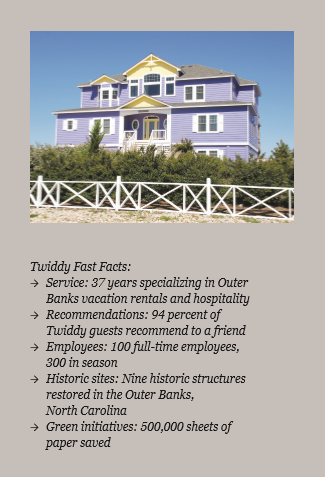

About Twiddy & Company: In 1978, Doug and Sharon Twiddy moved to the tiny village of Duck, North Carolina where Doug embarked on selling real estate and renting vacation properties. Not unlike most start-up companies, the business began out of an office located in the family home, and over time, expanded its operations. Four years after landing in Duck, Doug Twiddy opened the first, formal,Twiddy & Company office in the nearby town of Corolla, and Twiddy & Company was on its way to not only being the area’s premier rental management company but one of the most well respected local businesses.

Since its inception, the business has grown to 100 full-time employees who serve and represent nearly 1,000 Outer Banks vacation rental properties and their owners in Duck, Corolla, and the four-wheel drive beaches. Properties range from expansive 23-bedroom oceanfront estates to cozy rental cottages tucked away on unpaved roads.’

Since its inception, the business has grown to 100 full-time employees who serve and represent nearly 1,000 Outer Banks vacation rental properties and their owners in Duck, Corolla, and the four-wheel drive beaches. Properties range from expansive 23-bedroom oceanfront estates to cozy rental cottages tucked away on unpaved roads.’

Petrina Guthrie, Owner Services Manager

According to Petrina Guthrie, Owner Services Manager at Twiddy & Company, “I have been in the hospitality business for over 30 years, so I understand what it takes to provide an incredible vacation experience. When I first arrived in the Outer Banks (OBX), I surveyed several companies to see who was doing it right. Twiddy & Company was at the top of the list.”

The company’s mission is straightforward—provide vacation homeowners superior management services and guests an extraordinary vacation. And Doug Twiddy believes that this mission is only achieved with a team that, not only is competent, experienced, and motivated, but mirrors his drive for integrity and passion for personal service.

“Twiddy is extremely successful because it typifies what it means to be a good corporate citizen—whether to the staff, community, property owners, or guests,” adds Guthrie.

Starting with Kaba’s Keyless Locks

“About eight years ago, I was introduced to Kaba Oracode locks when I was working at another rental management company,” notes Guthrie. “We always had a good experience using the keyless access control system, so when I joined Twiddy I presented the locks as a replacement to the existing lock solution.”

Oracode is an intelligent, electronic access control system that provides keyless access for temporary users, such as vacation renters, timeshare owners, and corporate housing tenants. Using a time- and date-specific code, Oracode eliminates keys and cards as well as time-consuming access control management.

“With the Oracode system, we can generate and distribute lock codes in advance or in a moment’s notice and from anywhere in the world,” states Guthrie. When a guest enters a predetermined code into the lock, the lock uses its stored match “digital key” to decrypt the code. If the lock ID matches and the lock’s real-time clock indicates that the current time is between the designated parameters, then the lock will open—otherwise, the lock remains locked and secure. Oracode locks use three AA alkaline batteries, which typically last three years before needing replacement.

“Because our properties are located on or near the beach, they endure more wear and tear than homes located inland,” notes Guthrie. “One of most important selling points of Oracode locks is their oceanfront construction and finish options.”

Oracode locks are totally sealed to withstand climate extremes and meet ANSI A156.25 requirements for dust, humidity, and salt.

Upgrading to Kaba’s Oracode Live

“When Harry Schneider, the Kaba representative, told me that there was a new, next level of Oracode (Oracode Live), I was extremely interested to know how it could benefit not only our company, but homeowners,” says Guthrie. Oracode Live provides all the features of the stand-alone system but now adds real-time notifications and alerts, such as Guest First Arrival and Internet Down.

“When Harry Schneider, the Kaba representative, told me that there was a new, next level of Oracode (Oracode Live), I was extremely interested to know how it could benefit not only our company, but homeowners,” says Guthrie. Oracode Live provides all the features of the stand-alone system but now adds real-time notifications and alerts, such as Guest First Arrival and Internet Down.

According to Guthrie, “Oracode Live is definitely more convenient because of its ability to “talk to” the lock remotely. We have homes on the four-wheel drive section of OBX, which means it is very remote, and sometimes you have to drive 15 minutes on the beach to reach certain properties. Oracode Live lets us communicate with a lock without standing in front of it. Also, our maintenance staff has sent lock codes to preferred vendors directly from their smartphones, allowing vendors unattended access inside a property.”

Twiddy & Company has migrated 125 properties from the stand-alone Oracode system to Oracode Live.

Oracode Live also integrates into the BeHome247 energy management system. This unique combination further enhances a guest’s experience by creating a welcoming and comfortable environment as well as streamlines property management operations. With the BeHome247 Enterprise Property Control™ system, managers can: → Monitor and control a property’s temperature and lights → Adjust pool and spa settings, lights, and pumps → Receive notifications when the HVAC system or appliance is out of service

“An additional benefit of the Oracode Live system is the integration capability to the BeHome247 package,” says Guthrie. “We are really interested in its status management segment. Our house cleaners travel a great distance to OBX properties so knowing which home is vacant—because the guest checked out early—is really important to us. With status management, a guest enters a code into a lock and BeHome247 captures it, alerting us that a house can be cleaned early. Whether it’s allowing a guest simple, easy entry into a property or helping provide that WOW factor once inside a property, a satisfied guest means we’ve done our job. And in turn, we’ve served the homeowner well.”

Read More: http://www.kabalodging.com/

In addition, security breaches affecting businesses with an online presence or actively involved in ecommerce have become commonplace and well publicized.

In addition, security breaches affecting businesses with an online presence or actively involved in ecommerce have become commonplace and well publicized.

Pack has more than 13 years in the Outer Banks property management and real estate sales industry.

Pack has more than 13 years in the Outer Banks property management and real estate sales industry.