Property managers (PMs) traditionally provide a wide range of activities, including design and listing preparation, competitive benchmarking, pricing advice, marketing, distribution, guest screening and communications, reservation services, payment management, operations management, property care, emergency support, and owner services (e.g., tax and compliance and trust accounting).

The dominant model in the US is the full-service property management company in which all of the above services are delivered as one all-you-can-eat package and is typically priced between 15 percent and over 50 percent of rental income. There have been departures from this model in the US: most notably, Evolve Vacation Rental, which charges a 10 percent fee for marketing, distribution, and some listing preparation services, but does not provide on-the-ground property care services or operations.

Is the full-service, all-you-can-eat manager the only viable model or are there attractive, unbundled models? Is the idea of unbundling a threat or an opportunity for a PM? Will the listing platforms that drive unbundling change how the pie is divided? How should each of the components be priced? Is unbundling a “gateway drug” that can help ease DIY homeowners into using a PM or a margin killer that will relentlessly drive PMs’ margins down?

All-you-can-eat vs a la carte

One common economic argument for bundling is to package a key service with several services of lower value, and hence drive a higher take rate than what could otherwise be obtained. Arrangements like this typically do not last very long, as competitors are likely to unbundle in an effort to gain market share. From this perspective, Evolve’s progress will surely be closely watched because its entire strategy is centered on an unbundled, low-cost product. Much will depend on whether Evolve correctly identified the key value driver.

David Angotti, a former PM and co-founder of SmokyMountains.com, who first explained his vision of an unbundled PM to me, is on the other side of this debate. In his view, selling a homeowner exactly what he or she wants—unbundled guest management, distribution, property care, or revenue management—should have two positive effects: one, it should increase the addressable market by offering something for everybody (e.g., the Gen X empty-nester with the million-dollar second home may not want to relinquish screening guests, but he or she may not want to deal with the daily operational hassle of managing cleaning staff or revenue management). Second, as long as the “sum of the parts” is priced significantly higher than the bundle, the initial unbundled service might just be the prelude to an evolving, full-service relationship.

The European example

The European market is quite different from the US market, and its much larger traditional PMs—Novasol, Interhome, Interchalet, and Belvilla—are mostly master-distributors: a significant majority of their inventory has on-the-ground services either managed by the owner or by a local third party. In other words, they look much more like Evolve than Vacasa.

This likely explains why European enterprise PMs are larger than their US counterparts: offering listing, distribution, guest support, and owner services without directly providing on-the-ground services allows them to focus on source markets—which is important in Europe, where a different language is spoken every few hundred kilometers—while covering much of Europe for destinations.

So, this unbundling was likely driven by necessity due to relatively small source markets and distributed destination markets, but it seems to have had the side effect of increasing some European PMs’ scale. Simon Lehmann, former GM of Interhome and president of Phocuswright, argues that the different dynamics of the European market are also due to the greater maturity of this market. Whichever the reason, the European example demonstrates that unbundling is viable at a significant scale.

Pricing each component

So, if one was to unbundle a PM’s services, how much would each component be worth? This is a difficult question to answer, but here is an attempt. Let’s assume a full-service manager charges an effective commission of 50 percent including guest fees. A good proxy for a PM focused on listing management and distribution only is Evolve in the US, and Novasol, Belvilla, Interhome, and Interchalet in Europe. Commissions for this group cover a wide range: from Evolve’s 10 percent to the European’s commissions in the low- to mid-thirties.

What explains the discrepancy? The fact that European PMs control a significantly larger share of direct bookings through more complex distribution arrangements likely explains this discrepancy. A typical European “master distributor” likely captures a much higher share of its bookings from direct channels: direct mail, catalogs, CPC, its house list, and its own website. Even master distributors’ third-party distribution is likely more complex because thousands of travel agencies still play some role in Europe. Conversely, Evolve’s bookings are likely more concentrated across the three large listing platforms. This likely caps the opportunity to increase master distributers’ commission rate in the short term until direct distribution is significant.

One additional distribution component that can be priced separately is the channel manager; there are several available, and charges typically hover around the 1 percent commission mark.

