The vacation rental industry has witnessed a significant evolution in technology over the last five years. With every property management system that goes to the graveyard, five more arise in its place, all promising to be the all-in-one answer to all the industry’s problems. To further complicate things, we’ve seen specialized plugin software platforms emerge providing functionality to meet the needs of every imaginable business need from hiring and housekeeping to distribution and revenue management. We use terms like integration and APIs as often as we use check-in and checkout. Even entry-level staff members are now expected to be adept in multiple systems.

The current state is overwhelming, even for tech-savvy millennials and Gen Zers; and often professionals who excel in hospitality are driven out of the vacation rental industry because of the demands related to the revolving training required with an ever-changing tech stack. Vacation rental management company founders didn’t sign up to be SaaS project managers.

Where is the industry heading in 2021 and beyond? Is there any light appearing at the end of the tech tunnel? We reached out to the industry’s technology leaders to find out what they are predicting and what vacation rental managers can expect as the industry continues to evolve.

Eric Broughton, Chief Strategy Officer, InhabitIQ

While the pandemic touched every aspect of the vacation industry, we were impressed by the resiliency and tenacity of our brands, clients, and partners. Beyond delivering technology solutions, we are encouraged by the way our industry is coming together to educate local, state, and national leaders on how travel can be done safely and by the positive impact of professional managers on the economy.

While the pandemic touched every aspect of the vacation industry, we were impressed by the resiliency and tenacity of our brands, clients, and partners. Beyond delivering technology solutions, we are encouraged by the way our industry is coming together to educate local, state, and national leaders on how travel can be done safely and by the positive impact of professional managers on the economy.

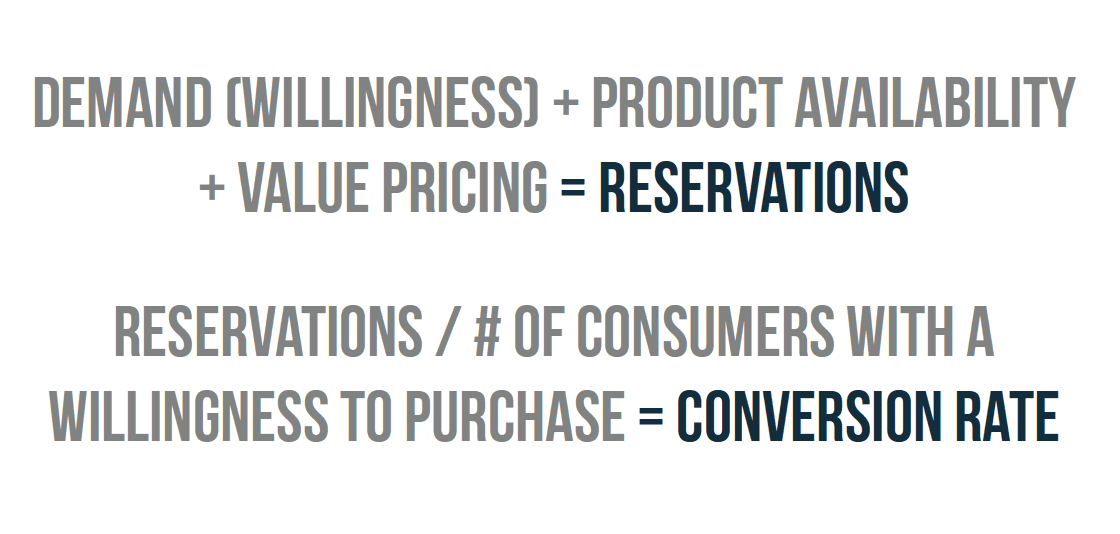

For the first half of 2021 and likely beyond, length of stay (LOS) is a major trend as travelers are choosing to stay at their destination longer because of online school and/or work. The ability to optimize yield for our property managers through enhanced LOS solutions that seamlessly integrate within their websites and the major OTAs will deliver value. In collaboration with LOS, revenue management solutions that optimize pricing will deliver significant returns. We continue to be impressed by the consistent uplift in yield experienced by property managers utilizing either a managed or algorithm-based solution. We’ve seen groups that have previously managed their pricing find a 14 percent increase in year-over-year revenue with our service while those that hadn’t managed pricing in the past experienced an average revenue increase of 58 percent year-over-year.

Because of tighter budgets, we see a focus on stretching website and agency dollars further through improved marketing spend and more organic traffic. We are investing in these segments of our business to support new and returning travelers organically.

Toward the end of 2021, we predict the return of urban core markets, which had been taking off prior to the pandemic. Pent-up demand for travel combined with purpose-built, short-term rental properties that began with shovels in the ground during the heyday will come online at the perfect time.

We’re inspired by property managers’ resourcefulness and resolve, and we’re enthused by the positive trends that are pointing to a better year in 2021.

From what I’m seeing in the marketplace, technology is definitely a challenge—specifically, the lack of financial visibility in the business. Most companies do not have accurate or timely financial statements that allow them the opportunity to make good business decisions.

From what I’m seeing in the marketplace, technology is definitely a challenge—specifically, the lack of financial visibility in the business. Most companies do not have accurate or timely financial statements that allow them the opportunity to make good business decisions.

Financial visibility and fundamental management is sorely lacking. We’ve been offering a free business assessment to anyone concerned about their business. Having reviewed hundreds of businesses over the years, we’ve helped highlight systemic business issues and provide changes to generate a more meaningful profit. Financial visibility is paramount to having a perpetually sustainable business.

Jeremy Gall, Founder and CEO, Breezeway

Over the past year, vacation rentals have proven their resiliency and appeal as a travel category, attracting new travelers and carving out more market share. We often beat the drum about increasing expectations of owners and guests and the push for quality in the industry. Professional managers have continued to elevate their businesses to meet these demands. Now, it’s important that operators don’t take their foot off the gas. We can expect increased competition from hotels edging into the vacation rental market with products that are designed to provide the authenticity of a vacation rental with full hospitality services. Technology that helps professional vacation rental operators deliver “hotel-like” guest experiences and services will continue to be a critical piece of successful management.

Over the past year, vacation rentals have proven their resiliency and appeal as a travel category, attracting new travelers and carving out more market share. We often beat the drum about increasing expectations of owners and guests and the push for quality in the industry. Professional managers have continued to elevate their businesses to meet these demands. Now, it’s important that operators don’t take their foot off the gas. We can expect increased competition from hotels edging into the vacation rental market with products that are designed to provide the authenticity of a vacation rental with full hospitality services. Technology that helps professional vacation rental operators deliver “hotel-like” guest experiences and services will continue to be a critical piece of successful management.

Technology solutions for vacation rentals will become smarter and smarter over the next few years. Today’s technology creates value for clients, whether through marketing, operations, accounting, or revenue management software. But there is so much more value that can be delivered in the space. The market is demanding deeper customization with various levers to further unlock automation across business functions. This trend for more customization and automation is really exciting and will enable a leap forward in property management service. With more efficiency and the ability to take on more work, this opens up new revenue opportunities for vacation rental managers to monetize the guest and owner experience.

Andrew Kitchell, Founder and CEO, Wheelhouse

2021 is going to be the year that professional-grade software comes to the STR space.

2021 is going to be the year that professional-grade software comes to the STR space.

