Over the past 72 hours, it has become clear that vacation rental managers are facing a much more serious impact from COVID-19 than previously expected. With circumstances changing each hour, company owners and executives are finding it difficult to prepare for the future when the end zone keeps getting pushed further away.

Multiple vacation rental management (VRM) company leaders have contacted us to find out what other managers are thinking and what actions are being taken. Consequently, we reached out to industry leaders who have extensive experience in dealing with crises. Even though the COVID-19 challenge is unprecedented, there are company executives who have weathered 9/11, fires, the BP oil spill, back-to-back-to-back hurricanes, and many other bizarre and unexpected challenges.

While we do not want to overreact, after speaking to experienced VRM executives, there are some concrete strategies enterprise-level property managers can implement to prepare for the road ahead.

Be realistic about the timeline

Yesterday, President Trump responded to the question about how long this situation will last, telling a surprised nation, “We’ll see what happens, but they think August, could be July, could be longer than that.”

After speaking with multiple C-level VRMs after that press briefing, there is substantial disagreement about whether or not Trump is to be believed. Some managers believe that “he says things off the cuff all the time” (as one PM described), and it won’t be that long. Others believe Trump’s timeline is accurate.

Whether you are preparing for this to be a 30-day or a 150-day disruption, careful and proactive planning is critical. Each company has its own level of acceptable risk. The strategies below originated directly from experienced enterprise-level vacation rental managers who are determined to weather this storm and ensure the viability of their companies and their communities.

1. Expect expanded CDC guidelines and state and local restrictions

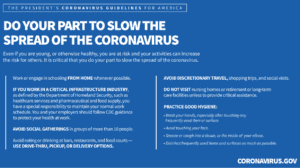

The CDC and Trump administration have provided guidelines for US citizens to limit the spread of this coronavirus.

In addition to these guidelines, state and local governments have been putting policies and restrictions in place that directly affect vacation rental companies, including:

- Closing of theme parks, public beaches and ski resorts

- Non-essential travel restrictions, including destinations closing the region to visitors

- Closing of restaurants, bars, and nightclubs

- Shelter-in-place mandates

- Mandatory curfews

- Non-essential business closings

2. Prepare for your team to work from home

It is highly likely that your team will be prohibited from coming to work in the office, if it hasn’t happened already.

Robin Craigen, CEO at Moving Mountains in Steamboat, Vail, and Beaver Creek, Colorado, is packing up and moving his office home today. He shared that he wishes he had prepared for this two weeks ago when guidelines began expanding. He has purchased laptops for employees and is working with his IT provider to establish VPN connections and reconfigure his VoIP network.

To shift to a remote workforce, team members will require access to email, internet, teleconferencing, limited file sharing, and function-specific capabilities (finance, HR, etc.) from their remote work site. They also require access to Software-as-a-Service (SaaS) applications in the cloud, such as the PMS and Microsoft Office 365.

Craigen advised managers to contact their IT providers immediately to get on their schedule and purchase laptops if your team doesn’t currently have them. Here are some steps to move to a remote workforce.

3. Protect cash flow, and do not use advanced deposits to pay expenses

While some states mandate trust accounting, others do not. For many, it is tempting to use advanced deposits (monies collected for future reservations) to pay short-term expenses. The most important advice from experienced mangers is do not do this.

According to Jim Olin, CEO of C2G Advisors and former ResortQuest CEO, “The worst item you can run out of during this crisis is cash. And this includes my suggestion to abstain from dipping into advanced deposits—whether it is legal or not.”

In the past, prematurely tapping into advanced payments for future reservations to pay expenses has been the leading cause of business closings during crisis situations.

Olin added, “One other suggestion is to constantly analyze your cash flow statement for at least the next six months. Modify it weekly. During several hurricane crises, my CFO did daily cash flow statements since we got very, very tight. In fact, after Hurricane Opal, we got down to $230.66 one day, but we worked our way back up to a multi-million dollar company. Don’t give up, don’t stop sourcing cash, and don’t do anything illegal/stupid.”

4. Seek cash now

Review, renew, and expand your credit line now, if possible. And if you don’t have a line of credit, experienced executives strongly advise securing one.