How attractive are the margins for a master distributor? As reliance on listing platforms is increasing, these margins are likely shrinking. This is first because the listing platforms are bidding up the price of advertising, especially online. Second, the effective low rates charged by most listing platforms are probably not going to last; a master distributor like Evolve can’t distribute on a platform like Booking.com because a 10 percent commission can’t cover a 15 percent booking fee. The other platforms are still viable because they simply pass the cost onto the guests via the guest fee. However, the listing platforms’ effective booking fees (combining guest and booking fee) are already well above 10 percent; this begs the question of whether guest fees will last. The success of vacation rental metasearch engines—Tripping and others—might make charging guest fees more difficult.

The urban PM and Airbnb’s cohost

The urban PM presents an interesting case study: many urban PMs focus on on-the-ground services much more than on distribution; and as such, they are a good proxy for an unbundled PM focused solely on operations and property care. This is particularly the case for Airbnb-only PMs and Airbnb’s cohost program. Many urban PMs and Airbnb’s cohost program charge between 15–20 percent commission (typically without guest fees other than a pass-through cleaning fee). This implies that a 15–20 percent range is a good guess for the stand-alone value of setting up the listing, managing guest communication, and most importantly, coordinating local services.

Guest communication is an item that can be further isolated; as a technology component, (unified inboxes, auto responders, and templates), this is typically priced at 1 percent or below. Companies like Guesty have long operated stand-alone services. Similarly, there are several outsourced call center services available, which are also typically priced at 1–2 percent. Interestingly, the listing platforms are encroaching on this domain both by offering tech solutions and services (such as guest call center support).

This implies that a 10–14 percent commission is a reasonable proxy price for the component of a PM’s job that relates to managing—but not providing—local services. The services themselves are typically either charged to the guest (e.g., cleaning) or to the owner (e.g., maintenance).

The tech–enabled PM

Revenue management is another feature of the service stack offered by a PM that can be priced out separately: stand-alone charges for these services typically hover around the 1 percent mark or lower by wholesale providers. This, together with guest service apps, is often a feature of the so-called tech-enabled PM.

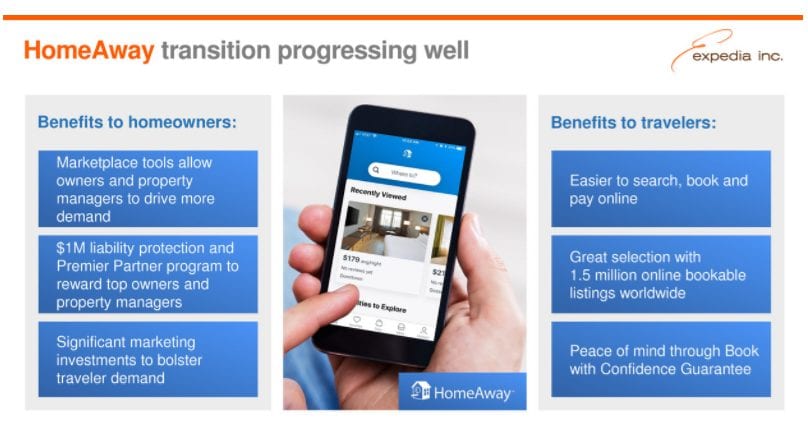

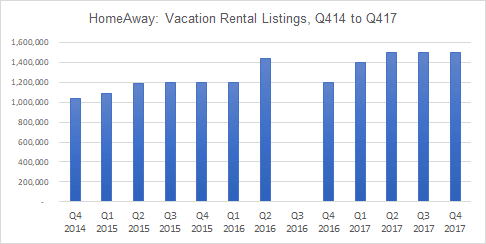

The “tech-enabled PM” label is often used in conjunction with a small group of typically US-based PMs who hope to derive efficiency, better distribution, or more accurate pricing through technology. More likely, we will find the tech-enabled PM elsewhere: with the listing platforms that are truly offering more and more sophisticated technology to both owners and PMs. These platforms include HomeAway’s MarketMaker, Airbnb’s unified mailbox or check-in help, and Airbnb’s increasingly extensive integrations with local government to account for and collect taxes; there is no doubt who has the required scale in a technology race between PMs and platforms.

So even the aforementioned owner services, when unbundled, may be under pressure from parallel offerings from the listing platforms.

Gateway drug or margin compression?

So, is an unbundling of property management services a smart strategy to bring in a wave of new clients, or is it a necessary evil as the listing platforms start chipping away at the services traditionally offered by a PM?