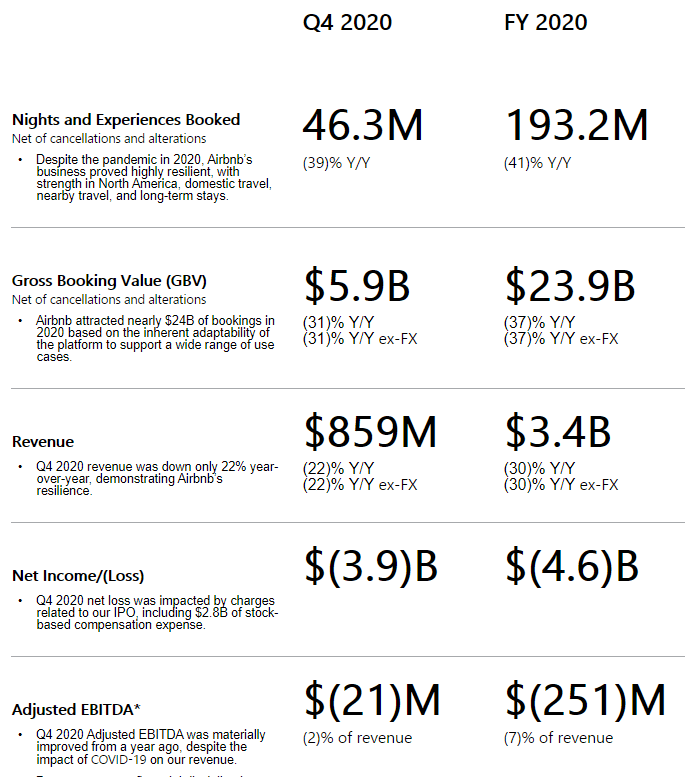

Why? Because the scale of the opportunity to transform travel and housing is massive. And, the evidence that the broader market recognizes this has already been demonstrated by (a) the stunning success of the Airbnb IPO, (b) the broader shift in travel spend from hotels to STRs, and (c) the increasing scale and sophistication of investors in and around PropTech and STRs in general.

This scale is going to encourage strong technology teams to enter the category and to create elegant solutions to empower both small- and large-scale operations.

As an operator, 2021 needs to be the year you lean into software— should you not already be there. As a technology company, 2021 needs to be the year we lean into customers—to make sure they are empowered as never before.

At Wheelhouse, we’re making sure that 2021 is the year that transparency truly comes to the dynamic pricing space, and we look forward to sharing our deep investments in revenue generation with customers everywhere.

Amber Knight, GM, LiveRez

The biggest changes we’ll see are shifts in consumer behavior. Like everyone else, vacation rental managers have radically adjusted priorities and reevaluated what’s important. This applies to software they’ve opted into in the past, how much they’re willing to pay, and the lightning-fast (for the industry) adoption of new products that deliver results.

The biggest changes we’ll see are shifts in consumer behavior. Like everyone else, vacation rental managers have radically adjusted priorities and reevaluated what’s important. This applies to software they’ve opted into in the past, how much they’re willing to pay, and the lightning-fast (for the industry) adoption of new products that deliver results.

Software that enables managers to take advantage of booking direct, retaining repeat guests, and optimizing revenue without building a bloated organization will see the biggest increase in market share. The most adaptable software companies will be able to objectively aid managers in wading through the process of choosing the right software stack and deciding how to clearly measure success. Managers are going to stop expecting one-size-fits-all on a global scale from their software, and software companies that succeed will have to both find their niche and help professional managers grow. Companies that simply provide another flavor milkshake won’t make it.

Simon Lehmann, Founder and CEO, AJL Atelier

Nothing will be the same!

Nothing will be the same!

For a couple of years now we have focused heavily on technology adaption in our industry. Many surveys have been made to find out how property managers are increasingly using software and technology to run daily business. Their use has increased substantially, but at the same time, it has been identified as one of the biggest pain points for the operators. No big surprise. Vacation rental has been the only travel vertical in the start-up scene that has received more investment, and technology start-ups popped up on a monthly basis even during 2020. So what has happened? And what is the consequence?

We have started to micro-verticalize our value chain with technology providers between guests and hosts. On average, a property manager is working with eight different software products to run his business. But this is not sustainable. While the OTAs are taking 50 percent of the gross margin, technology has not become cheaper, and the net margin for property managers has become smaller. Most of the tech companies are venture-funded and are not profitable either, which does not help the situation. Today, we can source software for any process that the PMS does not offer. It is obvious now that each technology provider is trying to expand its value proposition and increase its take rate—no matter if it is an operations and cleaning software, revenue management system, channel manager, or a traditional PMS. Channels are being integrated, and add-on features are being developed to offer a one-stop shop to the property manager.

Keeping sane looking at the jungle of technology providers has become a challenge not only for property managers but also for us as thought leaders and any other industry intermediary. Therefore, the consequence of the current market environment is going to be consolidation. We will see many tech companies shutting doors and not surviving. Others will try to merge with one another or expand their customer base and value proposition, and yet others will raise more funds and buy up technology companies. So watch out when making decisions to source new technology. Get external advice to help you with the specifications that you need and with the selection process! The landscape is changing very rapidly; and we will see fewer, but much larger, technology companies in the future. Remember the last VRMA in New Orleans, when you went to the exhibition hall? I never saw so many exhibitors before. If there is going to be a VRMA this year in San Antonio, then my prediction is that there will be less than half the exhibitors there.

Matt Loney, President and CEO, Xplorie

The pandemic has shifted our industry in ways that are hard to comprehend just yet. But it’s important to take a moment and appreciate how technology helped propel the vacation rental industry to be one of the few travel success stories of 2020. Without virtual/keyless check-in and cleaning protocols systematized by new operating applications, managing the pandemic in a way that reinforced vacation rentals as a safe alternative to traditional lodging would have been far more difficult.

The pandemic has shifted our industry in ways that are hard to comprehend just yet. But it’s important to take a moment and appreciate how technology helped propel the vacation rental industry to be one of the few travel success stories of 2020. Without virtual/keyless check-in and cleaning protocols systematized by new operating applications, managing the pandemic in a way that reinforced vacation rentals as a safe alternative to traditional lodging would have been far more difficult.

Our industry’s “technology stack” was there when we needed it most. And unlike any time in our industry’s history, operators are now embracing technology across the entire guest journey and collecting guest data across multiple touchpoints. Moving forward, managing this growing technology ecosystem is not only the most significant tech challenge for the vacation rental industry but also the greatest opportunity.

Over the next few years, consolidation of guest data will allow property managers to personalize the guest experience along the entire guest journey. The logical source for the consolidation and organization of data is our property management systems, which owe a duty to our industry to begin to normalize our data and API connections in a way that allows ancillary technology companies to consume it and leverage it for the benefit of all stakeholders. Additionally, guest personalization at scale will require an effective means of delivery and control by the guest.

Our industry has explored mobile apps, mobile web pages, tablets, televisions, and voice assistants—all with varying degrees of success. Ultimately, how best to interact with the guest needs to be based on what technology drives the most significant guest interaction. By reducing the barriers to adoption, we will promote the exchange of preference data between our technology systems and the guests.

As for Xplorie, we are focused on consolidating guest preferences for in-market experiences to better understand guest motivations. Right now, we’re working to provide a more personalized guest service via our Xplorie Enabled Voice Assistant (XEVA) powered by Amazon’s Alexa. Answering common guest questions—such as “What’s the Wi-Fi password?” “Where can we get the best burger?” or even “What should we do today?”—is a perfect example of using big tech in a small way to customize a guest’s stay. And we’ll be seeing much more of this type of guest-centered tech in the near future.

Vacation rentals continue to benefit from the hard lessons learned by the hotel industry. Whether it’s channel distribution, yield management, or operations, hotels paved way for vacation rentals. And personalization of the guest experience is no different. By the time hotels discovered the importance of guest personalization, their technology ecosystem had become so bloated that getting their systems to talk, let alone work together, was nearly impossible. Even today, most hotels don’t even consolidate data from the minifridge to identify loyalty members’ favorite drinks or snacks.

