While the vacation rental industry faces challenges related to COVID-19, property managers and homeowners are having to work directly with third-party booking providers—including Vrbo and Airbnb—to meet their mutual customers’ needs.

Between these companies, responses to pandemic-related challenges could not have been more different. In short, with its inventory based in traditional vacation rental markets, Vrbo made the decision to place significant trust in its second-home owners and managers; in contrast, Airbnb demonstrated it did not trust its “host” community and stepped in and make decisions for them.

Although Airbnb’s actions have grabbed media headlines over the last two months, Vrbo remains the primary third-party channel utilized by US leisure-based vacation rental management companies. Consequently, we reached out to Vrbo’s Lisa Chen, vice president of global business for property managers, to ask the most pressing questions we’ve received about the company’s actions related to COVID-19.

Q&A with Vrbo’s Lisa Chen

How did Vrbo decide to handle COVID-19-related cancellations and concerns from travelers?

Our policy was driven by an effort to do what was right by everyone involved and by our trust that property managers would find the best solution—and so many did! It was important to us to try to balance partner and traveler needs to find the fairest way to handle a nearly impossible situation. By rewarding those who went above and beyond their cancellation policies to offer refunds or to provide a travel credit, we are encouraging property managers and owners to take care of travelers while giving them the agency to do what is needed.

A couple years ago, we created a team dedicated to property managers and their needs to continually learn and consider the nuances of how their business operates. By understanding things like legal obligations to homeowners; the need to pay contractors, vendors, and employees at various times; and accounting requirements, we made the decision to give managers the flexibility to do what is necessary based on their business processes, realizing there are likely many other things we’re unaware of or didn’t consider.

Most important, the relationships we’ve developed with so many property managers over the years gave us confidence that their kindness and hospitality would lead them to go above and beyond for travelers whenever possible. We’re incredibly thankful that the vast majority of owners and managers went outside of their policies to reach a resolution.

What has been the reaction from the homeowners and property managers (PMs)?

Goodness, it has been (and will continue to be) a journey. I’ve observed property managers handle the situation much as I and our teams would have: At first, it’s a shock to the system with maybe a little bit of denial. Then we take stock and move to action. And we probably shed some tears along the way—I know I have. The whole experience has been humbling.

Despite the hardship the pandemic has brought, it’s been heartwarming to see so many in the vacation rental industry come together and help. For example, we are inspired by Danielle Dirks, a Vrbo partner in Detroit who has opened her vacation homes to medical personnel working long shifts at the local hospital. In addition to giving these hardworking heroes a place to relax and recharge, she’s been able to keep her housekeeping and cleaning staff employed and help local businesses in her community. And there are so many other property managers and owners who are doing similar things.

We also have heard about acts of kindness from travelers—for example, when one Vrbo partner reached out to their guest to assure them that they’d receive a full refund without penalty, the traveler’s response moved them to tears:

“My husband and I could do nothing but cry in emotional gratitude. While we thought we were doing our best in the interest of our guests, our guests had a plan of their own to donate to our cause when we needed it most.”

I’m proud of how the vacation rental community has responded and honored to be part of it all.

How has Vrbo’s years of experience given the company a competitive advantage during this time?

We call property managers “partners” for a reason. Only by working together and understanding their needs can we continue to help families everywhere take the best vacations of their lives.

Despite social distancing, our team is still carrying on with feedback forums in virtual settings, like Rise and Shines and Customer Advisory Board meetings. From our front line agents, to myself and Jeff Hurst, president of Vrbo, everyone at Vrbo is prioritizing ongoing, open, and honest conversations.

Historically, we’ve used feedback from partners to build tools like MarketMaker and Win/Loss Cards that provide actionable insights on destination trends and competition. Meanwhile, we’ve configured our team to more rapidly provide tips and resources in different formats that help partners be more successful. We anticipate these product features and resources will prove even more valuable as we navigate the uncertainties of recovering from a pandemic.

Are there any new features you’ve added directly as a result of COVID-19?

Many of the features mentioned previously, which were already on our roadmap and have begun rolling out, should prove helpful as travelers and property managers navigate COVID-19. Importantly, we are seeing travelers have higher expectations for flexible cancellation policies. Vrbo is launching new ways for partners to merchandise their flexible policies and giving them tools to process cancellations and modifications more easily and efficiently.

Travelers are also concerned about cleaning procedures, and this is an area where we are focusing sharply on education. Many vacation rentals are already professionally cleaned, and we believe property managers have an opportunity to highlight this value to travelers.

What features and functionality has Vrbo added that may have gone under the radar with the current events?

