ASCENT has been helping merchants take credit card payments in the Vacation Rental (VR) industry for more than 20 years. We are, therefore, uniquely positioned to provide some perspective on what is happening in the payments industry during the COVID‐19 pandemic. The VR Industry will get through this crisis, but not without some potentially serious introspection and infrastructure changes in some areas to create a more solid financial foundation. If you are in this space for the long haul, read on.

Credit Card Processors, OTA’s, and Payment Facilitators are holding funds at an unprecedented rate at a time when cash flow is desperately needed by many short‐term and medium‐term rental property managers. Within days of the stock market plunge, reports surfaced of large processors putting an immediate hold on all travel‐related monetary distributions, including valid credit card transactions. Well known OTA’s in the Short‐Term Rental (STR) space made unprecedented policy changes to refund rental payments to guests who had not yet completed their stays, while others chose to discontinue their “early payout” programs. To understand why these decisions were made, and how the players in the VR space are being affected, let’s take a look at how the banks that process credit cards look at risk and the impact of consumer’s rights in the U.S throughout the payment system.

How Acquiring Banks Calculate Vacation Rental (VR) Risk

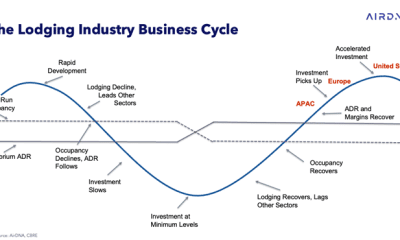

The credit card companies (card brands) and acquirers (processing banks) tend to lump VR under a generic “T&E” (travel and entertainment) category, along with airlines, cruise lines, and hotels. Scrutiny of these businesses is extremely high, especially at this time. The federal government is working on getting bailout funds to the airlines due to how hard they’ve been hit by the coronavirus causing halts on air travel. Every airline has an acquiring bank behind them who processes their credit card payments and is responsible for covering the millions and millions in risk. Acquirers look at VR in a similar light.

Acquirers underwriting a vacation rental property management company must have knowledge regarding both the VR ecosystem in general and how the management company operates in specific. From a processing bank’s perspective, the farther in advance a property manager takes rental deposits, the longer they need to count on the PM to stay in business, stay fiscally sound, and to continue to provide the service at the level the guests expect. The more volume a PM processes on credit cards, and the longer in advance before providing the guest with the exact experience they expected, the higher the processor’s risk grows.

The risk is held at the acquirer/processor level because if anything goes wrong with the PM or the service they are providing, the processing bank is required to step in on the PM’s behalf and make it right for the cardholder. What can go wrong?

- the house doesn’t look like the photos the guest saw online

- the house is no longer available to rent

- natural disaster wipes out access or homes themselves

- PM goes out of business

In these situations, the guest can exercise their legal right to dispute the transaction in the form of a chargeback. Chargebacks are an annoyance when they come in one at a time to a healthy PM, but when they come in by the hundreds (or thousands) due to a serious issue, risk mitigation quickly becomes a high priority. Processing banks take on millions of dollars of risk with each approval of large property managers. A quick and dirty calculation of how much risk the bank is taking on YOUR account is to take your monthly credit card volume and multiply it by how many months in advance you accept rental deposits. What happens if you don’t have enough funds in the bank to cover all those advanced payment refunds in a crisis? The processing bank is required to cover it on your behalf.

All merchant processors, whether Payment Facilitator, MSP (Merchant Service Provider), or local bank, have risk policies designed to monitor and identify potential losses before they occur (or sometimes, as they are occurring). In one monitoring process, the acquirer will conduct a periodic account review (often annually, in normal times). They will analyze the processing history of the account, including refunds and chargebacks, and ask for updated financial information for the business to verify the business’ liquidity and financial stability.

Acquirers also have systems in place to analyze processing on a transaction by transaction basis. If there are any changes or anomalies, the transactions will be flagged and often investigated. One example of this would be abnormally large sales and/or refunds: if a donut bakery ran a $100,000 sale, they might reasonably pull that transaction aside and check in with the bakery before sending the transaction through the financial settlement system. Was it an employee error, a fraudulent charge, or a valid sale to a Simpson’s convention? (mmmmm donuts…)

Acquirers also look at unusual refund and chargeback velocity. Refunds with no previous offsetting sale can be a fraudulent way for crooks to steal money. With high refunds occurring due to the COVID‐19 cancellations, the acquirers are also needing to verify that merchants have the funds to cover the refunds they are processing. Which brings us to one of the biggest factors in risk and business health within the vacation rental ecosystem.