We are already hearing reports from California of banks “pulling up the drawbridge” (as one PM described) and limiting credit line exposure, so now is the time to work with your lenders to ensure lines of credit are secured, if it isn’t too late.

In addition, Small Business Administration (SBA) loans are available, but they take time; and the demand for these loans is going to increase. Money will be available from speculative lenders, but the cost of those funds is high and will only go up.

“I would highly suggest contacting your bank(s), look at SBA options, search for minority business loans (if applicable), look for the ability secure a line of credit, and any other short-term cash resources.” Olin said. “Make sure you know your NAICS code for your business since—most of the time—financial aid during a crisis is available by NAICS codes.”

5. Examine payroll expenses and research unemployment options

After 9/11, the first thing large VRMs did was eliminate overtime and initiate wage freezes and hiring freezes. Since payroll is likely your largest expense, the next step is to reassess the need for seasonal employees and contract employees and look at cutting business hours and employee hours.

You can also explore unemployment options for your current employees. States are offering unemployment benefits for workers affected by the coronavirus. In Alabama, for example, “the requirement that a laid-off worker be ‘able and available’ to work while receiving unemployment compensation benefits has been modified for claimants who are affected by COVID-19 in any of the situations listed. Additionally, claimants will also not have to search for other work provided they take reasonable steps to preserve their ability to come back to that job when the quarantine is lifted or the illness subsides.”

Based on historic performance for vacation rental destinations, when this challenges passes, or “washes through” as President Trump said, travel is expected to rebound quickly. Decisions about payroll will be the most difficult and the most impactful in managing expenses, so experienced managers recommend not putting these off.

6. Analyze other expenses, supply chains, and upcoming projects

Eliminate nonessential and recurring expenses, and take a hard look at each line item. One Georgia manager shared that they have eliminated comp stays and employee stays in properties, have stopped extending credit to homeowners for services performed in the home, and is looking at renegotiating vendor contracts and at better managing their supply chains.

With the need to conserve cash, some special projects will need to be put on hold. However, in some cases, if time opens up for your team members, this may be a good time to go forward on special projects like implementing new software, systems, or building a new website. This option isn’t right for everyone, as managing cash is critical right now. However, technology providers are likely to be flexible on the setup fees or will be willing to defer payments.

7. Settle competing interests in your mind

As one manager said, “this is the point where capitalism meets community responsibility.”

Each company has difficult decisions in front of it, weighing the need to preserve revenue against the need to limit visitors to protect the community. And each manager we talked to is carefully considering cancellation policies.

We will address cancellation policies in more detail this week, but most managers are currently offering rebooking for future stays instead of cash refunds. This is also true for airlines and cruise lines.

As one manager said, “There are no good choices here, just good decisions.”

As leaders in your destinations, you are in the difficult position of establishing priorities and setting examples in a very different way than you ever have before. However, state and local governments are acting quickly, so many of these decisions are being made for you.

8. Take care of yourself and your families

Not to be cliché, but this is a marathon not a sprint. You are not going to be able to help anyone if you are unable. Besides physical health, mental health is a major concern during this challenge. Taking care of yourself and your family must take a high spot on your to-do list.

While the challenges you face are real, you are not in this alone. There are thousands of other VRM executives out there going through the same thing. And we—at VRM Intel—are going to be here for you and will continue to find ways to connect you with other executives to share information and look for opportunities.

Historically, travel rebounds quickly, and the vacation rental industry is more resilient than any other sector in tourism. The decisions you make are critical to ensure you come out of this. And if the past is an indicator, those that do will be stronger and better than ever before.

Wise words Amy. As a former CFO I would be working on various cashflow scenarios (summer recovery, part summer recovery, fall recovery, Jan 2020 recovery, etc). And plan them at lower occupancy given we’ll probably have less air travel. Honesty is important in these forecasts to help prepare for the different outcomes. We’ve all learnt once how quickly outlooks can change. Be ready with the different cashflow scenarios. It’s exactly what we’re also doing here at Touch Stay. And despite all this, let’s do more of #8!!