At this week’s Skift Global Forum, Airbnb cofounder and CEO Brian Chesky told an audience of travel providers that the world is experiencing a “travel revolution” and “travel as we know it is never coming back.”

“There’s a whole new game,” Chesky said. “And I think it’s a good thing.”

Chesky explained his theory, sharing that “hundreds of millions of people”—a phrase he used often during the interview— are working remotely; have more flexibility without being tethered to an office; and are now combining living, working, and traveling by staying in “Airbnbs” for longer term stays. “This revolution is really about flexibility. You can live anywhere. You can work anywhere . . . so imagine hundreds of millions of people now all flexible.”

Watch Skift founder Rafat Ali’s interview with Airbnb CEO Brian Chesky.

20% of Airbnb’s business now for stays longer than 30 days

“A fifth of our business, by room nights, is 30 days or longer. And we think this is going to stay and probably go up,” Chesky said. “So that means that one-fifth of our business—and growing—is not even travel. It changes our entire identity.”

He went on to describe how hundreds of millions of people can now “live in Airbnbs” as people are no longer tied to a place because they are able to work remotely.

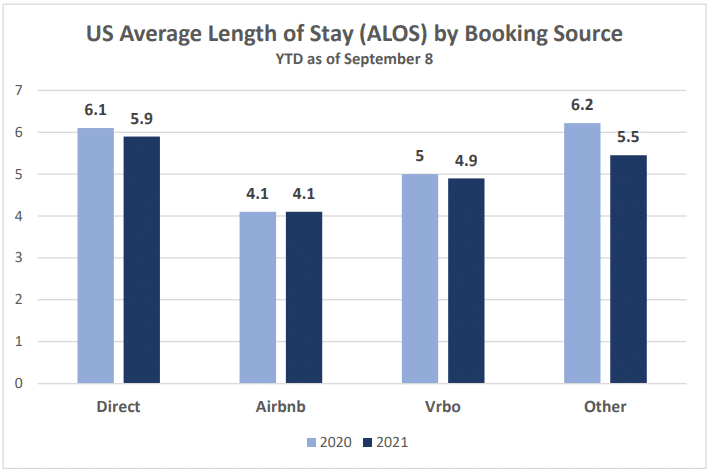

At first blush, it seems—in order for Chesky to make this proclamation—that an insignificant portion of Airbnb’s revenue is coming from traditional vacation rentals. According to Key Data, the average length of stay for vacation homes booked on Airbnb is 4.1 nights, consistent with the prior year. However, the average length of stay for vacation rental bookings coming from Vrbo is 20 percent longer, and the average length of stay for direct bookings is 44 percent longer than stays booked on Airbnb.

Leisure and Domestic Travel

Chesky acknowledged that domestic travel has increased in popularity. “The less people travel for business, the more, I think, they travel for leisure,” Chesky said. “It’s a little bit of a shift, and business and leisure will probably blur together anyway. I mean, when your home is your office, they’re kind of blurring anyway.”

“The reason domestic travel is going to stay really popular is—what’s one of the largest expenses in travel? It’s flights. I think a lot of long-distance travel is being replaced by short-distance travel.”

40% of Airbnb’s shoppers don’t know when or where they want to travel

Chesky told Ali that, previously, consumers would come to Airbnb and search for short-term rentals in a specific location and travel dates. However, since the pandemic, “that whole paradigm has changed.”

“40 percent of people come to Airbnb—now this is hundreds of millions of people—and they either don’t have a destination in mind or they don’t have a date range in mind,” he said. “What this means is that we have an ability to point demand to where we have supply.”

Airbnb’s role in directing consumers where they should travel is part of the company’s plan to combat overtourism, which Chesky defined as “too many people going to too few places at the exact same time.”

“The holy grail of overtourism is travel redistribution,” Chesky said. “More than 500 million people have used our ‘flexible date’ feature.”

Chesky told Ali that consumers’ indecision about where they want to travel gives Airbnb the ability to steer them in way that combats overtourism for destinations. It would be interesting to know how conversion rates for “flexible searches” on Airbnb compare to searches with a specified location and date.

Airbnb’s Significant Decrease in Marketing Spend

Ali asked Chesky about Airbnb’s reported shutdown of marketing during the pandemic.

“We were spending $800 million on a run-rate basis, mostly on Google keywords,” Chesky said. “And we got to do the experience that I think every CMO in the world wishes they could do: ‘What if we just turned off 100% of marketing? What would happen?’”

