering a stay in your area. And let’s not talk about blunt knives, dull photos, and flat copy ever again.

I often come across situations in which sales representatives don’t feel like they personally can afford such a stay, so they are not comfortable quoting higher prices. I find that lack of value building and overall confidence in the homes they are selling come out in the sales representatives’ tones when quoting pricing. The reservation sales agent often will also be quick to discount or will not ask for the reservation and quote only the lowest pricing available. In these situations, I recommend coaching the sales representative to give three pricing options. Start with a home that is an extra treat for the caller—maybe the home has a game room, mountain view, or hot tub—followed by quoting the price, being careful not to pause, and asking the caller how the home feels for his or her family. Callers will then share if the price is more than they are looking for or not. The next step is to go to the second pricing level based on the caller’s response, and then follow the same steps until getting to an agreed-upon fit for the caller.

I often come across situations in which sales representatives don’t feel like they personally can afford such a stay, so they are not comfortable quoting higher prices. I find that lack of value building and overall confidence in the homes they are selling come out in the sales representatives’ tones when quoting pricing. The reservation sales agent often will also be quick to discount or will not ask for the reservation and quote only the lowest pricing available. In these situations, I recommend coaching the sales representative to give three pricing options. Start with a home that is an extra treat for the caller—maybe the home has a game room, mountain view, or hot tub—followed by quoting the price, being careful not to pause, and asking the caller how the home feels for his or her family. Callers will then share if the price is more than they are looking for or not. The next step is to go to the second pricing level based on the caller’s response, and then follow the same steps until getting to an agreed-upon fit for the caller.

every department!

every department!

demonstrating their dedication to the security of their vacation rental companies,” says Amber Mayer,

demonstrating their dedication to the security of their vacation rental companies,” says Amber Mayer,

another brand must lose. There are

another brand must lose. There are

In my training programs, I always advocate for a phone call in these situations. Participants resist at first, and the most common response is, “If they wanted to talk on the phone, they would have called us! These are ‘chat’ people, Doug!” Managers seem to be biased towards using pre-written templates to respond quickly by simply answering the question rather than personalizing the messaging to push for a sale. Yet, once they give my ideas a try, they find that some guests are very open to talking. It’s just that, for whatever reason, they started out on chat. Hey, it’s worth a try, right? Isn’t it better to engage an undecided guest via phone so we can share our enthusiasm and show empathy for their travel plans or circumstances? Can’t we read the guest better when we can hear their reactions, vocalizations, and inflections?

In my training programs, I always advocate for a phone call in these situations. Participants resist at first, and the most common response is, “If they wanted to talk on the phone, they would have called us! These are ‘chat’ people, Doug!” Managers seem to be biased towards using pre-written templates to respond quickly by simply answering the question rather than personalizing the messaging to push for a sale. Yet, once they give my ideas a try, they find that some guests are very open to talking. It’s just that, for whatever reason, they started out on chat. Hey, it’s worth a try, right? Isn’t it better to engage an undecided guest via phone so we can share our enthusiasm and show empathy for their travel plans or circumstances? Can’t we read the guest better when we can hear their reactions, vocalizations, and inflections?

Alex and his partner Tammi are frequent speakers and panel moderators at VR conferences in North America and Europe; their sessions have been attended by thousands of property managers and owners.

Alex and his partner Tammi are frequent speakers and panel moderators at VR conferences in North America and Europe; their sessions have been attended by thousands of property managers and owners.

You want more bookings and revenue. Property photos have become your ticket to get there, and HGTV has changed everything. For those reasons, décor matters. And not just whatever décor your owners fancy. A certain “look” is booking better than others. Guests have come to expect that their vacation home will be as nice—or nicer—than their homes. They come from larger cities where every restaurant worth visiting is hip, cool, and very 2018, not 1998. And they choose where they will stay from thousands of vacation rentals based entirely on the photos. If your 1999 pastel fish house is listed next to the cool West Elm one, you know who is going to get the booking. Or, you’ll have to lower rates significantly to get the booking but will still have the same costs to clean, host guests, and maintain the home.