Failure to aggregate and leverage acquired guest data is clearly a missed opportunity in the hotel industry. But for the vacation rental industry, it’s still early enough in our technology growth curve to learn from their mistakes—and make the appropriate corrections as we move forward.

Lino Maldonado, President, BeHome247

This is a resilient industry, no doubt in my mind. But as I think about how this pandemic differs from hurricanes, oil spills, low snow years, and economic pressures, it may be that for the first time, perhaps ever, technology is ready to play a significant role in the recovery if we let it.

This is a resilient industry, no doubt in my mind. But as I think about how this pandemic differs from hurricanes, oil spills, low snow years, and economic pressures, it may be that for the first time, perhaps ever, technology is ready to play a significant role in the recovery if we let it.

We’ve learned (or been told) over the past year what is absolutely essential, how to stretch everything from our time to toilet paper, and which facets of our businesses can function remotely and which cannot, but have we invested any time in evaluating processes in our business to determine where some automation in the workflow could generate greater efficiency, improve guest and/or owner experience, and add margin to our bottom lines?

I’ve been through a number of software migrations over the years, the most painful thing your business may ever self-inflict. So why is it that when we decide to make a switch, the first thing we do is try and make our new tools map to an old process? It’s human nature to fall back into what we are most comfortable with or to find a new work-around to overcome a perceived shortfall in the new system, and my teams and I were really good at it, but that rarely led us to innovation. What we typically ended up with was a new system, or another bolt on, that every office would try and make act like what they had prior.

There are more great tech products on the market today than ever before, and we will certainly see new point solutions introduced over the next few years. Whether these new tools are focused on a single issue or a full PMS, they will only be as impactful to your business as your teams are comfortable in using them, so pick a partner who is as good at support as they are in sales.

As we adopt to how the world looks post the arrival of COVID in early 2020, I think we will see the following technology shifts become part of our lives in 2021:

As we adopt to how the world looks post the arrival of COVID in early 2020, I think we will see the following technology shifts become part of our lives in 2021:

Guest data privacy: As VRMs look to create and maintain relationships with guests in current stays and to plan future stays, they are looking to know more about their guests and how to get ahold of them. I think how data are collected, used, and managed will become a growing concern to guests and a risk mitigation vector for vacation rental managers. The key will be how all of those activities respect consumers’ growing awareness of data privacy as well as developing regulations around it, such as CCPA. I have seen several tools, including smart lock providers, deploy tools to collect guest information, but I expect the growing consumer expectations and regulations to drive this to be more of a core function of PMS and/ or CRM tools.

Reassuring guests: Tools like property care software have helped to augment our process to meet changing guest demands, but I expect more advances around how we market safety and cleaning protocols to help. (Investments in things like better Wi-Fi will also support changing guest needs—like in workcations.)

Shift from property management to asset management: Interest and attention in the vacation rental space will continue to grow in 2021 because I think private accommodations will continue to better meet travelers needs, especially as we work to get to the other side of a COVID vaccine. With this interest will come more business but also outside investment, disruption, and consolidation. VRMs who want to come out of this evolutionary stage stronger and larger will have to think about not only how they fill vacant homes but also how they help owners take better care of their homes and grow the overall value of that asset. Technology that enables proactive protection and maintenance, such as monitoring security and intelligently preventing water damage or HVAC damage, will help VRMs simultaneously remain competitive in their core focus but also grow their business with value-added services that homeowners appreciate.

Much like the vacation rental industry itself, VR tech has been a fragmented space with niche providers. In many other vertical industries, there are clear enterprise leaders with $1B+ valuations (e.g., Procore and Veeva). Although there has been some consolidation over the last few years, it is more of a roll-up private equity strategy, where companies operate independently, still fragmented, and with the primary objective to generate short-term shareholder returns. Although there is nothing wrong with this strategy, I believe that over the next three years we will see a company separate from the rest. There will be niche product consolidation under a cohesive long-term vision, and an enterprise software company will be on the path to being a clear, global market leader. This will contribute to the maturation of our industry and will be a positive development.

Much like the vacation rental industry itself, VR tech has been a fragmented space with niche providers. In many other vertical industries, there are clear enterprise leaders with $1B+ valuations (e.g., Procore and Veeva). Although there has been some consolidation over the last few years, it is more of a roll-up private equity strategy, where companies operate independently, still fragmented, and with the primary objective to generate short-term shareholder returns. Although there is nothing wrong with this strategy, I believe that over the next three years we will see a company separate from the rest. There will be niche product consolidation under a cohesive long-term vision, and an enterprise software company will be on the path to being a clear, global market leader. This will contribute to the maturation of our industry and will be a positive development.

For starters, I think the stream of companies converting to another PMS will continue, with a handful of brands seeing the vast majority of the growth. This shuffling will add a lot of work for vendors, but it should result in an updated and increasingly robust platform from which to improve the technology in our space in the next few years. In the short run, tons of money continues to pour into pricing, revenue, and data tools, which should see significant growth this year. VR companies continue to be split into those focused on channel distribution and those focused on their brand. The prior saw consolidation over the last few years. I believe the roll-up of the larger regional brands will begin in earnest this year and continue through next year, with the creation of increasingly large companies in the US. The ones that get it right will focus on the people, the culture, and the service. The ones that focus on growth for growth’s sake will relearn the lessons our industry has previously taught. In the end, I think the next few years will see the full-scale arrival of the private equity firms, the flags, and the money. I believe that this will provide huge opportunities for those ready to grow, improve, and run fast—both in the VR company and on the vendor side. Up or out, as they say. Last, I’d look for the hotels to hit back once they’re on their feet. Any way you look at it, it should be an interesting ride for sure.

For starters, I think the stream of companies converting to another PMS will continue, with a handful of brands seeing the vast majority of the growth. This shuffling will add a lot of work for vendors, but it should result in an updated and increasingly robust platform from which to improve the technology in our space in the next few years. In the short run, tons of money continues to pour into pricing, revenue, and data tools, which should see significant growth this year. VR companies continue to be split into those focused on channel distribution and those focused on their brand. The prior saw consolidation over the last few years. I believe the roll-up of the larger regional brands will begin in earnest this year and continue through next year, with the creation of increasingly large companies in the US. The ones that get it right will focus on the people, the culture, and the service. The ones that focus on growth for growth’s sake will relearn the lessons our industry has previously taught. In the end, I think the next few years will see the full-scale arrival of the private equity firms, the flags, and the money. I believe that this will provide huge opportunities for those ready to grow, improve, and run fast—both in the VR company and on the vendor side. Up or out, as they say. Last, I’d look for the hotels to hit back once they’re on their feet. Any way you look at it, it should be an interesting ride for sure.

COVID has changed a lot of things. With change comes opportunity, and this feeds into what Barefoot has been promoting the last few years. Portals’ branding to guests continues to be strong, but their focus on owners the past few years has been even stronger. Like all platforms (Uber, Zillow, Amazon), their goal is to remove the middleman. Vacation rental companies are the middleman. Barefoot’s goal is to build your value proposition for guests and owners.

COVID has changed a lot of things. With change comes opportunity, and this feeds into what Barefoot has been promoting the last few years. Portals’ branding to guests continues to be strong, but their focus on owners the past few years has been even stronger. Like all platforms (Uber, Zillow, Amazon), their goal is to remove the middleman. Vacation rental companies are the middleman. Barefoot’s goal is to build your value proposition for guests and owners.

Barefoot continues to drive functionality and knowledge that allow vacation rental companies to compete against portals with a significantly stronger owner value proposition. This is with the understanding that you cannot compete with portals on rental commission. Where you compete is based on services and the understanding that owners buy their properties as an investment, and renting the property is just one piece of the pie. During the height of COVID, portals’ marketing disappeared. During the height of hurricanes, portals cannot assist. When an owner buys a home, portals cannot add value to that investment; provide the best property management services; sell the home; or make the owner feel special and that someone is in their corner and acting as a trusted partner, overseeing one of their biggest assets. If you brand to your lodging niche and promote a remarkable local expert, vacation guests like your owners will find you. This creates a life cycle because owners were once guests.