Chesky continued,” Of course, we were forced into that experiment. So we shut off $800 million of run-rate marketing, and what happened was our traffic was still 95 percent of the year prior. So we realized that we don’t have to return to that spending, and we have not.”

“If you can get people talking about you, that’s the best marketing.”

Family Travel

After Chesky’s “travel revolution” declaration, Ali astutely asked Chesky about family travel, the historic primary driver of vacation rental travel. Chesky’s response demonstrates that—in spite of company’s narrative that hundreds of millions of people will be living in Airbnbs in the future— Chesky is clear-eyed about the high returns coming from large vacation homes and the importance of the established family-leisure travel sector.

“A bigger opportunity [in the next] ten years for everyone is family travel. Even people with families—they can’t be totally untethered—but most of their kids are only in school 180 days in the year.” Chesky said. “The other 185, they can travel—a lot of them—so I think family travel is one of the greatest [opportunities], and it has benefited us.”

“I mean, why did our average daily rate (ADR) go up? Our unit economics improved, in part, because people started spending more money per night on Airbnb. Why did they do that? Because we were booking larger homes. And who were booking larger homes? Families and groups. So, I think family travel will boom, and the other thing that I think is going to boom is multiple families traveling together or friend groups traveling together.”

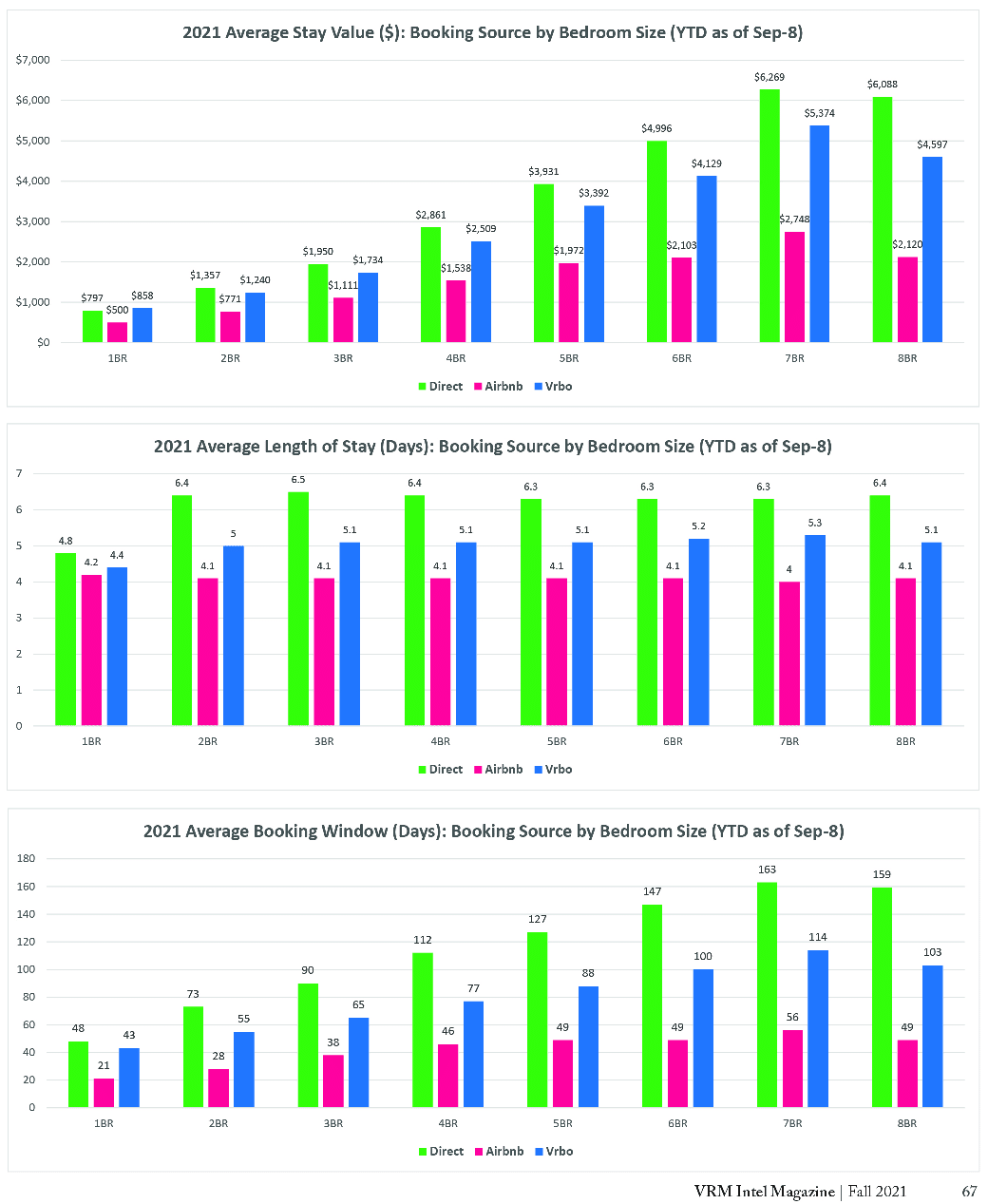

How is Airbnb stacking up for bookings in larger homes? The charts below show 2021 vacation rental KPIs comparing direct performance with Airbnb and Vrbo by bedroom size. Airbnb’s average stay value is lower, the length of stay is shorter, and the booking window is smaller on Airbnb than Vrbo and direct-channel bookings for professionally managed vacation rentals. The gap widens as the size of the home increases, and Vrbo is performing much better for larger professionally managed vacation homes.

