This past February, I pulled into the driveway of my Orlando vacation rental around 9:00 p.m. on a Saturday night. It’s always unsettling to arrive to a dark home at night, so it was a welcome relief to see that the front porch lights were on. I opened my text messages to find my keycode, entered the home, and found lights tastefully on, soft music playing from the TV, and curtains opened to the lit pool and patio area. Exhale. Finally, after a year of not traveling, my vacation had begun.

“A relative newcomer to property management, Casiola founder Dennis Goedheid leveraged his technology and marketing background, along with a fresh look at the industry, to quickly grow and scale his Orlando-based vacation rental management company.”

As many guests do, I set out to explore the home, both out of curiosity and to make sure everything was OK. I was happy to see that all the beds had fresh white hospitality bedding, tight-tucked corners, and white towels folded perfectly and stacked on the beds. The bathrooms were spotless, with white bathmats folded and ready for use. Moving into the kitchen, I opened the cabinets to find that all glasses, dishes, pots, pans, flatware, utensils, and potholders were matched sets and were placed intentionally and carefully on shelves or organized in drawers. After unloading the car, I put on a swimsuit, made a cocktail, and took a dip in the perfectly heated pool.

The experience was so beyond my expectations that I had to call Casiola to find out more about the company.

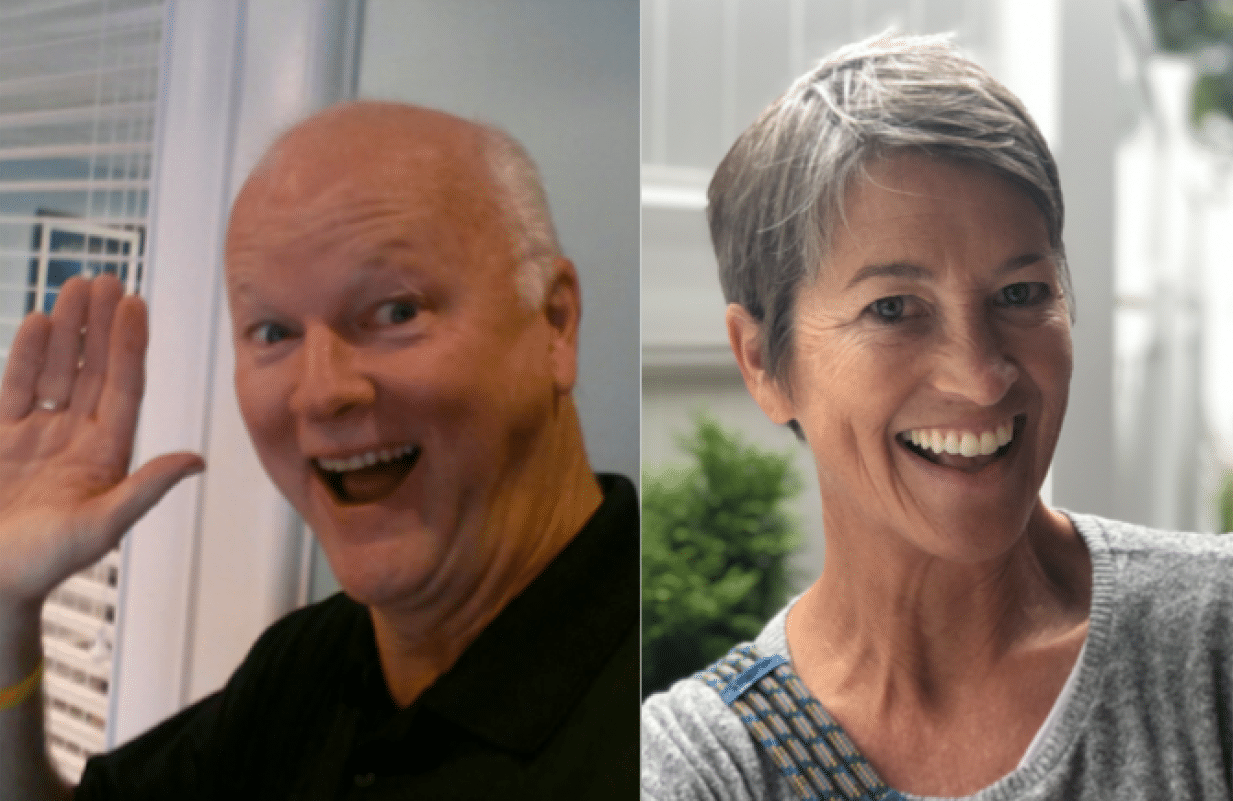

Dennis Goedheid, Founder and CEO, Casiola

Founded in 2014, Casiola is based in Orlando, has 35 full-time employees, and manages 300 homes in the Orlando area and 20 homes in Aruba.