In 2021, our technology and consultative approach continues with added accounting functionality, concierge, social media, asset management, and communication tools. It is why we have a 96 percent retention rate and deal with resorts, real estate companies that focus on creating clients for life, and agencies looking to dominate their market. Finally, we continue to grow our portal program because they are a guest and owner feeder for our clients. Collectively, there is a lot to be learned from competition. There is even more to learn if you take that knowledge and apply it to yourself and your niche.

For Southern, having a large multistate footprint provides a clear advantage. In 2010, when the perception was that the BP oil spill affected the beach, guests were able to stay inland. When COVID-19 hit last spring, Florida shut down, but Alabama was still open. “Things will happen. You will shut down. When your business is geographically strained, you won’t have many options. So allow yourself opportunities,” Seay encourages.

For Southern, having a large multistate footprint provides a clear advantage. In 2010, when the perception was that the BP oil spill affected the beach, guests were able to stay inland. When COVID-19 hit last spring, Florida shut down, but Alabama was still open. “Things will happen. You will shut down. When your business is geographically strained, you won’t have many options. So allow yourself opportunities,” Seay encourages.

Renters won’t give outdated spaces a second look, so if a property seems sad and worn, it’s definitely time to upgrade, say the pros. The good news is that upgrading needn’t eat up all the rental profits.

Renters won’t give outdated spaces a second look, so if a property seems sad and worn, it’s definitely time to upgrade, say the pros. The good news is that upgrading needn’t eat up all the rental profits. Should you invest in high-end furniture? Barnett says no. “You may not be able to recoup the investment of an expensive sofa, for example,” she explains. “A stylish, mid-range sofa in a performance fabric will do. Inexpensive sofas may look cute at first but won’t be inviting to sit on and will wear out quickly. And because renters like quirky touches, don’t hesitate to mix new and vintage pieces.

Should you invest in high-end furniture? Barnett says no. “You may not be able to recoup the investment of an expensive sofa, for example,” she explains. “A stylish, mid-range sofa in a performance fabric will do. Inexpensive sofas may look cute at first but won’t be inviting to sit on and will wear out quickly. And because renters like quirky touches, don’t hesitate to mix new and vintage pieces. All designers and stagers warn not to skimp on art and accessories.

All designers and stagers warn not to skimp on art and accessories.

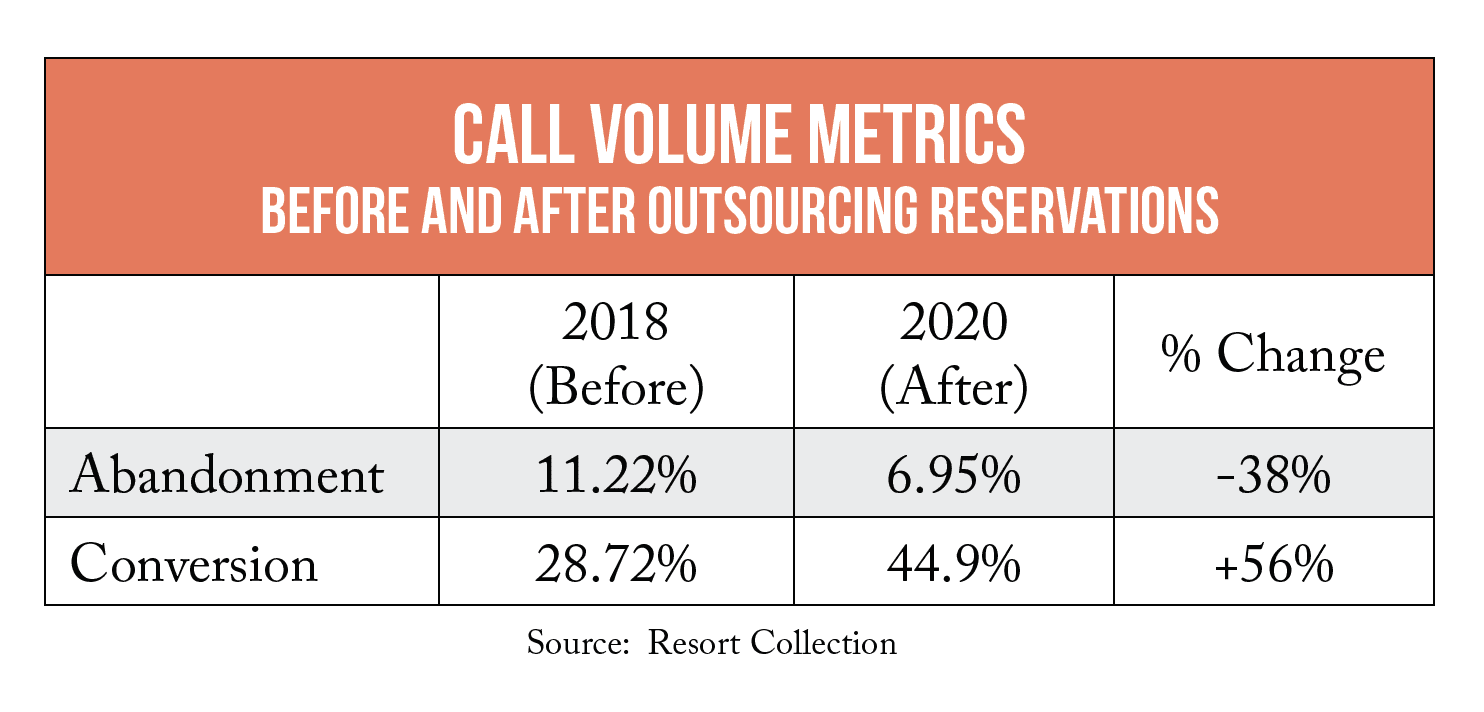

I felt comfortable, too. Frankly, more than a little disappointed that I wasn’t actually calling to book a vacation at one of Resort Collection’s 900 accommodations located in the 13 different properties it manages along the Florida Panhandle.

I felt comfortable, too. Frankly, more than a little disappointed that I wasn’t actually calling to book a vacation at one of Resort Collection’s 900 accommodations located in the 13 different properties it manages along the Florida Panhandle.

Laltoo, who helps staff about 65 hotel and resort properties throughout the US, says the vacation rental industry can learn a lot from Resort Collection’s experience and the call center craze in the Caribbean.

Laltoo, who helps staff about 65 hotel and resort properties throughout the US, says the vacation rental industry can learn a lot from Resort Collection’s experience and the call center craze in the Caribbean.

