COVID-19 Road Map to Recovery Key Indicators

Travel trends are changing daily as the world navigates through the COVID-19 crisis, especially in the vacation rental industry. We’ve been monitoring markets affected by COVID-19 since January and have focused on key indicators to identify important trends ahead of time. Although there is still uncertainty regarding recovery, we wanted to share how we have been monitoring markets, so you can keep an eye out for signs that your own market is starting to recover.

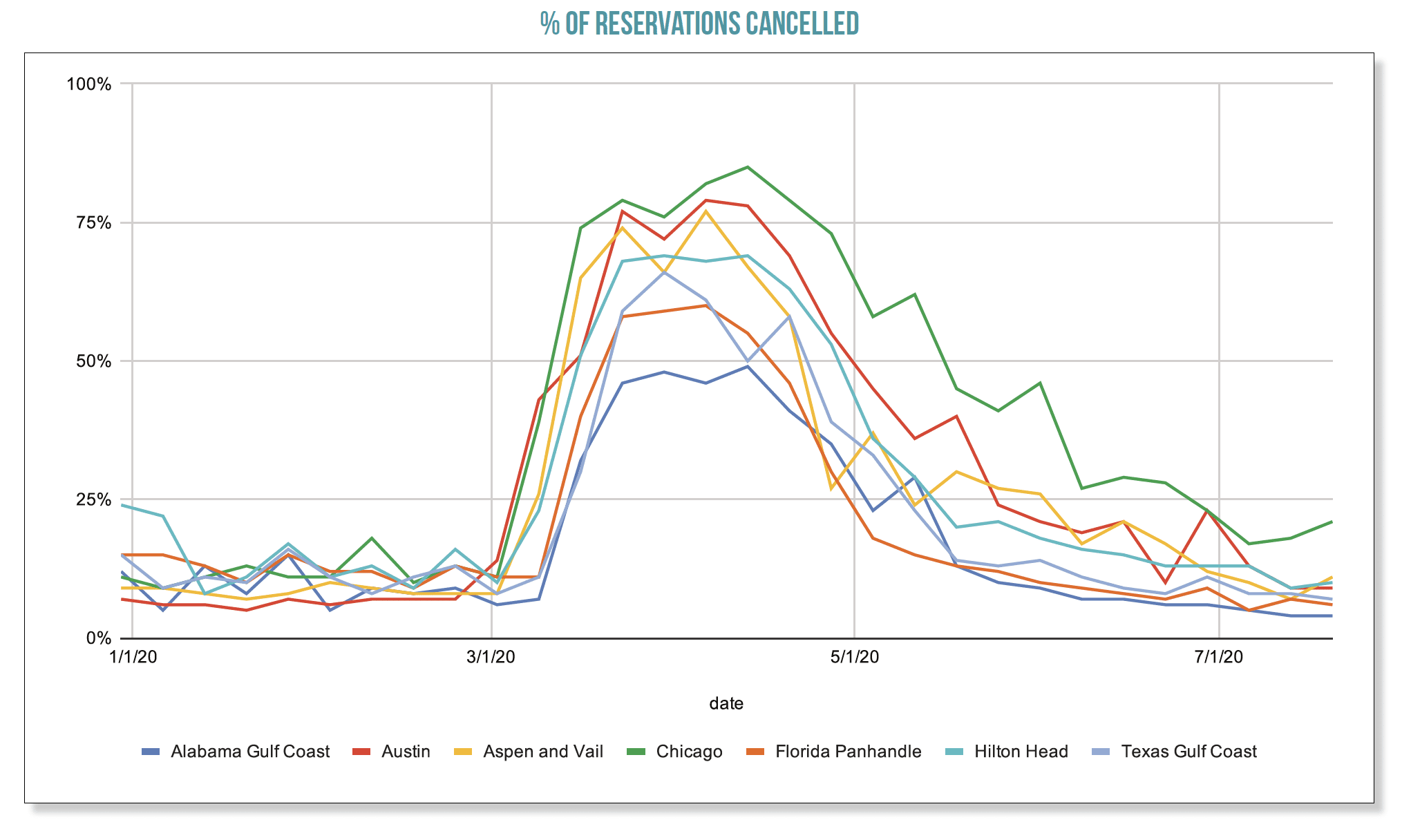

Cancellations by Cancel Date

As soon as COVID-19 cases began to rise in the United States, cancellations in the vacation rental market surged for about a week, signaling a weakening of travel confidence.

