It’s been quite a roller coaster ride since launching VRM Intel Magazine in the fall of 2015.

I love the vacation rental industry. I love the uniqueness of vacations in privately owned homes, villas, condos, cabins, chalets, cottages, and gîtes and the lifelong memories that result. Families become closer during a vacation home stay. Friendships are deepened, and solo travelers can push the reset button, as I can attest to while writing this from an English cottage in Suffolk.

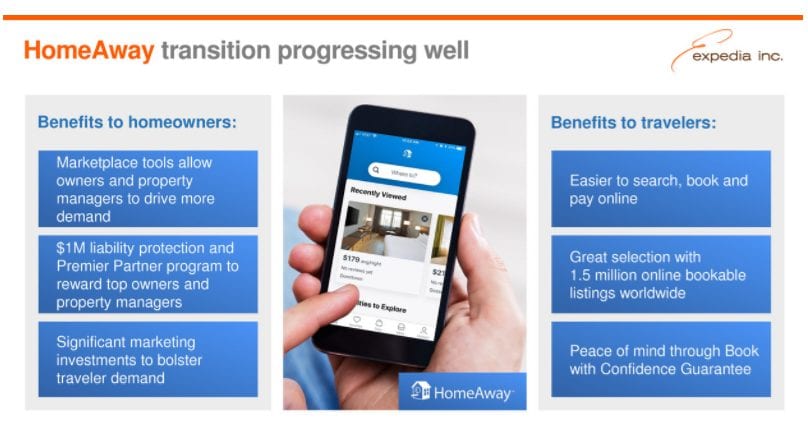

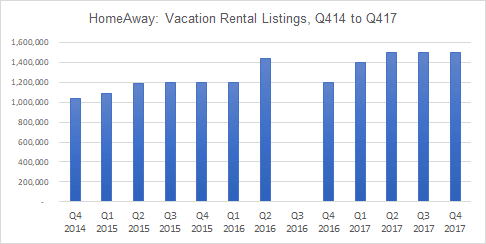

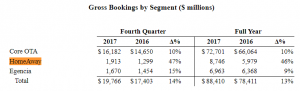

Since launching the magazine, so much has changed in the vacation rental industry—the technology landscape, consolidation, margin compression, the propping up of unproven business models by outside investment, and the increasing dominance of OTAs. For many managers and homeowners, Expedia’s purchase of HomeAway sucked. I know because they write to me about it all the time. Under Expedia, HomeAway seems to change algorithms, business models, and policies with the weather. Even Comcast CSRs are saying, “At least we don’t work at HomeAway.” (It’s a joke, Expedia; don’t sue me.) Expedia CEO Mark Okerstrom excused the displeasure by saying, “The property manager and owner community are adjusting to the changes.” Perhaps the property manager and owner community would adjust . . . if the business model and rules of the game would stop changing. Hopefully, the company is getting close to solidifying its pricing model and terms, and PMs can begin to see some stabilization.

Meanwhile, industry experts are maintaining that the “top of the funnel”—which for us commoners means the widest market point where customers find vacation rentals—is closed, arguing that Airbnb, Expedia/HomeAway, Booking, and TripAdvisor (in that order, at least today) have shut innovation down with monumental barriers to entry for newcomers. And those industry experts advise property managers to stop fighting it. In fact, in the upcoming spring issue of VRM Intel Magazine, we include two articles by authors who make strong pro-OTA arguments.

In addition, greed is affecting the industry. Investors smell huge returns. The tiny margins received for vacation rental bookings are being redistributed in chaotic, irrational fashion. And true innovators and entrepreneurs who work every day to make the industry better and level the playing field are being pushed out by more avaricious investors and executives (Spoken like a bleeding-heart liberal . . . I get it).

My frustration is that these influences do not define the vacation rental industry. While I fear I am being irrationally self-indulgent with this Jerry Maguire moment, there are some observations from the past two and a half years I feel compelled to share.

Note to OTAs

Vacation rentals are more of a considered purchase than hotel rooms are. That means vacationers have more questions and take more time deciding on the right rental than they do when booking a hotel room. Trying to force vacation rental buying processes into the narrowly defined path of booking a hotel leaves ample room for disruption. If the goal of OTAs is to simplify the booking process, they might consider finding ways to answer as many shopper questions as possible. For example, forcing vacationers to firmly decide their exact location and exact dates to complete a search does not address the needs of a large segment of travelers looking to stay in a vacation home. Admittedly, the current OTA path is more effective in urban areas; but for travelers who would choose to stay in either Vail, Breckenridge, or Keystone for the right value or who would consider North Myrtle Beach, Hilton Head, or Tybee Island for their summer vacation, this booking path is anything but simple. (Try these exercises.) Even easy property FAQs would be a great addition.