H

H

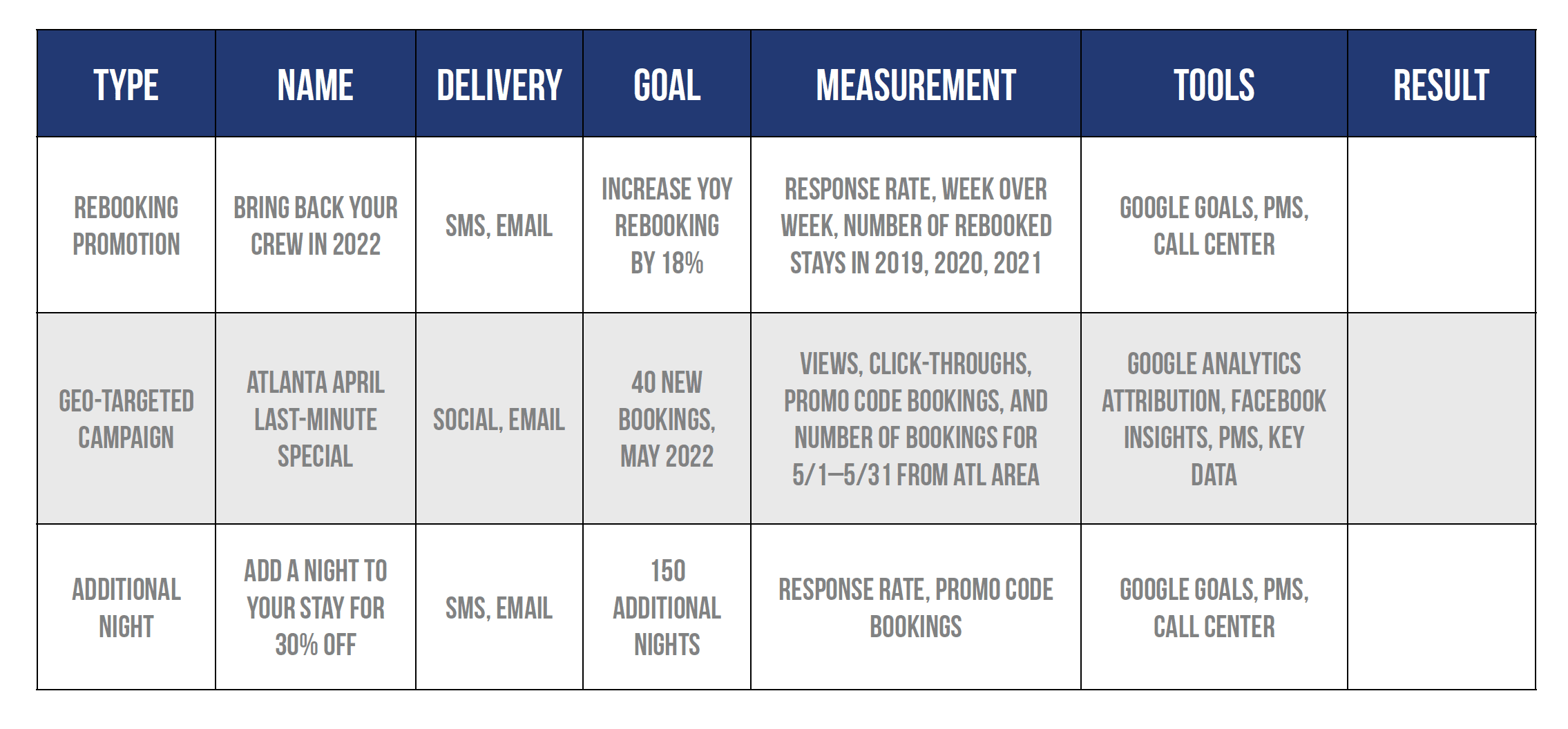

Everything you do—every campaign, channel, web page, promotion, and social post—should have a defined goal, performance tracking plan, and evaluation. This will allow you to quickly identify which efforts are working and which ones need improvement or reworking. Top measurement tools include

Everything you do—every campaign, channel, web page, promotion, and social post—should have a defined goal, performance tracking plan, and evaluation. This will allow you to quickly identify which efforts are working and which ones need improvement or reworking. Top measurement tools include

