Google’s Richard Holden, vice president of product management, and Rob Torres, managing director of advertising and marketing for the travel sector spoke with Sean O’Neill at Skift Global Forum in New York today, bringing the company’s travel product and marketing heads on the same stage for the first time.

Torres said, “We work closely together. I am there pushing a lot [and asking], ‘are you thinking about this from an advertising perspective what this means.'”

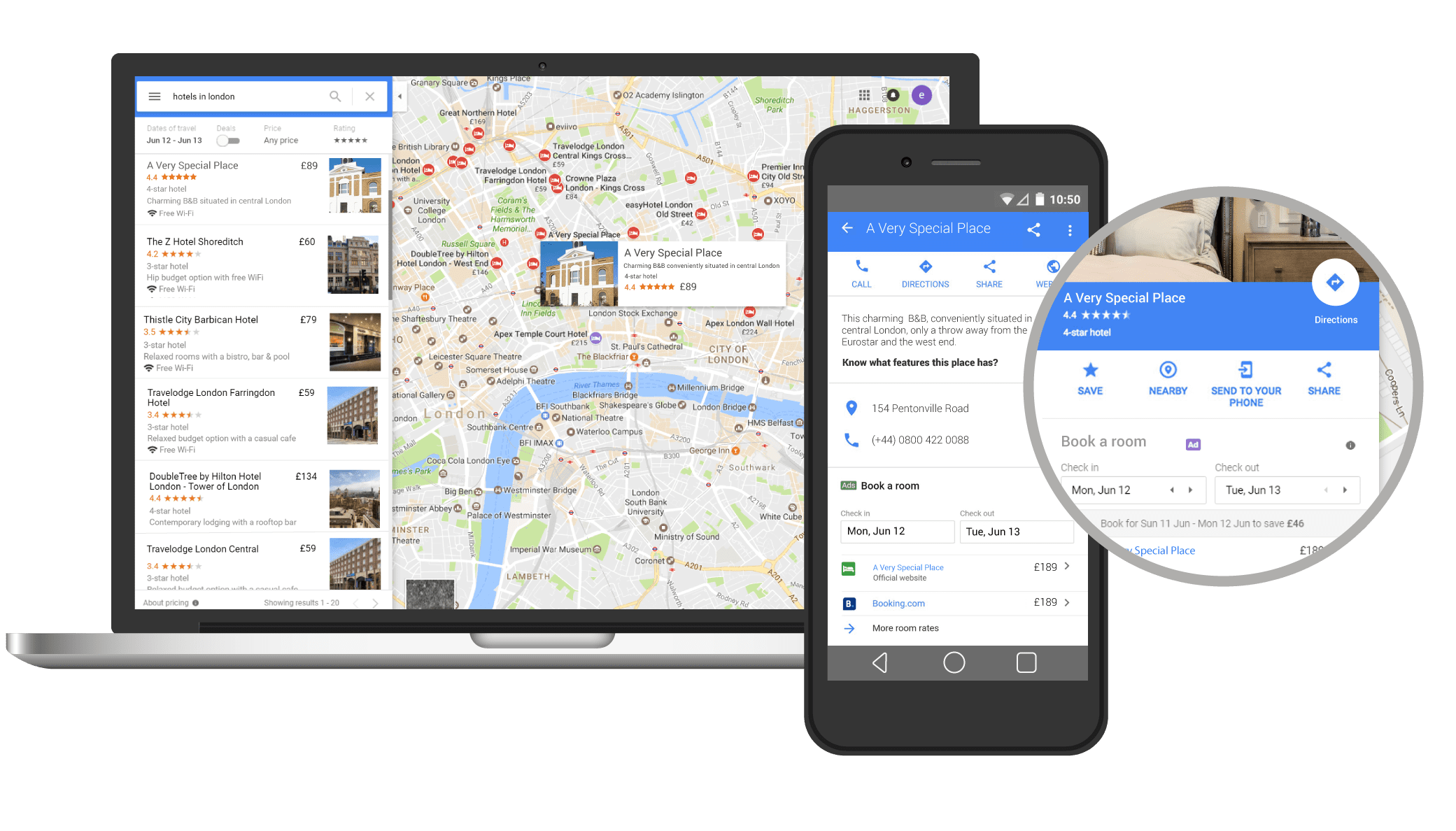

Google expanded Google Hotel ads to more than 150 countries on Google.com and Google Maps, helping travelers browse hotels on mobile devices and find hotel deals. In the first six months of 2018, the number of leads to partners grew 65 percent year over year. Holden and Torres discussed that later this year, Hotel ads management will move into the Google Ads platform.

In comparing Google Ads and Google Hotel ads, the group discussed the higher cost for Hotel Ads and where in the funnel hotels are finding customers, as Google Ads (blue links) reach the consumer at the “bottom of the funnel.”

Torres added, “Companies should only be looking at ad platforms that are profitable for them. Is this a profitable channel for you? It depends on where you are and what kind of leads are you looking for.”

For vacation rental managers the discussion of Google Hotel ads versus Google Ads is important because the company confirmed its intentions to add vacation rentals in the same way they display hotels, but Holden indicated that adding alternative accommodations has not been easy and admitted it had been spending more time on hotel-like inventory than single homes.

“We’ve struggled with what is the right way to integrate those offerings,” said Holden. “We’ve added it as a filter in Europe . . . We will be–in the near future–moving into offering [alternative accommodations] as well. We feel it’s huge.”

The Google executives also discussed growth in consumer demand for tours and activities. “One travel trend [we see] is the growth and interest in the activities space. We all know the activities space has grown, but it is the acceleration and speed [of customer demand for activities] that is surprising to us,” said Holden.

Other topics that were addressed included machine learning and the future of “match scores” that match travel products and restaurants based on customer behavior, and they shared two goals for Google Travel. First, as has been their core objective, Google is focused on comprehensiveness and trust, trying to find and aggregate all the information, all the room rates, etc.