Born and raised in Belgium, Casiola’s founder and CEO Dennis Goedheid is an intentional and savvy serial entrepreneur. After building and selling an online printing company in 2013, Dennis set out to find his next business venture. With a background in building complex and scalable technology, he headed to Silicon Valley and met with tech companies to scope opportunities. With the Bay Area’s high cost of living and fierce competition for talent, Dennis decided starting a company in that environment didn’t align with his dream for the family he was ready to start. After selling his last company, Goedheid wasn’t just looking for crazy multiples and a fast exit: “My goal was not to be traveling 300 days a year. I wanted to find a business that I could build, one in which I enjoy what I’m doing, am able to spend time with my family, and have the feeling that I can make a difference.”

Ten years before selling his company, Dennis met his wife Liliana Rojas in Barcelona when she was traveling with her family from Peru to Spain on vacation. As fate would have it, her mother took a job in Barcelona, which brought Dennis and Liliana closer in proximity and able to date, get engaged, and eventually marry.

Ten years before selling his company, Dennis met his wife Liliana Rojas in Barcelona when she was traveling with her family from Peru to Spain on vacation. As fate would have it, her mother took a job in Barcelona, which brought Dennis and Liliana closer in proximity and able to date, get engaged, and eventually marry.

Liliana joined Dennis in Belgium, but between travel and time in the office while building the printing business, Dennis wasn’t able to spend as much time at home as he would have liked. His primary goal with his new venture was to build a business that would allow him to partner with Liliana and create a life for their future family. The opportunities he found in Silicon Valley didn’t fit that plan, but the short-term rental industry caught his eye during his time there, so he headed to the vacation rental capital of the world and “happiest place on earth”—Orlando—to start a property management company.

Using his experience in marketing and graphic design, he began the company with a strong brand and professional collateral, which he then used to add inventory. Because many property owners in Orlando reside outside the United States, his European background and connections helped in building the business.

Dennis initially believed he would be able to work more reasonable hours from home, leverage OTAs and listing sites for bookings, and build a stable of reliable contractors to take care of the properties. “I have to say that I didn’t know what I was getting into,” Dennis laughed.

In 2014, Dennis and Liliana acquired FLCondos4Rent and its 20 management contracts, and the couple did everything: soliciting inventory, onboarding properties, answering phones, bookkeeping, communicating with homeowners and guests, marketing, managing cleaning and laundry, and much more. As the company grew, it wasn’t long before they found themselves working 16- to 17-hour days, which was the opposite of what they had planned. Dennis then returned to his roots and began developing systems and technology for standardization, automation, and communications that would help the company both scale and grow.

In 2014, Dennis and Liliana acquired FLCondos4Rent and its 20 management contracts, and the couple did everything: soliciting inventory, onboarding properties, answering phones, bookkeeping, communicating with homeowners and guests, marketing, managing cleaning and laundry, and much more. As the company grew, it wasn’t long before they found themselves working 16- to 17-hour days, which was the opposite of what they had planned. Dennis then returned to his roots and began developing systems and technology for standardization, automation, and communications that would help the company both scale and grow.

Custom-Built Technology System: Mobile First and Consumer Grade

Although Dennis uses Escapia as his software for reservations and accounting, like many managers he found that property management systems didn’t have all the functionality he needed for operations and communications.

“We started out building everything around it that we didn’t find in Escapia,” he explained. “We have two rules [for development].

The first thing is mobile-first. Everything we build has to work on a phone, so all functionality is built for a phone screen, but it also works on a desktop, of course. Second, everything we build has to be consumer-grade, meaning the user experience (UX) doesn’t require training. You should not need a manual to know how it works. The software has to be plain and simple. It’s saved so much time for our team, not having to go through extensive technology training or click on 20 screens to access everything they need in a day. We have three sections—properties, reservations/guests, and owners—and all sections are interconnected within the app.”