Although this initial wave of cancellations lasted a week, there is potential for another wave of cancellations for summer and fall reservations. We will probably see another round of cancellations for most markets as shelter-in-place restrictions extend further.

Additionally, if there are flare-ups of a second wave of the virus in the fall, we may see more cancellations then. Always be aware of travel perceptions in the media as well as shelter-in-place restrictions in your part of the country; these factors will be early indicators of future rounds of cancellations.

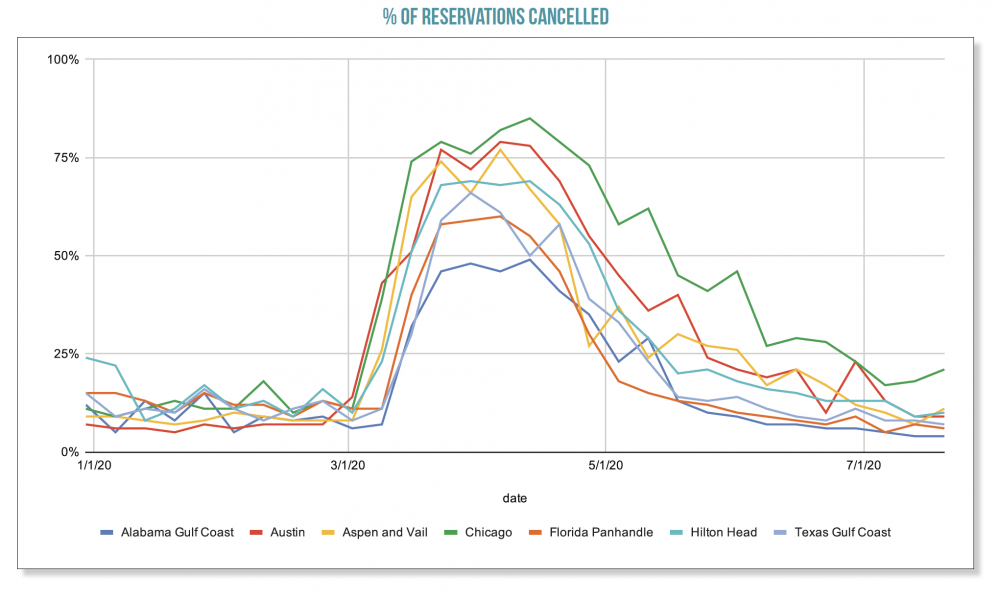

Cancellations by Check-in Date

In addition to looking at the number of cancellations made when travel restrictions are issues, we can also glean insight from analyzing the stay dates for those cancelled reservations to measure how uncertain guests are about their ability to fulfill their future travel plans. In most of the United States, we have not seen many reservations cancelled past mid-May (at the time of publication).

This dynamic will depend on market lead time, but the majority of cancellations made were for bookings in the same 30- to 60-day period. Because this is a fluid situation, monitoring how far out guests are cancelling reservations is another main indicator of consumer confidence moving forward.