In the STR industry, it can be difficult during normal times for a processor with millions of dollars at risk with each merchant account to know which merchants are going under and which are financially sound. In the middle of a global pandemic, it is even harder. One of the strongest indicators is whether the property manager holds the advanced deposit funds until the stay occurs. Those who do, have strong reserves to meet unanticipated demands. Those who don’t, or those who feel the need to “borrow from escrow” to pay operational expenses likely do not have the liquidity to make it through a crisis. Regardless of what your own state’s real‐estate regulations require, thinking of your guests’ rental deposits as your GUEST’S money – and therefore untouchable until the promised services have been delivered – is not only wise, it’s the only way vacation rental property managers are going to make it through this crisis.

ALL payments providers in this space – whether OTAs, payment facilitators, banks, or processors – are looking at the travel merchants right now and trying to determine how to best limit billions of dollars in potential losses. Property Managers should expect to hear from their payments provider and should be prepared to provide financial documentation that can support cash on hand relative to current exposure based on the payments they’ve accepted for bookings that haven’t happened yet. It’s important now, more than ever, to have a payments partner that can advocate for you, tell your story, and help keep your cash flow flowing. The property managers that are utilizing trust/escrow accounts are going to be the ones that get through the crisis we’re facing today and will be prepared for whatever the next one is.

How Consumer Rights affect VR Risk

Years ago, consumer rights were governed by Federal Regulation Z (Truth in Lending), which provided consumers the right to a full refund on transactions they claimed they were “not satisfied” with. Today, similar consumer rights are governed at the U.S. federal level under the Fair Credit Billing Act, as detailed here: https://www.consumer.ftc.gov/articles/0219‐disputing‐credit‐card‐charges .

The card brands (Visa, MasterCard, American Express, Discover) further regulate the process as it pertains their payment method. Each company has hundreds of pages outlining what a consumer/cardholder must do in order to invoke these rights after paying with a credit card, and what a merchant must do in order to prove that the payment is valid and should be honored.

Given the cardholder’s federally mandated rights, and because the card brands maintain that they are not a collection service but instead a payment method with which to transfer funds between two willing parties, the responsibility ultimately falls on the merchant’s shoulders to prove:

- the cardholder authorized the payment

- the cardholder read and agreed to all relevant policies

- the services were provided on time and match what the cardholder expected

In the VR industry, where payments are taken in advance and generally not in person, proving these things can be complicated.

How to Protect Yourself

1. Proactively communicate with your guests

2. Have your documentation in order:

- We recommend that each guest who is paying is required to physically sign the lease agreement or a receipt and return it to your office.

- Guest signature and/or initials should be within one inch of the cardholder agreement, the total due, and any policies you want to protect – especially your cancellation policy.

- If the guest did stay, you’ll need to provide the date services were completed and prove that the customer acknowledged receipt. Consider having guests sign a document when they arrive and depart.

3. Process refunds due in a timely manner

- If you receive a chargeback where you agree that a credit is due, and you have already issued a refund, provide proof that the refund was issued, along with a brief explanation and timeline of the transaction to avoid refunding the guest twice.

- If you received a chargeback where you agree that a credit is due but you did not yet issue a refund, we recommend you accept the chargeback because the cardholder has already been credited.

4. Make sure you are the Merchant of Record (MOR)

-

- Payment Facilitators (like Stripe and Yapstone) and Channel Managers (like Expedia and Airbnb) bundle your transactions together with your competitor’s transactions to submit them through the processing system. They receive your funding from the card‐ issuing banks and place them in accounts that are not necessarily FDIC insured before they send the funds to your financial institution. Payment accounts through Payment Facilitators (Payfacs) and channel managers often require you to sign over control to them in areas such as cancellation policies and dispute negotiations. It’s difficult to advocate for your own best practices when someone else has control of your money, your terms, and your policies.

- Processors and Merchant Service Providers provide individual merchant relationships directly with the acquirers and, instead of making up their own rules about your money, are required to enforce card brand regulations as they apply to risk, chargebacks, and security. The card brand regulations rely on clear documentation from individual merchants to help them enforce the payment of transactions and rental terms. If a Property Manager with an MOR account has a rental agreement that says no refunds, and the PM got the (actual) cardholder’s signature or initials next to that policy, the card brands, the processor, and the MSP will help support that agreement throughout the chargeback system. The MOR always has the latitude to give a refund or a partial refund as they see fit, but that decision will not be made for them as long as they supply the correct documentation within the chargeback cycle.

