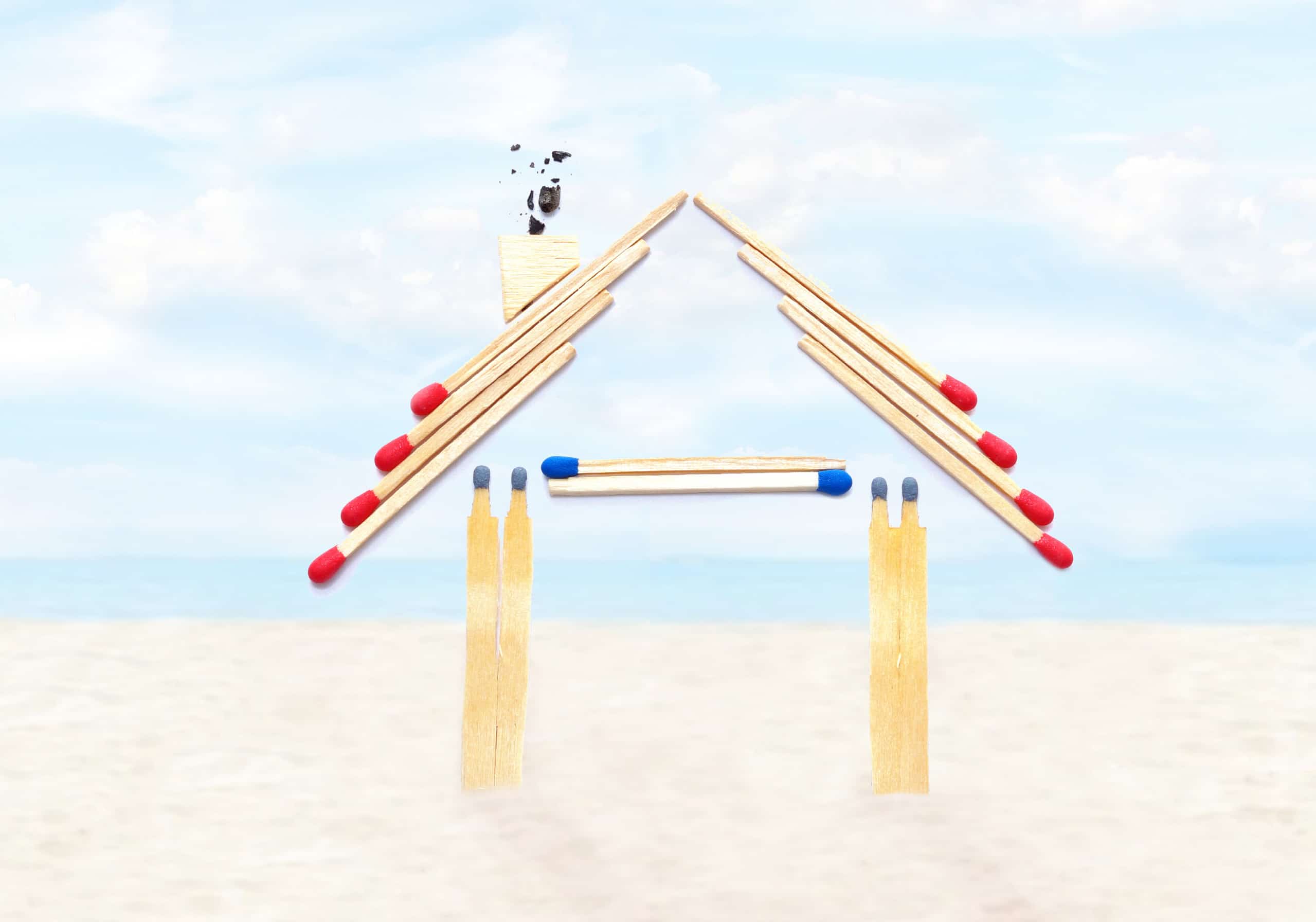

On an early January morning in 2021, a devastating fire broke out in a vacation rental home in Malibu where smoke alarms had not been installed. Just 111 days earlier, the Malibu City Council had enacted an ordinance that, among other things, mandated smoke alarms be installed in all short-term rentals. This ordinance was overdue because the state had accepted the International Building Code’s guidance that smoke alarms be installed in all transient rentals in the state years ago.

