7 Key Drivers of Destination Travel Scenarios

How can destination resorts plan and prepare for the upcoming Winter 2020/2021 season when there are so many unknowns and so few reliable data sets or precedents?

They begin by understanding where things stand for seven key drivers, which will then inform and shape the three destination travel scenarios.

Forecasting for the Winter 2020/2021 season is one of the key challenges that Insights Collective, a pandemic economy think tank, reported on during VRM Intel’s recent Data and Revenue Management (DARM) Conference in a special presentation sponsored by Laird Sager and Red Sky Travel Insurance.

We focused on the essential drivers of supply and demand, the two variables upon which revenue management is based and the keys to understanding pricing power during an unprecedented disruption of the economy.

To best project where things stand and where they might evolve, let’s define and discuss the seven key drivers for 2020/2021 scenario planning:

1. Virus Tracking and Management

In both feeder and destination markets, this information will determine visitation ability and restrictions.

2. Reopening: Return of Demand Economics

This will drive travel and may override local or feeder market conditions but may create fulfillment, image, brand, health issues, and ramifications of pent-up demand.

3. Changing Consumers and Impacts

Particularly in the consumer marketplace, behavioral and demographic changes will create uncertainty on the fulfillment side and are not easily foreseen this time around.

4. Local Sentiment

Destination residents who are “somewhat” or “highly” resistant to outside visitation will push back against publicly funded entities marketing the destination, having an impact on previously more independent destination marketing organization (DMO)/government directives.

5. Paradigm Shift for DMOs

The pandemic will change how—or if—destinations make a call-to-action, which will change fulfillment volume, branding, and competitive advantages.

6. Federal Funding

Funding has played a major role, from PPP to various loan guarantees. However as debt grows, the future is less certain.

7. New Realities

Migration/urban exodus, changes in schooling, and working from home are prompting changes to visitation behavior within both local and feeder markets, creating opportunities.

To understand why forecasting is difficult, we begin with how the crisis is categorized (i.e., a black swan event). An event of this type is disproportionately high profile, hard to predict, and rare; perhaps it is beyond the realm of normal expectations in history, science, finance, or technology.

Pandemic Economy

The COVID-19 pandemic and its economic consequences are unprecedented.

Reliable data sets are not available. Results to date imply disruption beyond conventional business norms, but the new reality has yet to become clear.

