2018 was a whirlwind for those of us who cover the vacation rental industry. The pace of news about funding, acquisitions, regulation changes, and tech developments was startling; and several of these stories made our jaw drop. As we launch into 2019, let’s take a look back at the most surprising events and activity in the vacation rental industry in 2018. While it was hard to narrow down, here are our top 8.

1. Wyndham Vacation Rentals: Corporate Split and Sale of European Vacation Rental Business for $1.3 Billion

In February 2018, Wyndham announced that it had sold its market-leading European vacation rental businesses for $1.3 billion to an affiliate of private equity firm Platinum Equity. The news came on the heels of Wyndham Worldwide’s split into two publicly-traded companies: Wyndham Hotel and Resorts (NYSE: WH) and Wyndham Destinations (NYSE: WYND) which includes the timeshare business and North America’s vacation rentals.

There were two things that made Wyndham’s activities surprising. First, while looking for a buyer for Wyndham’s European vacation rental businesses, there were at least two other qualified buyers at the table who had performed extensive due diligence and had put together comprehensive plans for the transition and long-term success. According to multiple sources, Airbnb was a part of one bid for the company, while another included an impressive team of seasoned vacation rental operators, experts and analysts. In spite of the experienced options, in the end, Wyndham selected a last-minute Platinum bid, which felt to many industry observers like a short-sighted move to take the highest bidder, regardless of downward adjustments that would inevitably have to made as the deal moved forward toward closing.

Second, the decision to put the North America vacation rental business under the timeshare business instead of the hotel business was, according to inside sources, an eleventh-hour decision—and one that many believe will haunt the company as more hoteliers move into private home accommodations. Wyndham’s vacation rental business was the largest in North America until Vacasa took the lead in 2018. And speaking of Vacasa . . .

2. Big Moves at Vacasa: $207+ million in Funding, Co-founder Leaves, Oasis Purchase, IPO, and More

The developments at Vacasa have been dramatic and fast-moving. In February 2018, co-founder Cliff Johnson exited Vacasa, a move that shocked the entire vacation rental industry. In October 2018, Vacasa announced it had raised an additional $64 million Series B-2 round from existing investors, bringing Vacasa’s funding total to $207.5 million (Almost four times the amount raised in ResortQuest’s IPO).

Also in October, Vacasa announced that it had purchased Oasis, an urban short-term rental provider that has quite a history. According to insiders, Vacasa got an amazing deal on the company, in spite of significant investments in the company from AccorHotels and Hyatt. In 2016, AccorHotels acquired a 30 percent stake in Oasis, as it grew to list more than 2,000 non-exclusive properties in 22 cities worldwide and developed a strong B2B element, marketing its urban properties to business travelers. In August 2017, Hyatt injected a “significant investment” into the company, and AccorHotels took the opportunity to exit. However, after working with Hyatt, Oasis lost inventory. By the time Oasis sold to Vacasa, the company displayed only 826 listings—over 80 percent nonexclusive—in 17 markets, a 59 percent decline in inventory in 18 months. At Skift Global Forum, Hyatt CEO Mark Hoplamazian discussed Hyatt’s investment in Oasis and what the company has learned about vacation rentals from these businesses. “We are high on companies that have control over the inventory,” he said.

In 2018, Vacasa also launched a real estate referral program and entered into homeowner association (HOA) management, and the company has been moving toward a potential IPO. However, at Phocuswright in November, CEO Eric Breon seemed to be cooling on the idea of going public in 2019 saying, “It’s not an end goal. It’s not like my life gets better once that happens.”

3. HomeAway Announces—and Later Walks Back—Online Attribution and Auditing for Vacation Rental Managers

In early 2018, HomeAway made a series of announcements that rocked the vacation rental management world, including a 25 percent increase in the cost of listing subscriptions, new auditing requirements, rate-parity language in its premier partner pledge, and a new fee assessment for property management which became known as “match back.”