The tragedy in Malibu exposes that without precautions, occupying a dwelling—whether a hotel, condo, vacation rental, or house— poses many risks.

To address the potential hazards of staying in a hotel or motel and acknowledge the evolving need for fire safety in the hospitality industry, the U.S. government adopted the Hotel and Motel Fire Safety Act of 1990. The act recognizes that correctly installed and maintained smoke detectors and safety markers provide the most effective safeguards against fire incidents at hotel properties. Sprinkler heads, smoke detectors, maps of fire exits, and fire extinguishers in the hallway are some of the many features that hotel guests commonly encounter as a result of this act.

Contrast this with occupying a vacation rental or someone else’s home; sadly, similar government precautions have not been put in place. The number of fire-related tragedies and other accidents at rental homes are on the rise, and because mandatory safety elements such as hallway lighting, exit markers, and clear indicators of where fire extinguishers are located have not been established, many renters who are unfamiliar with a property could be in danger.

Understanding Fire Safety

So how do you keep your guests safe in your vacation rentals and keep your team safe when doing the same? Smoke alarms are simple but vital home safety features and can make all the difference when properly installed. The National Fire Protection Association says that three out of five home fire deaths result from fires in properties without working smoke alarms, and 38 percent of home fire deaths result from fires in which no smoke alarms are present at all. When looking to install or update a smoke alarm, there are several ways to ensure you are meeting this safety standard.

1. Choose the best smoke alarm on the market. Consumer Reports ranked smoke alarms in 2019 and revealed that dual detectors (which use ionization and photoelectric sensors) rank the highest.

2. Make sure your smoke alarms are less than ten years old. Statistics show that each year a smoke alarm ages, it becomes less reliable. There is a 30 percent failure rate for smoke alarms older than ten years. Because of this, many models now come with a ten-year sealed battery.

3. Interconnect your smoke alarms. Today’s technology allows smoke alarms to “talk” to each other through wired or wireless communications. A warning for a fire in one area of the home alerts the alarm in another area and will provide more time to notify occupants and let them escape.

Further Instrumental Rental Home Safety Precautions

Although fire and smoke accidents are some of the more publicized misfortunes that can occur in a vacation rental, there are many other risks guests encounter that need to be addressed.

Slips, Trips, and Falls

In 2019, 83 percent of all insurance claims submitted to Proper Insurance—a leading vacation rental insurance company—were from slips, trips, or falls. Preventing these hazards and injuries in your rentals is actually extremely easy. Making sure handrails are installed on all stairs that meet International Building Code Standards and that the rental walkways, inside and out, are well lit and easy to navigate are simple solutions to a potentially dangerous situation. Ensuring carpets and other trip hazards are secured from sliding and do not have turned up corners is another easy protectant against trip and fall accidents.

Pool and Hot Tub Safety

Unfortunately, pool and hot tub accidents are a leading cause of fatality for people under the age of ten at vacation rentals. Guests— many of whom do not have pools at home—often do not have the knowledge or experience to understand the details that constitute lifesaving precautions at a pool. Property managers should have necessary items such as locking covers, pool rescue poles, life rings, and easily accessible ladders at their properties and should clearly communicate to guests where they are located and how to operate them. Properly installed fences and safety gates with childproof locks are also a smart installation to provide further protection from unwanted access to water amenities.

Other Amenities

Many property owners are surprised to learn that the amenities they offer such as fire pits, grills, bikes, baby gear, or other “bonus” items are actually sources leading to an increasing number of accidents.