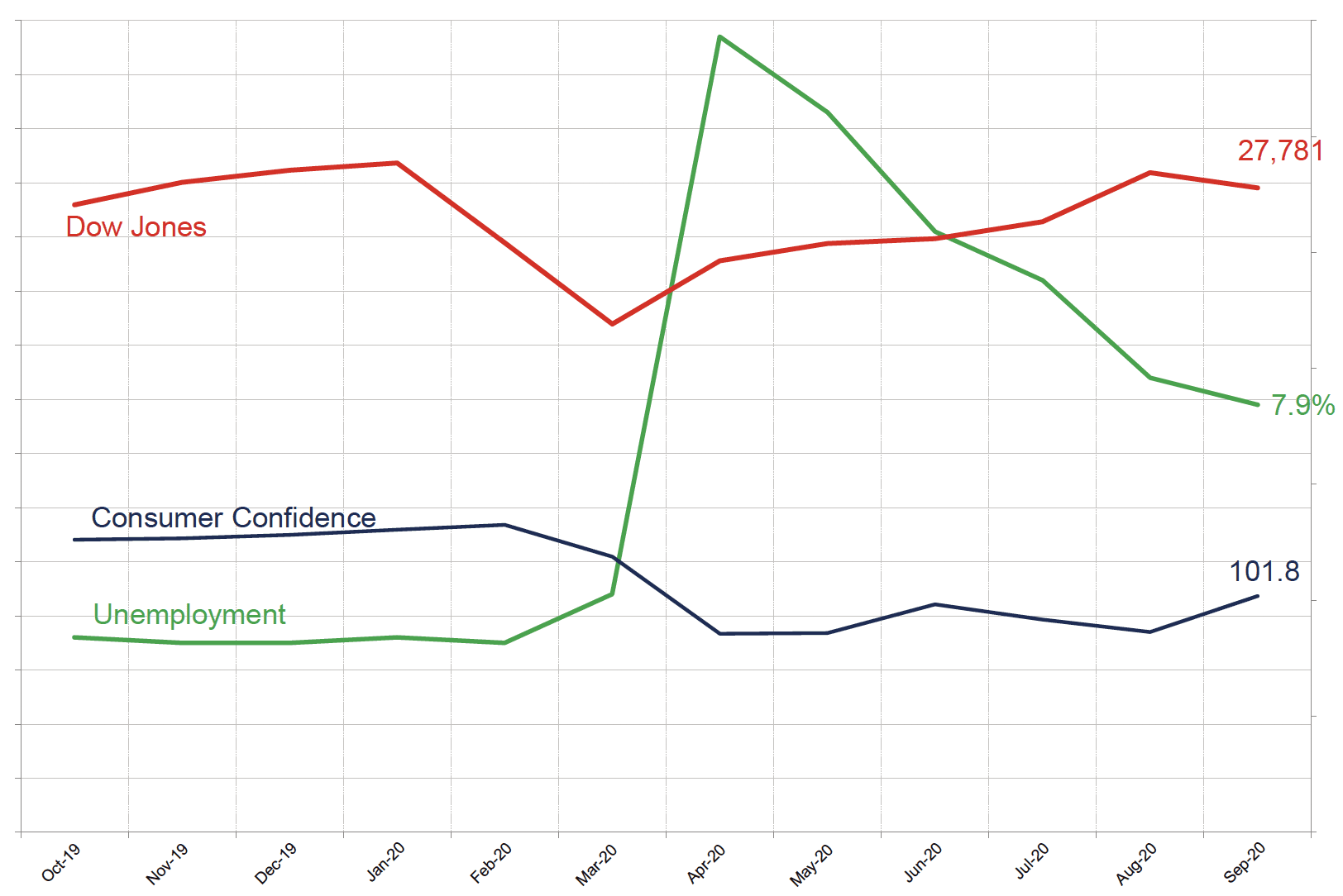

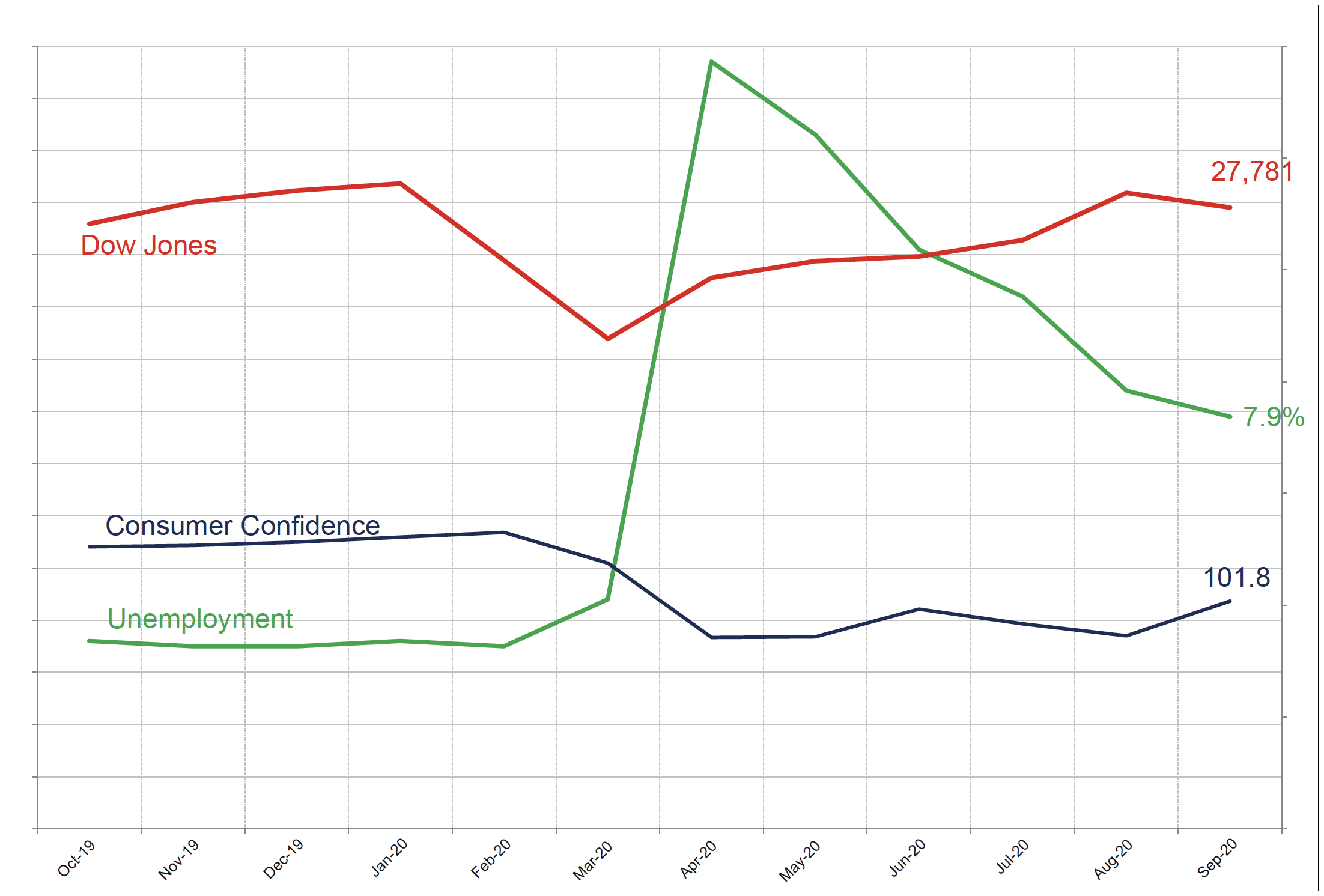

We can start to make sense of things by looking at the current economic situation. The most helpful lens is found in data for unemployment, consumer confidence, and the Dow Jones Industrial Average.