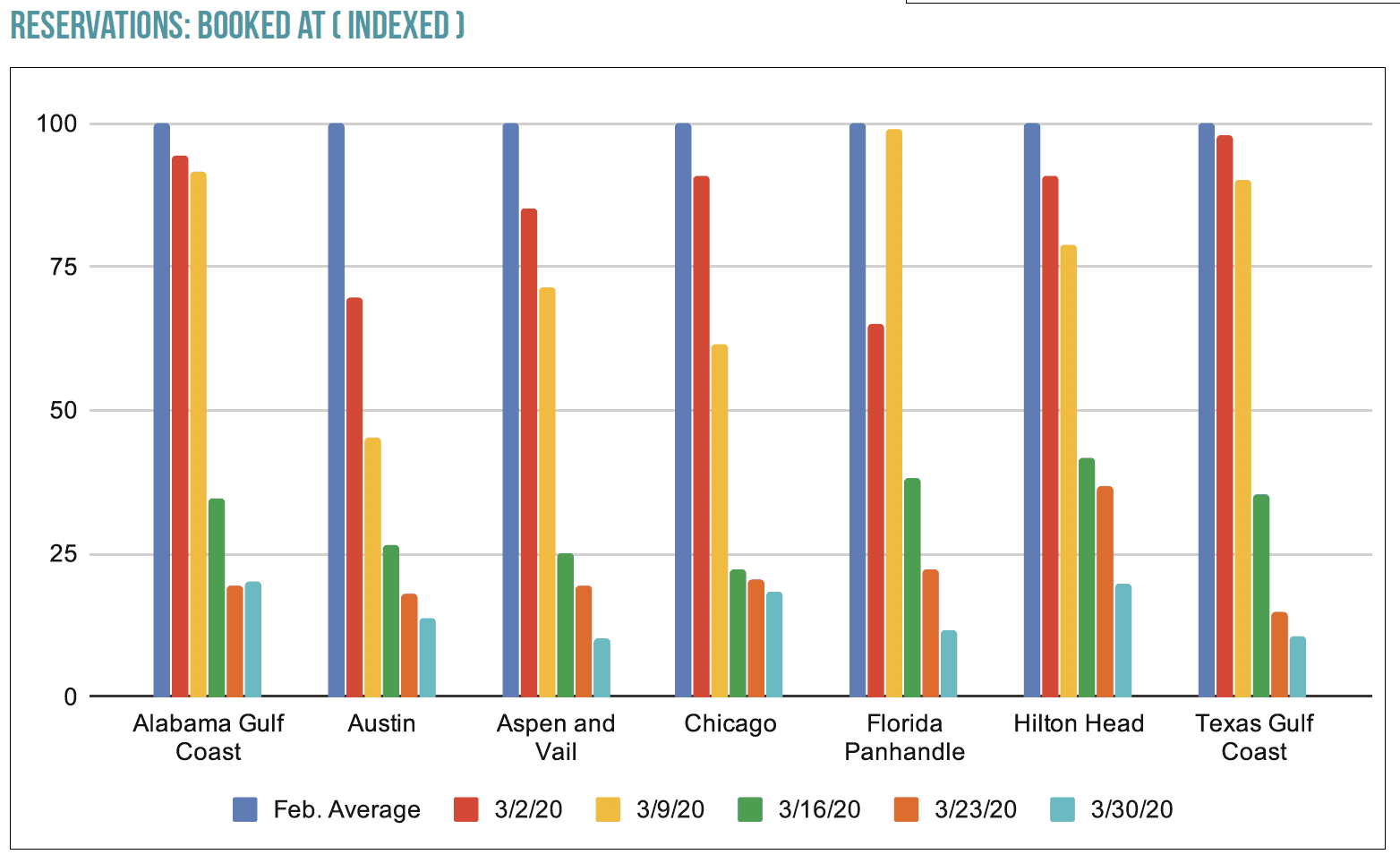

Booking Pace

Just as cancellation data can give insight into how optimistic guests are about fulfilling future travel plans, new bookings are also key measures of guest confidence.

As long as there is uncertainty surrounding the forecasted end date for most markets, we can expect the booking pace to remain slow. Guests are making few bookings farther out, and most bookings are made less than seven days prior to arrival, as a result of COVID-19.

