VacationRentPayment, a Yapstone payment processing facilitator widely used by vacation rental managers and homeowners, is notifying its property management (PM) customers that it will be holding funds for 30 days from the time of booking.

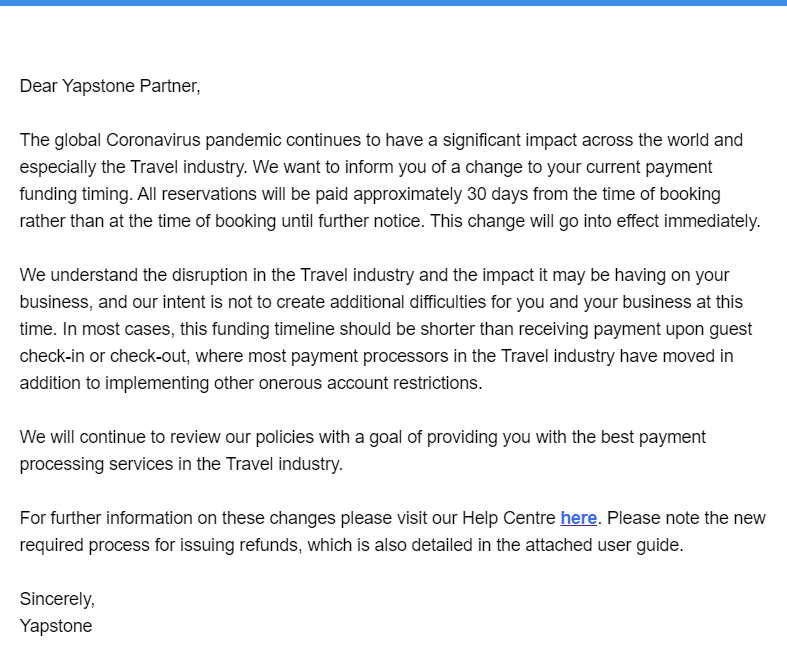

According to a company email to PMs, “We want to inform you of a change to your current payment funding timing. All reservations will be paid approximately 30 days from the time of booking rather than at the time of booking until further notice. This change will go into effect immediately.”

According to a company email to PMs, “We want to inform you of a change to your current payment funding timing. All reservations will be paid approximately 30 days from the time of booking rather than at the time of booking until further notice. This change will go into effect immediately.”

PMs are reporting that funds ceased to be deposited into their accounts the following day after receiving the email, including revenue from all credit cards, debit cards, and echecks.

Yapstone’s representatives are telling clients that, while some PMs have not yet been notified, the new 30-day policy will apply to all vacation rental management accounts.

According to one longtime Yapstone PM client, “I’ve never seen a vendor operate in such a unilateral, heavy-handed manner. This obtuse and short-sighted decision underscores the ineptitude of its senior management team, lack of fundamental business decorum and calls to question why anyone would partner with such a blundering business within an industry that is predicated on relationships.”

Ramifications for Vacation Rental Management Companies

The issue of delayed payments is quickly becoming the greatest COVID-related financial challenge facing vacation rental providers.

Each day we receive multiple emails from PMs about delayed payments for reservations booked through Airbnb, Vrbo, and merchant-of-record channel managers (e.g., VacayHome and RedAwning). However, delayed payments from credit card processors have extensive and far-reaching consequences for PMs, impacting nearly all booking revenue.

According to PMs who have reported the policy change, below are some of the difficulties resulting from Yapstone’s 30-day delay in payments:

- Yapstone’s new policy creates significant hardship in managing cash flow during a time when cash is critical to maintain operations.

- With an increase in last-minute bookings caused by COVID-19, many stays are occurring within 30 days. This means the management company must confirm, service and complete stays for guests without receiving any of the funds due to them.

- Necessary disbursements from rental revenue for occupancy taxes, travel insurance, and ancillary services cannot be remitted.

- The new policy violates many PM’s agreements/contracts with homeowners.

- If a guest wants to cancel or change a reservation during the 30-day window, the PM is unable to do so. The only recourse is telling the guest to initiate a chargeback which has additional negative consequences for the PM.

- PMs using Yapstone/VacationRentPayment are at a competitive disadvantage compared to other PMs who are receiving funds as usual, putting their inventory and financial health at risk.

- Many PMs earn interest on escrow accounts, and the policy change negatively impacts this revenue stream.

Yapstone’s website says the company manages payments for 400,000 vacation rental properties. If true, the company could be holding over $2.5 billion in rental revenue owed to vacation rental operators during a 30-day window, creating enormous exposure for an industry working to recoup losses related to COVID-19.

Additionally, in states that require escrow accounting reconciliation, the new policy threatens the ability for vacation rental operators to remain compliant. We spoke to Jeff Malarney, chairman of the North Carolina Real Estate Commission (NCREC) who said they are attempting to reach out to Yapstone to discuss potential compliance issues regarding the state’s Trust Accounting regulations.

Why is Yapstone making this change?

While we have not yet spoken directly to Yapstone, the core reason for the change appears to be risk management.