One of our main areas of focus continues to be price consistency and the features it unlocks (and don’t forget that managers see an average of 10 percent improvement in conversion after upgrading). For property managers who integrate through software, we’ve introduced the ability to include fees in the total nightly rate that travelers see, so that a consistent price is shown from search to the property page to checkout. When travelers select dates and search for a property, they will see the total price for the stay in addition to the average nightly rate.

We’ve also introduced the ability for property managers to accept bookings with a length of stay longer than 32 days, up to 180 days, as well as more flexible cancellation policies and the ability for travelers to initiate a cancellation or change request, streamlining communication efforts and resolution.

While every new feature is not yet available through all our software partners, our team is working with everyone to accelerate availability.

Are there changes to your payments policy and/or relationship with Yapstone?

For partners who process payments through Vrbo’s platform, we recently completed the migration of all partners from Yapstone to our in-house payment platform. We built our payment platform on three principles: security, reliability and choice. These are foundational, no matter the situation, and will guide our actions and policies ongoing. Property managers can continue using software to process their payments as we continue to work with Yapstone.

As it did for many other operations, COVID-19 created unprecedented disruptions to payment flows, prompting Vrbo to temporarily delay refunds and payouts. These delays enable the teams to accurately process refunds by sending the correct dollar amount to the correct place and helps avoid scenarios where payouts are sent to partners only to turn around and have their account debited because a traveler quickly cancelled.

We continuously monitor and analyze booking and payments data, which informs how we evolve our processes and policies—not only to address the current situation, but also to adapt to future needs.

Are there actions Vrbo has taken to support PMs in this time?

Yes, the first action our team took was to reach out to property managers—to see how they were doing personally and to understand how their business has been impacted. I’ve noticed the pandemic is bringing everyone closer together, both professionally and personally. We are talking to even more property managers these days in a desire to connect, commiserate, share ideas, and just be there for one another.

These conversations have reinforced the rationale behind our COVID-19 policy and underscored the importance of continuing to give property managers the flexibility and agency needed to operate their businesses in this challenging environment.

In addition to casual conversations, we’ve simultaneously increased the formal ways in which we gather feedback and investments through more educational resources and content.

Specifically, we’ve continuously updated our COVID-19 resource page on Discovery Hub, created a resource center for Escapia customers, and launched educational webinars for topics like applying for economic relief. We’ll continue to add resources on topics like cleaning guidelines, with webinars and updates from leaders throughout Vrbo and Expedia Group.

The Expedia Group government relations team also helped vacation rental managers and owners share their stories through more than 25,000 emails, calls and tweets that were shared into Congressional offices, highlighting the challenges property managers face and emphasizing their need to access economic relief programs. Days later Congress passed the CARES Act providing relief for managers across the nation.

Property managers should continue to check Vrbo’s Discovery Hub for ongoing updates.

What features have been added to Escapia that will help PMs navigate this situation?

In response to previous natural disasters, Escapia has always prioritized tracking and reporting. To provide even more tools and data during the pandemic, we will soon be releasing custom cancellation policies. We have already introduced automated email communications with travelers, the ability to customize fees by channel, and expanded length-of-stay options that will help Escapia partners adapt more easily to traveler needs, keeping pace with a rapidly changing environment as travel begins to recover.

In an effort to save partners countless hours or even days when tracking how COVID-19 is impacting their business, the Escapia team quickly launched a comprehensive cancellation report that includes all important data, such as associated revenue and guest information. The cancellation report may also prove helpful as property managers apply for loan forgiveness and other government relief programs.

Escapia customers can also use the Performance Dashboard to stay up to date with real-time pacing for bookings compared to previous time periods. The dashboard also includes a new option to see the number of cancellations via the bookings tab. Some property managers have already used the custom cancellation reports and Performance Dashboard data to justify business losses and apply for the Paycheck Protection Program and SBA loans. We’re grateful for the partnership and feedback from Escapia customers, and we look forward to continuing to work with them as we make even more investments to build the best platform for property managers.

Looking at booking activity, what are you seeing in traveler behavior or intent? What are your predictions for travel this summer in drive-to leisure destinations? Do you think the industry will see more aggressive pricing this summer?