Homeowner App

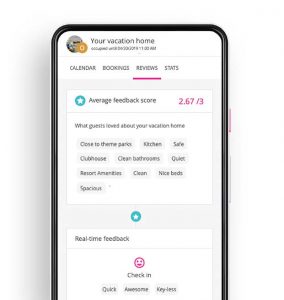

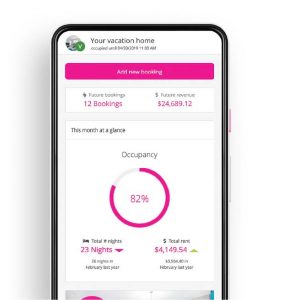

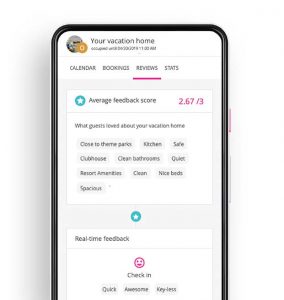

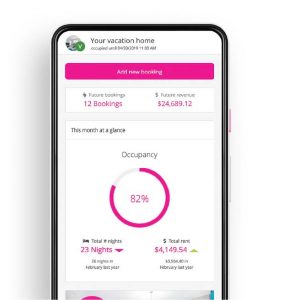

One of the most unique parts of Casiola’s platform is the custom homeowner app, which presents performance insights and shows homeowners everything that has happened and is happening in their home. At first glance, homeowners see the number of future reservations, total annual revenue, occupancy rate, and how the home’s performance compares to that of the previous year. Scrolling down, the homeowner sees a “property timeline” that displays all the current and previous activity in the home, including arrivals, departures, status items, clickable links to reports, invoices, work orders, and statements. It even shows when the pool heat was turned on or off.

“It started because I wanted to have a better overview of everything that was happening at a property. If you look at Escapia, you have a grid of all the reservations, but if you want to know what happened in maintenance or housekeeping, there’s just no place where it all comes together. What we created is like a property ‘feed’ so you can see in chronological order everything that happened.”

[su_row class=””]

[su_column size=”1/2″ center=”no” class=””] [/su_column]

[/su_column]

[su_column size=”1/2″ center=”no” class=””] [/su_column]

[/su_column]

[/su_row]

The homeowner also sees all reviews and comments as they are sent. “The owner can see how they’re doing and how we’re doing,” Dennis said. “Also, if it’s not good, they can view what they can do at their property to perform better with guests.”

I wondered whether Dennis was concerned that he was providing too much visibility, but he said that owners love it because they have insight into real-time performance and can see each action taken at the home. “When I first presented [the owner app] to the team, and especially the owner team, they all thought I was crazy. They were so afraid that the homeowners would yell and scream at them because they might see a bad guest review or see a service order and would want to know everything about it. In the end, it saved us a lot of time because the owner can see everything that’s happened, including photos and reports. Everything we know, they know.”

Operations App

Each role in the field has its own app view. For example, Casiola has a group of team members it calls “portfolio managers” who manage a portfolio of 20 to 30 homes, depending on size. These portfolio managers are fully responsible for every activity in each home in their assigned portfolio, including inspections and work orders. Their opening dashboard shows all arrivals, departures, outstanding to-do items, and all current and upcoming activities for the portfolio. They can view a chronological feed for all activity as a whole or by task type, property, contractor, or day.

The platform’s UX is extremely simple, with a dashboard for each role, intuitive color coding, a social-media-style feed format, and easy calendar views. All property photos that the guest sees are in the app, in addition to the standard appearance guides, housekeeping photos, checklists, and appliance guides.

Each part of Casiola’s technology is fully integrated with the others. One of the coolest features is that the app has its own search engine, so team members can do a quick search for any keyword (e.g., owner, property, guest, contractor). Every detail about the home can be found quickly, including door codes, Wi-Fi passwords, directions, reservation sources, all emails related to a reservation or property, work orders, maintenance requests, status reports, and reviews. All information and communications are stored and searchable within the app. Dennis has also automated much of the onboarding process, so he has been able to significantly reduce time getting new properties added.

Multilingual Feature in Beta

With so many international homeowners, team members, contractors, and guests, many of Casiola’s app users do not speak English as their first language. Consequently, Dennis has developed a multilingual version currently in beta that translates all text in the app into the user’s language of choice.

High-Level Standardization

As a Casiola guest, it was apparent that each room, closet, cabinet, and drawer in the home has a standard appearance guide and checklist for housekeepers and inspectors. Dennis shared that, shortly after the initial growth stage of the company, he set out to standardize bedding, linens, kitchen items, and their appearance at all Casiola homes.