And then there’s the leakage issue. Expedia, you came up with and promoted the “billboard effect” and used Cornell to defend your theory. You said that the value of listing on an OTA comes not only from the bookings that happen on your platform but suppliers stand to gain much more with off-platform bookings. Less than a year ago, you defended the billboard effect theory with a follow-up study saying, “the billboard effect still occurs, since many consumers visit an OTA prior to booking direct.” But for your vacation rental suppliers, you want to eliminate the billboard advantage that you promote to hoteliers as a core value proposition? And now you want to track down those off-platform bookings by requiring property management companies to provide reporting and submit to internal audits of their books? (See HomeAway’s new terms and conditions for property managers.) Instead of trying to monetize every visitor who clicked on one of your Google AdWords and subsequently booked off-platform, is it possible you should first improve your platform to earn the booking?

And speaking of Google, it is actively building a booking platform for vacation rentals. But before property managers jump on the Google bandwagon with both pocketbooks, our industry should be careful that it’s not escaping the frying pan only to leap into the fire. As Expedia and Booking know, Google can be more addictive and tougher to quit than opioids.

In the United States, downtowns were ruined by big box stores, which were ruined by Amazon and ecommerce. Today’s OTAs are reliant on models that are not ideal for booking a vacation rental—for the guest or the owner/manager. I respectfully disagree with many of my friends and colleagues who claim the “top of the funnel” is closed. If the current platforms do not adequately meet the needs of consumers and suppliers, opportunity exists for disruption. It may not happen overnight, but I believe it will happen.

Nonsensical Regulations

One of the reasons the industry has become so wacky is Airbnb. Yep, I know, you can’t say that, but it’s true. Airbnb provided a marketplace for homeowners and long-term tenants to rent homes, rooms, and mattresses in places where it was illegal to do so. In contrast to the centuries-old practice of renting vacation homes, those residential rentals sprung up unlawfully.

I believe Airbnb made things worse for the vacation rental industry in the following two ways:

- Airbnb did not attempt to ensure rentals were legal before allowing them to be listed. Instead, Airbnb allowed (some might say encouraged) illegal rentals on its marketplace, upset entire neighborhoods/cities, and then lobbied municipalities after the fact. I understand the concept of asking for forgiveness instead of permission, but Airbnb took that strategy to a whole new level.

- Airbnb has actively and successfully lobbied for the rental rights of primary home residents (owners and tenants) at the expense of second/vacation home owners, causing a wave of regulations that ban rentals in which the primary resident is not present.

The results of Airbnb’s actions have been felt in almost all traditional vacation destinations in the United States. City officials in residential markets have enacted precedents for legislation that are bleeding over into core vacation rental destinations. With spreading regulations and short-term rental bans, residents in mountain, beach-front, lake, theme-park, and golf communities have become emboldened to raise hell with small, resort-town city council members about the (undocumented, of course) late-night debauchery that is taking place in the evil dens inhabited by vacationers. Even vacation rental meccas like Orange Beach, Destin, and Tahoe are facing unnecessary regulation. And second-home owners don’t get a vote.

But even in urban areas, the excuses behind regulating rentals don’t make much sense. One of the dumbest arguments against short-term rentals is that such rentals reduce affordable housing availability. Really? Those short-term rentals exist because housing is already unaffordable. This is not a chicken-or-egg scenario: the unaffordability came first. In fact, the whole Airbnb phenomenon is the direct result of short-sighted municipal leaders failing to address the lack of affordable housing.

(Let’s be honest: the real reason for the proliferation of regulations and bans is that residents don’t like having people they don’t know next door. They say they want to “know their neighbors,” yet they barely wave to each other when their cars pass on the way to Bunko.)

The Vacation Rental Industry Was Not Built by Stupid People

The terms “fragmented” and “mom-and-pop” are not synonymous with dumb.

Many of these mom-and-pop operators left cushy jobs in major cities to move to places they love, and they used their wide range of skills to build highly successful businesses. And the homeowners? They own multi-million dollar investment homes. This is not a stupid bunch.

In contrast, those descriptors are more indicative of a fierce, independent nature. And that proclivity to independence is what makes our industry unique. That’s also why vacation rental managers are less likely than hoteliers to continue to do business with companies they don’t trust.