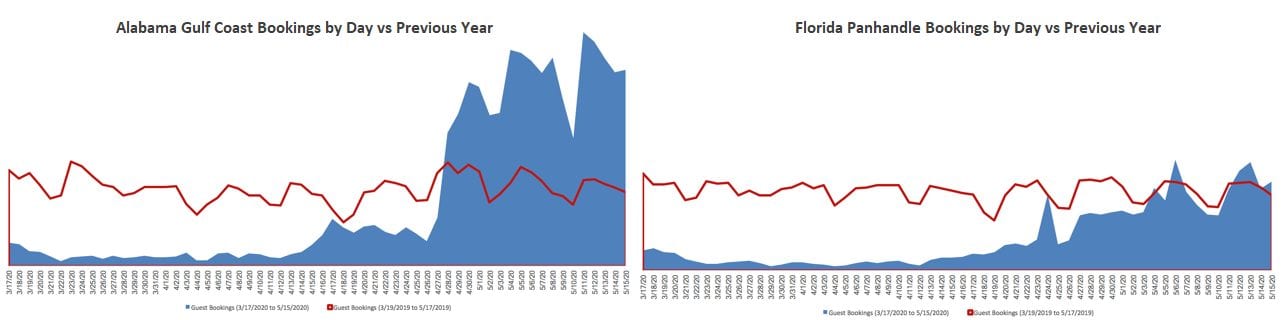

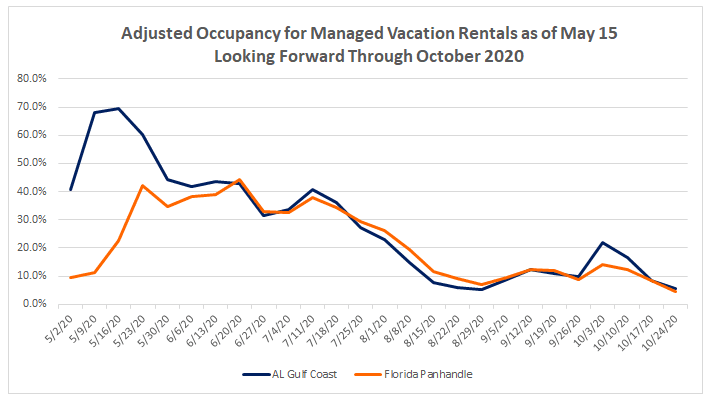

Beginning in mid-April we started seeing encouraging improvement in U.S. traveler demand, especially for longer trips during the end of summer. Google search data also support these trends, revealing that interest in vacation rentals and Vrbo are beginning to increase from their lows.

Meanwhile, almost three-fourths of travelers we surveyed indicated they are willing to stay in a vacation rental this year. As social distancing becomes the new norm (in the near term, at least), travelers may be more attracted to private vacation rentals with the space and amenities that allow them to take extra precautions.

The data also show that travelers who are dreaming about vacations are interested in traveling close to home, are curious about local recommendations for grocery pick-up and restaurant delivery options, and are seeking out listings with flexible and clearly stated cancellation policies. Specifically,

- Over three-fourths of travelers are more likely to book a rental with flexible cancellation policies

- Almost half of travelers consider a flexible cancellation policy extremely important

- Travelers are filtering out less flexible policies (i.e., using the “free cancellation” filter)

- Listings with relaxed cancellation policies see more bookings

- 31 percent of travelers expect to book closer to their travel date

None of us know exactly what the near future holds, as health experts debate possible scenarios that are dependent on governments, consumers, treatments and that will vary by region. In the face of uncertainty, the one thing we are certain about is that flexibility and real-time information will be more important than ever. This has certainly been true for my husband and I as we—counter to our usual last-minute travel habits—are planning vacations far into the future, focusing on vacation rentals with flexible policies.

But the skies will clear and families will want to travel again. Vrbo will do everything possible to help property managers be there with open arms to provide spaces to reconnect and recharge.

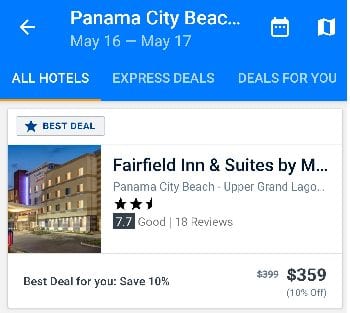

Alabama’s vacation rentals are not the only beneficiary of DeSantis’ short-term rental shutdown. Florida’s hotels in the panhandle are also benefiting. As of May 16, only one Panama City Beach 2.5-star hotel showed availability for the weekend, and this non-beachfront budget hotel was priced at $359 per night.

Alabama’s vacation rentals are not the only beneficiary of DeSantis’ short-term rental shutdown. Florida’s hotels in the panhandle are also benefiting. As of May 16, only one Panama City Beach 2.5-star hotel showed availability for the weekend, and this non-beachfront budget hotel was priced at $359 per night.