With the addition of a variable fee for travelers, HomeAway eliminated tiers and increased its subscription fee from $399 to $499. But that wasn’t the decision that disturbed managers. HomeAway also announced it will invoice an additional 10 percent fee for direct bookings made that HomeAway can attribute back to inquiries on their websites using its integrations with PM software systems. The policy was based on an assumption by HomeAway that any revenue derived from a guest who booked directly with a vacation rental company—and who had previously inquired on a HomeAway site—should be attributed to HomeAway, and HomeAway is entitled to ten percent of that revenue.

“. . . subject to review and audit, (and) if the Company (HomeAway) finds that a certain booking of a Listing originated on the HomeAway Network but was not properly reported as attributable to a HomeAway Lead under the above analysis, then the Company will notify PM of such discrepancy, and will be entitled to assess a commission or Off-Platform Booking fee on the amount charged for such stay unless PM provides reasonable evidence to the contrary.

After substantial push back from property managers, HomeAway later walked back the initiatives saying that attribution is now voluntary for PMs and the auditing requirements would be removed. CCO Jeff Hurst said, “In the case of audit rights, we listened to the feedback of property managers and have removed audit rights from our terms and conditions.”

“My biggest surprise of the year was HomeAway’s roll back on their match back program,” said Tim Cafferty, president and CEO of Outer Banks Blue and Sandbridge Blue. “It was a rare instance of strength of the property manager going against corporate greed and actually winning.”

4. Several Market-Leading Property Managers Remove Listings from HomeAway, TripAdvisor, Airbnb, and Booking.com as #BookDirect Message Grows

With all of the changes at Expedia’s network (including HomeAway and VRBO), Airbnb, Booking.com, and TripAdvisor, dozens of large, market-leading property management companies have decided not to list their inventory on these mammoth marketplaces. The decision is not only based on cost, but on their companies’ inability to adequately communicate with consumers, set expectations, and manage the end-to-end guest experience for bookings coming from these channels.

“We just didn’t want to be a victim of short-term thinking,” said Michelle Hodges, CEO of Meyer Vacation Rentals, a leading vacation rental company managing over 1,100 homes on Alabama’s Gulf Coast, who joined dozens of large, market-leading property management companies that have decided to remove listings from HomeAway.

While many newer companies are solely reliant on these sites for bookings, established management companies and owners are not—especially in markets that have strong drive-to feeder markets and a high percentage of repeat guests.

North Carolina’s Twiddy & Co. is also not listing its 500+ luxury homes on the big marketplaces, joining other NC property managers who manage over 7,000 listings. “I think in terms of partnering with listing sites our philosophy has been pretty straightforward over the years. We like to stay independent and agile, and we believe that people still do business with people,” said Clark Twiddy, who manages over 500 homes in North Carolina’s Outer Banks. “When we enter into a partnership there is a risk that our competitive advantage—our hospitality—gets diluted by things outside our control. We might lose a few bookings, but we’re unwilling to take the reputational risk for someone else to get in between us and our customers.”

Many large property management companies in established vacation rental destinations never listed their inventory on HomeAway or the other channels, a fact that will surprise analysts. “Over the years we sometimes agonized, and always analyzed, our decision, and we debated joining the many companies who were doing it,” said Claire Reiswerg, owner at Sand ‘N Sea Properties, which manages over 200 homes in Galveston, TX.. “Instead, we stuck with direct bookings. In the end, our business model has saved untold amounts of technological and policy headaches and of course, it has saved us lots of money. It also made us better at our primary job: keeping guests happy and coming back to Sand ‘N Sea.”

The non-branded Second Annual #BookDirect Guest Education Day is set for February 6, 2019, to let travelers know that there are many advantages to bypassing third-party channels to book directly with management companies and homeowners. Last year, property managers and homeowners came together to reach over 4 million guests with direct emails and over 25 million on social media platforms.

For analysts who might be counting, we’ve identified over 250,000 professionally-managed, high-producing luxury home rentals in the US in large vacation rental markets that are not listed on the channels.

