Every business owner understands the importance of having a well-designed business plan in place. A solid plan outlines strategies for growth, details how to train and motivate staff, and maintains flexibility based on trends in the industry.

The vacation rental management (VRM) industry has seen lots of recent change, and company owners are aware of the need to adapt. Having a business plan in place helps the management team know what is expected, even in the midst of these industry changes, and setting goals for the business motivates everyone to make strategic adjustments to stay on track. As the old saying goes: “If you don’t know where you are going, any road will get you there.” You just might not like where you end up.

Although VRM businesses may have a business plan in place, these plans may have neglected exit strategies.

After years of hard work building their businesses, company owners may find themselves floundering when it comes time to sell or transition because an exit strategy was not built into their plans. Taking the time to do advanced planning can have life-changing results when the right opportunity presents itself.

Here are key reasons that business owners should have a customized exit strategy:

1. Maximize value

In most cases, there are pre-sale steps that can be implemented to increase the value of a business to a potential buyer. Being strategic about expenses and taking measures in an effort to maximize revenues in the years leading up to a planned exit can dramatically increase the value of your business when you are ready to sell. You have worked hard to make your business successful – why not be proactive now in order to reap the largest reward later?

2. Reward key employees

Having a strong team in place is a powerful negotiating tool. An exit strategy that benefits employees may help you retain your best personnel during a transition and demonstrates they are integral to the team. When employees feel valued, they are more likely to produce better work to increase the overall value of your business.

3. Tax strategies

If you want to transition your business to family members or key employees, you can take steps over time to minimize the tax consequences of a sale or gift. In many cases, these techniques take years to implement to be fully effective, so creating your pre-sale plan now will ensure you get the most out of your sale when the time comes.

4. Understanding the other side of the sale

Many business owners are so busy running their business that they haven’t focused their energy on personal investment planning. Successful VRM owners enjoy a steady income produced by their business, and halting this revenue stream can be disconcerting, or even terrifying.

However, in most cases, they haven’t run an analysis of what would happen if they sold their business and invested the proceeds from the sale in alternative solutions. The pre-sale planning process does just that. We run an analysis through a Wells Fargo Advisors Envision® plan that factors in all sources of income and expenses. This informs the owner how much income they might expect when selling their business at different valuations.

This is vital during the negotiating process. Ben Edwards, President of Weatherby Consulting, LLC, stated: “Many sale opportunities are missed because owners have not done any pre-sale planning and they don’t understand the impact that selling their business will have on their lives.” We can help you be proactive by helping you plan your life after selling your business.

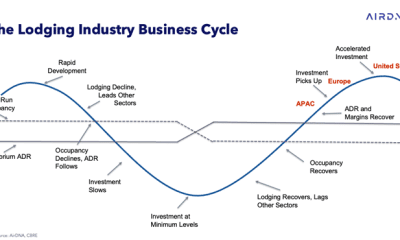

5. Capturing the top of the business cycle

As you know, the best time to sell is during a strong business cycle, but many VRM owners miss this opportunity if they aren’t familiar with the market cycle. Fear of the unknown often causes paralysis, which can lead to missing a higher market and waiting (potentially for years) for it to come back.

Many factors can contribute to a hot market and strong offers: high demand, change in demographics in a particular area, etc. Because these factors can be difficult to predict, creating your pre-sale plan years in advance can prepare you so that you don’t miss opportunities when the market cycle is right.

Here’s the bottom line for VRM business owners: Create an exit strategy that works for your VRM business, and prepare it years in advance of a sale or transition.

Although you can’t predict the twists and turns of life, you can take steps in an effort to maximize the value of your work and prepare your business’ legacy.

RSS