Although they are a great addition and favorite feature of many vacation homes, grills and fire pits require specific placement and clear operating instructions to prevent accidents. Grills should be placed at least three feet from combustible walls, fences, or other structures and should have a minimum of nine feet of overhead clearance from the grill surface. Fire pits should be placed at least 20 feet from the home and not have trip hazards around them. Additionally, the inspection of gas line connections and tank o-rings will ensure that grill and gas firepit fuel sources don’t leak.

Property managers and homeowners should consider the risks of offering bikes, golf carts, watercraft, or other transportation options with their rental. Although having these amenities at your home(s) can be great for guests, the risk associated with them is high. Unless a thorough inspection program is in place to inspect all these items before each renter uses them, and unless proper safety equipment such as helmets and life jackets are available for their use, these items should not be offered or available.

With many families traveling and looking to spend quality time together, it may seem like a generous offer to let renters use old cribs, highchairs, and portable playpens. Unless each of these items is personally inspected before each use, they pose the potential for tremendous risk to your business and, more important, they may cause harm to a child.

Professionalism requires Safety Awareness

Reducing risk in your vacation rental(s) protects you and the homeowner, helps ensure the safest and best experience for guests, and establishes your position as a professional. Across the United States, groups are coming together at a local level to address safety issues and regulations. Many of these groups are coordinated or supported by Rent Responsibly, a community-building and educational platform for local short-term rental alliances. Insurance companies such as Proper Insurance are leading the way to help make rentals safe to reduce insurance claims and prevent renter injuries. At Breezeway, we have developed safety checklists and inspection programs to help ensure property owners get their rentals up to current safety standards.

The subject of safety is important and can provide common ground for homeowners, insurers, and local regulators to work together to improve their communities and industry. Responsible managers who address safety items in their rental properties are more likely to address other concerns—such as parking, trash, and parties— which may ease community tensions over vacation rentals. By putting in time, effort, research, and the correct safety precautions, vacation rental managers can have a positive relationship with the community and provide the best experience for their guests.

Here’s a bonus: by signing up for the Right to Rent program, property managers new to VRMA will receive a one-year VRMA membership.

Here’s a bonus: by signing up for the Right to Rent program, property managers new to VRMA will receive a one-year VRMA membership.