You want more bookings and revenue. Property photos have become your ticket to get there, and HGTV has changed everything. For those reasons, décor matters. And not just whatever décor your owners fancy. A certain “look” is booking better than others. Guests have come to expect that their vacation home will be as nice—or nicer—than their homes. They come from larger cities where every restaurant worth visiting is hip, cool, and very 2018, not 1998. And they choose where they will stay from thousands of vacation rentals based entirely on the photos. If your 1999 pastel fish house is listed next to the cool West Elm one, you know who is going to get the booking. Or, you’ll have to lower rates significantly to get the booking but will still have the same costs to clean, host guests, and maintain the home.

Here’s an idea: At both of our locations, Winter Park and Steamboat, we purchased $2K worth of art (the wrapped canvas kind, no frames) and decorated our Winter Park and Steamboat offices with it. All for sale to owners. Average price is $125. We have already sold a lot of it and had to make another bulk purchase.

Here’s an idea: At both of our locations, Winter Park and Steamboat, we purchased $2K worth of art (the wrapped canvas kind, no frames) and decorated our Winter Park and Steamboat offices with it. All for sale to owners. Average price is $125. We have already sold a lot of it and had to make another bulk purchase.

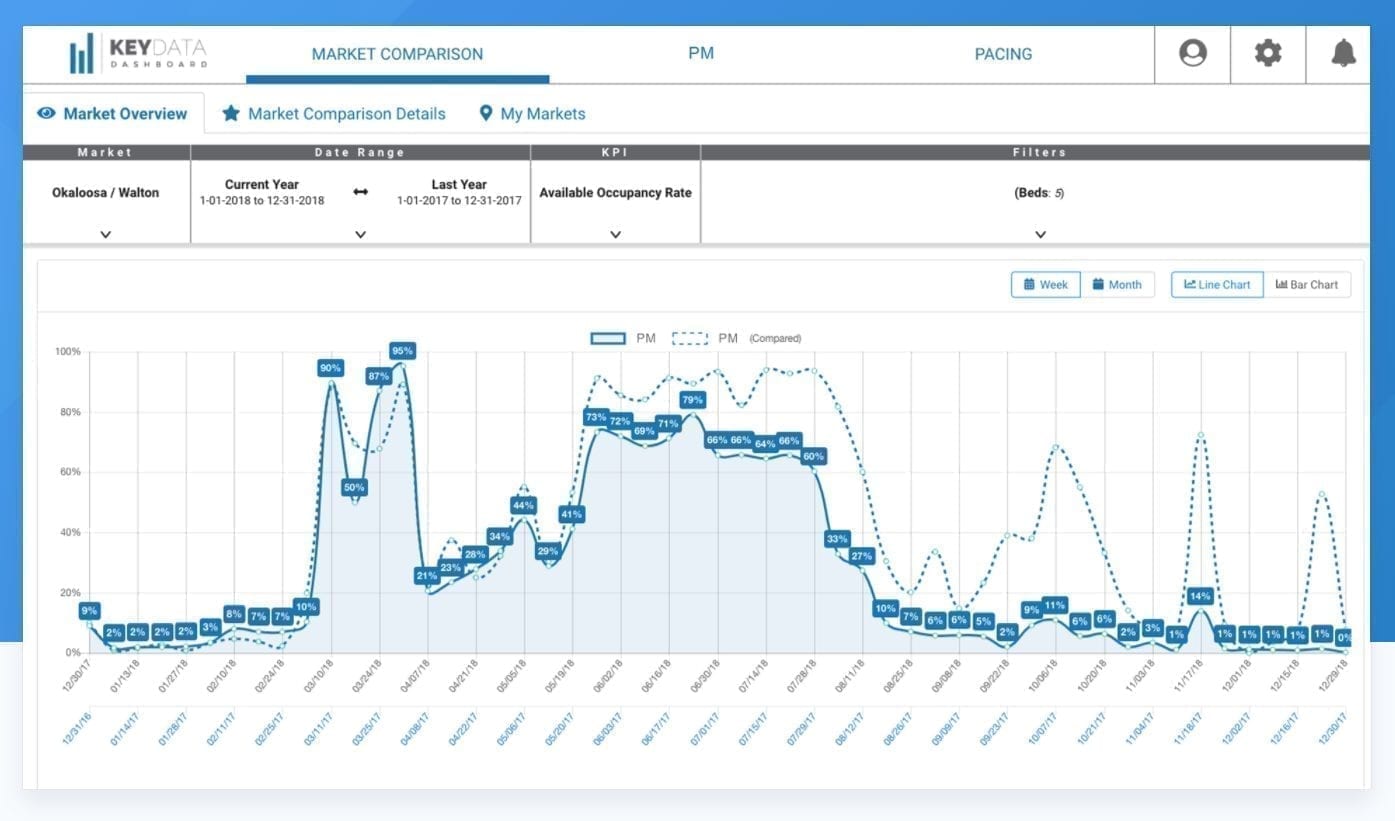

Although technology has always been prevalent in the vacation rental industry and companies have been able to vastly improve their businesses as a result, the options for operations lagged behind the adoption of technology, which focuses on marketing, distribution, and accounting solutions. The evolution of vacation rentals and increased guest expectations has required managers to come together to address the ever-changing needs of the industry and has resulted in the creation of purpose-built software and technology that improves efficiency. New policies and practices required adjusting expectations for both guests and owners while helping owners understand the need to update their rental properties to meet the demand of instant-satisfaction guests.

Although technology has always been prevalent in the vacation rental industry and companies have been able to vastly improve their businesses as a result, the options for operations lagged behind the adoption of technology, which focuses on marketing, distribution, and accounting solutions. The evolution of vacation rentals and increased guest expectations has required managers to come together to address the ever-changing needs of the industry and has resulted in the creation of purpose-built software and technology that improves efficiency. New policies and practices required adjusting expectations for both guests and owners while helping owners understand the need to update their rental properties to meet the demand of instant-satisfaction guests.

“Never has there been a time in our industry when your content needs to count more.” – Wes Melton,

“Never has there been a time in our industry when your content needs to count more.” – Wes Melton,