For the tech entrepreneurs from the hotel industry who believe your highly advanced hotel experiences will transform the vacation rental industry and the fragmented mom-and-pop operators will bow in appreciation for your enlightenment, call me. I can provide a long, colorful list of industry disruptors from the hotel world who believed the same thing only to end up disrupting their own careers, families, and investor friends.

And to potential investors, don’t simply focus on the successes in the industry; study the failures. Don’t simply accept the broadly brushed research; look at segments. For example, while urban rentals are on the rise, traditional rentals have flat-lined in many US destinations. Because of cumbersome regulations, inventory and availability are declining in some cases. Consolidation means there are fewer companies to sell to, and many of those large companies are building their own technology. Advancements in APIs are making it easier to connect directly with industry providers, and middle men are starting to feel the heat and are adjusting their business models. Commissions paid to property managers (PMs) are decreasing, the amount of fees PMs can charge are declining (or are not supported by OTAs), and OTA-built revenue management tools are pushing pricing downward. That means less money can be spent on tech products. Industry economics are changing quickly, so dive deeply into analyzing a company’s future prospects before jumping in.

Common Sense Standards

For both PMs and homeowners, customer expectations are shifting and ushering in a logical, increasing demand for standards in cleanliness and property appearance. Sheets that were purchased pre-2010 should be thrown away. (Think about how many couples have enjoyed those sheets.) Nonstick pans that have no more nonstick left should be thrown away too. The same goes for moldy shower curtain linings, sand-caked bathroom rugs, pans with food stuck on them, dull knives, foggy drinking glasses, garage-sale china, and twentieth-century mattresses. And if you have a question about whether something is too old, invite your mother, wife or—better yet—a gay guy friend to the property for a critique and ask these questions: Would you sleep on this, cook with this, sit on this, or dry yourself with this? And if you want to go super crazy and elevate your standards even more, mandate that floors and carpets be professionally cleaned annually, or join our European friends and convert those worn out bedspreads to professionally laundered duvets.

Discrimination

For too many vacation home owners, “vetting guests” is code for keeping people of color out. If age is a problem, don’t rent to people under twenty-five, but using vetting as an excuse to discriminate based on race must stop. And if homeowners don’t stop that practice, the entire industry is going to face the consequences with new sets of regulations aimed at preventing discrimination.

A New Hope (Pardon the Star Wars reference . . . I have one for every occasion)

A new generation of travelers is emerging—one that should bring us all hope—in the millions of post-millennials/Generation Z’ers who marched yesterday to end gun violence. They appear to have unmatched and refreshing bullshit detectors.

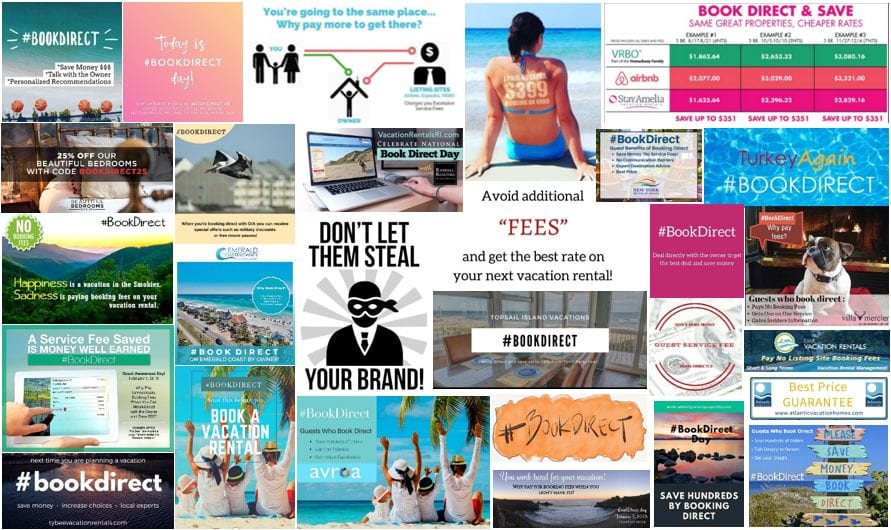

I believe this generation is not going to pay an extra 10 to 15 percent simply because they like Expedia or Airbnb. They are certainly resourceful enough and internet savvy enough to bypass bullshit fees.

And the members of this new generation don’t appear to be lazy. They are willing to put in the time to find authenticity and transparency.