Holden described a second objective of “stitching together” the entire process of travel planning, from inspiration to post-travel reviews (a model that sounded very similar to the recently announced “All-new TripAdvisor” powered by Trip Feeds).

Holden explained that the team is beginning to stitch together all parts of planning a trip, from inspiration to transportation, accommodations, weather, restaurants, tours, activities, sharing, and reviews. And Google will track behavior to help users pick up where they left off.

“We will have all that research [users] have already done, so again, [they] can pick up where [they] left off,” Holden said. “The Trips concept will be initially available on Trips on the US mobile app.”

“If we get more people coming and searching, I’m going to be able to send you more leads,” added Torres.

This Stitch article and info coming from Google is just as vague as its ever been since the EU beta test for short term Vacation Rentals. Not sure why they are having integration issues, all the large OTAs and large Property Mangers all have software that can share the metadata for search aggregation.

In the end, Google has a huge opportunity to shut down OTAs which depends strictly on their revenue model for handling STR listings. If it behave just like regular search does now, with adds /bid for top positions followed by organic results? Google will quickly realize that filters and sorts will be required to help select STRs, which is more complex than just Hotel accommodations. In the end, I hope they stick with organic search core business and monetize addition advertising along the vacation travel planning.

GOOGLE has the opportunity attempt to provide direct Owner and PM listings to capture the meta data for search (and not requiring a commission based channel mgmt intermediary). This WOULD finally level the playing field between Owners/PMs and the reservation-fee/commission based OTA sites like Airbnb, HomeAway, VRBO, Trip Advisor, and Booking. Currently, the OTAs have just above 50% direct traffic, if Google plays their cards right with Owners / PMs, they could capture all the traffic and become the new household BRAND for STR search. Google just needs to provide a mechanism to easily enter independent listings, and match the current market expectations for fee-free direct processed transactions (including no owner commissions), usability for searching, communicating and reserving.

Hmmmm

Little guy net placement is competively dead and about to become deader-

You’ll find your proud of….tinseee ity bity….web site on page eight-

Maybe!