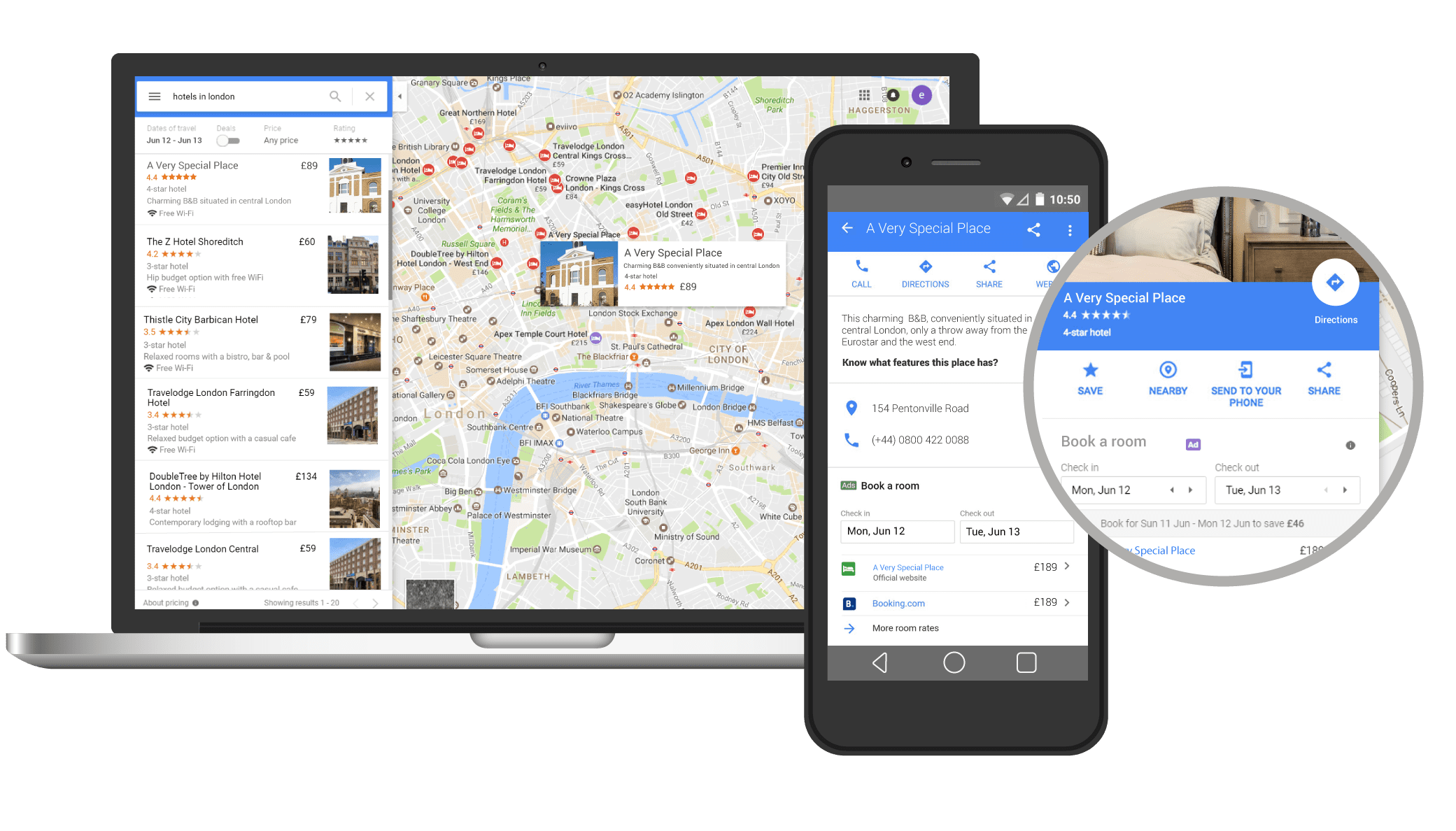

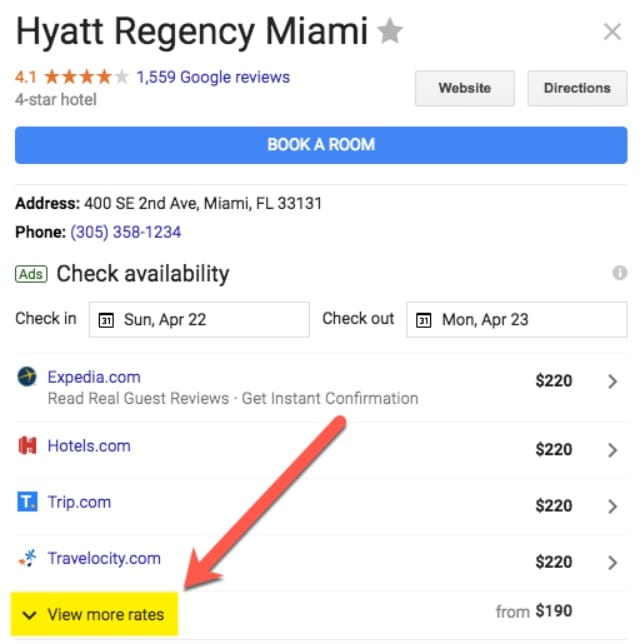

In the light of the significant changes taking place, the greatest challenge for property managers has been the lack of standardization in the industry for dealing with third-party booking sites, and that challenge creates issues for when property managers attempt to distribute their inventory. The difficulties predominantly lie in the rules and configurations required to list properties, which vary from channel to channel.

In the light of the significant changes taking place, the greatest challenge for property managers has been the lack of standardization in the industry for dealing with third-party booking sites, and that challenge creates issues for when property managers attempt to distribute their inventory. The difficulties predominantly lie in the rules and configurations required to list properties, which vary from channel to channel.

“We’ve basically put the T-A back in OTA,” said Alex Husner, chief marketing officer at Condo-World. “For a commission lower than that of the major OTAs, this new

“We’ve basically put the T-A back in OTA,” said Alex Husner, chief marketing officer at Condo-World. “For a commission lower than that of the major OTAs, this new