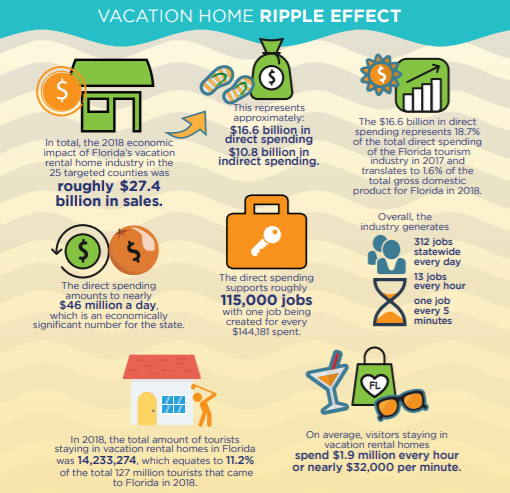

In Florida, vacation rentals have been an established and popular lodging type in the state for a century.

In Florida, vacation rentals have been an established and popular lodging type in the state for a century.

On April 20, 2010, high-pressure methane gas ignited and exploded on the Deep Water Horizon drilling rig, engulfing the platform. Eleven missing workers were never found and are believed to have died in the explosion. 94 crew members were rescued by lifeboat or helicopter, and the Deepwater Horizon sank on April 22.

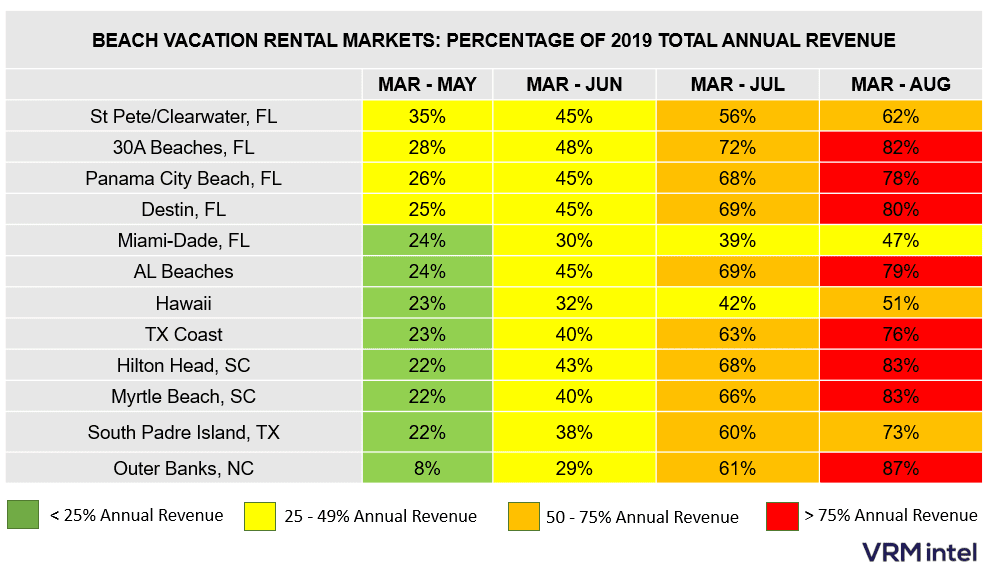

On April 20, 2010, high-pressure methane gas ignited and exploded on the Deep Water Horizon drilling rig, engulfing the platform. Eleven missing workers were never found and are believed to have died in the explosion. 94 crew members were rescued by lifeboat or helicopter, and the Deepwater Horizon sank on April 22. In 2010, travel was rebounding from the 2008 recession, and vacation rental managers located in Gulf states were anticipating their strongest summer on record. In the same way, in 2020, booking activity was up approximately 15 percent, and the vacation rental industry was looking forward to an exceptional year before shutdowns related to the spread of COVID-19 began. And, like the 2010 BP Oil Spill, no vacation rental business had listed “global pandemic” on their 2020 SWOT analysis.

In 2010, travel was rebounding from the 2008 recession, and vacation rental managers located in Gulf states were anticipating their strongest summer on record. In the same way, in 2020, booking activity was up approximately 15 percent, and the vacation rental industry was looking forward to an exceptional year before shutdowns related to the spread of COVID-19 began. And, like the 2010 BP Oil Spill, no vacation rental business had listed “global pandemic” on their 2020 SWOT analysis.

While vacation rental companies and destination marketers were trying to keep guests coming, the locals protested that conditions were not safe and states were not doing enough to protect the beaches, seafood, ecology, and the environment.

While vacation rental companies and destination marketers were trying to keep guests coming, the locals protested that conditions were not safe and states were not doing enough to protect the beaches, seafood, ecology, and the environment.