In the first two articles of this series, we explored the best strategies to prepare your short-term vacation rental company to sell. Now that you have grown your revenue and inventory, hired the appropriate staff, and updated your management contracts, your company is ready to receive an offer.

In this final article, we will examine multiples and structures of common deals in the current market. Although higher multiples increase the overall purchase price, the structure and terms of pay-out can be the most crucial part of the offer.

MULTIPLES

Of course, every seller wants the highest offer for their company, and a multiple of your financial position is where your buyer will start.

Adjusted EBITDA

EBITDA represents your earnings before interest, taxes, depreciation, and amortization. In our “Back of Napkin Analysis,” we discussed common add-backs and deductions to help you find your adjusted EBITDA (AE).

Up to $1 Million Adjusted EBITDA

For companies with up to $1 million AE, the current market multiples are three to five times LTM (last twelve months) AE or a weighted average of the previous 36 months, with heavier weight on the more recent periods. If your company did $750K AE, you can expect somewhere between $2.25M and $3.75M on the initial offer.

What multiple will you get? We also dove into the subjective aspect of higher multiples in the “Back of the Napkin Analysis” article, but below are some of the major factors that are important to buyers:

Unit growth and revenue growth per unit

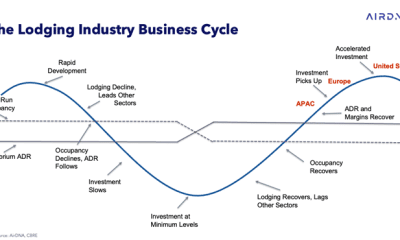

How “hot” the market is (i.e., longer and more frequent peak seasons, higher management commissions, available inventory)

Staff and management contracts

The terms you are willing to accept (We’ll get into this below)

Over $1 Million Adjusted EBITDA

Most short-term vacation rental companies do not fall into this category, so we will not dive in too deep. If your company is doing over $1 million in AE, has unit count growth, revenue growth, and has a strong staff, you can likely command a premium multiple higher than the three-to-five range.

Net Revenue “Take”

Net revenue or “take” represents your management commissions and ancillary fees. Ancillary fees are all the extra fees a guest pays, such as damage waivers, booking fees, or housekeeping fees.

Other than looking at multiples of adjusted EBITDA, we are also seeing buyers make offers of approximately one times the net revenue.

For example, if your company takes $750k in rental commissions and $500k in fees, you could be looking at an offer of $1.25 million.

STRUCTURE AND TERMS

As mentioned above, a high purchase price may look appealing, but the devil is truly in the details.

How “clean” is your company? Do you have consistent growth? Can your staff operate efficiently without you? Are all your management contracts assignable and auto-renewable? How clean your company is will determine the terms of the deal.

In today’s market, we typically see 50–75 percent cash at closing and 25–50 percent in notes from one to five years. The buyer note may or may not be contingent on certain factors, which can be negotiated. These contingencies are normally based on consistent revenue, unit declination, or the owner staying on for an agreed amount of time.

While you may be cautious of a buyer note full of contingencies, there can be substantial earn-outs for sellers. We’ve seen buyers offer an extra $10,000–20,000 per additional unit onboarded for one year after the sale. That could be an extra several hundred thousand dollars if you’re a rapidly growing company.

Remember, better positioning your company to sell directly correlates to higher multiples and more lucrative terms.

RSS