Several PMs have pointed out that some segment of owners may only want to give up control of certain aspects of managing their property: for instance, Gen Xers who do not currently rent their second home may want to maintain control over screening who gets to stay at their home but may not want to get involved with the day-to-day hassle of organizing turnovers.

Similarly, an RBO may not want to take on a full-time manager just yet, but it might be willing to pay a fee for after-hours maintenance support. Viewed this way, unbundling services may act like a “gateway drug”: once owners start realizing that it is advantageous to give up control over some aspects of managing their property, they may ultimately gravitate towards adding on other services.

Based on the calculations above, not all components of a PM services bundle have the same margin. Viewed like this, it could actually be beneficial for a PM to let go of certain services. Also, David Angotti makes the argument that owners rarely understand just how many services their PM provides to them. Once services are unbundled, the sum of the parts may quite well cost more than the bundle—and this alone guides owners back to service bundles.

The local service conundrum

Tobias Wann of Europe’s @Leisure maintains that a linchpin in the relationship between PM and owner is still the local relationship—the on-the-ground-services. This idea makes sense because ultimately, the asset value of the property dwarfs the annual revenue stream; thus, good stewardship of the asset is likely to feature prominently in an owner’s priorities.

From the back-of-the-envelope calculations above, it also seems that local services are a meaningful revenue component inside a PM services bundle; because the actual cost of the service is typically passed on to the guest (or owner for maintenance), management of these services should carry healthy margins. Lastly, PMs should not expect margin pressure over local services from the listing platforms because this is not an area of strength for them. Indeed, a country manager for a leading listing platform told me recently that, from his perspective, control of the relationship with local service providers was the leading reason why owners chose PMs vs rent-by-owner.

Of course, this critical local component has traditionally also limited PMs’ ability to scale beyond their original service area. Combining technology that helps manage and deliver local services more efficiently with building an advantage in sourcing high-quality, local service providers is an attractive path toward building a sustainable competitive advantage for PMs.

Conclusion

The full-service PM has long been the dominant model in the US. With the emergence of the urban, Airbnb-only PM, there is now an emerging case study of a set of US PMs focused mostly on local services. This group of PMs sets a benchmark for how operations, listing management, and guest management, unbundled from distribution, would be priced; a prevailing price point is around a 15–20 percent commission.

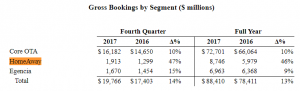

Conversely, Evolve has unbundled a package of services focused on distribution and including listing management and guest management. Large European PMs offer similar hybrid models. These bundles are typically priced between 10 percent and 30–40 percent, depending on how much distribution clout the PM has. As the listing platforms continue to drive more traffic to PMs, distribution-focused bundles will see margin pressure; the more a PM’s distribution is proprietary, the stronger the position of that PM (but margin pressure will continue because the significant spending of the listing platforms are bound to drive traffic acquisition costs up).

In most markets, a significant number of homeowners still choose a rent-by-owner model over a PM, and millions of second homes have not entered the rental market yet. Offering property management services a-la-carte, versus only bundled full-service packages, can provide an introduction to property management services for both RBOs and latent supply. Starting from local services may be more defensible in the long run and likely carries higher margins.

Two conferences,

Two conferences,

Mark Okerstrom:

Mark Okerstrom:

Additionally, Lehmann has been involved in strategic planning with many of the leading and up-and-coming players in the vacation rental sector, has served as a board member for

Additionally, Lehmann has been involved in strategic planning with many of the leading and up-and-coming players in the vacation rental sector, has served as a board member for

However, HomeAway chief commercial officer, Jeff Hurst said that was never going to be the case.

However, HomeAway chief commercial officer, Jeff Hurst said that was never going to be the case.

I recently traveled to Tallahassee to represent the

I recently traveled to Tallahassee to represent the

However, the reality is that many vacationers don’t know those three W’s when they begin their online research.

However, the reality is that many vacationers don’t know those three W’s when they begin their online research. However, if travelers would prefer to search by why (fishing, beach, ski, golf, etc.) or how much, there is no easy option.

However, if travelers would prefer to search by why (fishing, beach, ski, golf, etc.) or how much, there is no easy option.