A note about the (actual) cardholder signature mentioned above: In cases of fraud, including someone using a stolen credit card number or a spouse “borrowing” a card number, different rules apply. And it is in these cases, as well as the cases where the cardholder claims the property is not what they expected (dirty, broken hot tub, etc.), that being the MOR is not enough. Here you need a Processor/MSP who is not only experienced in applying chargeback regulations in general, but also in the vacation rental space in particular.

5. Ensure you have the Consultative Support you need

There are over 120 different chargeback reason codes, and each reason code applies differently to each industry type. Make sure you choose a processor who knows how to interpret the 869 page Visa chargeback regulations and how to apply those requirements to the VR space, who can offer guidance on the verbiage to use in your rental agreement that best protects your business, and who will take the time to provide personal analysis and counsel for each dispute you may receive.

Updated Chargeback Information Relating to COVID‐19

As of 4/6/2020, the card brands have not made any adjustments to the chargeback rules or timeframes to accommodate the COVID‐19 pandemic. They maintain that merchants are ultimately responsible for issuing a refund to the cardholder when the merchant has cancelled the service. Merchants can offer a credit or voucher for future use if that is acceptable to the cardholder but should process a refund promptly if the cardholder declines the merchant’s offer.

Outlined below are the two most common chargeback codes used to‐date by issuing banks to justify COVID‐19 cancellation disputes, and how you can best protect yourself against them:

Cancelled Services/Credit not Received

- Used when the guest cancelled and is expecting a refund, even if they were in violation of your cancellation policy.

- Best chance of reversal will PROVE the guest agreed to your cancellation policy and cancelled outside of it.

- Guest signatures and/or initials are within 1” of your cancellation policy

- Proof the guest had to click to agree to your cancellation policy online to complete the booking

- Documentation showing the date the guest attempted to cancel

Services not Rendered/Provided

- Used when the guest participated in the transaction then claims they did not receive the services because the merchant was unwilling or unable to provide it.

- Best chance of reversal will PROVE the guest completed their stay or agreed to your cancellation policy and cancelled outside if it.

- Guest signatures and/or initials are within 1” of your cancellation policy

- Proof the guest had to click to agree to your cancellation policy online to complete the booking

- Documentation showing the date the guest attempted to cancel

In anticipation of these chargebacks increasing due to COVID‐19 cancellations, Visa recognizes the significant burden on the merchants, and has issued a statement regarding their intent to resolve disputes fairly and with consideration given to the unprecedented situation merchants find themselves. Without technically changing chargeback regulations, they’ve recommended the following:

- If a cardholder purchased services and the merchant cancels due to a government prohibition of providing the service paid for, the cardholder should not have a right to dispute the transaction and receive a refund.

- If a cardholder is unwilling or unable to use the services made available by the merchant, who has fulfilled its obligations to provide the service and has properly disclosed its terms and conditions, the cardholder should not have a right to dispute the transaction and received a refund.

While we are very early stages of the fallout of this pandemic, it appears Visa is attempting to clarify that if a merchant cancels the reservation, funds should be returned to the cardholder. However, if the cancellation is due to government access prohibition, no refund should be due. Ascent Processing is

hopeful that this will indeed prove to be the case, become a permanent adjustment to the Visa regulations, and be adopted by MasterCard, American Express, and Discover. Please note that it is still the merchant’s responsibility to respond to each dispute received with the pertinent information and documentation to prove their case.

With estimates of an upcoming 20% or higher unemployment rate due to the current medical and financial conditions, one can only imagine how many cardholders will attempt to dispute otherwise valid transactions in order to reduce their own debt and monthly expenditures. In anticipation of this, Visa has modified their processes to include velocity tracking of chargebacks coming from individual issuing banks across all merchant types. Their intent is to intercept as many invalid chargebacks as possible before they get to the merchant, but their ability to manage this on a case‐by‐case basis is limited.

BOTTOM LINE:

To maintain the most control over your payments during this extraordinary time, be flexible and offer your guests solutions that satisfy their needs.

Stay safe out there, friends.

Great article and clarifies why to date the chargeback “noise” has been minimal compared to other effects.

Regina, Julia, Brett and team – this article makes it clear why Sand ‘N Sea has been an Ascent partner for 20+ years. Thank you.

Agreed, Claire. This is why we have also been an Ascent customer for as long as I can remember. I love the clarity they provide in “normal” times and especially appreciate the assistance when things are completely turned upside down.