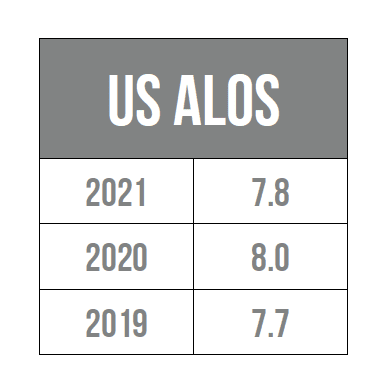

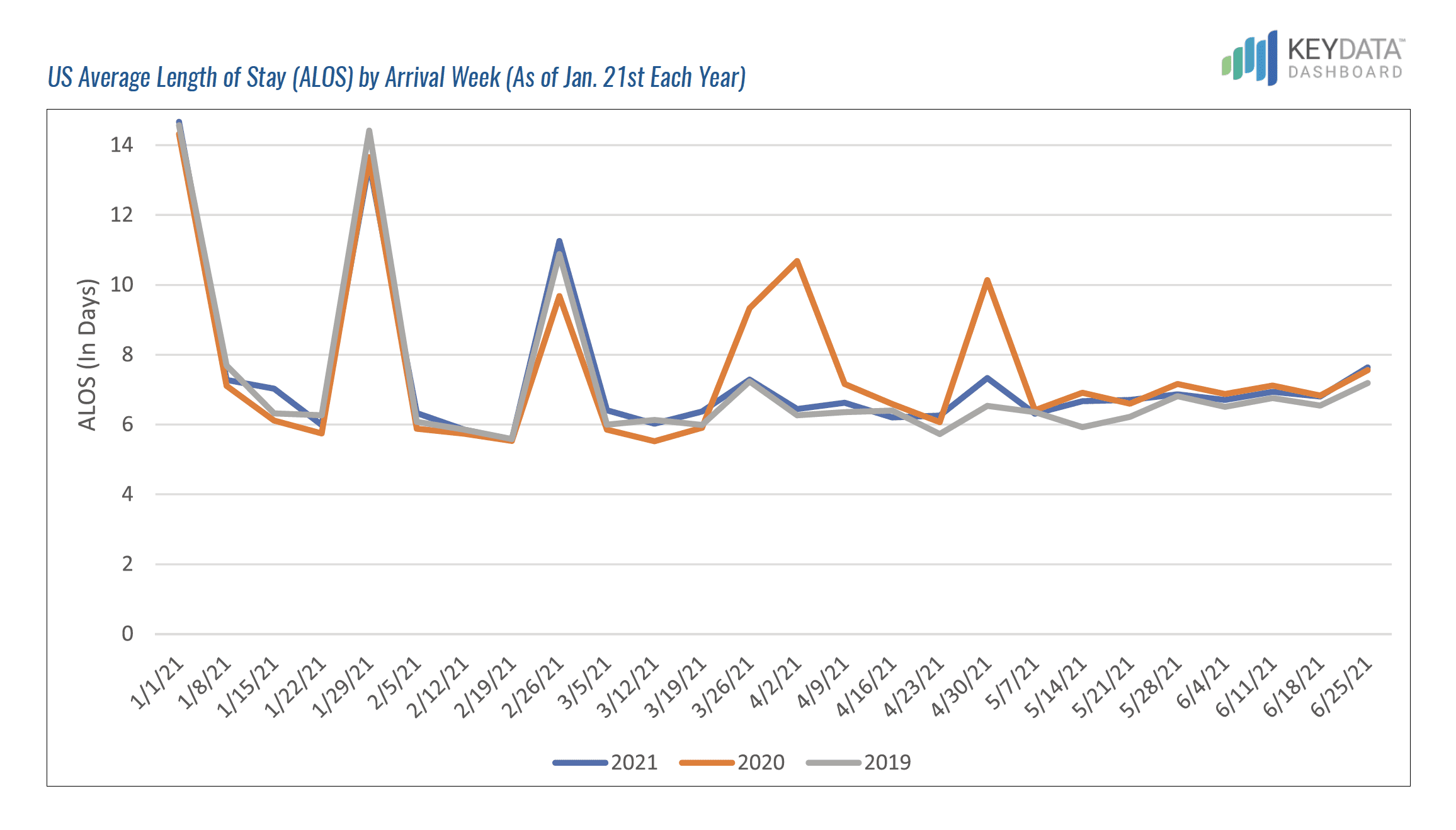

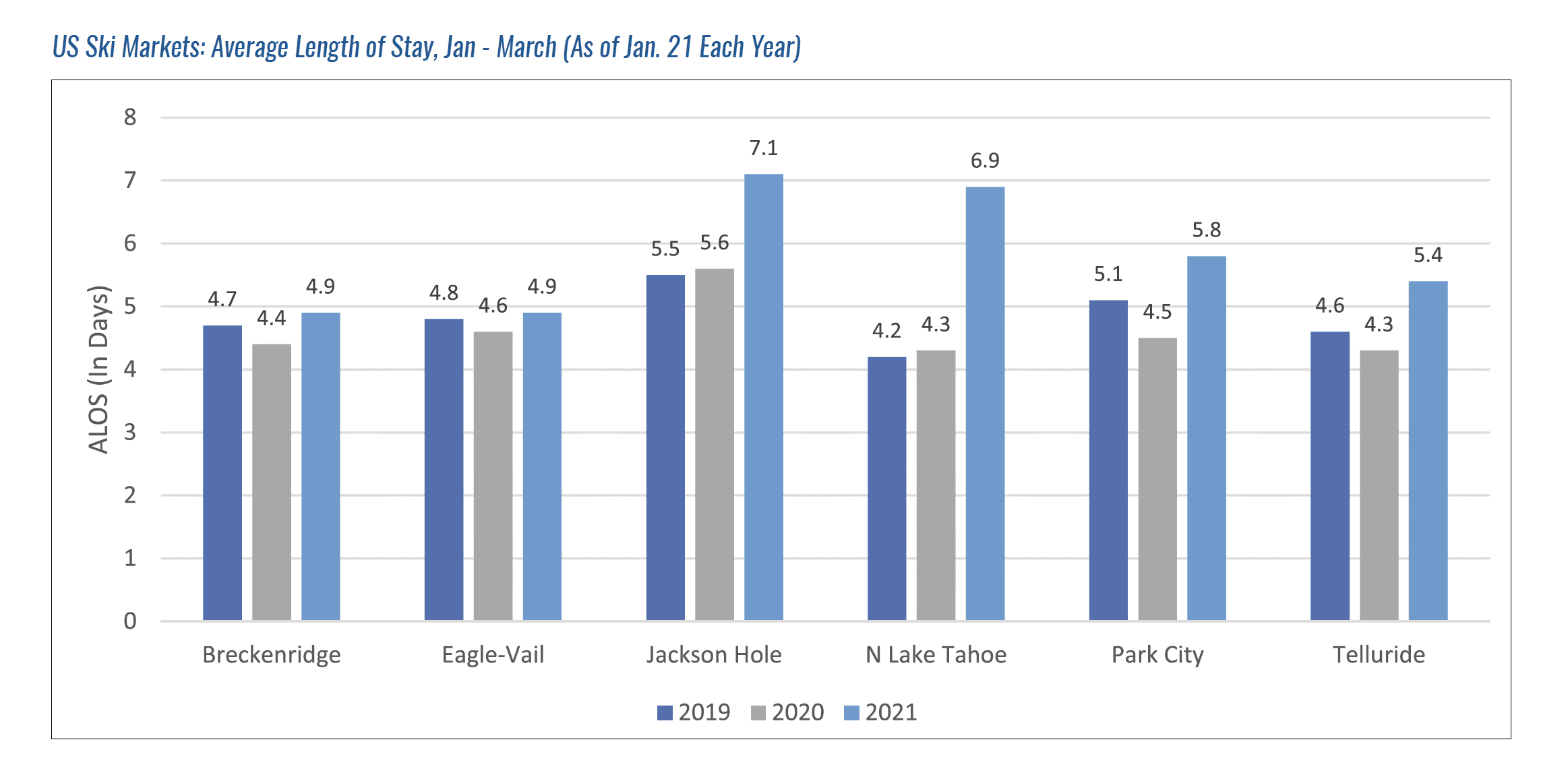

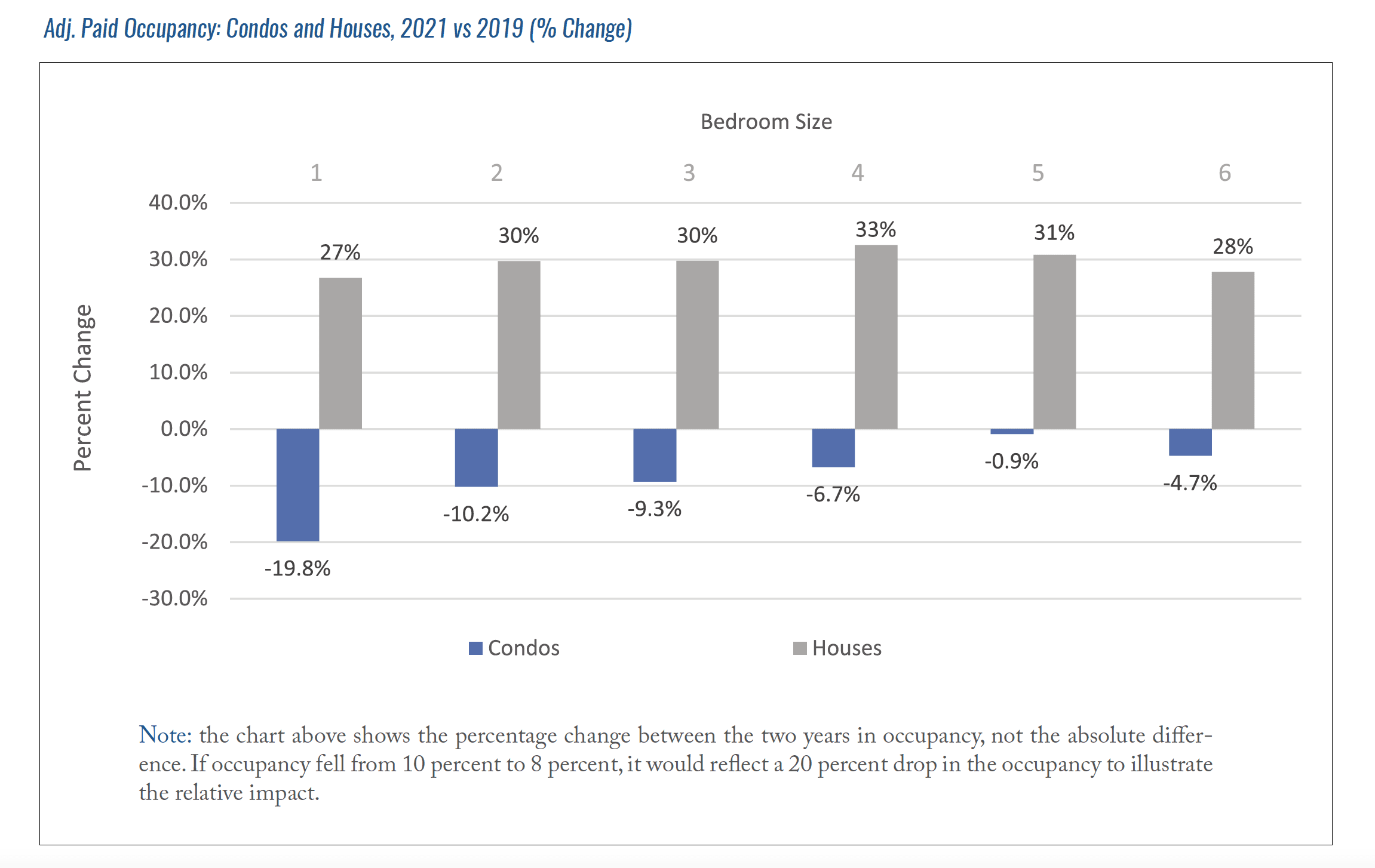

There is much talk about how ALOS is increasing significantly. But is it for our professionally managed vacation rentals? It would seem to make sense with COVID-19. People working from anywhere can stay longer. Many kids are doing school online. Here’s what the data shows.