Subscription Model

Rafat also asked Brian what he thinks about the future of OTA subscription models.

“I think anything that’s used frequently is where a subscription model works,” Chesky said. “Some people have asked, ‘What is the most popular app in the world that’s never worked?’ And a lot of people say it’s a travel planning app. Like every engineer and every product person, their pet project is a travel planning app. Why do travel-planning apps not stick? It’s because they’re very complicated and people use them once a year. That’s a bad combination.”

“You need to have something that’s used frequently,” he explained. “And to be a travel app that’s used frequently, you need really big scale or you need to be something that’s relevant to people’s lives. That’s hard in an infrequent business. If you can solve the scale problem or the frequency problem, you have a great subscription platform.”

Whether he knows it or not, Chesky’s comments throw a bit of shade on TripAdvisor’s new subscription model. We’ll look forward to hearing from TripAdvisor CEO Stephen Kauffer, along with Expedia CEO Peter Kern and Booking CEO Glen Fogel later in the show.

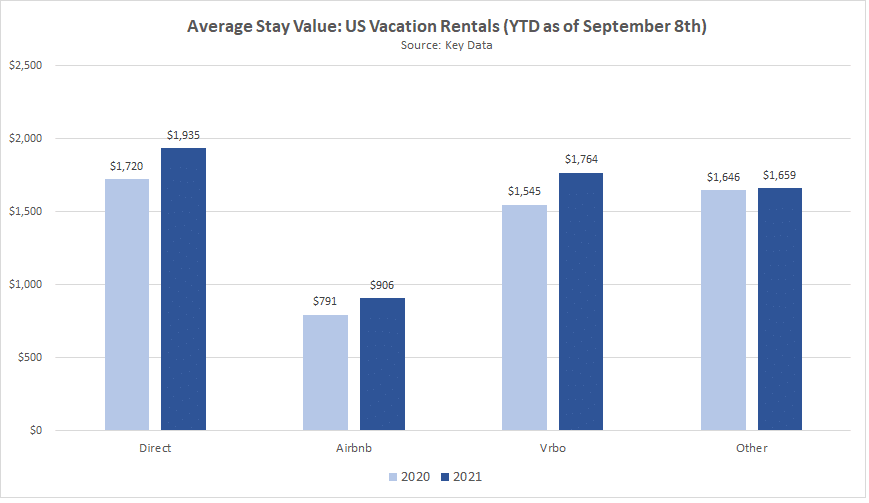

One more Chart: Average Stay Values by Booking Source

Looking at average stay values (ASVs) for professionally managed vacation rentals, Airbnb had an ASV of $906, which was more than 53 percent below the ASV for direct bookings ($1,935). The difference in ASVs is the result of a combination of higher ADRs and longer stays for direct bookings.

Another way to look at it is that it takes 2+ bookings on Airbnb to equal one direct reservation. Even though Chesky is looking for a revolution, the company needs to close this gap in revenue per booking.

I need help.

I disagree with your assessment & opinion of your company! My name is MARTHA LINGO

mjlingo@gmail.com

951 357-5765