5. PM Software Shakeup

Changes at leading software companies triggered hundreds of calls and emails to VRM Intel in 2018. While it is true that HomeAway’s PropertyPlus system support is coming to an end, and the announcement of the shutdown of Escapia websites affects hundreds of property managers, the largest reason for reaching out was news of a private-equity-funded rollup of technology providers in the vacation rental industry.

According to multiple sources, private equity firm Greater Sum Ventures (GSV) began rolling up existing technology companies by initiating the purchase of majority stakes in Streamline Vacation Rental Software, Virtual Resort Manager, Rental Guardian, Bluetent, BizCor and several other industry tech providers that include website development companies, payment processors, and more. Headquartered in Knoxville, Tennessee, GSV is a long-term equity investor that provides capital to growth-oriented software/SaaS, and technology-enabled business services companies.

GSV declined to comment.

How will service at these companies change? We don’t know. And GSV isn’t talking, even though they have been present and vocal at industry conferences in sourcing acquisitions. We have seen three companies purchase multiple software providers in the vacation rental industry (HomeAway, RealPage, and Airbnb), and we’ve had the chance to observe how those acquisitions were handled. However, as a private equity company, GSV may take a different approach. While we have had reports that GSV has been contacting ancillary service providers to renegotiate partnership contracts and is actively seeking additional companies to add to the mix (including a channel manager), GSV has yet to communicate with us or any other media source about its vision or plans.

In addition to this rollup, HomeAway’s Cliff Vars stepped down as HomeAway Software’s General Manager to take on a new role at Expedia, and HomeAway named Ryan Hutchings as interim GM. In December, LiveRez let go key members of its leadership and sales teams.

As we are seeing in the global economy, uncertainty causes angst in the markets. In vacation rental technology, it is also true as vacation rental managers attempt to make critical decisions in choosing software without having access to the information they need to make the decision that is right for their businesses.

If all of the leading US vacation rental software companies are in a state of transition, the industry is likely to see little innovation from these providers in 2019. And it appears they are all in the same boat. As a result, PMs are expected to look more to plug-and-play solutions to meet their needs for property care, data/reporting, channel management and merchandising, revenue management, and customer relationship management (CRM).

In his article Vacation Rental Software: The Good, the Bad, and the Ugly, Simon Lehmann said, “The incumbents (several of whose tech platforms are between 6 and 10+ years old) aren’t easy to use and simply aren’t innovating—not technologically, commercially, or in terms of customer success . . . Furthermore, the systems—even the leading ‘all-in-ones’—are disconnected, often leaving managers with no choice but to pay for, and sign into, 5 to 10+ separate providers.”

6. Massive Investment in Urban Multi-Family, Short-Term Rental Companies

The world of short-term rentals in urban, multi-family housing developments became a power-play arena in 2018.

The numbers are shocking—$135 million to Sonder, $62 million for Stay Alfred, reports of a $75 million investment from Airbnb in Lyric, Vacasa’s purchase of Oasis, Expedia’s purchase of Pillow and ApartmentJet, and Airbnb’s acquisition of urban PM Luckey Homes.

Will we see a Hilton or Marriott—or even an Airbnb—Apartment Collection? Big bets are being placed on the affirmative, and there is a current and highly competitive race to the front.

The increase in consumers’ desire to stay in short-term rentals, along with potential high occupancy rates in city centers, makes this an attractive growth opportunity. However, there are risks. The industry has yet to see an urban rental model that truly delivers hotel-level quality and services in multi-family housing developments; and with a population shift to city centers, increased regulation of urban housing is expected. In addition, the margins and retention rates are higher for whole-home vacation rental inventory.

Not everyone is bullish on this sector. In a panel at Phocuswright, we asked Vacasa CEO Eric Breon, in light of his purchase of Oasis, if we could expect to see a Vacasa/Sonder or Vacasa/Stay Alfred acquisition or partnership.