Key Economic indicators: 2019-2020, Courtesy: Inntopia/DestiMetrics

The Dow Jones has rebounded since the early spring arrival of COVID-19 in the US—a leading indicator that suggests Washington’s response was appropriate. Unfortunately, consumer confidence fell and has not yet recovered. Moreover, unemployment has increased; sharply at first, and now remaining at recession-level numbers. Wall Street cannot continue to climb while Americans are out of work and feeling lousy about their prospects—can it?

Virus Tracking

The University of Washington’s forecasting model projects 410,000 US deaths by end of year, nearly double the approximate 200,000 deaths attributed to COVID-19 by the end of September 2020. The Centers for Disease Control and Prevention (CDC) has forecasted that 12 states and territories will see decreasing numbers of new cases per week, while virus spokesperson Dr. Anthony Fauci predicts we all need to hunker down this quarter, be mindful of flu season, and accept the reality that a vaccine will not be in wide use until the third or fourth quarter of 2021.

With virus tracking, the first traces of predicting the winter season come into focus. Management and mitigation of local cases will differentiate winning destinations from losing destinations. For example, at the time of publication, in western ski destinations, Jackson (Teton) and Park City (Summit) lead the pack in terms of new cases. Crested Butte, Bend, and Steamboat, by comparison, show the least number of new cases. Destinations that become known as “hot spots” are at risk, while those with well-controlled local caseloads will be better positioned.

Consumer Trends and Considerations

While there is inherent demand for leisure travel (21st century Americans consider it a birthright), taking cues from the economy has been difficult. Among the suggested recovery curves (V, U, L or W), a newly formed K is in play. In a K-shaped recovery, some segments will head upward seeing robust growth opportunities, and other segments will face a declining economic situation.

As in any scenario, there are early adopters for travel, but at Insights Collective, we’re seeing pent-up demand as something that is now behind us; it has already occurred. New demand will depend on consumer trends and considerations.

KŰbler-ROSS model

To appreciate consumer sentiment trends more fully, we turn to the Kübler-Ross Emotional Response to Change scale. This scale tracks morale and competence across seven phases: starting at shock and concluding with integration. At the six-month milestone, consumers are shifting out of phase four, anger/depression, and toward phase five, experiment. Society is well past phase one, shock. We are a long way from the integration of phase seven. Changes are not yet understood or accepted, and there is not yet a renewed sense of normal.

What factors are helping to influence the consumer’s decision to travel for ski vacations?

First, we look at the top three concerns of mountain travelers: safe air travel protocols, potential COVID-19 hot spots, and the ability to maintain social distance once at the destination. Personal financial situations are a factor for only approximately one in ten travelers. This supports the K-shaped economic recovery model while acknowledging the increase in the unemployment rate.

If those concerns are mitigated, resorts can then focus on providing the top two pieces of information that would induce travelers to visit a resort: health and safety measures implemented on property and in the destination and the ability to cancel trip reservations without penalty. Taking this approach can shift the demand/supply equation and help return pricing power to the property.

Conclusion

We have outlined and expanded upon three of the seven primary drivers. Taking all seven together, potential scenarios for a particular destination starts to form. As forecasts become more clear, resorts need to focus on tactical responses—management and mitigation—to earn the trust of travelers until a widely available vaccine neutralizes the effect of the pandemic on our industry.

Insights Collective is an industry think tank focused on leading resorts and destinations through the new realities of management, marketing, and positioning. It is made possible by contributions from other civic-minded organizations, including Red Sky Travel Insurance.

Jane Babilon spent 10+ years working for DestiMetrics (later Inntopia Business Intelligence) in a variety of roles but primarily as an Account Manager focusing on Southeast clients. In this role she worked to ensure that clients were getting the most value out of their lodging research programs.

Ralf Garrison is a destination travel industry veteran, generally recognized as a thought-leader, innovator and a serial entrepreneur resulting from the various businesses that he has founded over the years.

Brian London is a respected research consultant, economist, and editor-in-chief of Travel Industry Indicators – Trends, Outlook, and Commentary.

For further information, our resources can be found at: theinsightscollective.com.