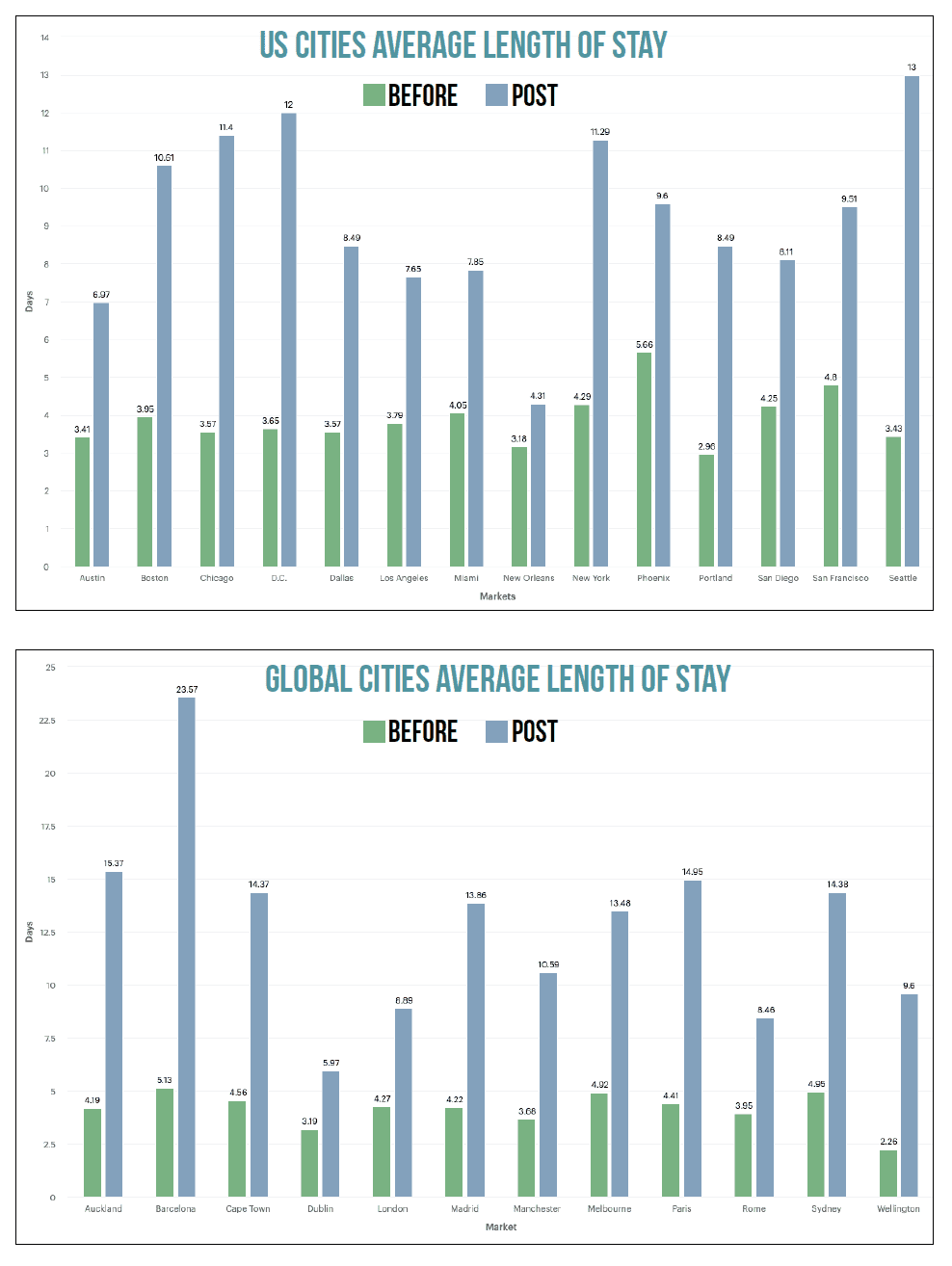

Shifts in Market Pricing by Listing Type

In addition to monitoring cancellations and booking pace, we have also seen a major shift in length of stay, particularly in urban centers. Looking at both US and European data, we see a clear shift to longer-term bookings. As a result, the ADR in the short term has also dropped significantly, given that most managers price their 30-plus-day rentals at a discounted rate compared with short-term daily pricing.

This might change the supply of vacation rentals because many of these urban managers might shift toward a long-term strategy.

A change in short-term stay supply in the near future will benefit those managers who continue to practice solely short-term bookings. Although it is too early to tell if supply has permanently shifted between different distribution channels (removing listings or shifting to long-term stays), this will probably appear in the long term and have an impact on prices across different channels.

Pent-Up Demand

Pent-Up Demand

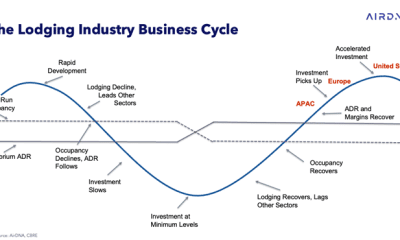

Unlike the gradual recovery of a stock market recession/depression, it is likely that when either a vaccine or antibody test (or both) are released to the general population, groups of individuals will reenter normal society after months of being cooped up at home.