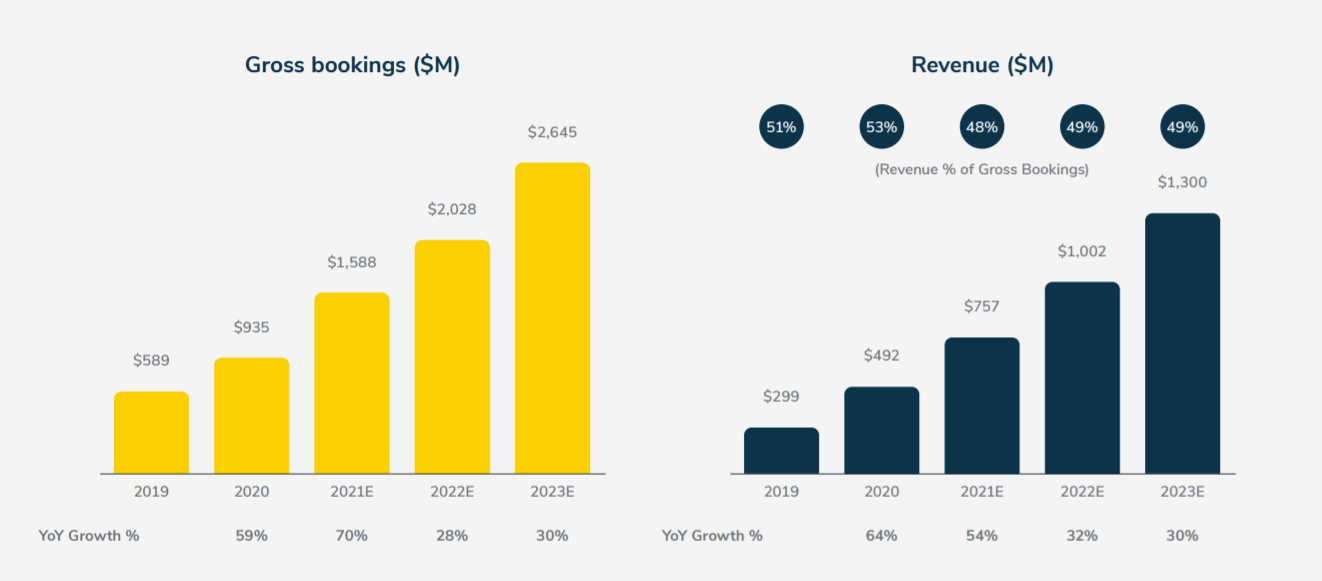

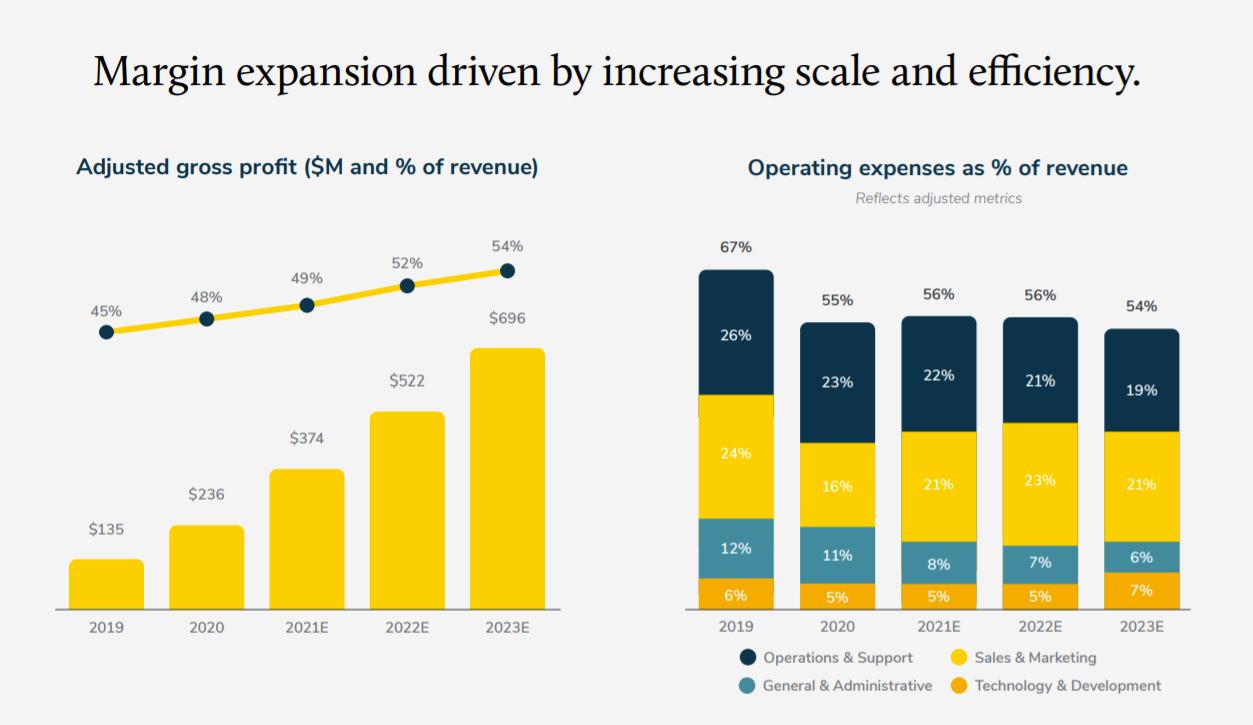

Sascha Hausmann, partner at Howzat Partners, has been

Sascha Hausmann, partner at Howzat Partners, has been

WASHINGTON, D.C. (September 27, 2021)—The Vacation Rental Management Association (VRMA), the leading voice of the professional vacation rental community, announced today that it is expanding its membership to include rental property owners, many of whom self-manage bookings through platforms such as Vrbo, part of Expedia Group.