Standardized Bedding and Kitchen Packages

Dennis explained that, in Europe, hospitality-quality bedding was a standard expectation. “I’ve always wondered, even before I got into this business, when I traveled here, for me the most disgusting thing ever is a comforter and a hundred pillows on the bed. The only thing you can do is throw everything on the floor before you can go to sleep. I’ve never understood it. And it was too much to manage; when there are stains on a comforter, you have to get a replacement and get it dry-cleaned. It just never felt clean to me, and if I don’t want to be in a bed like that, why would I expect my guests to sleep in a bed like that?”

Dennis explained that, in Europe, hospitality-quality bedding was a standard expectation. “I’ve always wondered, even before I got into this business, when I traveled here, for me the most disgusting thing ever is a comforter and a hundred pillows on the bed. The only thing you can do is throw everything on the floor before you can go to sleep. I’ve never understood it. And it was too much to manage; when there are stains on a comforter, you have to get a replacement and get it dry-cleaned. It just never felt clean to me, and if I don’t want to be in a bed like that, why would I expect my guests to sleep in a bed like that?”

As with operations, Dennis built a linen management technology platform that provides staff with quantities and linen types for each home and generates labels with scannable QR codes so management knows when linens are picked up and dropped off. Once linens are switched out and returned, they are scanned again and weighed to check for missing items.

Casiola also has standardized kitchen packages with standard glassware, dinnerware, flatware, cookware, small appliances, utensils, and potholders for its homes.

Dennis worked with Durk Johnson to create each property’s standard appearance guidelines, and that information is communicated with housekeepers and inspectors via the company’s custom app. Each room, closet, cabinet, and drawer has a corresponding set of photos showing what it should look like, along with the quantity of each item that should be placed there.

Dennis worked with Durk Johnson to create each property’s standard appearance guidelines, and that information is communicated with housekeepers and inspectors via the company’s custom app. Each room, closet, cabinet, and drawer has a corresponding set of photos showing what it should look like, along with the quantity of each item that should be placed there.

“We define how many of each item there should be in each cabinet and drawer, what it should look like, and how it should be organized,” Dennis said. “All these details are important, and it has to look nice, so we have pictures for each area of the property. That also tells us that each item has been inspected to make sure it’s clean.”

Additionally, the app contains documentation and photos for large appliances, TVs, and remotes and shows housekeepers how each bed should be made and what it should look like.

Marketing and Revenue Management

Using his experience in branding and printing, Dennis carefully researched each aspect of Casiola’s brand creation, including colors, fonts, and design. With his passion for standardization, it isn’t a surprise that strict brand guidelines are used in everything that Casiola touches, including professionally printed signage for almost everything in the home. Reminiscent of a large, luxury hotel brand, standards carry over to the office, uniforms, brochures, email templates, the company website, guest and owner apps, and email signatures.

Vacation rental management companies in the Orlando area face a unique set of marketing challenges such as fewer year-over-year repeat guests, fierce competition from hotels, and astronomical PPC rates. Dennis explained, “When I hear from companies that have 70 percent repeat traffic, that’s something we don’t have in Orlando. We’ve stopped bidding on keywords, for example. It’s cheaper for us to get business initially from OTAs.”

“Every single major hotel and hospitality brand is here, including Disney and Universal, and they’re all competing with each other,” Dennis added. “Most of our bookings come from OTAs because it’s the cheapest way for us to get those bookings. It costs us more to get a direct booking using SEO/SEM than through a third-party channel. For our homes in Aruba, it’s different. We’re already seeing top search-engine placement for our Aruba rentals after only a few months, and therefore we’re able to get more direct bookings.”

“Every single major hotel and hospitality brand is here, including Disney and Universal, and they’re all competing with each other,” Dennis added. “Most of our bookings come from OTAs because it’s the cheapest way for us to get those bookings. It costs us more to get a direct booking using SEO/SEM than through a third-party channel. For our homes in Aruba, it’s different. We’re already seeing top search-engine placement for our Aruba rentals after only a few months, and therefore we’re able to get more direct bookings.”

With its heavy use of OTAs, Casiola has dedicated resources to revenue and channel management. “In Orlando, there are submarkets like the convention center area where we have a lot of homes,” Dennis explained. “It’s a completely different market than the Kissimmee area, where you have people going to Disney. You need to have extensive local knowledge of each of these areas, be able to change revenue management strategies and channel marketing – even the channels themselves and your cancellation policies – for each area.”

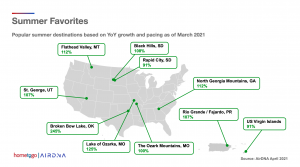

Emily Pattillo, who heads up revenue management for Casiola, optimizes each home’s pricing and merchandising on each channel using a combination of channel managers, pricing tools, and manual overrides. Pattillo shared more about the company’s revenue strategy in an article on page 78 and will be joining us at the Data and Revenue Management (DARM) Conference in Charleston, August 17–18, to discuss strategies.