There is much talk about how ALOS is increasing significantly. But is it for our professionally managed vacation rentals? It would seem to make sense with COVID-19. People working from anywhere can stay longer. Many kids are doing school online. Here’s what the data shows.

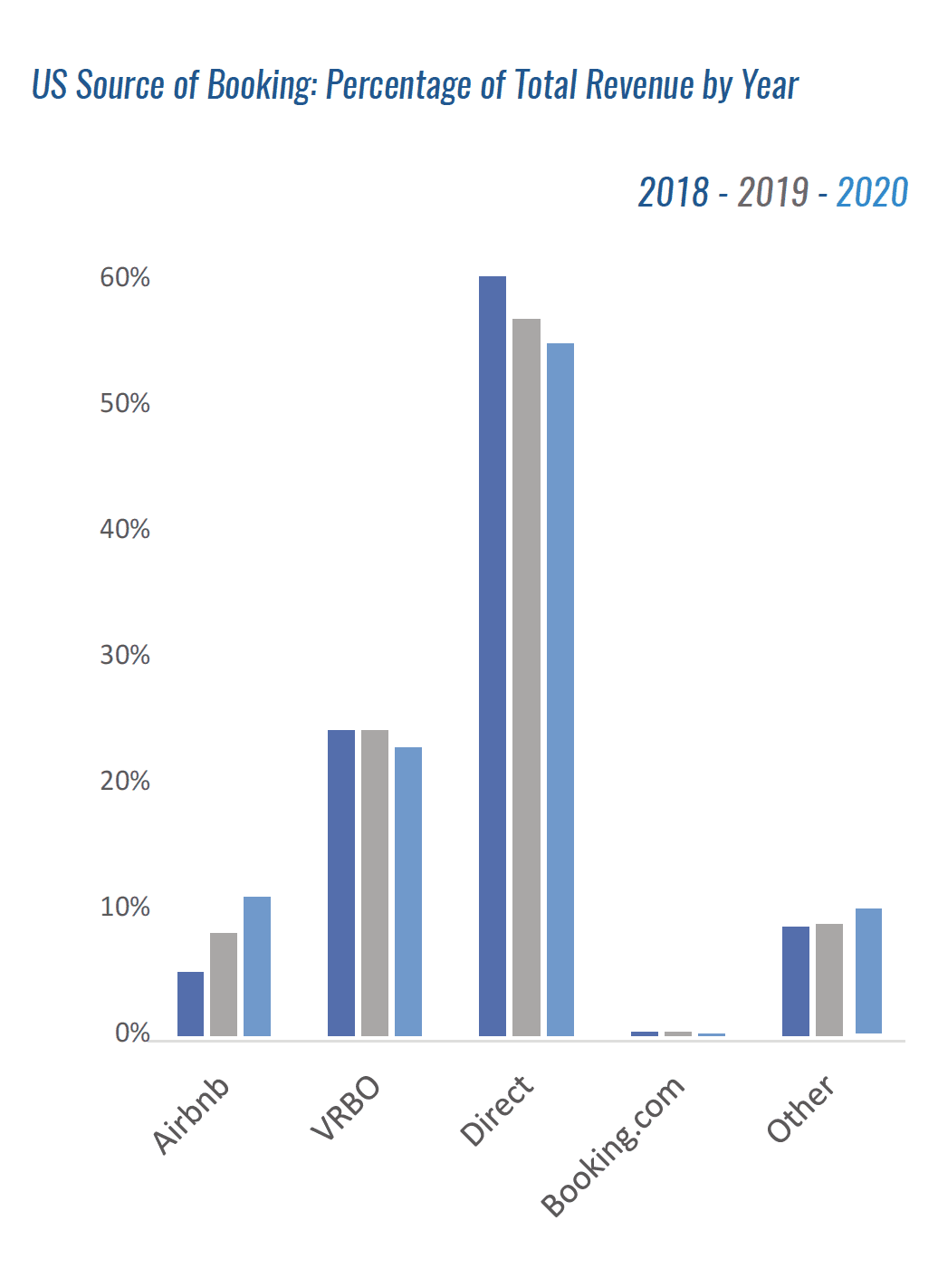

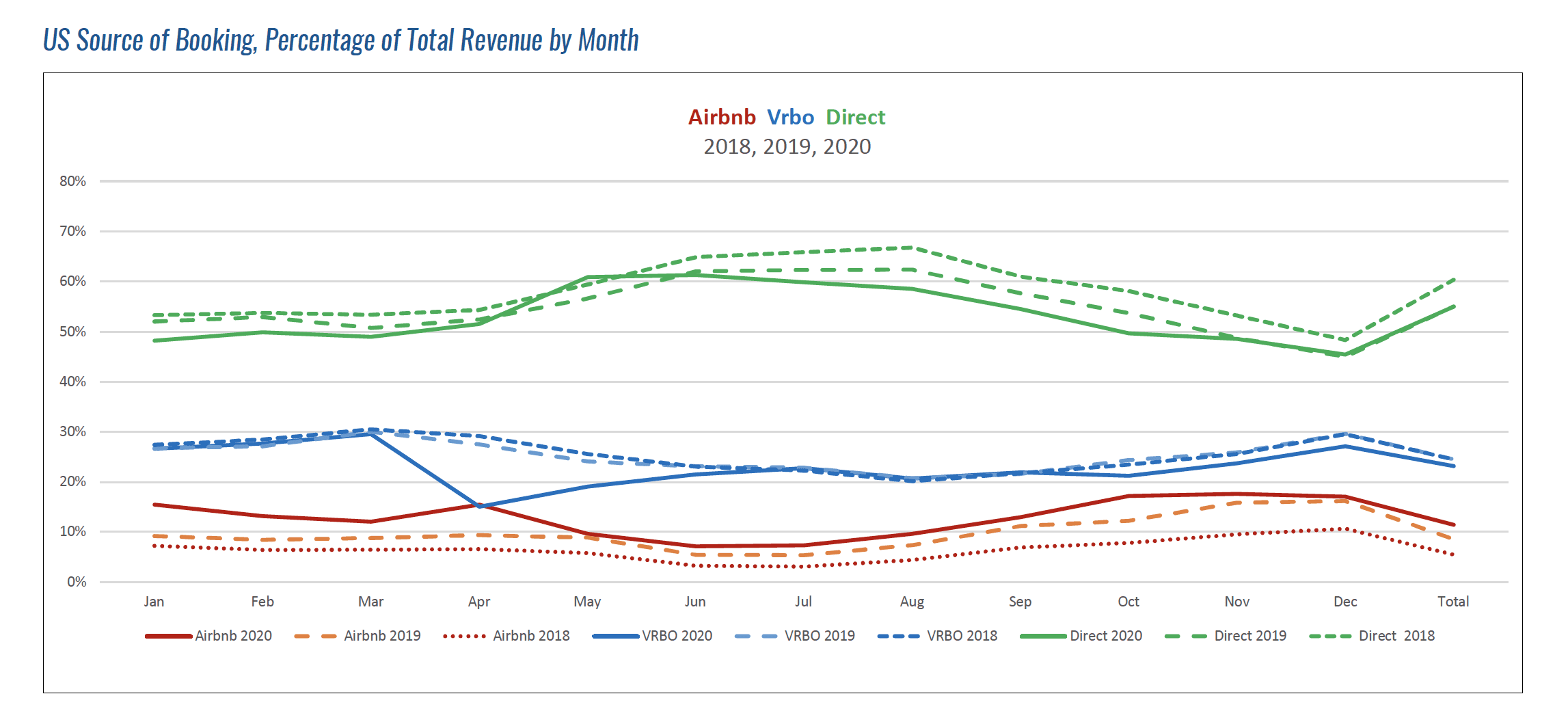

There is much speculation on how the OTAs are affecting each other and how professionals are keeping up with their push for direct bookings. Below we look for the first time at this data from the perspective of professional property managers on Key Data, which reflects significantly more of the leisure markets than the urban.