WASHINGTON, D.C. (September 27, 2021)—The Vacation Rental Management Association (VRMA), the leading voice of the professional vacation rental community, announced today that it is expanding its membership to include rental property owners, many of whom self-manage bookings through platforms such as Vrbo, part of Expedia Group.

“This is the first time the whole team will meet since March 2020 last year,” Ali said. “We haven’t used this muscle in more than two years now, and it will take some doing to shake off those rusty muscles, so to speak. So much of the happiness is just meeting our team again—and so many people we have hired in the last two years we haven’t ever met in person! Also NYC is back, for sure, so there’s a little bit of that thrill of being part of the revenge of the big city.”

“This is the first time the whole team will meet since March 2020 last year,” Ali said. “We haven’t used this muscle in more than two years now, and it will take some doing to shake off those rusty muscles, so to speak. So much of the happiness is just meeting our team again—and so many people we have hired in the last two years we haven’t ever met in person! Also NYC is back, for sure, so there’s a little bit of that thrill of being part of the revenge of the big city.”

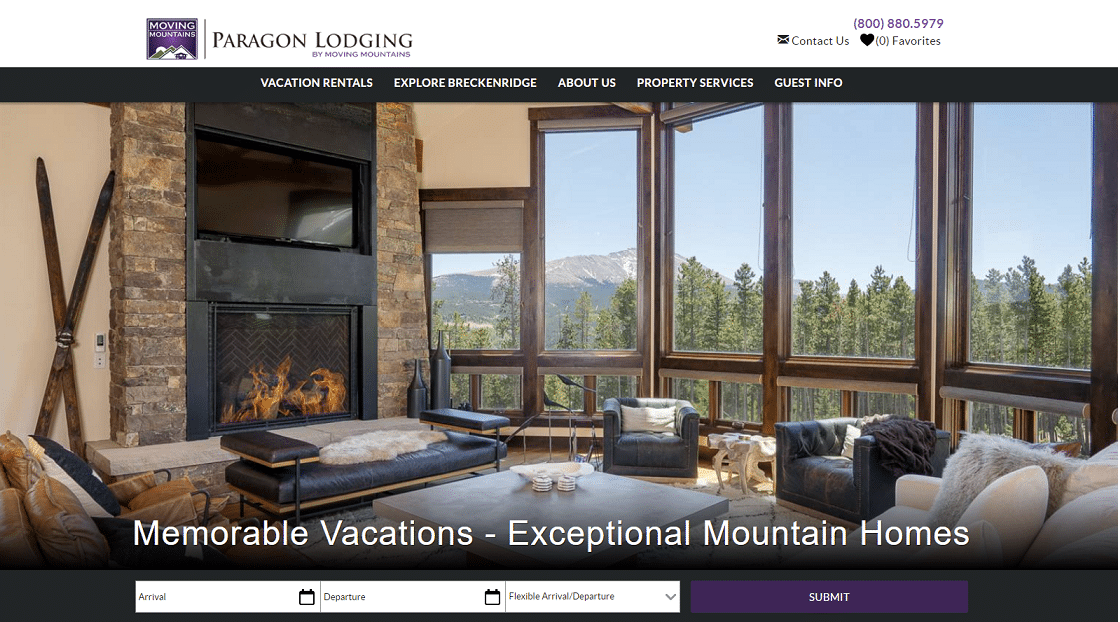

“Our guests constantly ask where else they can stay with us, and with this expansion further into Colorado we can help meet their needs,” said Robin Craigen, president and CEO of Moving Mountains. “We have known Johna and Krista for over seven years and have long identified with the similarities in our approach to service and experience. They have a special team and spectacular homes—the perfect opportunity for smart growth different to what is happening elsewhere in the industry.”

“Our guests constantly ask where else they can stay with us, and with this expansion further into Colorado we can help meet their needs,” said Robin Craigen, president and CEO of Moving Mountains. “We have known Johna and Krista for over seven years and have long identified with the similarities in our approach to service and experience. They have a special team and spectacular homes—the perfect opportunity for smart growth different to what is happening elsewhere in the industry.”