We might see a recession/depression as a result of COVID-19; however, we believe that travel, particularly for vacation rentals, will recover faster than most industries once the shelter-in-place orders are dropped for a majority of the general population. The signals we will watch for to measure this recovery are a decrease in cancellations, an increase in booking pace, and a lengthening of the booking lead time in various markets.

The Need for Active Revenue Management for the Recovery

Despite decades of research and development, and millions spent on developing proprietary pricing algorithms, airlines and major hotel chains still practice “active revenue management.” This entails having revenue managers and pricing analysts constantly watch what their software is suggesting, so they can make judgment calls on behalf of their businesses. It is absolutely critical that property managers in the vacation rental space mirror these practices by investing time and resources into using objective data to make pricing decisions for their businesses.

Dynamic Pricing Is More Important Now Than Ever

Staying on top of changes in supply and demand in your market has always been important, but with travel trends changing daily now, dynamic pricing is an important tool for the entire vacation rental industry. It will continue to be important to react quickly to changes in your market, moving forward.

Using market-level data alongside individual listing data points allows dynamic pricing tools to stay competitive in a quickly changing landscape. Typically, market supply and demand do not shift much from day to day. This has changed recently, though; most markets around the world are changing daily as cancellations increase and booking pace decreases.

Bringing on New Owners Poses a New Challenge

The lack of quality historical data during the months most affected by COVID-19 will make establishing initial rates for new properties much more challenging.

To confront that directly, take advantage of market demand to gauge how to best set prices and edit and adapt those prices almost daily for new listings as you monitor pacing. You can do so manually or with an automated dynamic pricing tool. In either case, spending dedicated time daily to focus on pricing will be critical for the recovery process.

Be Ready for a Flood of Short Lead Time Bookings

Once restrictions are lifted, be prepared for a noticeable increase in short lead time bookings. With reservations slowing down dramatically for stay dates within the next six months, you’ll have more open calendars (even during high season) than you will have had in years prior. As a result, you’ll need to react quickly to adjust your last-minute discount strategy, override prices or minimum stay requirements, and reconsider new promotions or discounts you have in place.

These nimble approaches will attract new guests during orphan nights (available nights positioned on the calendar between two other reservations) and uncertain times.

The speed of the recovery is unknown, and every property management company will have to follow it daily to make the best strategic revenue management decisions for their organization.

A Caveat on Lowering Prices

With a lot of uncertainty right now, we caution you against lowering prices too aggressively to gain occupancy in the short term. Lowering your prices to be more competitive can be easily imitated by your competitors and can ultimately lead to a nasty price war.

Although occupancy may rebound quickly in the near future as guests begin traveling again, lower ADRs can take years to recover.

Use market data insights to assess how aggressively you need to update your strategy on a daily basis. Avoid lowering prices just because demand is low for your market, and be sure to take a look at booking pace, pricing by listing type, average length of stay, and more key indicators to make informed decisions when it comes to pricing. Although staying competitive with your pricing is important, it’s best to avoid digging price holes in the short term, which you could take years to emerge from in the future.

Revenue Management Is More Than Just Pricing

Revenue management and dynamic pricing are not one and the same. Using dynamic pricing is a great practice, but with low demand in many markets, property managers are going to have to develop their strategy to stay competitive when markets begin to bounce back.

Dynamic pricing is one component of a larger revenue management strategy that should also include channel management, marketing, forecasting, and other methods. Right now is a great time to get a grasp on a comprehensive revenue management strategy to implement in your business, starting with the way your inventory is sold and distributed.

Getting Creative with Distribution

If you are currently selling only on one channel (your direct website, Airbnb, Vrbo, or others), have you looked into expanding your channel presence and getting more eyes on your properties?

Low prices may not be enough to get occupancy levels up, and there can be completely new audiences for you to sell to on different channels. If you are not driving more traffic to your website via increased marketing efforts, then you should not expect more guests to find you.

Expanding your online channel presence can be an easy way to increase your potential guest pool. As always, it’s important to be mindful of the cost of distribution on various channels, given that we know commissions and fees can vary. Be sure to review any costs associated with expanding to new channels as well as the net rates you would see after booking.

Definitely agree that revenue management is more important now than ever. Dynamic pricing is absolutely essential in today’s climate.

Another important thing for property managers to consider is growing inventory. With more properties coming on the market, now is the time to pounce. If you need help with business development, visit http://www.VRMLeads.com.