There is much speculation on how the OTAs are affecting each other and how professionals are keeping up with their push for direct bookings. Below we look for the first time at this data from the perspective of professional property managers on Key Data, which reflects significantly more of the leisure markets than the urban.

Travis Riner (Riner):

Travis Riner (Riner):

While the pandemic touched every aspect of the vacation industry, we were impressed by the resiliency and tenacity of our brands, clients, and partners. Beyond delivering technology solutions, we are encouraged by the way our industry is coming together to educate local, state, and national leaders on how travel can be done safely and by the positive impact of professional managers on the economy.

While the pandemic touched every aspect of the vacation industry, we were impressed by the resiliency and tenacity of our brands, clients, and partners. Beyond delivering technology solutions, we are encouraged by the way our industry is coming together to educate local, state, and national leaders on how travel can be done safely and by the positive impact of professional managers on the economy. From what I’m seeing in the marketplace, technology is definitely a challenge—specifically, the lack of financial visibility in the business. Most companies do not have accurate or timely financial statements that allow them the opportunity to make good business decisions.

From what I’m seeing in the marketplace, technology is definitely a challenge—specifically, the lack of financial visibility in the business. Most companies do not have accurate or timely financial statements that allow them the opportunity to make good business decisions. Over the past year, vacation rentals have proven their resiliency and appeal as a travel category, attracting new travelers and carving out more market share. We often beat the drum about increasing expectations of owners and guests and the push for quality in the industry. Professional managers have continued to elevate their businesses to meet these demands. Now, it’s important that operators don’t take their foot off the gas. We can expect increased competition from hotels edging into the vacation rental market with products that are designed to provide the authenticity of a vacation rental with full hospitality services. Technology that helps professional vacation rental operators deliver “hotel-like” guest experiences and services will continue to be a critical piece of successful management.

Over the past year, vacation rentals have proven their resiliency and appeal as a travel category, attracting new travelers and carving out more market share. We often beat the drum about increasing expectations of owners and guests and the push for quality in the industry. Professional managers have continued to elevate their businesses to meet these demands. Now, it’s important that operators don’t take their foot off the gas. We can expect increased competition from hotels edging into the vacation rental market with products that are designed to provide the authenticity of a vacation rental with full hospitality services. Technology that helps professional vacation rental operators deliver “hotel-like” guest experiences and services will continue to be a critical piece of successful management. 2021 is going to be the year that professional-grade software comes to the STR space.

2021 is going to be the year that professional-grade software comes to the STR space. The biggest changes we’ll see are shifts in consumer behavior. Like everyone else, vacation rental managers have radically adjusted priorities and reevaluated what’s important. This applies to software they’ve opted into in the past, how much they’re willing to pay, and the lightning-fast (for the industry) adoption of new products that deliver results.

The biggest changes we’ll see are shifts in consumer behavior. Like everyone else, vacation rental managers have radically adjusted priorities and reevaluated what’s important. This applies to software they’ve opted into in the past, how much they’re willing to pay, and the lightning-fast (for the industry) adoption of new products that deliver results. Nothing will be the same!

Nothing will be the same! The pandemic has shifted our industry in ways that are hard to comprehend just yet. But it’s important to take a moment and appreciate how technology helped propel the vacation rental industry to be one of the few travel success stories of 2020. Without virtual/keyless check-in and cleaning protocols systematized by new operating applications, managing the pandemic in a way that reinforced vacation rentals as a safe alternative to traditional lodging would have been far more difficult.

The pandemic has shifted our industry in ways that are hard to comprehend just yet. But it’s important to take a moment and appreciate how technology helped propel the vacation rental industry to be one of the few travel success stories of 2020. Without virtual/keyless check-in and cleaning protocols systematized by new operating applications, managing the pandemic in a way that reinforced vacation rentals as a safe alternative to traditional lodging would have been far more difficult. This is a resilient industry, no doubt in my mind. But as I think about how this pandemic differs from hurricanes, oil spills, low snow years, and economic pressures, it may be that for the first time, perhaps ever, technology is ready to play a significant role in the recovery if we let it.

This is a resilient industry, no doubt in my mind. But as I think about how this pandemic differs from hurricanes, oil spills, low snow years, and economic pressures, it may be that for the first time, perhaps ever, technology is ready to play a significant role in the recovery if we let it. As we adopt to how the world looks post the arrival of COVID in early 2020, I think we will see the following technology shifts become part of our lives in 2021:

As we adopt to how the world looks post the arrival of COVID in early 2020, I think we will see the following technology shifts become part of our lives in 2021: Much like the vacation rental industry itself, VR tech has been a fragmented space with niche providers. In many other vertical industries, there are clear enterprise leaders with $1B+ valuations (e.g.,

Much like the vacation rental industry itself, VR tech has been a fragmented space with niche providers. In many other vertical industries, there are clear enterprise leaders with $1B+ valuations (e.g.,  For starters, I think the stream of companies converting to another PMS will continue, with a handful of brands seeing the vast majority of the growth. This shuffling will add a lot of work for vendors, but it should result in an updated and increasingly robust platform from which to improve the technology in our space in the next few years. In the short run, tons of money continues to pour into pricing, revenue, and data tools, which should see significant growth this year. VR companies continue to be split into those focused on channel distribution and those focused on their brand. The prior saw consolidation over the last few years. I believe the roll-up of the larger regional brands will begin in earnest this year and continue through next year, with the creation of increasingly large companies in the US. The ones that get it right will focus on the people, the culture, and the service. The ones that focus on growth for growth’s sake will relearn the lessons our industry has previously taught. In the end, I think the next few years will see the full-scale arrival of the private equity firms, the flags, and the money. I believe that this will provide huge opportunities for those ready to grow, improve, and run fast—both in the VR company and on the vendor side. Up or out, as they say. Last, I’d look for the hotels to hit back once they’re on their feet. Any way you look at it, it should be an interesting ride for sure.

For starters, I think the stream of companies converting to another PMS will continue, with a handful of brands seeing the vast majority of the growth. This shuffling will add a lot of work for vendors, but it should result in an updated and increasingly robust platform from which to improve the technology in our space in the next few years. In the short run, tons of money continues to pour into pricing, revenue, and data tools, which should see significant growth this year. VR companies continue to be split into those focused on channel distribution and those focused on their brand. The prior saw consolidation over the last few years. I believe the roll-up of the larger regional brands will begin in earnest this year and continue through next year, with the creation of increasingly large companies in the US. The ones that get it right will focus on the people, the culture, and the service. The ones that focus on growth for growth’s sake will relearn the lessons our industry has previously taught. In the end, I think the next few years will see the full-scale arrival of the private equity firms, the flags, and the money. I believe that this will provide huge opportunities for those ready to grow, improve, and run fast—both in the VR company and on the vendor side. Up or out, as they say. Last, I’d look for the hotels to hit back once they’re on their feet. Any way you look at it, it should be an interesting ride for sure. COVID has changed a lot of things. With change comes opportunity, and this feeds into what Barefoot has been promoting the last few years. Portals’ branding to guests continues to be strong, but their focus on owners the past few years has been even stronger. Like all platforms (

COVID has changed a lot of things. With change comes opportunity, and this feeds into what Barefoot has been promoting the last few years. Portals’ branding to guests continues to be strong, but their focus on owners the past few years has been even stronger. Like all platforms (