Staffing Challenges

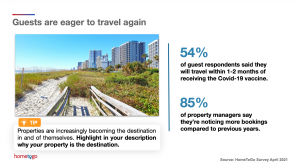

As with the majority of vacation rental management companies, Casiola is currently facing significant staffing challenges. Orlando’s low occupancy as a result of COVID-19 lasted longer than many other leisure destinations, but, when booking activity resumed, it did so in a whiplash fashion.

“It’s like someone announced in February that COVID was over in Orlando. January and February are usually our highest booking months. This past January was our worst month ever, but then a tsunami of reservation activity hit us in February,” Dennis explained. “Now, we’re booked heavily for the rest of the year—all months—and we had the best spring break on record.”

Dennis shared that his team struggled to keep up with the overwhelming email and call volume. The booking window was extremely short, which made it difficult to adequately staff, and Dennis said it has been impossible to find frontline workers.

“In February, it went from 0 to 100 in two to three weeks. I worked for three months straight, seven days a week, 16 to 17 hours a day to keep up. I was doing 300 to 400 emails a day, answering calls, and taking reservations. It was bad. Since spring break ended, it’s been more reasonable, and we were able to hire five more people. We also started working with Extenteam to hire people in the Philippines to help with guest email and call volume, and it turned out great! They’re now covering our night shift, and we can now start the day without a backlog, so it really makes a big difference.”

With the explosion of booking activity, reservations stretching well into 2022, and revenue optimization strategies that have brought ADRs up, Casiola is expecting a record-setting year.

Looking to the Future

Over the past year, as Dennis networked with other property management company owners, he has seen interest from other companies regarding licensing his technology, branding, and marketing. As a result, he’s working on a model to partner with local operators, which he has successfully done in Aruba.

“We’re trying to fine-tune that concept right now. We’ve learned that you have to have local partners with local knowledge and property knowledge. If you have good local operators who really care and who understand hospitality and guest satisfaction, and we can combine that with our marketing, branding, and technology, we have a really strong concept and combination.”

In this newly created position, Lang will work across the division to drive strategic initiatives and client advocacy programs that accelerate the future of vacation rental technology and deliver greater value for the vacation rental industry. She will report to Eric Broughton, Chief Strategy Officer.

In this newly created position, Lang will work across the division to drive strategic initiatives and client advocacy programs that accelerate the future of vacation rental technology and deliver greater value for the vacation rental industry. She will report to Eric Broughton, Chief Strategy Officer. Additionally, Robin Bulba has joined the company as Vice President, Vacation PMS. With more than 20 years of experience in property management, Bulba has led all aspects of business operations. She is skilled at strengthening operations management while improving workflow, streamlining processes, systems analysis, quality improvement, and cost control.

Additionally, Robin Bulba has joined the company as Vice President, Vacation PMS. With more than 20 years of experience in property management, Bulba has led all aspects of business operations. She is skilled at strengthening operations management while improving workflow, streamlining processes, systems analysis, quality improvement, and cost control.

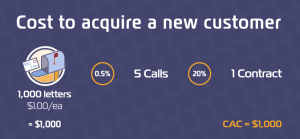

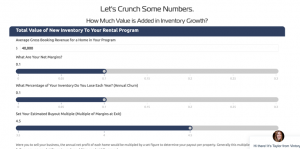

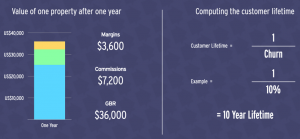

Ultimately the cost of these clicks is so low because there are many more impressions available, and at its heart, the Google Auction is modeled off of supply and demand (with plenty of nuance along the way). People are ALWAYS (especially now) looking for inspiration to travel and go on vacation. The number of people who are going to travel in a given time period vs the number of people who are looking to list their home with a professional rental manager is vastly different.

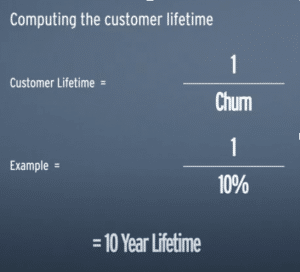

Ultimately the cost of these clicks is so low because there are many more impressions available, and at its heart, the Google Auction is modeled off of supply and demand (with plenty of nuance along the way). People are ALWAYS (especially now) looking for inspiration to travel and go on vacation. The number of people who are going to travel in a given time period vs the number of people who are looking to list their home with a professional rental manager is vastly different. Let’s go back to $2,000 – $20,000 hitting the net margins each year. With a 10-year lifetime value, you’re looking at somewhere between $20,000 and $200,000 in lifetime value and a lifetime Gross Booking Revenue of $2M+.