“The space scares me a lot right now,” Breon answered. “There’s a lot of bidding. They’re trying to get growth by buying market share by outbidding each other on spaces. I think that’s an unhealthy climate for the long term. When you look at individual homes, it’s ridiculously sticky. We have an owner on a home—one owner, one contract, a commission rate. That’s very, very sticky. When you think about leasing a multi-family building on a two-year lease, what comes up in two years? It’s going to be up for bid again. So I think it’s important for us to be a part of it just because we have guests looking for that accommodation, but it’s also going to be a small play for us.”

Solidifying a hotel-like brand in urban multi-family units will take time, and any hotel that leaps into this space is willing to accept significant losses in both money and resources in order to take the lead. The competition and funding activity in this sector is going to be interesting to watch in 2019.

7. Immediacy in Customer Service and Text Adoption

Immediate gratification is the new normal, as near-real-time responsiveness to guests and owners became an expectation in 2018. According to Clark Twiddy, CAO of Twiddy and Company in North Carolina’s Outer Banks, “We’ve noticed that guests and owners are less and less patient with an inefficient or clunky process—they simply will not wait through it. They will seek faster workarounds . . . With the enormous shift to online and digital engagement, we’re still learning that online engagement does not lead to less phone volume–in fact, it may even increase it.”

Vacation rental management companies rapidly adopted mobile text-based customer service and communications in 2018. “Even though we knew it was coming, the adoption of text-driven engagement has been much faster than we anticipated,” said Twiddy. “Guests seem to prefer to communicate that way more frequently than any other option.”

The shift to 24-7 support has been challenging. For in-market companies, the challenge is in staffing qualified on-site staff. For multi-destination managers, national call centers do not have in-market knowledge. In the article Instant Gratification and the Five-Minute Golden Window Alexa Nota writes, “Expediency is a nonnegotiable, especially for pre-booking questions—but also the in-home (I-can’t-work-the-toaster) as guests’ experiences during their stay are part of the sales process for future reservations. Property managers have no choice but to keep up on both sides to compete with each other and maintain a huge upper hand against the OTAs.”

