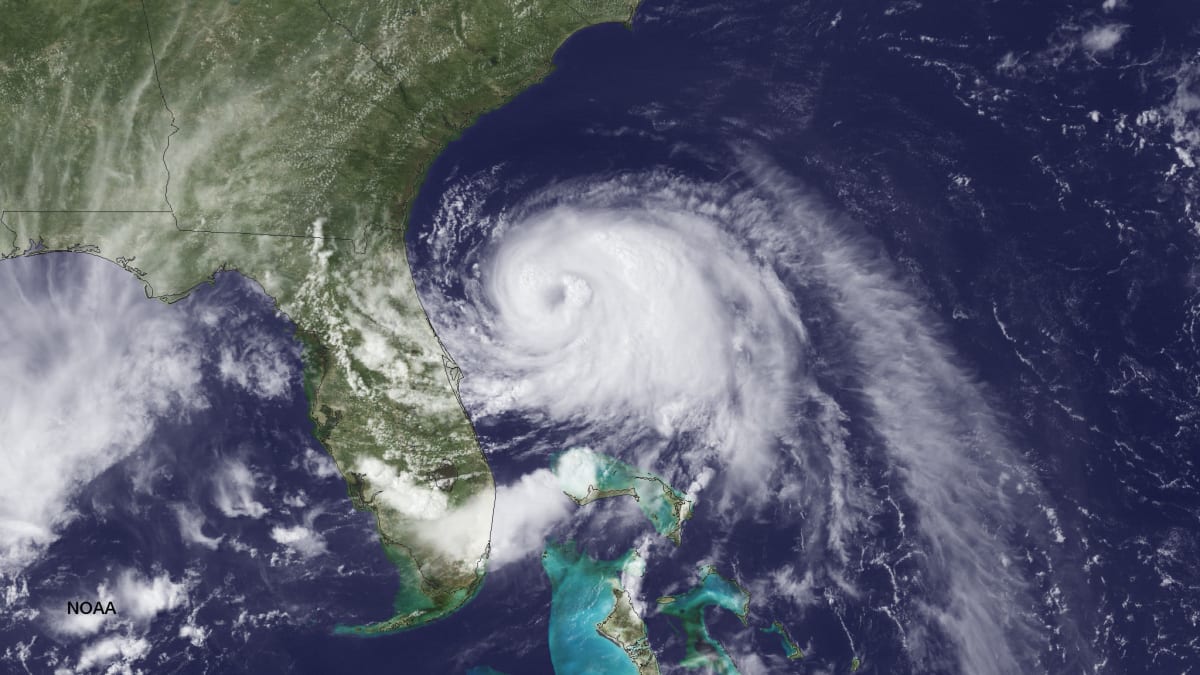

As Hurricane Arthur makes its way northeast, hugging the U.S. coastline, vacation rental managers are assessing the potential economic impact of the event. As of Thursday afternoon, North Carolina’s Dare County ordered a mandatory evacuation of Hatteras Island and predictions show Arthur to peak at a Category 2 105 mph by the time it reaches the Outer Banks.

Economic impact of a July Hurricane

Looking at sample data, if a traditional East Coast vacation rental management company collects $10 million in annual rental revenue, depending on the number of days the storm impacts accessibility and utilities in the destination, the results in July could look something like the table below:

| Number of reservations affected | Total rental revenue impacted | % impact to annual rental revenue | 15% commission on impacted revenue | |

| 7 days | 227 | $598,000.00 | 6% | $89,700.00 |

| 14 days | 406 | $978,000.00 | 10% | $146,700.00 |

| 21 days | 596 | $1,418,000.00 | 14% | $212,700.00 |

| 28 days | 819 | $1,933,000.00 | 19% | $289,950.00 |

As seen with Hurricanes Ivan, Katrina and Irene, these numbers continue to rise with increased intensity and longevity of the event’s impact. In these events, travel insurance provides protection for the guests, for the homeowners, and for the vacation rental management company.

North Carolina’s Vacation Rental Act, which directly addresses what will happen when mandatory evacuation orders affect the rental, says the guest is only entitled to a refund if the vacation rental company or homeowner does not provide travel insurance and offers it to all guests. If a guest is ordered to evacuate and was offered rental insurance when he signed the rental agreement and did not take it, then the owner/VRM is not required to refund money in case of a mandatory evacuation.

According to Laird Sager, President and CEO at Red Sky Travel Insurance, there are three outcomes which are addressed in travel insurance policies for storms:

1. Mandatory Evacuation: When a government municipality, county or state issues an order of evacuation.

2. Uninhabitability: When a property cannot be inhabited (due to safety or utility issues).

3. Inaccessibility: When a property cannot be accessed (due to road closures, flooded parking lots, etc).

Does the travel insurance policy meet the specific needs of the destination?

“There are major differences between travel insurance policies as they relate to these outcomes,” said Sager. “It is incredibly important when choosing an insurance provider that you look closely at your individual destination’s risks and specific needs.”

When Hurricane Irene occurred in the Outer Banks in 2011, the storm cut an inlet through the barrier island. About 900 feet of road was washed away, cutting off Cape Hatteras and several Outer Banks towns from the rest of the state.

“No one could access the island through the ‘traditional and anticipated route’, and we call that inaccessibility or road closure,” said Sager. “Some policies provide for road closure for 15 days from the event, and others provide for 30 days. Red Sky Travel Insurance provides coverage until accessibility has been restored.”

“In that case, we paid claims for 47 days,” added Sager.

When to buy travel insurance

If a guest is vacationing on the east coast or Gulf coast during hurricane season, they are strongly advised to purchase travel insurance. The guests can typically add travel insurance to a reservation up until the storm has been named.

“While it is a tropical storm, with Red Sky, you may still purchase travel insurance,” said Sager. The instant it becomes a named hurricane, the time has run out to purchase a policy.”

Bottom line…if guests did not purchase travel insurance from a North Carolina vacation rental management company that offers it before a hurricane is named, they are not entitled to a refund for their vacation rental accommodations.

Protecting your company and homeowners while maximizing the benefits from travel insurance

Laird Sager says there are several important steps vacation rental managers can take in getting the most from their travel insurance.

1. Choose a policy that is relevant for your destination’s risk. It is important to do the research about policy specifics when choosing a provider, e.g. road inaccessibility, flooding, or payment timing and procedures.

2. Train your staff. “Many reservation agents are not adequately trained to talk to guests, which is why we provide in-person training on demand for VRMs,” said Sager. “One company increased its policy sales from $435k to $765k with no inventory growth – just from training. With a 25%+ commission paid to the rental company, the increase added significantly to the company’s bottom line.”

3. Add the topic of travel insurance to weekly meeting agendas. “This allows people to share case studies and ask questions,” said Sager.

4. Follow up with guests making online reservations. This allows you to make personal contact, answer any questions, and address the risk of not purchasing travel insurance.

Opt-out

If the destination is at a high risk for events which cause disruption, having guests opt out of travel insurance instead of opting in helps protect the guests, homeowners and the VRM. “We’ve seen increases from 18% to 49% adoption just from changing to an opt-out model,” said Sager.

“Hurricanes aren’t the only events which require protection,” added Sager.”Sixty-five percent of cancellations were due to illness. Whether it is protecting against health issues, limited accessibility, road closure delays, or even lack of snow in ski destinations, make sure you choose a policy which addresses your company’s individual and specific needs.”

By Amy Hinote