Let’s go back to $2,000 – $20,000 hitting the net margins each year. With a 10-year lifetime value, you’re looking at somewhere between $20,000 and $200,000 in lifetime value and a lifetime Gross Booking Revenue of $2M+.

In my experience, most technology vendors are more than willing to collaborate with property managers and value their input regarding product features. If part of their product isn’t working for you, tell them. There are brilliant minds out there eager and willing to build and adapt their products to your needs. Sometimes it takes longer than we want or requires a bit more nudging. Sometimes the squeaky wheel gets the grease, and sometimes it requires a ton of persistence. However, if we don’t constantly try to better our strategies and our ability to execute them, we do not evolve as a company or an industry.

In my experience, most technology vendors are more than willing to collaborate with property managers and value their input regarding product features. If part of their product isn’t working for you, tell them. There are brilliant minds out there eager and willing to build and adapt their products to your needs. Sometimes it takes longer than we want or requires a bit more nudging. Sometimes the squeaky wheel gets the grease, and sometimes it requires a ton of persistence. However, if we don’t constantly try to better our strategies and our ability to execute them, we do not evolve as a company or an industry.

Ten years before selling his company, Dennis met his wife Liliana Rojas in Barcelona when she was traveling with her family from Peru to Spain on vacation. As fate would have it, her mother took a job in Barcelona, which brought Dennis and Liliana closer in proximity and able to date, get engaged, and eventually marry.

Ten years before selling his company, Dennis met his wife Liliana Rojas in Barcelona when she was traveling with her family from Peru to Spain on vacation. As fate would have it, her mother took a job in Barcelona, which brought Dennis and Liliana closer in proximity and able to date, get engaged, and eventually marry. In 2014, Dennis and Liliana acquired

In 2014, Dennis and Liliana acquired

Dennis explained that, in Europe, hospitality-quality bedding was a standard expectation. “I’ve always wondered, even before I got into this business, when I traveled here, for me the most disgusting thing ever is a comforter and a hundred pillows on the bed. The only thing you can do is throw everything on the floor before you can go to sleep. I’ve never understood it. And it was too much to manage; when there are stains on a comforter, you have to get a replacement and get it dry-cleaned. It just never felt clean to me, and if I don’t want to be in a bed like that, why would I expect my guests to sleep in a bed like that?”

Dennis explained that, in Europe, hospitality-quality bedding was a standard expectation. “I’ve always wondered, even before I got into this business, when I traveled here, for me the most disgusting thing ever is a comforter and a hundred pillows on the bed. The only thing you can do is throw everything on the floor before you can go to sleep. I’ve never understood it. And it was too much to manage; when there are stains on a comforter, you have to get a replacement and get it dry-cleaned. It just never felt clean to me, and if I don’t want to be in a bed like that, why would I expect my guests to sleep in a bed like that?” Dennis worked with

Dennis worked with  “Every single major hotel and hospitality brand is here, including

“Every single major hotel and hospitality brand is here, including

All employees of Resort Collection, Distinctive Beach Rentals, and Resort Properties Management were offered jobs by VTrips at the same or better pay and benefits, said Milo. “VTrips believes that employees are the lifeblood of these companies, and we are doing everything possible to create a positive environment for them.”

All employees of Resort Collection, Distinctive Beach Rentals, and Resort Properties Management were offered jobs by VTrips at the same or better pay and benefits, said Milo. “VTrips believes that employees are the lifeblood of these companies, and we are doing everything possible to create a positive environment for them.”

As CEO, Les Williams has been responsible for the overall strategic direction and operation of the SH Enterprises family of companies as well as the day-to-day oversight of STARR Textile Services. Williams has worked for SH Enterprises for since 2005, including as chief operating officer for Meyer Services, vice president of administration and finance for Meyer Real Estate, and a variety of other leadership roles.

As CEO, Les Williams has been responsible for the overall strategic direction and operation of the SH Enterprises family of companies as well as the day-to-day oversight of STARR Textile Services. Williams has worked for SH Enterprises for since 2005, including as chief operating officer for Meyer Services, vice president of administration and finance for Meyer Real Estate, and a variety of other leadership roles.