8. Google

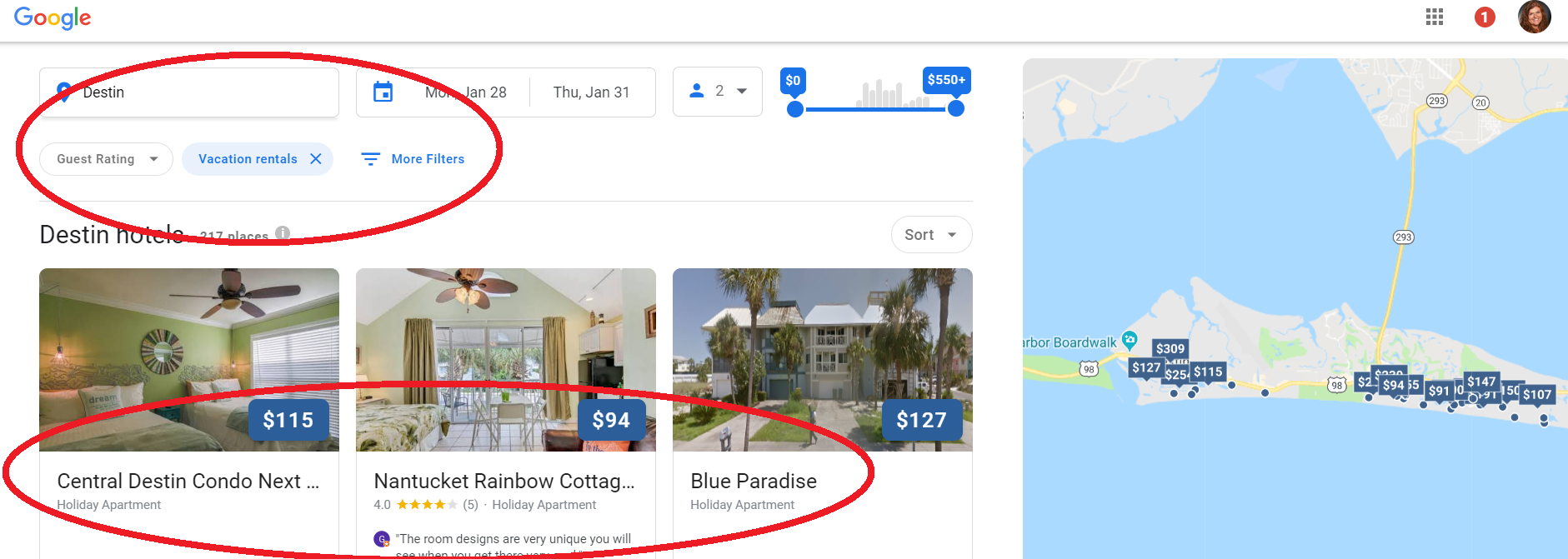

Google’s Richard Holden, vice president of product management, and Rob Torres, managing director of advertising and marketing for Google’s travel sector, spoke with Sean O’Neill at Skift Global Forum in New York and confirmed its intentions to add vacation rentals in the same way they display hotels.

To be fair, Holden indicated that adding alternative accommodations has not been easy and admitted it had been spending more time on hotel-like inventory than single homes. “We’ve struggled with what is the right way to integrate those offerings,” said Holden. “We’ve added it as a filter . . . We will be—in the near future—moving into offering [alternative accommodations] as well. We feel it’s huge.”

RedAwning CEO Tim Choate has been working directly with Google to test its vacation rental booking platform. “We are now live with Google Hotel Ads,” Choate said. “There is no doubt their movement into the vacation rental space will change the way travelers search for and book vacation homes, and we will be part of it from the ground up. So much to look forward to there.”

In the Phocuswright panel with VRM Intel, John Banczak, co-founder and chairman at Turnkey Vacation Rentals, said, “We’re looking forward to what Google has to offer . . . If you think about how Google operates, it is very clear how to work with Google. If anyone’s ever managed any type of Google campaign, you really know how to manage it. You know what you get, you know why you’re positioned in a certain area, you know why it costs what it does. You don’t get that from the HomeAways or the Airbnbs of the world . . . For us, to the degree a channel makes it hard for us to understand how to drive revenue through it, then you naturally have to look for another channel.”

Banczak continued, “And I think that’s what’s happening right now with the HomeAways of the world—if you don’t know how to manage a channel—then you either just stare at the screen and then hope for the best or you go find an alternative. We’ve been doing a lot of finding alternatives so our direct traffic is way up. I think our brand is obviously starting to catch on. We have got more repeat visitors now. But once the Google ads launch in the way we expect them to, I expect that to be a sizable dent into what we get from HomeAway.”

However, David Angotti, co-founder at SmokyMountains.com warns vacation rental managers in Google Hotels: Not the Magic Bullet, “Even if your local brand overcomes the brand favoritism that Google typically defaults to, consumer confidence is inevitably higher with Booking or HomeAway as opposed to a local brand. Complicating matters further, additional fees (including the traveler fee) are not passed into the [Google] card rates, which creates the illusion of price parity until deep in the booking process.”

Angotti also discussed commission rates on Google, “Depending on the competition in your rental market, a bid between 10 and 15 percent (rent line-item only) will be the norm. In addition to Google’s commission, you can expect an additional 2+ percent in technology costs that will be charged by the authorized Google Hotels Integration Partner. The aggregate commission is similar to the typical 15 percent Booking.com commission or the 12 percent Airbnb program that eliminates guest fees.”

Angotti added, “However, it is worth noting that unlike a traditional OTA, the Google Hotels transaction will take place on your website and you will own the guest record.”

And that may make all the difference.

They let go of the entire executive team that presented at last conference. So far, no replacements have been hired. Rumor is it’s a mess.