VacationRentPayment/Yapstone is a Payment Facilitator (PayFac), which is a sub-merchant account used to provide payment processing services to their own merchant clients. “A payments facilitator (or PayFac) allows anyone who wants to offer merchant services on a sub-merchant platform. Those sub-merchants then no longer have to get their own MID and can instead be boarded under the master MID of the PayFac who is sponsored by a bank,” Roy Banks, CEO of NMI, told PYMNTS.com. “The PayFac does not have to underwrite all merchants upfront — they are instead, underwriting the merchants essentially as they continue to process transactions for them on an ongoing basis.”

As a result, if a PayFac is not diligent about vetting its customers’ financial stability, a company like Yapstone can end up with a portfolio that includes high-risk clients. While Yapstone services many large, well-funded PMs, it also provides services for less sophisticated PMs who struggle to operate year-round without dipping into advance deposit funds.

When a situation—like a pandemic, for example—occurs (causing numerous refunds, reservation changes, cancellations and chargebacks), less responsible PM companies that have have borrowed from advance deposits don’t have the funds to return to the guests; and Yapstone is left holding the bag and is required to refund the guests themselves. It is likely that Yapstone is hedging against potential losses by holding on to 30 days worth of transactions before distributing them to the merchants.

In short, financially healthy professional VRMs are paying the price for Yapstone’s decision to do business with less responsible and less credit-worthy companies.

“VRP’s growth at any cost and lack of basic financial oversight when onboarding new clients has created a business that is heavily invested in unsustainable vacation rental management companies,” said one PM whose company has been working with Yapstone/VRP for a number of years. “Why would [Yapstone] agree to provide merchant services to a company that doesn’t have reconciled accounts and unfunded liabilities? This drunken management style inevitably creates a collection problem, but instead of culling out the bad apples, they crack down on those of management companies that have been trusted partners to bail them out?”

“It’s unfair that when you do everything right, you’re the one that gets penalized for other people’s mistakes!” said another long-time VRP client. “How do you manage cash flow when your partners aren’t paying you?”

Another PM called it “classic embezzler’s logic.”

While Yapstone attempts to decrease its exposure, this new policy substantially increases exposure for vacation rental providers.

The numbers are not small.

Concerns about COVID-19 are causing many travelers to book last minute. For example, a company with 500 properties receiving hundreds of reservations for peak summer stays, will be waiting for Yapstone to pay over $10 million for stays that are occurring within the 30-day window.

Yapstone may not be the only payment processing company making changes to its policy. We have received unconfirmed reports that Lynnbrook is also making changes. We reached out to Lynnbook and have not yet received a response.

We also reached out to Ascent Processing who said that it is “business as usual” for its clients, and Ascent will not be delaying payments.

Yapstone and Vrbo

Until recently, Yapstone was the payment facilitator for Vrbo/HomeAway, and there are hundreds of comments on social media demonstrating homeowners’ frustration with the Yapstone’s policy changes which included a 3 percent surcharge for timely payment disbursement.

In April, Vrbo moved away from Yapstone to an in-house payment platform.

“For partners who process payments through Vrbo’s platform, we recently completed the migration of all partners from Yapstone to our in-house payment platform,” said Lisa Chen, Vrbo’svice president of global business for property managers. “We built our payment platform on three principles: security, reliability and choice. These are foundational, no matter the situation, and will guide our actions and policies ongoing. Property managers can continue using software to process their payments as we continue to work with Yapstone.”

However, homeowners have also reported delayed payments from Vrbo.

“As it did for many other operations, COVID-19 created unprecedented disruptions to payment flows, prompting Vrbo to temporarily delay refunds and payouts,” said Chen. “These delays enable the teams to accurately process refunds by sending the correct dollar amount to the correct place and helps avoid scenarios where payouts are sent to partners only to turn around and have their account debited because a traveler quickly cancelled.”

What to do?

According to PMs who recently have spoken with Yapstone representatives, the company appears resolute in its decision and may be considering additional delays.

One PM told us her Yapstone account rep said the company is considering further delaying payments to 30 days after the reservation—a move that would be devastating for vacation rental management companies.

In the past, the vacation rental industry has seen vendor companies reverse heavy-handed policies when public backlash from its clients is severe. In this case, though, it is hard for a PM to take a hard, public stance out of fear that payment services could be turned off before the PM is able to find an alternative.

Even in normal times, anytime a private company is holding billions of dollars that are not FDIC-insured, the risk for default is significant. But in a volatile market environment like the one PMs are currently in, the risk is unacceptable.

I spoke with Yapstone today and they deny this is being applied to all pms. Just some. They said none from vrmintel reached out to the, for comment.

Seems like that should have been done.

This is completely unacceptable. Already none of our clients were actually happy with their service, but some stuck with them due to their rates. We have a PM client who had this happen retroactively. VRP started withholding funds on June 3 and they weren’t notified until June 8. Now they’re holding a large amount of money hostage, money the PM will have to pay out to homeowners for stays in early June before they get it from VRP. (IF they get it from VRP.) This does not strike us as something a reputable or solvent processor would do. As a result of this, we are urging all of our clients to immediately switch away to one of our many alternative options.

If Yapstone thought this was a remotely acceptable thing to do then they would have given advance notice. Instead it was announced when or before the change took place. Everything about this hinders the PM’s ability to operate and serve their owners and guests.