Like it or not, Gordon Gekko’s “greed is good” world is shrinking (and even Brian Chesky knows it…see his “infinity memo”), and that’s giving PMs a new chance to relate to consumers with messaging, policies, and practices that promote the unique world of vacation rentals. Vacation rentals offer this generation the authenticity and connection they want, so the industry has a very real opportunity to capture a huge market share of leisure travels. But remember—they don’t like bullshit.

The Future of the Vacation Rental Industry

It’s bright, in spite of all the noise.

The demand for vacation homes is healthy. The enormous advantages of staying in a home instead of a hotel for vacations resonate with consumers. Margin compression, consolidation, business model shifts, the wave of regulations, and plenty of investment-propped-up noise are making things seem chaotic, but ultimately, the industry is still about providing safe, welcoming, privately owned accommodations and services for travelers.

Here are some observations and lessons from successful vacation rental management companies around the industry that could help:

Good neighbor policies

Don’t be an ass in the destination. Keep an eye out for nuisance guests. Educate guests about noise ordinances, trash, parking, and how not to be obnoxious on their vacation. Let the city and neighbors know about 24/7 response lines. Work to elect city and state officials who understand the value and revenue that vacation rentals bring to the area. For multi-destination companies, empower in-market managers to engage in the community.

OTA management and diversification

Analyze OTA performance in relation to the cost of listing on these channels. Include time, anxiety, resources, commissions, subscriptions, and anything else that is a cost to your company. And please do not rely on one channel for over 35 percent of bookings. Industry conditions are changing so rapidly that such a reliance puts the company and its homeowners at risk. Diversification provides freedom and the perk of not being held hostage by poor business practices.

Cooperation with like-minded business models

Invest in like-minded business models, partners, and vendors. In the world of OTAs and listing sites, supply is everything. If PMs find a website or marketplace that does business in a way that fits their needs and ideals, they should work with it. Same goes for tech companies. Working with companies that value the PM’s business, team, and guests makes life easier.

Destination-oriented marketing and expertise

Leverage destination expertise and local marketing channels to the fullest. PMs can compete fiercely with OTAs locally. It may not be realistic to be the best in the world, but you can be known as the most trusted, knowledgeable, professional vacation rental provider in your market.

Proactive inventory acquisition

New companies are gaining inventory not because they are great but because they have implemented goal-oriented, performance-based sales plans. An intentional inventory acquisition strategy is necessary for growth and is not too difficult to implement. Becoming the vacation rental thought leader in the market, participating in city meetings with facts and figures, or writing about market performance will yield significant benefits in acquisition efforts. Brag about successes such as conversion rates, retention rates, occupancy rates, revenue performance, and property value increases.

Fun Fact: In most cases, when a PM company is acquired, 10–20 percent of owners leave for other management companies.

Property care and standards

The industry is quickly improving in this area, and property managers who aren’t on top of this trend will likely fall behind quickly. PMs will begin to notice it by closely monitoring reviews in the market and by watching retention performance, and they will make healthy use of owners’ closets to hide the home’s dirty secrets.

Nurturing leads and past guests

Prospective and past guests may have found a rental on another website, but the savvy PM will make sure they don’t go back to that site.

Consumer education

Both managers and homeowners will gain by educating the consumer market about the advantages of booking direct. The hotel industry is spending millions in that effort for a reason.

To Wrap up My Rant

The market will eventually work itself out. Consumers will ultimately decide if they want to pay hundreds more just to book on an OTA. The optimal booking path will emerge. Funding for unprofitable business models will dry up. Margins will eventually be distributed logically.

What will always remain is professionally caring for homes and matching travelers with the best accommodations and service for their much-needed vacations.

The service you provide, my vacation rental friends, matters. The experiences and memories for the families, groups, and nomads who stay in your rentals last forever. Travel defines us and changes the way we perceive the world around us, and you are significant part of that.

So VRM Intel is back online and, after experiencing a little bullying myself, I’m less afraid of reporting the truth. Rant over. Fact-based reporting to recommence.

Two conferences,

Two conferences,

Mark Okerstrom:

Mark Okerstrom:

Additionally, Lehmann has been involved in strategic planning with many of the leading and up-and-coming players in the vacation rental sector, has served as a board member for

Additionally, Lehmann has been involved in strategic planning with many of the leading and up-and-coming players in the vacation rental sector, has served as a board member for

However, HomeAway chief commercial officer, Jeff Hurst said that was never going to be the case.

However, HomeAway chief commercial officer, Jeff Hurst said that was never going to be the case.

I recently traveled to Tallahassee to represent the

I recently traveled to Tallahassee to represent the